Ian Tuttle

In my last article, “Roblox Could be the Next Big Social Networking Platform“, I briefly covered the user metrics of Roblox (NYSE:RBLX) internationally. Today I want to talk more about this, the size of the market they’re selling into, their competitors, and just how big it could get.

International User Metrics

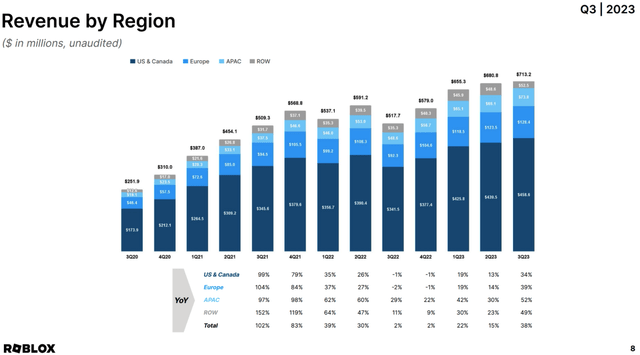

While domestic revenue growth in the USA remains healthy at +34%, Roblox is really starting to crank internationally. In Q3 2023, revenues in the rest of the world were up 49%. Revenues from Asia Pacific are up from $19 Million in Q3 2020 to $74 Million in Q3 2023, a 289% boost or 57% CAGR.

Let’s break down each of these bucks from 2018 to the annualized run rate from Q3 2023 to see how impressive growth has been.

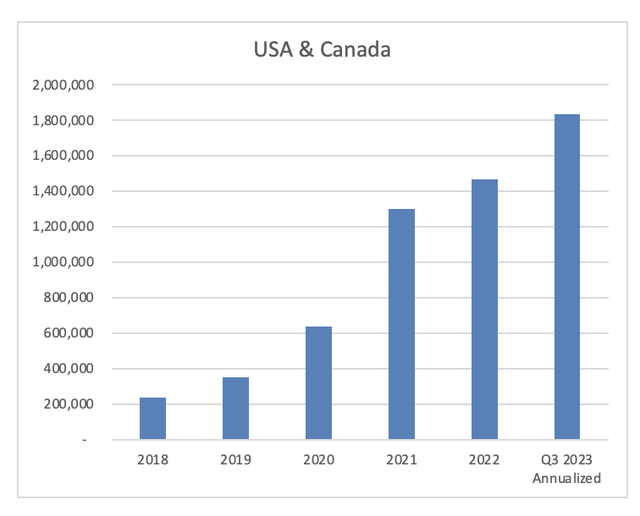

USA & Canada

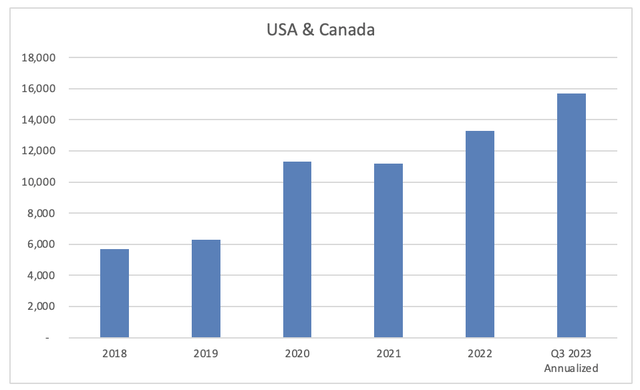

USA & Canada is by far the largest segment of Roblox’s revenues, making up 64% of total revenues in Q3 2023 to an annualized run rate of $1.83 Billion. However, this % of the total has fallen from 76% in 2018 as the gaming platform has grown rapidly in Europe, Asia Pacific, and the rest of the world.

Compounded annualized growth in the USA and Canada is 50% from 2018 to 2023. The Q3 2023 annualized run rate of $1.83 Billion is up 25% from full year 2022 revenues of $1.47 Billion.

Roblox Revenues USA & Canada 2018 to 2023

22% of Roblox’s daily active users are based in the US & Canada, equating to 15.7 million users in this region as of Q3 2023. The total number of gamers in the USA & Canada is roughly 224 Million. This implies that only 7% of all gamers are using Roblox in this region.

Let’s look at the user growth in USA & Canada. In 2018, 5.7 Million users were in USA & Canada and this number has climbed to 15.7 Million in Q3 2023, an annualized growth rate of 22%.

