Jason Kempin

Back in September, I wrote that I thought investors could take a starter position in RH (NYSE:RH), but that I’d like to wait a little longer to see how things play out. The reason is that home improvement is expected to start to decline in 2024 and there were still a lot of unknowns. The stock is down -17% from that write-up and up over 7% from my original write-up in April when I said it was a well-run company facing a difficult macro environment. Let’s catch up on the name, as with some new headwinds popping up in the form of higher freight costs and lower expected remodeling activity, I’m lowering my rating.

Company Profile

As a reminder, RH is a luxury furniture brand that sells furniture and home décor through its full-price retail stores and galleries, online, and through its outlet stores. The company also produces Sourcebook Catalogues to promote its collections. In addition to its namesake brand, it also owns the Waterworks brand.

At the end of October, it had 68 RH Galleries, 42 RH outlets, 14 Waterworks Showrooms and 1 Guesthouse hospitality property. Of its RH Galleries, 28 were Design Galleries that average nearly 34,000 square feet and 15 include restaurants and wine bars. It opened two new RH Galleries in Germany in early November.

Getting Worse Before It Gets Better

The home furnishing market remained difficult this winter, which likely will continue to hamper RH and its turnaround plans. In November, overall furniture and home furnishing sales were down -7.3%. The declines continued in December, with category sales down -1.0% sequentially and -4.7% year over year.

On its FQ3 call last month, RH CEO Gary Friedman called the housing market “frozen” due to homeowners with locked in mortgages at much lower rates than current mortgage rates. He also noted that the promotional environment had picked up.

I went couch hunting this winter, and anecdotally there were some pretty hefty discounts from the likes of Arhaus (ARHS) and Lovesac (LOVE), which appeared more than normal. Various internet-led brands were offering heavy discounts, as well.

RH noted that the promotional environment would likely lead to more clearance sales for RH, which would impact gross margins. But that likely isn’t the only thing that will hurt margins in the near to medium term. Ocean freight rates have also been on the rise.

There are currently two major issues impacting ocean freight at the moment. The first issue is delays at the Panama Canal that have been caused by drought issues. The canal handles about 5% of global seaborne trade, and the issues have limited the number of vessels per day that can pass through. There is a lot of competition for spots, and several containership carriers began to add Panama Canal Surcharges, with MSC adding a $297 Panama Canal Surcharge on December 15th and Hapag Lloyd adding a $130 charge on January 1st.

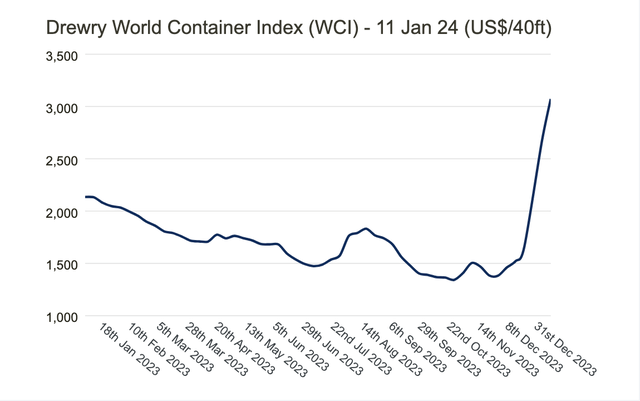

The second issue to hit shipping rates is Yemeni Houthis rebels attacking shipping vessels in the Red Sea as a response to the Israel-Gaza war. With U.S. and U.K. naval forces now in conflict with the Houthis rebels, companies have been diverting cargo away from the Red Sea and taking long routes. The Drewrey World Container Index, which tracks shipping rates for container ship routes, shot up to $3,072 the week of January 11th, which is more than double average pre-pandemic rates of $1,420.

Container Price Index (Drewry)

RH and other companies had started to see better margins in 2023 as ocean freight rates began returning to more normal levels following the supply chain disruptions associated with the pandemic. It appears that the tailwind is now set to reverse and once again become a strong headwind.

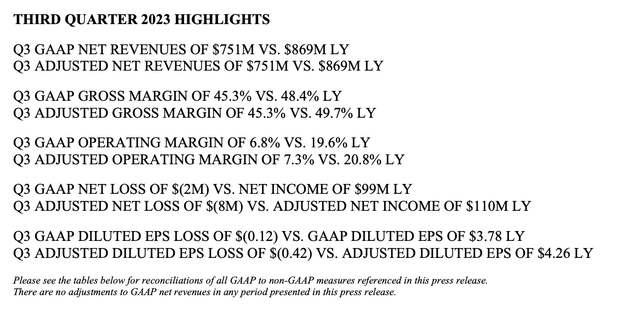

The combination of selling more clearance items and higher ocean freight costs will be a double whammy to RH’s gross margins, likely starting in FQ4 and into at least FQ1. At this point, it’s difficult to say when ocean freight rates may begin to normalize again. RH, meanwhile, was already seeing some gross margin pressure before this, with its adjusted gross margins falling -440 basis points in Q3 to 45.3%.

The current environment has been a difficult one for RH, as evidenced by the nearly -14% decline in sales it saw in Q3 to $751 million. Meanwhile, adjusted EPS went from $4.26 a year ago to a loss of -42 cents.

Shareholder Letter

Looking ahead, the company narrowed its full year revenue guidance to $3.06- $3.08 billion, with adjusted operating margins of 13.6%-14.0%. That compared to a prior forecast for sales of $3.04-$3.10 billion and adjusted operating margin in the range of 14.5%-15.5%. The adjusted guidance shows that the company expects to see continued margin pressure in Q4, but this was before the spike in ocean freight rates.

