amgun

Life is a sort of a debtors’ prison where we are all playthings of fortune ― Smollett Tobias George

Today, we put RingCentral, Inc. (NYSE:RNG) in the spotlight. The stock appears cheap by some key valuation metrics, but the shares saw some notable insider selling in February. As can be seen below, the stock has been volatile over the past 12 months as well. Which way will the equity head from here? An analysis follows below.

Company Overview:

RingCentral is headquartered in Belmont, CA. The company provides cloud communications, video meetings, collaboration, and contact center software-as-a-service solutions globally. RingCentral has several products on the market and serves both mid-market and large enterprises.

The company was founded in 1999 and has just under 4,000 employees. Almost all of RingCentral’s revenue comes from recurring subscription fees. The stock currently trades just under $34.00 a share and sports an approximate market capitalization of just north of $3.1 billion.

Fourth Quarter Results:

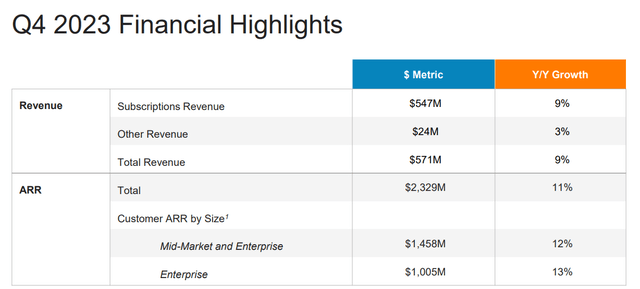

The company posted Q4 results on February 20th. RingCentral delivered a non-GAAP profit of 86 cents a share, four pennies a share above the consensus. Revenues rose just under nine percent on a year-over-year basis to just over $571 million, in line with expectations.

Subscription fee revenue came in at $547 million, up nine percent from the same period a year ago. Annual Recurring Revenue or ARR rose 11% to nearly $2.33 billion.

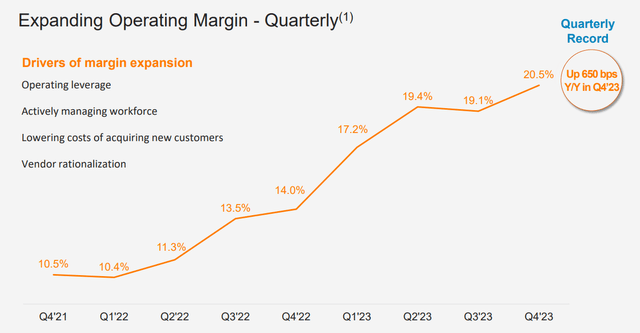

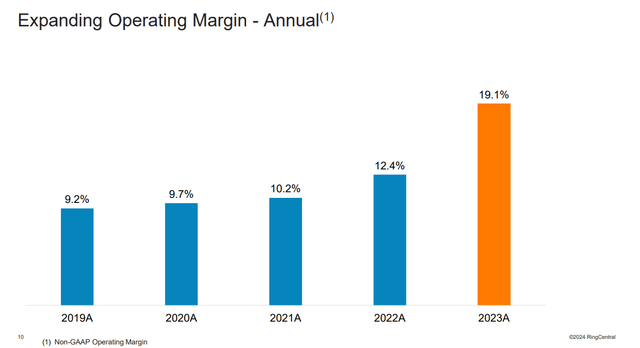

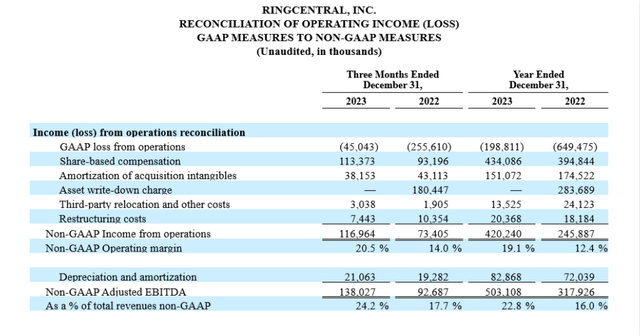

Leadership has done a commendable job taken steps to increase operation margin, which came in at 20.5% during the quarter, up an impressive 650bps from the same period a year. This drove net cash produced by operating activities up to $114 million for the quarter, up drastically from just under $40 million in 4Q2022. Q4 capped a huge year on that front.

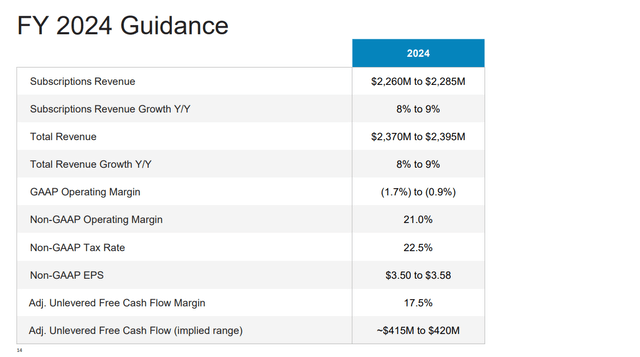

Management provided the following initial guidance for FY2024 where it expects subscription revenues to grow eight to nine percent and non-GAAP earnings to come in at between $3.50 to $3.58 a share.