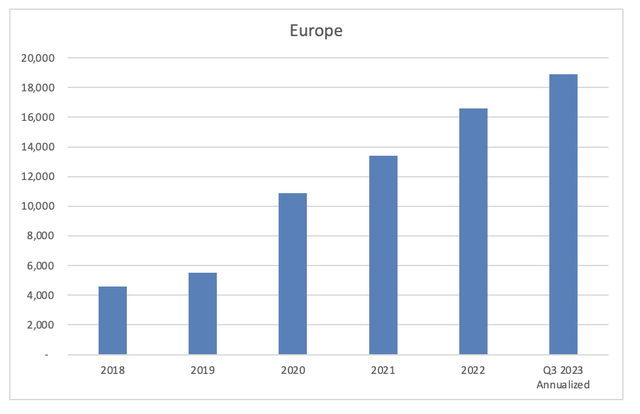

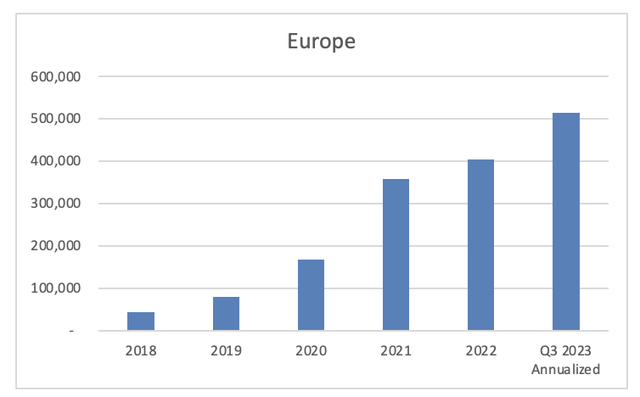

Roblox in Europe

Europe is currently the 2nd largest segment of Roblox’s revenues, making up 18% of total revenues in Q3 2023 to an annualized run rate of $514 Million. While revenues grew at a compounded annualized growth rate of 65% since 2018 from $42 Million to $514 Million, this is actually lower than Asia-Pacific and rest of the world. As a result, Europe’s share of total Roblox revenues has flat-lined at around 18% for 3 years now.

Roblox Europe Revenues since 2018

As of 2023, Roblox has approximately 18.9 million daily active users in Europe, which represents about 26.9% of its total worldwide user base. Users have grown from 4.6 Million in 2018 to 18.9 Million today, representing a 33% CAGR. While this is impressive, the user growth in APAC and rest of world has outpaced this, resulting in Europe making up fewer users of the total Roblox base vs 2018.

There are approximately 330 Million gamers in Europe, so only 5.7% of all gamers in Europe use Roblox, leaving the room open for substantial user growth in Europe.

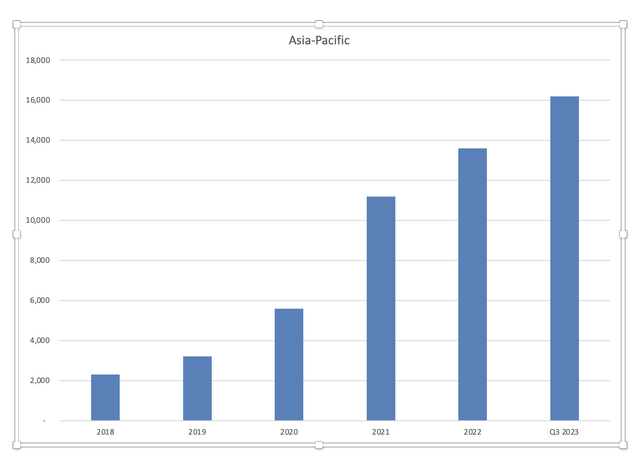

Roblox in Asia-Pacific

Asia Pacific is very exciting to me as an investor in Roblox. I am excluding China from all figures simply because I don’t believe they’re open to allowing foreign countries into the region.

Even excluding China, the user base in APAC is astounding. , there are still close to 1 Billion users in Asia Pacific.

In 2023, the Asia-Pacific region stands as a dominant force in the global gaming landscape, accounting for more than half of all gamers worldwide. This significant presence is largely due to the substantial markets in countries admire India and China, as well as highly engaged gaming communities in Japan and South Korea.

