Frazer Harrison

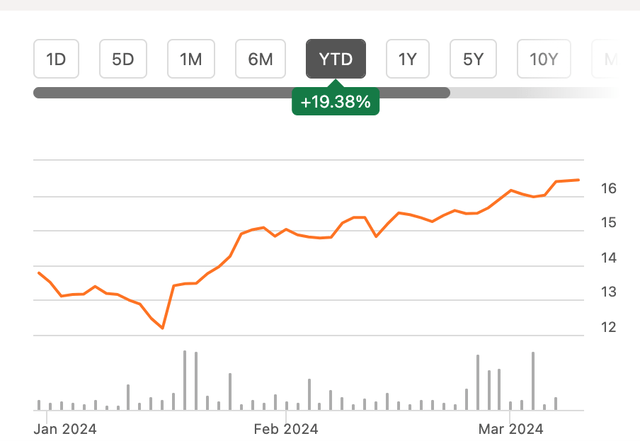

Since the last time I wrote about the Swiss luxury company and Cartier owner Compagnie Financière Richemont (OTCPK:CFRUY) (OTCPK:CFRHF) in November last year, its price is up by 32.5%. At the time I had gone with a Hold rating on the stock based on its weakening performance, especially at actual exchange rates [AER] in the second quarter of its current financial year (Q2 FY24, year ending March 2024). Also, the company itself warned of slowing sales in Europe, its second-biggest market, which suggested potential weakness going forward.

Price Chart (Source: Seeking Alpha)

Luxury rally supports Richemont

It’s perplexing why the stock should be rising at a time of weakness. But Richemont isn’t alone in seeing softer sales growth on the one hand and improved price performance on the other among peers. This is true for the rest of the luxury set as well, with a price rally in recent months.

In the same time since the last article, the S&P Global Luxury Index has risen by almost 19%. Richemont likely saw a higher than average price increase since it was trading at competitive market multiples compared with the biggest luxury stocks at the time.

Growth recovers somewhat

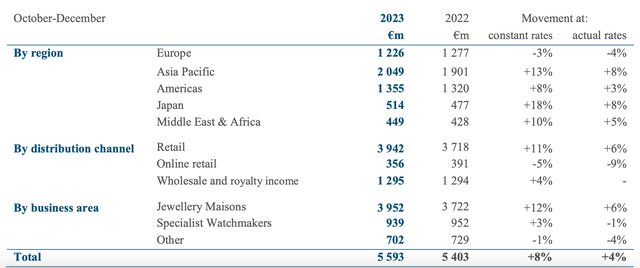

But there are fundamental reasons for the uptick as well. While the company was accurate in its prediction of slowing European sales in recent months, it’s overall sales have been supported by other geographies. In fact, after seeing a revenue contraction of 2% year-on-year (YoY) in Q2 FY24 in AER, it saw a 4% increase in Q3 FY24. Even at constant exchange rates [CER] it saw sales growth accelerate to 8% in Q3 FY24 compared to 5% the quarter before.

Sales Performance in Q3 FY24 (Source: Richemont)

The growth was supported by Asia Pacific, which isn’t surprising considering that spending in China grew fast on a weak base of last year when COVID-19 restrictions were in place in the country. At 13% growth from the region was still lower than the 40% at CER seen in Q1 FY24, but an improvement at the same time over the 8% seen in Q2 FY24. Significantly, the Americas surprised with 8% growth after seeing a 2% contraction in Q1 FY24 and a relatively small 4% increase in Q2 FY24.

Macros indicate it’s not out of the woods yet

As a result, the company’s growth in the nine months to December 2023 (9m FY24) is at 11% at CER and 5% at AER, most strongly buoyed by double-digit growth in Q1 FY24. However, it can’t be assumed that the latest growth improvement will continue. There are three macro reasons for this:

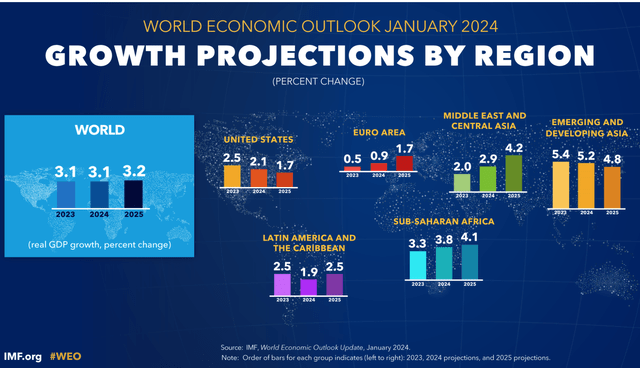

- The Americas may still see some weakening in 2024. JPMorgan has projected an increase of a paltry 0.7% for the US economy for this year. And while it might be more pessimistic than other forecasters, some growth moderation is still expected. For example, the IMF sees US growth at 2.1% in 2024, which isn’t too bad, but it is a softening from 2.5% in 2023.

- China is also an ongoing concern, with a slight moderation in its growth forecast of “around 5%” in 2024 compared to the 5.2% increase in 2023. The country’s property sector is a particular challenge, as is the ongoing deflation in the economy.

- Finally, the European market continues to be weak as well. The European Commission has reduced the growth forecast for the euro area to just 0.8% for 2024, with the number expected to exceed 1% only in 2025, similar to the IMF’s forecasts (see chart below).

Even though the luxury market tends to be more resilient than the average consumer discretionary stock during times of slowdown, if the latest trends are anything to go by, right now it is being impacted by macroeconomic trends. This means, that until the broader economic picture improves, the risk to the market and the companies therein remain.

Outlook up to FY25 and market multiples

The key question now is, what’s next for the stock after its big recent price rise and the continued risk to its sales growth going forward? To assess this, I’ve made estimates for both the remainder of FY24 and also for FY25.

For FY24, I’ve assumed that the full-year revenue growth at AER continues to be subdued at 5%, the same as for 9m FY24 and that the net margin stays constant at the level of 14.7%, as seen in the first half of FY24. This results in a net income of EUR 3.08 billion (USD 3.36 billion) and a forward price-to-earnings (P/E) ratio of 28.8x.

For FY25, I’ve assumed that the revenue growth at AER will improve to 6%. This higher growth is based on the potential for some improvement in markets like the US and Europe, and also that by 2025 the growth recovery could begin in earnest. The number is obtained by averaging the expected growth for FY24 and the past 10 years’ compounded annual growth rate [CAGR] of 7.1%. The net income margin is assumed to remain the same as in FY24. This results in a net income of EUR 3.27 billion (USD 3.56 billion) and a forward P/E of 27.2x.

These are much higher than the level of 22.1x the last I checked. And the TTM P/E is also bigger now at 22.7x compared to the 16.8x then. Even though it’s still lower than the median P/E of 30.4x over the past ten years, it’s still not low enough to justify a much further price increase for me, not with its even higher forward P/Es.

What next?

While some recent recovery is indeed a positive, it’s not enough. Not only has it been somewhat unpredictable, but there’s little guarantee that it can be sustained. With the resulting moderate growth expectations, even with sustained margins, the forward P/Es aren’t low enough to warrant a Buy rating on the stock, not after the recent uptick in price. If growth continues to recover, the rating can change, but that remains to be seen. I’m retaining a Hold rating on Richemont.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.