phototechno

In keeping with my coverage on short-term and variable rate funds, thought to have a look at the FolioBeyond Alternative Income and Interest Rate Hedge ETF (NYSEARCA:NYSEARCA:RISR). RISR invests in traditional mortgage-backed securities, or MBS, as well as interest only MBS. Both securities offer good yields, in the 6.0% – 8.0% range, with the fund itself yielding 6.8%. Credit risk is very low, as the fund exclusively invests in AAA-rated MBS. Fund duration is negative, as interest only MBS have negative duration.

In my opinion, RISR’s good 6.8% yield, very low credit and interest rate risk make the fund a buy. The fund’s key differentiator is its negative duration, so the fund seems particularly well-suited as a portfolio hedge, or for more hawkish investors.

RISR – Basics

- Investment Manager: FolioBeyond

- Expense Ratio: 1.13%

- Dividend Yield: 6.79%

- Duration: -6.10 years

- Total Returns CAGR (Inception): 21.29%

RISR – Holdings and Strategy

RISR has a fantastic investment pitchbook, which I think explains the fund’s strategy, characteristics, and benefits in a simple manner. I’ll explain the fund in my own words, but do propose reading through the pitchbook.

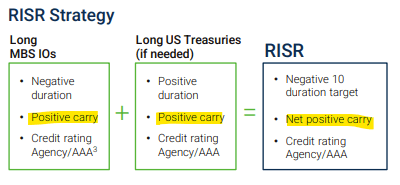

RISR has two main goals, to create income, and to protect against rising rates.

Income is generated through investments in MBS, which are bundles of mortgages. Homeowners pay their mortgages, investors in MBS acquire the payments (the process is more complicated, but close enough).

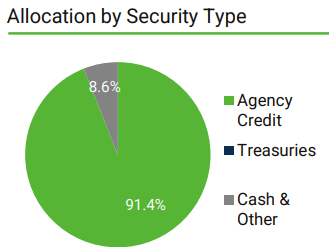

Right now, MBS account for over 90% of the fund’s portfolio, with cash and other short-term securities accounting for the rest.

RISR

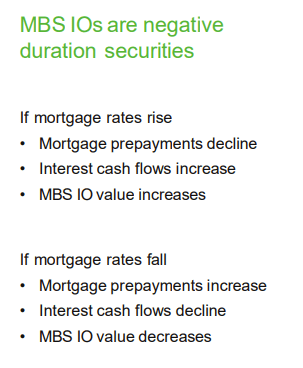

The fund is protected against rising rates though investments in interest only MBS. Investors in these securities only acquire the interest rate portion of any applicable mortgage payment.

Prepayment tends to hurt these funds, as homeowners stop making interest payments when they prepay their mortgage (prepayment is pure principal). Prepayments tend to enhance when interest rates decrease, as homeowners refinance their mortgages at lower rates. Due to this, interest only MBS see declining prices and income when rates decrease. On the flipside, interest only MBS see higher prices and income when rates enhance, due to lower prepayments. In the fund’s own words:

RISR

It took me a while to grasp the process above, but it does make sense, and it does work as expected, as evidenced by RISR’s negative duration.

RISR

RISR’s holdings and strategy benefits investors in several important ways. Let’s have a look at these.

RISR – Benefits and Positives

Good Dividends

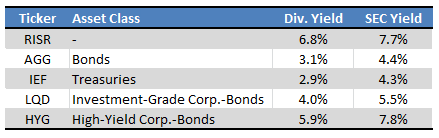

Federal Reserve interest rate hikes have led to sharply higher mortgage rates, with benchmark 30Y rates reaching 8.0% last week. RISR focuses on mortgage-backed securities, so fund income and yields are indirectly tied to these high mortgage rates. RISR currently yields 6.8%, and sports a monthly SEC yield of 7.7%. Both are reasonably good figures, and higher than average. High-yield corporate bonds do yield more, as do some of the more niche income-producing securities, including BDCs and mREITs.

Fund Filings – Table by Author

As an aside, the fund sometimes describes these positions as having positive carry, meaning positive expected returns (from holding these positions). Carry is important for some niche investments and strategies, such as commodity futures, as these sometimes have hidden costs. This does not seem to be the case for RISR, as per the fund’s management.

RISR

Low Rate Risk

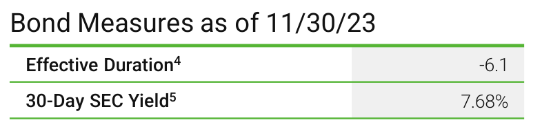

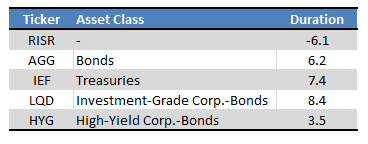

RISR invests in securities with positive and negative duration. The result is a fund with a duration of negative 6.1 years. Said figure is quite close to zero, so overall interest rate risk is quite low, and lower than average.

Fund Filings – Table by Author

As RISR’s duration is negative, the fund tends to see higher prices when interest enhance, the opposite of most bond funds. Expect significant, outsized returns and outperformance when rates enhance, as has been the case since early 2022.

The opposite is true as well, and the fund should see significant losses and underperformance when rates decrease.

In my opinion, the fact that RISR’s duration is negative is neither a positive nor a negative. The fact that duration is low, on the other hand, is definitely a positive, insofar as it decreases portfolio risk and volatility.

