TexBr

While mining stocks have not been solid in recent years, many have risen dramatically over the past few months. The mining giant Rio Tinto (NYSE:RIO) has increased by around 19% over the past three months. Its peers, BHP Group (BHP) and Glencore (OTCPK:GLNCY) have risen by ~9% and ~22%, respectively. Rio Tinto and other base metal miners have seen strong performance similar to that seen at the end of each year since 2020. That is to say, since 2020, Rio Tinto has consistently rallied around the fall-to-winter period and declined after that. Its overall performance since 2021 has been lackluster, with it unable to break into new highs despite these seasonal rallies.

The stock trades at a decent forward “P/E” of 9.8X with an attractive yield of 4.8%. The analyst consensus view is that the firm should maintain its annual EPS level over the coming years, but no income or revenue growth is expected. The company’s valuation is certainly not high, but it is around 25% higher than it has been over the past five years, depending on the valuation metric. Accordingly, RIO is also unlikely to be undervalued today unless one has reason to believe iron ore or other metals should rise in value. Should base metals reverse, then the stock should fall with them.

Rio Tinto is China Dependent Today

Since 2021, I have maintained a neutral position on Rio Tinto due to its dependence on China’s precarious construction market. Many analysts focus on Rio Tinto’s supply chain technologies and the demand potential from ESG changes in Western markets. While those are not necessarily unimportant factors, the impact of China’s economy is the primary driver of Rio Tinto in the immediate term. Rio Tinto is a massive global mining company specializing in aluminum, copper, and iron ore. However, most of its profits usually come from iron ore, with copper, aluminum, and other minerals only accounting for a minor portion of its income.

Where does all of this iron ore go? Crucially, over 70% of global iron imports go to China. This iron is turned into steel, primarily used for its construction market, though some are exported abroad, accounting for the country’s historically positive steel trade balance. That said, central Asian nations have a more positive steel trade balance overall, with China’s being just above that of Japan. Given this, we know China’s economy is a voracious iron ore consumer and is, by far, the primary driver of global iron ore prices. China’s estimated end use of steel products is just over half of the global total and nearly 10X higher than that of the US (950M tons vs 97M in the US).

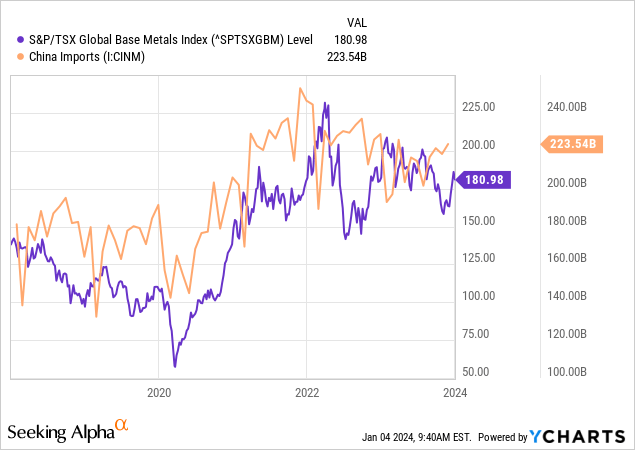

This fact should be at the forefront of any outlook regarding Rio Tinto. Even if the US adopted “infrastructure growth” policies that caused steel demand to double over a few years, which is not likely, it would hardly impact the global trade balance compared to China. A small dent in China’s demand could offset marginal US or Western market increases. This relationship is strong enough that there is a close correlation between China’s total imports and the prices of base metals. See below:

Put simply, the strength of China’s economy drives the trend in base metals prices, which determines Rio Tinto’s profitability. Much of Rio Tinto’s products are sold to China, but China’s economic power in the steel market is so immense that it also drives sales prices to other countries, as steel is a global commodity.

