ktsimage

Strategic Acceleration: Rocket Pharmaceuticals’ RP-A501 For Danon Disease

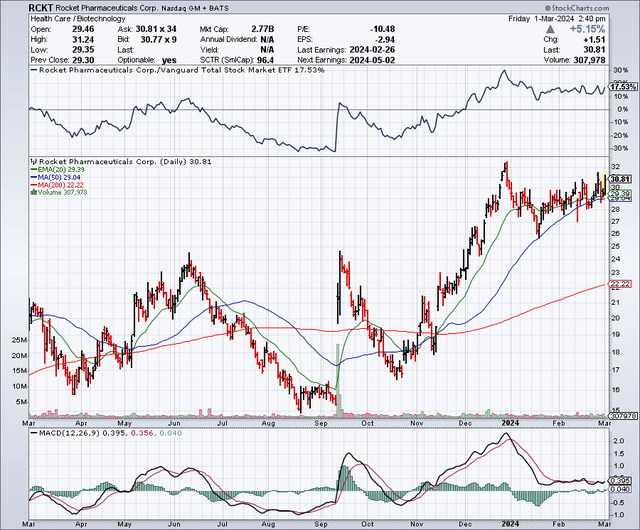

Rocket Pharmaceuticals, Inc. (NASDAQ:RCKT) stock is up 76% since my “Buy” recommendation in August. The stock shot up in September on the heels of a public offering and some other news. Interestingly, the FDA and Rocket reached an agreement supporting the potential for accelerated approval based on the results of a Phase 2 trial assessing its gene therapy, RP-A501, in Danon disease (lysosome-associated membrane protein 2 deficiency). This is an exciting development, as it forges a clearer path towards commercialization.

According to GeneReviews:

Danon disease is a multisystem condition with predominant involvement of the heart, skeletal muscles, and retina, with overlying cognitive dysfunction.

The annual incidence of Danon disease in the EU and the U.S. is estimated by Rocket Pharmaceuticals to be between 800 and 1,200 persons, with a prevalence of between 15,000 and 30,000 cases. The focus of the current course of treatment is on complications (such as cardiomyopathy).

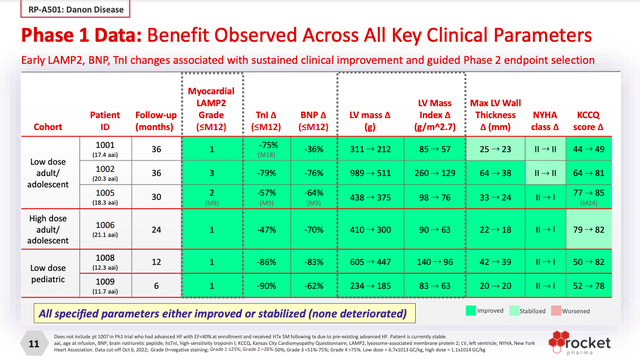

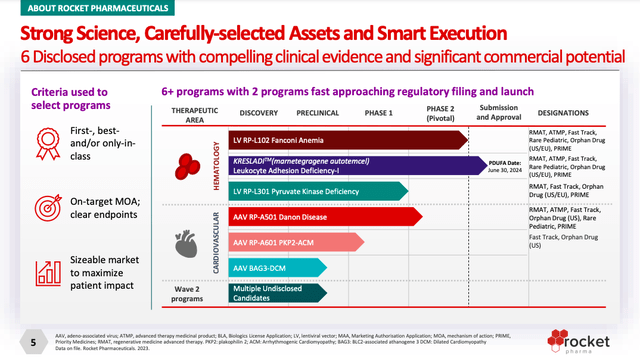

RP-A501 is “a recombinant adeno-associated virus serotype 9 (AAV9) containing the human lysosome-associated membrane protein 2 isoform B (LAMP2B) transgene.” The gene therapy is currently recruiting 12 patients in a Phase 2 clinical trial. The trial’s co-primary endpoint are biomarkers (“myocardial tissue expression of LAMP2 protein and decrease in left ventricular mass index”).

RP-A501 has been evaluated in a Phase 1 trial and, judging by the results below, should fare well in the Phase 2 trial, barring safety surprises.

Gene therapy has gotten some attention as of late after Vertex (VRTX) and CRISPR Therapeutic’s (CRSP) gene therapy, Casgevy, received approval in December for the treatment of Sickle Cell Disease. Both stocks have been up significantly since then, a testament to the market’s perception of their market potential. On the flip side, bluebird bio (BLUE) also nabbed FDA-approval for its Sickle Cell Disease gene therapy, Lyfgenia, the same day. However, its stock has plummeted to ~$1/share as investors weigh the uncertainties of marketization and competition.