The region’s gaming market is influential, contributing to 46% of global gaming revenues. Making up Asia-Pacific, excluding China, are roughly:

- 35 Million gamers in South Korea

- India is estimated to have 444 Million gamers in 2023

- 17 Million gamers in Japan

- 17 Million gamers in Australia

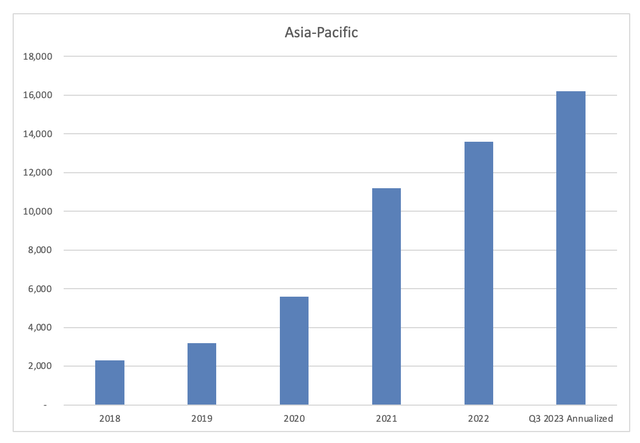

All combined, APAC represents a region that is more than double the size of USA & Canada. User growth for Roblox in APAC has been blistering at a CAGR of 48% since 2018.

Roblox Asia Pacific users since 2018

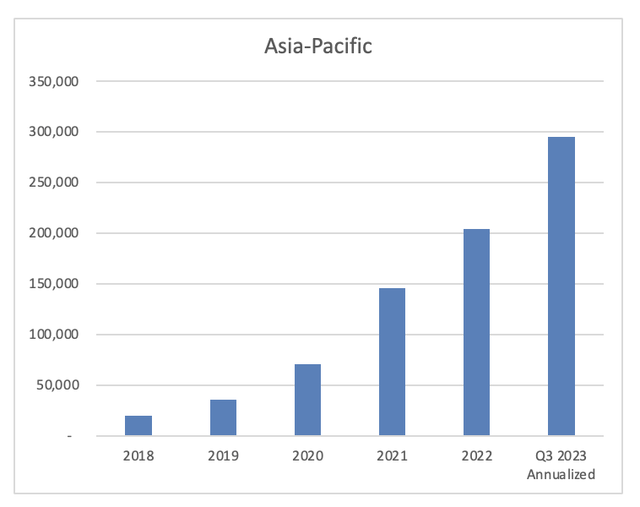

Meanwhile, revenues in APAC have grown at a 71% CAGR since 2018. 71%! APAC now makes up 10.3% of total revenues, up from 6.4% in 2018.

Roblox Asia-Pacific Revenues since 2018

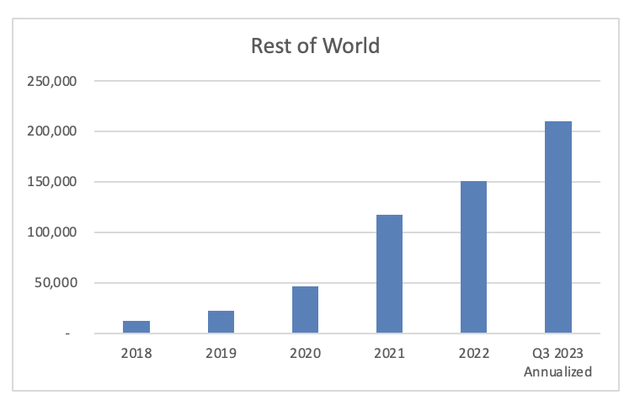

Roblox in “rest of world”

Roblox breaks out the rest of the world (South America, Latin America, Africa) in their financials. The user growth and revenue growth in this region are also pretty incredible.

Rest of World (ROW) now makes up the largest user base for Roblox at 19.4 Million. This is up from 3.3 Million in 2018, representing a CAGR of 43%.

Roblox rest of world user growth

Even more impressive is the 77% compounded annual growth rate of revenues for ROW for Roblox. ROW now generates almost as much annualized revenues (using Q3 2023 figures) as all of USA and Canada did in 2018.

