Coolpicture/Moment via Getty Images

Rhythm Pharmaceuticals (NASDAQ:RYTM) produces a medicine that focuses on obesity caused by a set of genetic mutations. While interesting, the issue is that the markets don’t appear sufficiently large to justify the valuation, as the set of mutations that can be treated by Rhythm are too few. Moreover, Novo Nordisk’s (NVO) Ozempic tackles the same patient groups. No thanks.

Product and Innovation

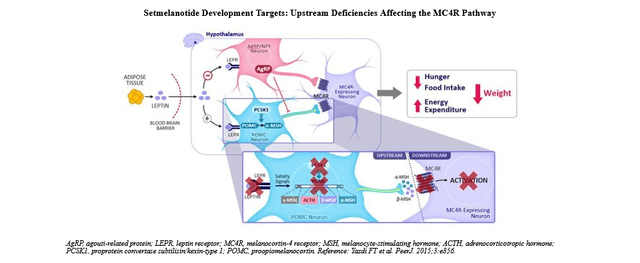

It is clear that different types of obesity could be present in people, but really rare and specific are the types which are the consequence of genetic mutations. Rhythm Pharmaceuticals’ focus is to find solution of the genetically mediated obesity problems in patients who suffer from mutations in some of the regulator genes in metabolic pathway cascades, such as Melanocortin 4 receptor (MC4R) pathway.

This is a neuro-endocrine metabolic pathway in the brain (hypothalamus region) whose main role among others is to regulate hunger, control how much we eat and interfere with metabolic rate. If some of the genes in this pathway are somehow defective, it will be manifested in lack of proper stimulation of MC4R due to the absence of melanotropine stimulating hormone as a consequence of genetic mutation. This will result in hyperphagia, a pathological hunger and excessive food intake, which obviously leads to severe obesity.

Their main product is IMCIVREE (setmelanotide) which acts as a MC4R agonist by mimicking the natural substrate MSH in patients who are suffering from that MC4R pathway impairment. Main clinical trials for this product are completed and IMCIVREE gained approval by U.S. Food and Drug Administration, as well authorities in other countries (approval from European Commission and Great Britain’s Medicines and Healthcare Products Regulatory Agency).

Although it shows good results in clinical trials, where significant weight loss in targeted patients was achieved, our main concerns lies in its usability. Considering conditions in which this product is approved (only 3 genetic conditions) we get really small number of people which can be treated with IMCIVREE. For example, mutations of the melanocortin receptor have been recorded in 12,800 people in the U.S. This is obviously a very small subset of the obese population. If we suspect that from this number of people who potentially could be treated with this product, some of them maybe have other health conditions which are contraindicated, the effective size of market could be even lower. Taking all the people with the mutations, the market size in the US is $442 million with US per capita burden figures in terms of potential value capture. There may be another $210 million market addressable in the EU, but probably less since the cost of disease is lower in Europe on account of cheaper healthcare.

Taking all things into consideration, IMCIVREE is great solutions for people who suffer from obesity caused by this specific mutations. Unfortunately, this is not a drug that can be broadly used. When we talk about obesity therapy options, Ozempic (semaglutide) still remains the really popular option. By acting as a glucagon like peptide 1 (GLP-1) analog, semaglutide has much wider usage potential, since its mechanism of action is much more general and it is not specific (can target much more patients then IMCIVREE).

Financial Conclusions

It seems to us that the markets are too limited here. We have value capture opportunities at more than $600 million, but not much more, and the market cap is around $2.60 billion with around $230 million in cash and short-term investments as of the just released earnings to offset EV. But there’s also around a 10% outstanding dilution from equity options in compensation plans. At least no outstanding development burdens.

They are guiding towards $250-270 million in non-GAAP operating expenses which excludes share-based compensation, and includes an expense related to an in-licensing that they’ve done for another obesity and MC4R related molecule. IMCIVREE is really quite early on its journey, and it has just received reimbursement approval in new geographies like Italy and Spain. The expenses are pretty under control since the $100 million is a fixed consideration, and in our understanding, should be one-off, so it’s plausible in our view that with progress in growing IMCIVREE revenues, they should become profitable. Nonetheless, we just see a big value gap here, and with drugs like Ozempic on the market that can help the same people in Rhythm’s markets, we just aren’t interested here.