aydinmutlu/E+ via Getty Images

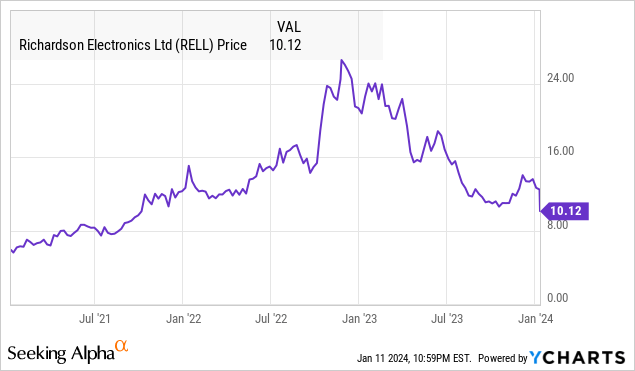

Richardson Electronics Ltd. (NASDAQ:RELL) latest quarterly earnings came in short of market expectations, sending shares down nearly -20% on the report. The company, recognized as a global leader in specialized power circuit components, microwave technologies, and imaging solutions, is citing “challenging economic conditions” amid a broader process of revamping its product portfolio.

It’s not all terrible. Management maintains a level of optimism for conditions to improve going forward, noting a backlog increase and new growth initiatives. Notably, Richardson’s balance sheet carries zero debt which we believe supports the stock’s current dividend for the foreseeable future.

On the other hand, it’s hard to build a level of conviction on the stock given the circumstances and what remains significant uncertainties. Ultimately, we expect the volatility to continue over the next several quarters until there is evidence of an operating and financial turnaround.

RELL Earnings Recap

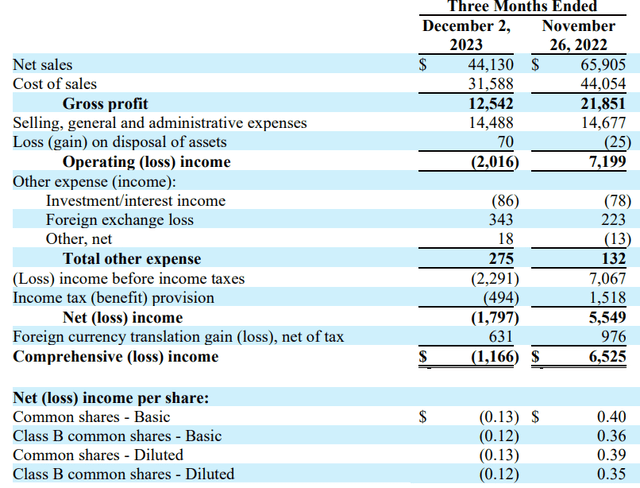

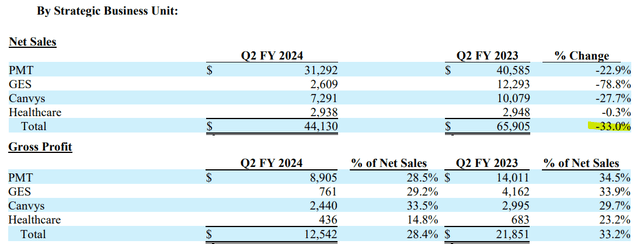

RELL reported a fiscal 2024 Q2 EPS of -$0.13, a surprise loss compared to the consensus estimate for a $0.01 profit. Revenue of $44.1 million declined by -33% year-over-year and was well below the estimate of $52 million.

The company pointed to the timing of certain large orders and particular weakness from customers in China to explain the otherwise poor performance. The top-line decline led to a gross margin of 28.4%, down from 33.2% in Q2 fiscal 2023 reconciling to operating loss this quarter.

By segment, the weakness was across the board in terms of sales. The core Power & Microwave Technology (PMT) group posted a -23% drop in sales connected to a slowdown in orders from semiconductor wafer fabrication customers.

More concerning was the -79% collapse in sales from the Green Energy Solutions (GES) segment. In this case, the comparison period last year featured an early wave of large orders related to ultracapacitor modules for wind turbines among large-scale projects in the period.

The “Canvys” segment, which deals with the manufacturing of specialized displays and monitors, also faced a large decline during the product design cycle.

Comments by management reiterated the long-term confidence of the business. Despite the messy results, the firm-wide backlog climbed by 2% representing over $150 million in a pipeline of business.

On this point, the GES group covering not only wind energy solutions but also energy storage and even battery technologies is still seen as an important growth driver going forward.

While not offering formal financial guidance, management expects “significant bookings” over the next few quarters implying an improvement of the results into fiscal 2025. From the earnings conference call:

Our customers repeatedly tell us we have maintained our market share for our core GES applications and have identified new product opportunities. And the decline in revenue we are experiencing is purely a timing issue. In fact, our customer pipeline and the number of opportunities continues to increase as we look to take advantage of significant energy transformation projects globally.

We mentioned the strong balance sheet. Richardsons ended the quarter with $23 million in cash and no debt. This compares to the current dividend which represents an annualized payout of $3.4 million, keeping in mind that the cash flow from operations was positive this last quarter. Assuming financial conditions are set to improve, we believe there is room for the dividend to be maintained through this year.

What’s Next For RELL?

When looking at RELL, the main takeaway for us is that the underlying business is viable and commands an intrinsic value, even if it’s difficult to quantify what that fair value should be.

Just annualizing the latest quarterly sales, the company is on track to do $180 million in revenue this year which is in the context of the current market cap under $150 million.

Considering the balance sheet cash position, RELL is trading under 1x sales, with a case to be made that the valuation is relatively reasonable for a high-tech engineered electronics manufacturer. At the same time, the uncertainty regarding a timetable for an earnings recovery and the trend of declining sales also places RELL into a potential “value trap” category with the risk that results continue to disappoint.

Final Thoughts

We rate RELL as a hold, acknowledging the current weakness against what remains some strong points in the fundamentals. We sense that it’s likely too late for shareholders to sell following this latest leg lower which has likely already incorporated many of the negatives in the situation.

The first step to any rebound in the stock will be for the operating and financial trends to at least stabilize over the next few quarters. Unfortunately, we just haven’t seen any evidence of that yet. Management believes conditions will improve, but the track record over the past year leaves room for a lot of skepticism.

For anyone just looking at the stock for the first time, keep RELL in an avoid category, lacking any sort of near-term catalyst to suggest a sustained rally higher. Monitoring points over the next few quarters will be signs of a sequential sales improvement, trends in the gross margin, and cash flow levels.