Roblox Rest of World Revenues since 2018

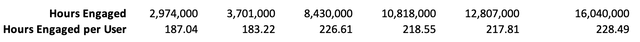

User Engagement

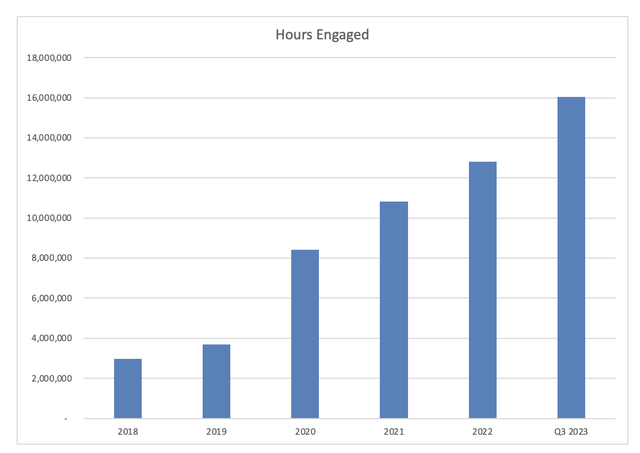

A key metric to focus on with Roblox is user engagement. Roblox provides us with hours engaged on their financial disclosures. We can back into hours per user simply by dividing hours engaged by users.

Total hours engaged has gone up from 2,974 Million to 16,040 Million from 2018 to Q3 2023, a CAGR of 40%.

If you recall, RBLX was historically viewed as a COVID beneficiary and that the old user metrics would not return post-COVID.

This is simply wrong.

Hours engaged per user in Q3 2023 stood at 228.49 hours/user, eclipsing the Covid high of 226.61 hours/user. The engagement is at all-time highs on Roblox.

Hours engaged per user on Roblox

“Aging Up”

The largest cohort of users for Roblox is over 17 years old now, meaning they’re aging up into a higher earning cohort. I want to leave you with this very important quote from their investor day in November 2023.

Next growth vector, we’ve always talked about is platform for everyone. Let’s just take a look. We’re really in the middle of this. So there are almost 30 million people on our platform over 17, and the growth rate of that is pretty substantial.

The exciting thing about platform for everyone is — those of you that have been with us for 2 years know that the cohort from 9 to 13, for example, or 13 through 16 is much smaller than the cohort from 17 to 60. Do the math.

So there’s a lot of opportunity out there, north of 17 on our platform, and we’re starting to see a lot of the work we’ve done in expanding this age group really come to fruition. You’re going to hear more today from Christina around Gen Z and really the growth we’re seeing in that 13 through 24 segment, which is arguably a very, very valuable and difficult segment to reach for brands who want to engage with that was really exciting on our platform is the amazing growth of this segment, especially in 17 through 24 and also the engagement in that the daily active users on Roblox spend about 2.5 hours on our platform, which really bodes well for the future of brand interaction.

This is very important: The most appealing cohort to brand advertisers is now the largest cohort for Roblox.

Conclusion

While all of the above stats are impressive, some things really stand out to me.

- User engagement, as defined by hours engaged per user, is now at all-time highs.

- Asia-Pacific, the largest addressable market at over 500 Million gamers (excluding China), is now generating revenues in excess of what the USA and Canada were generating in 2018 for Roblox.

- Users in Asia-Pacific and the rest of the world now make up more than half of all Roblox users.

- Roblox is still only penetrating roughly 5-7% of users in each major region, giving it ample room to grow over time.

- The largest cohort is now 17+, meaning Roblox is aging up to users with more discretionary income.

I previously shared the reasons why I see at least 20%+ CAGR for investors in Roblox:

As Roblox matures and eclipses the $10 Billion revenue market toward the back half of this decade, I think it’s reasonable for it assume it will be doing $2.5 to $3.5 Billion free cash flow per year.

META has traded around 25 to 40X FCF on average. Assuming Roblox trades at similar valuations, it should be able to get up to a valuation of $75 Billion to $150 Billion, depending on what valuation the market places during euphoric times.

If we discount that back to present day using a 10% discount rate, we are looking at compounded growth rates of 20% to 40% per year.

When taking into account an addressable market that is roughly 20X the size of Roblox right now, with a user base that is accelerating overseas and that is more engaged than ever, and with a management team that is focusing on turning Roblox into a social media platform as well as a gaming platform, I think Roblox is a sleeping giant.

The company is now free cash flow positive and said in its Q3 2023 earnings release that it expects to see operating leverage going forward. I believe this is a company that is still incorrectly being grouped in with the Covid-beneficiary crowd. All of its metrics suggest otherwise.