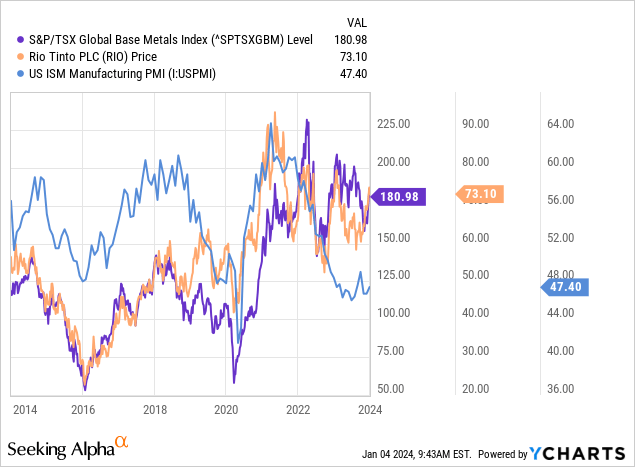

Of course, the US economy is also essential, with the manufacturing PMI having a decent correlation to base metals and RIO’s value. See below:

Weakness in the US manufacturing base has potentially influenced Rio Tinto’s profitability, but not as much as in 2016 and 2020. Fundamentally, the US manufacturing PMI is an indirect measure of the global economy because most “US manufacturing” is the throughput of commodities and finished goods toward other countries. In other words, the US manufacturing base is far less vertically integrated than in the past, so changes in manufacturing activity largely depend on supply and demand changes abroad. China’s manufacturing PMI has also been weak in recent months, but I place less importance on that figure because survey data is not as reliable in China.

One huge issue with analyzing Rio Tinto’s macroeconomic backdrop today is China’s lack of reliable data. According to the Federal Reserve, China’s real GDP could be overstated by as much as 65% due to differences between reported data and satellite light intensity data (being a strong GDP predictor). Iron and steel import and export data are much more difficult to fudge, but statements and data from the Chinese government must be regarded as being, most likely, propaganda.

Since China has not looked to transition toward a consumption and services economy, it is highly focused and dependent on construction activity. China’s middle class also uses real estate as a primary wealth storage source instead of equities or bonds. Due to overdevelopment, around 22% of China’s housing stock is vacant, an extremely high figure that China’s government actively seeks to suppress. As the government aims to stop this bubble from popping, its median home price-to-income ratio has risen to a whopping 29.6X (compared to ~7X in the US). As such, total private debt-to-GDP in China is estimated at around 192% today, among the highest in larger nations. Of course, that figure is much higher if we account for its overstated GDP as referenced by the US Federal Reserve.

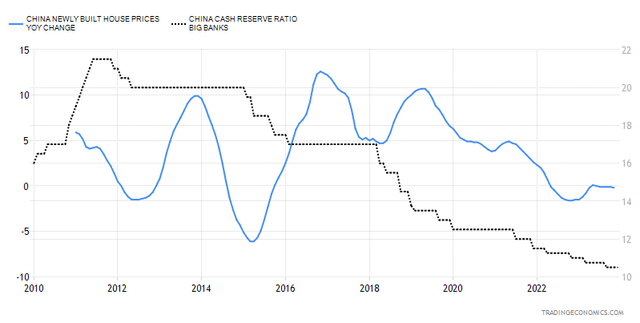

In recent years, the property bubble has nearly popped on many occasions. Home price growth has continually slowed, causing China’s government to cut the bank reserve rate to expand leverage levels to stop the crisis. Lately, they’ve become particularly aggressive in cutting reserve rates, but that no longer positively impacts home price growth. See below:

China home prices YoY vs. Reserve Rate (TradingEconomics.com)

We should also remember that China has a high home vacancy rate and population decline. Indeed, there are already far fewer twenty-year-olds in China today than older demographics, meaning there will not be enough homebuyers over the coming decade or two.

This is undoubtedly a long-term issue for Rio Tinto because China’s highly overdeveloped real estate sector is the main driver for global steel demand. With tremendous effort from the CCP, China saw steel production rise in 2023 despite its weak construction market. Indeed, most of China’s steel mills are likely losing money when producing basic construction steel. Yet, their demand for iron has continued to increase over recent months. This situation has recently created a “prisoner dilemma” among China’s steel producers which are now creating a market glut that may not be resulting in failures among steelmaking companies.