The company hopes to turn its fortunes around in 2024 with a huge product transformation. It is looking for FQ2 to be an inflection point following the introduction of its new RH Modern and RH Outdoor Sourcebooks in Q1. Friedman has said the new collection will be of a “design and quality inaccessible in our current market, and a value proposition that will be disruptive across multiple markets.” We’ll have to see what the new collection entails, but RH has a certain look and feel that appear to its core customers, so anything that strays from this might not be the best ideal. it also seems like the company is admitting its quality good be better, despite its high price tag. This may not be the best environment for such a be shift.

Meanwhile, the company opened two additional international locations, both in Germany, in November, bringing its total up to three. Opening in international markets continues to be a big push for the company to help reinvigorate growth.

In its Q3 letter to shareholders, Friedman said:

“While many retailers boast of a capital-light, franchise or licensing approach to international expansion, we believe the only way to build a brand and optimize the business globally, is to invest into, and control the brand in the same manner we do locally. With people who live and breathe our values, because it’s their values. People who will lead our cause and build our culture, because it’s their cause, and it’s their culture. We believe when you aspire to be the very best in the world, there are no shortcuts, and greatness can never be delegated, nor licensed or franchised. Our next international openings include RH Brussels, The Gallery on the Boulevard De Waterloo, and RH Madrid, The Gallery on the Plaza Marques De Salamanca in the first half of 2024, followed by RH Paris, The Gallery on the Champs-Elysées in the fall of next year.”

However, cracking the European market for RH may not be easy, and the company is spending a lot of money diving head first into a number of European markets. Some of the issues surrounding breaking into these markets can be seen in the commentary of the opening from German online magazine Alethea, which wrote:

“The space RH is moving into is beautiful and prestigious, but Düsseldorf is a market with prominent, well-connected interior designers and numerous luxury interior brands already have their own showrooms in the city.”

The European wealthy often work with interior designers, who generally have relationships with top European furniture makers. Breaking into this market as a U.S. upstart that manufactures its furniture in China could be a tough sell versus companies that have handcrafted pieces from places like Italy and Portugal.

Valuation

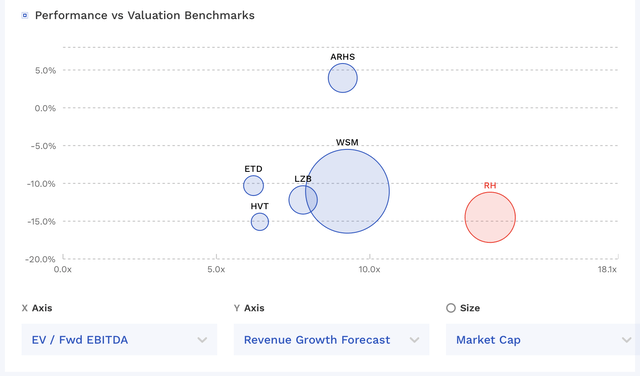

RH stock currently trades at 12.2x the FY2025 (ending January) consensus EBITDA of $647.7 million and 11.0x the FY2026 consensus of $717.0 million.

It trades at a forward P/E of 21.2x the FY25 consensus of $11.83 and just at 15.6x the FY26 consensus of $16.12.

Revenue growth is expected to drop -14.5% this year, and then grow over 6.4% in fiscal year 2025 and 8.4% in fiscal year 2026.

RH trades at a wide premium to its peer group given its long-term track record.

RH Vs Peers Valuation (FinBox)

Given some of the headwinds in the market, I’d value RH between 8-10x FY26 EBITDA, which would place the stock between $141-$220. This range is closer to its faster-growing high-end peers like Williams-Sonoma (WSM) and Arhaus (ARHS). I also think it allows for some downside to current estimates, which could be too high given the surge in ocean freight rates and weak projections for things such as remodels. However, coming off a down sales year and with more store openings, they don’t look out of line.

Conclusion

RH CEO Gary Friedman likes to take big swings, and his European expansion is his latest one. He’s taking on some very expensive leases to get into top-notch locations. However, how well the RH product resonates with European consumers is still an unknown at this point.

The company is also aggressively looking to expand in the U.S. this year in a difficult home furnishing market. In addition, Friedman has a list of bold ambitions, from buying two companies to start creating one-of-kind bespoke furniture to selling fully furnished luxury homes and apartments.

Friedman’s long-term vision for RH is intriguing; however, the short term will likely continue to be pressured from a combination of a difficult home furnishing market and high ocean freight costs. Its European stores may also not initially be profitable, weighing some on results.

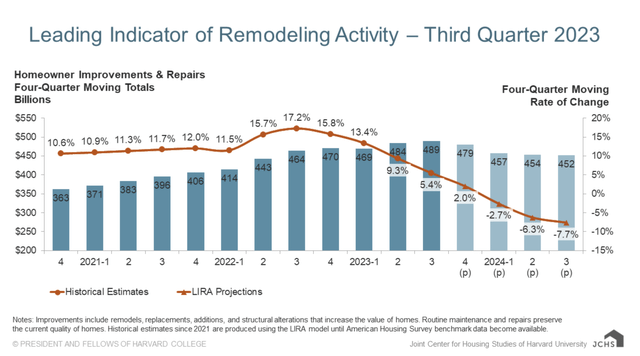

The company is betting heavily on a inflection in the U.S. with its new product revamp, but with the housing market stalled and remodeling expected to decline this year, that could be a tough road.

Home Remodeling Projections (Joint Center for Housing Studies of Harvard University)

As such, given this backdrop, I’m going to take my rating on RH to “Sell” in the near term. I like it longer term, but there remain a lot of near- to medium-term headwinds. My target price is $180.