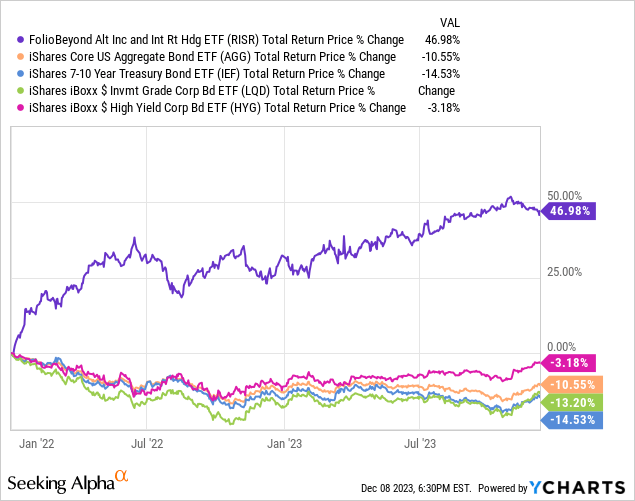

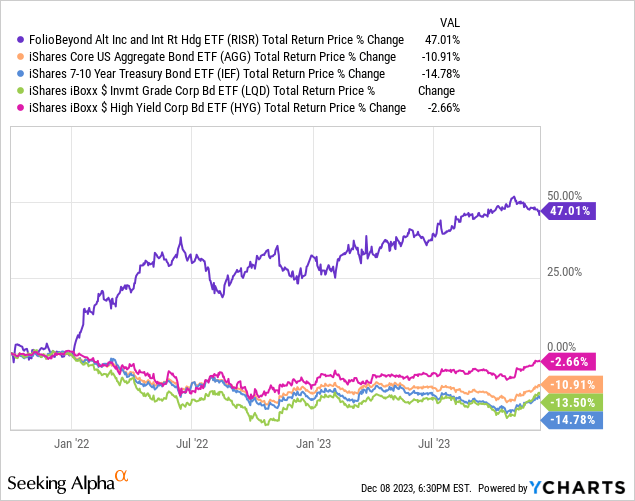

Strong Performance Track-Record

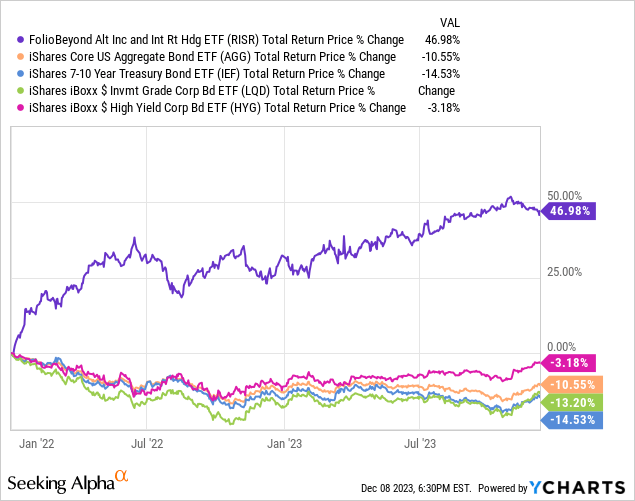

RISR’s performance track-record is outstanding, with the fund significantly outperforming most bonds and bond sub-asset classes since inception, and for most relevant time periods.

RISR’s returns and outperformance were due to the fund’s negative duration, and significant Federal Reserve hikes. The fund is extremely unlikely to perform so well long-term, although much will depend on future Fed policy and the investment horizon of each investor.

RISR – Key Differentiators

RISR’s good dividends, low rate risk, and strong performance track-record are all important benefits for the fund and its shareholders. These are also common benefits, shared with many securities and funds. I’ve covered dozens of these throughout the months, including those focused on high-quality CLO tranches, senior loans, and assorted variable rate securities. Although specifics vary, these funds have many similarities, and broadly similar value propositions.

Considering the above, thought to have a look at RISR’s key differentiators: what sets the fund apart from other bond funds with low duration. The fund’s negative duration combined with its strong carry stand out. Let’s have a look at these.

Negative Duration

Most short-term and variable rate funds have low duration, and so suffer low capital losses when interest rates enhance. RISR has negative duration, and so sees positive gains when rates enhance. Due to this, RISR tends to significantly outperform other short-term and variable rate funds when rates enhance, as has been the case since early 2022.

In my opinion, RISR’s negative duration can be leveraged in two key ways.

First, investors in bonds and bond funds can use RISR to hedge their portfolio’s interest rate risk. Investing in, say, the iShares Core U.S. Aggregate Bond ETF (AGG) or the iShares 20+ Year Treasury Bond ETF (TLT) carries significant interest rate risk. Investing in TLT and RISR has much lower rate risk. Investors can tailor portfolio weights to reduce duration to zero as well.

Second, hawkish investors can use the fund to (potentially) profit from higher rates. RISR’s returns have been very strong since the Fed started to hike, and gains could continue to be strong if rates remain higher for longer. Which brings me to my next point.

Good Carry

Some interest rate hedges have negative carry, so holding them is quite costly. These include most short treasury ETFs, and most that use interest rate options or derivatives. Negative carry means negative long-term expected returns too, although short-term returns still mostly depend on rate movements.

RISR, on the other hand, has positive carry, so investors can profit from higher rates and acquire good dividends without incurring excessive costs. This makes RISR a much stronger long-term investment opportunity than most other interest rate hedge securities and ETFs. In other words, I feel much more comfortable with a long-term investment in RISR, than in the ProShares Short 20+ Year Treasury ETF (TBF) or the streamline Interest Rate Hedge ETF (PFIX).

Conclusion

RISR’s good 6.8% yield, very low credit and interest rate risk make the fund a buy. The fund’s key differentiator is its negative duration, so the fund seems particularly well-suited as a portfolio hedge, or for more hawkish investors.