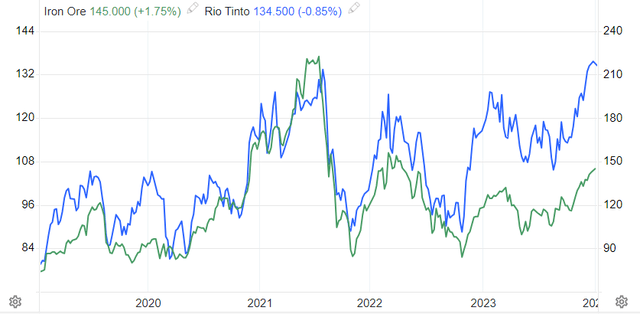

We cannot know precisely what is going on in China’s economy when it consistently distorts or eliminates data that does not point toward a positive outcome. Rio Tinto’s rally in recent months is mainly due to the increase in iron ore following China’s Xi Jinping’s “pledge” to strengthen the economy in 2024. Unsurprisingly, third-party data has shown China’s industrial sector has weakened in recent months despite tremendous efforts to stimulate it, hampering base metals prices. Iron ore remains elevated from its lows, but I do not expect that to remain as China struggles to support its flailing construction market artificially, despite massive efforts. See below:

Rio Tinto price vs. Iron Ore China Price (TradingEconomics.com)

RIO’s price is highly correlated to iron ore prices delivered to Tianjin. Most of its revenue and income comes from iron ore, but copper and aluminum are also heavily tied to China’s construction industry. Thus, any downside in iron ore is a significant profit-risk to Rio Tinto. While China is making tremendous efforts to keep its iron ore demand high, its efforts in 2023 are not nearly as successful as in the past, despite arguably taking more significant measures than ever. Undoubtedly, the CCP has more economic power than Western governments, but if it is doing more and accomplishing less, then that is a sign they’re likely unable to stimulate its property bubble forever artificially. 2024 may not be the year that the bubble pops, but I believe the setup is the strongest it has ever been, with Rio Tinto and other iron ore producers likely being among the most indirectly impacted.

The Bottom Line

There is much to like about Rio Tinto if not for its dependence on China’s precarious steel market. The company is well-run and will likely benefit from technological innovation that may improve its profitability over the coming years. Its vast size and scope give it diversified exposure to the base metals complex. Still, because the base metals complex is highly tied to China, Rio Tinto’s managers cannot diversify it away from the Chinese risk factors. The company is also trading near its long-term median valuation levels. It has very low debt, with some positive exposure to a potential decline in the US dollar and inflation.

Despite these positives, I am bearish on Rio Tinto today and believe RIO will lose value in 2024. The stock has rallied significantly in recent months due to a rebound in iron ore prices stemming from tremendous stimulus efforts from the CCP. However, these efforts are not having as positive an impact on China’s industrial activity as many had hoped. Further, all this has accomplished is causing the country’s property bubble to stagnate, merely delaying the inevitable pop.

In my view, 2024 is set up to be a year where this property bubble pops on a sufficiently large scale that China’s iron ore imports fall dramatically. While further stimulus is possible, the fact that the 2023 stimulus hardly worked signals that further external support will not work. Indeed, I believe China may be increasing pressure on Taiwan to distract its population from its growing economic crisis. Of course, should that geopolitical conflict grow, it could become challenging to import metals into China, sinking the global base metals market.

Outside of tremendous global inflation, which would also not benefit Rio Tinto (as costs rise proportionally and labor issues mount with inflation), I do not expect iron ore or other base metals to retain their current price in 2024. I believe base metals prices today are artificially supported by China’s stimulus, which, as it has been since ~2018, is usually a short-lived factor. Further, if the property bubble pops and the construction industry halts, then I expect iron ore will be depressed for many years, likely causing sales levels to fall and prices to shift below breakeven prices. For now, because we’ve not yet seen this catalyst, I value RIO at ~$60 (its fall price range), assuming we will see a reversal of the recent iron ore rally. However, if the Chinese economy deteriorates, I expect RIO to fall further.