Analyst Commentary & Balance Sheet:

Since Q4 numbers hit the wires, six analyst firms including Needham and Bank of America have reissued/assigned Buy/Outperform ratings on the stock. Price targets proffered range from $36 to $48 a share. Nine analyst firms including Goldman Sachs, Jefferies and Piper Sandler have maintained/assigned Hold/Neutral ratings on the shares. Price targets from this analyst group range from $31 to $35 a share.

Just under eight percent of the outstanding float in the shares is currently held short and insiders hold less than two percent of the share count. Several insiders including the company’s CEO disposed of approximately $8.5 million worth of equity collectively in February, a notable uptick from previous months insider activity.

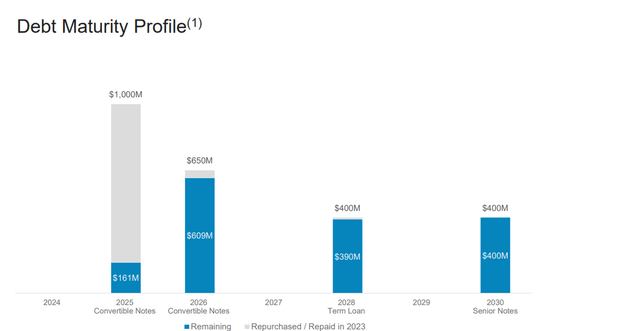

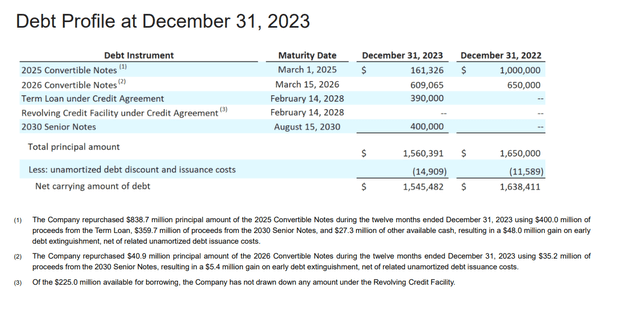

RingCentral exited the fiscal 2023 year with approximately $222 million in cash and marketable securities on its balance sheet against long-term debt of just over $1.5 billion according to the 10-K the company filed for FY2023. Interest expense for FY2023 was listed as approximately $36 million for the fiscal year. The company filed an automatic mixed shelf offering on February 23rd. RingCentral repurchased $60 million of its own shares during the fourth quarter.

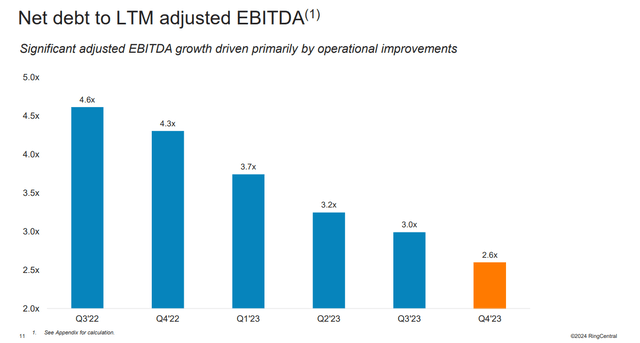

It should be noted that management has done a good job in bringing down leverage in recent quarters. It also has paid down most of the convertible notes due in 2025 (some as the result of new term loans). However, 2026 looms on the horizon. Paying down those notes will continue to drain cash/increased fixed debt and/or cause dilution if/when the notes are exercised.

February Company Presentation February Company Presentation

Verdict:

RingCentral made $3.23 a share in profit (non-GAAP) in FY2023 on $2.2 billion of revenues. The current analyst firm consensus has earnings rising to $3.55 a share in FY2024 as sales grow to $2.38 billion. They project $4.06 a share in profits in FY2025 on eight to nine percent sales growth.

The stock seems quite cheap on a P/E basis at just over eight times forward earnings. However, there are plenty of caveats. First, those are based on non-GAAP numbers. On a GAAP basis, the company had a net loss in FY2023.

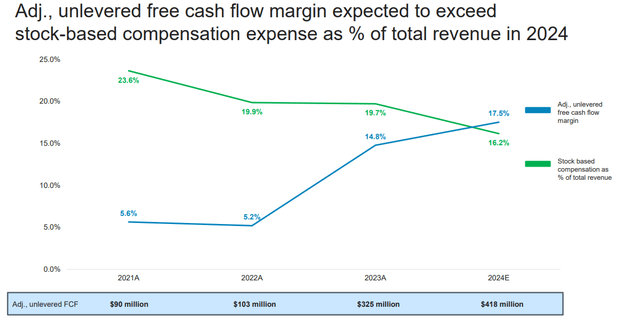

One of the reasons for the difference is accounting for share-based compensation. And while that is coming down as a percentage of sales, it still seems quite high. Add in the debt on the balance sheet and the recent insider selling, I can see why the majority of the analyst community is not sanguine on RingCentral’s current prospects despite progress on several fronts in 2023. Therefore, I also will remain on the sidelines in regard to any investment recommendation on RNG.

Death is the great equalizer. No matter how rich or how poor, we’re all going in the same direction. ― Todd Perelmuter