Personally, I am more confident in Rocket’s market prospects for Danon disease. Unlike patients with Sickle Cell Disease, patients with Danon disease do not have disease-modifying therapies like hydroxyurea. In fact, there are no drugs approved for the treatment of Danon disease. Moreover, the life expectancy for Danon disease, especially for males, is much lower than that of Sickle Cell Disease sufferers. So, there is a dire need for disease-modifying therapies like Rocket’s.

1,000 patients at $1,000,000 per treatment could result in a blockbuster opportunity for Rocket, but it’s very difficult to estimate at this point. There are too many variables (e.g., what the coverage will look like, how receptive patients will be, etc.). If approved, the company should qualify for a rare pediatric disease voucher. Biotechnology companies will typically sell these to other companies. They are frequently worth upwards of $100 million.

The company’s lead candidate, Kresladi, awaits a PDUFA decision in June for the treatment of severe Leukocyte Adhesion Deficiency-I. This is a much smaller market than Danon disease, with an estimated prevalence of 800 to 1,000 individuals. Moreover, Kresladi would likely only see utilization in severe patients. Nonetheless, Kresladi should also nab a voucher, and it serves as a good proof-of-concept for the technology.

Financial Health

Turning to Rocket Pharmaceuticals’ balance sheet, the combined value of “cash and cash equivalents,” “marketable securities,” and “investments” stands at $407.5 million. When juxtaposed with the company’s liabilities, which include “Accounts Payable and Accrued Expenses” among others totaling $73.8 million, a substantial liquidity cushion is evident. The current ratio, calculated as current assets divided by current liabilities, yields a value of approximately 7.8, suggesting a strong short-term financial health.

Over the last year, Rocket Pharmaceuticals reported a “net cash used in operating activities” of $194.9 million, translating to a monthly cash burn of approximately $16.2 million. Given this rate, the “cash runway” is estimated to be around 25 months, highlighting a cautionary note that these figures are based on historical data and may not directly predict future performance.

The cash flow activities reveal a significant cash burn in operating activities, somewhat mitigated by substantial financing inflows, including $208.4 million raised through various equity offerings. This pattern suggests an aggressive investment in R&D and operational expansion, balanced by active capital raising efforts.

Given the current cash position and monthly burn rate, the odds of requiring additional financing within the next twelve months are medium, contingent on the company’s ability to further monetize its assets or reduce its cash burn.

Market Sentiment

According to Seeking Alpha data, Rocket Pharmaceuticals boasts a market capitalization of $2.65B, signaling a robust financial scale within its sector. Analysts forecast a staggering revenue growth, projecting an increase from $20.46M in FY 2024 to $421.53M by FY 2026, indicating significant growth prospects. RCKT’s stock momentum outpaces SPDR® S&P 500 ETF Trust (SPY), with gains of +52.52% over the year compared to SPY’s +28.36%, underscoring strong market performance.

Per Fintel, short interest stands at 9.2 million shares, or 13.3% of its float, highlighting a notable skepticism among investors. Institutional ownership is high at 98.47%, with a dynamic shift observed as 38 new positions open, introducing 2,501,457 shares, against 18 sold-out positions, shedding 537,106 shares; notable institutions include RTW Investments, LP and Wellington Management Group. Insider trades over the past twelve months show a positive net activity of 126,983 shares, suggesting confidence from insiders. Given these factors, the market sentiment towards RCKT is deemed “robust.”

My Analysis And Recommendation

In conclusion, I still like Rocket Pharmaceuticals at these prices. Its work on RP-A501 for Danon disease is notable. The FDA’s support for an accelerated RP-A501 approval highlights its unique market value in an untapped therapeutic area. Rocket showcases good financial health, with significant cash reserves ensuring operational and research stability. Expected revenue growth, strong institutional support, and active insider buying reinforce its market position.

Yet, the biotech landscape’s volatility — from regulatory challenges to market entry and competition — casts shadows on this bright outlook. Investors are advised to keenly watch Rocket’s clinical, regulatory, and market readiness for RP-A501. Diversification and stop-loss orders may safeguard against unforeseen setbacks. The company’s funding needs, amidst its spending rate, pose a dilution threat, urging careful watch on capital management. Despite these hurdles, Rocket Pharmaceuticals, Inc.’s strategic niche focus, coupled with financial solidity and market confidence, maintains its “Buy” status. Investors, however, should tread with risk-awareness.