LPETTET

Last week, I published an article highlighting Realty Income (O) as my favorite high-yield REIT.

In that article, I mentioned that I couldn’t call “The Monthly Dividend Company” my favorite REIT overall because of another, faster-growing company that I like just as much.

I said that Rexford Industrial (NYSE:REXR) is my favorite high-growth REIT and that attempting to compare its shares to Realty Income’s shares is like comparing apples to oranges.

Thankfully, I like both apples and oranges and I’m happy to own them both.

In today’s piece, I’ll put a spotlight on why Rexford is one of my highest conviction long-term REIT picks and why I believe that this stock has the potential to outperform its peers, the REIT sector, and the broader market, moving forward.

Why Rexford’s “Low” Dividend Doesn’t Bother Me

Rexford appears to be overlooked by many REIT enthusiasts, largely because of its low yield, I think.

I get it – most people who own REITs do so because of the high yields that they pay.

REITs have to return at least 90% of their taxable income to shareholders as a dividend to maintain their tax status and this tends to result in safe, high yield from blue chip REITs.

I read a lot of commentary on REITs and I can’t tell you how many times I’ve seen readers comment something like, “I’ll buy company X when it yields 5%.”

Or, “The 10-year yields 4%, so I’m not interested in buying company Y until it yields 6%.”

You get the drift.

Well, REXR shares only yield 2.85% right now.

For reference, that’s still twice as high as the S&P 500’s 1.4% yield; however, it’s well below the 4.04% yield attached to the Vanguard Real Estate Index Fund ETF (VNQ).

At first glance, REXR’s low yield might look like a problem. But, after looking at the company’s fundamentals/operating results, you’ll quickly realize that Rexford’s low yield is a product of its sector-leading growth, not a lack of generosity from management.

You see, there is generally an inverse relationship between fundamental growth and dividend yields.

As I said in my article from yesterday, highlighting 25 stocks with double-digit dividend growth potential in 2024, “To have high dividend growth prospects a company must have high fundamental growth prospects and the market is always willing to place a premium on outsized growth potential.”

Well, when it comes to fundamental growth, dividend growth, and total returns, it doesn’t get much better than Rexford in the REIT sector.

Yes, this company’s yield is 2.85%, but its 5-year DGR is 18.89%.

Using the rule of 72, REXR’s annual dividend would double every 3.8 years if it continues to compound at that pace.

REXR’s most recent dividend increase came in at 20.6%. At that rate, its dividend would double every 3.5 years.

I’ll take a 2.85% yield with that sort of organic compounding potential all day long.

And while I don’t expect to see 20%+ dividend increases continue over the long-term here, I think REXR’s forward-looking fundamental growth prospects support ongoing annual dividend growth in the 15%+ range.

Looking at consensus estimates, in 2024, this company is expected to produce AFFO growth of 16%. In 2025, consensus points towards AFFO growth of 21%. And in 2026, Rexford’s consensus growth estimate is 16%.

Right now, the stock’s forward AFFO payout ratio is just 76%.

All in all, 5 years down the road, I think REXR’s annual dividend will be in the $3.00/share range.

Using today’s share price of $53.25, that would represent a yield on cost of 5.6%.

And it’s not likely that REXR’s growth prospects are magically going to end when 2028 rolls around.

As this company matures, I expect to see its dividend growth rate slow. But, due to secular tailwinds pushing demand for industrial real estate space higher, I think REXR will be well situated for ongoing growth for decades to come. With that in mind, I think a yield on cost in the 7% area is possible by 2030 and a yield on cost in the 10% range is possible by 2035.

Therefore, this is one of those rare stocks that can scratch my growth & income-oriented itches.

REXR was the only REIT on my double-digit dividend growth stock list for 2024.

It was also the only company with a dividend yield above 2.5%.

Without a doubt, this company’s attributes are unique and this is why REXR remains near the top of my personal buy list at the moment.

Diversification, Be Damned

Something else unique about Rexford Industrial is the lack of geographic diversification across its property portfolio.

While blue-chip peers, like Prologis (PLD), have expanded their industrial empires out across the globe, Rexford has been content to dominate a single market: Southern California.

This company has made a fortune for its inventors over the years (despite their recent woes, REXR shares have crushed the S&P 500, rising by more than 304% during the past decade) by investing in infill properties surrounding the Port of Los Angeles (which is the busiest port in the western hemisphere).

There are only a few primary access points to the North American market from the Asian Pacific markets: Los Angeles/Long Beach, Seattle/Puget Sound, and Vancouver.

Although the geopolitical relationship between the US and China remains rocky, there are plenty of imports flowing into the US from Asian markets overall (despite the trade war and political disagreements, China remains a huge trading partner and there are plenty of US allies shipping goods here from the other side of the Pacific).

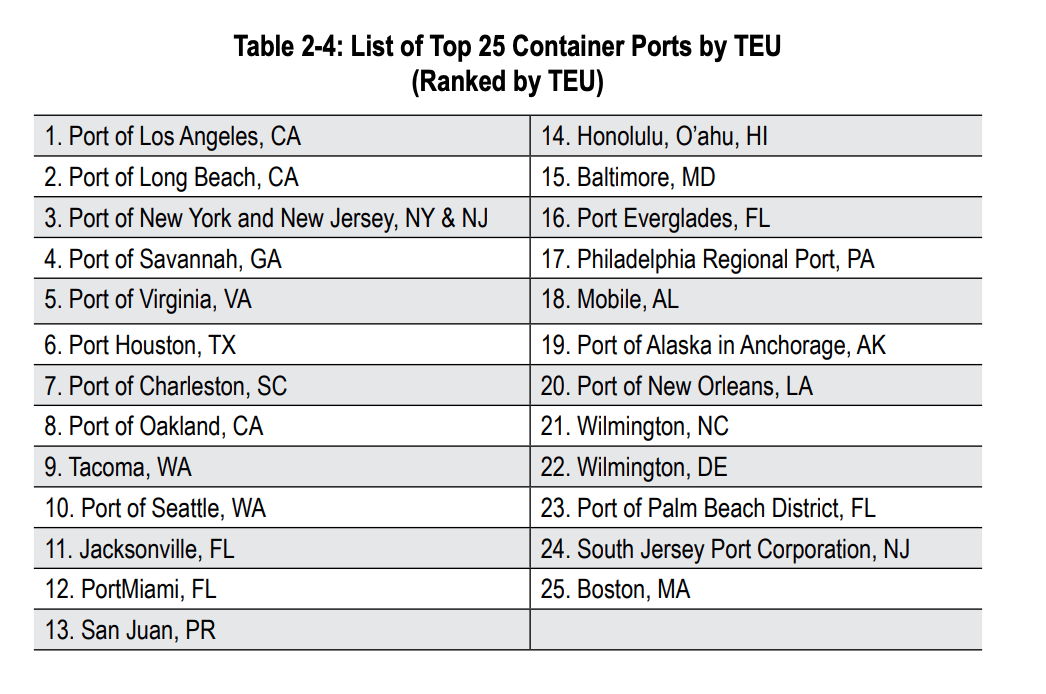

In terms of shipping container volumes, the Port of Los Angeles/Long Beach dominates the US shipping scene.

Bureau of Transportation Statistics 2024 Annual Report

Total tonnage is relatively lower coming out of those two ports (overall, Long Beach ranks 5th in total tonnage and Los Angeles ranks 10th) because they don’t specialize in energy shipments; however, those shipping containers and the goods within are going to be the primary concern for industrial REIT investors from a warehousing perspective.

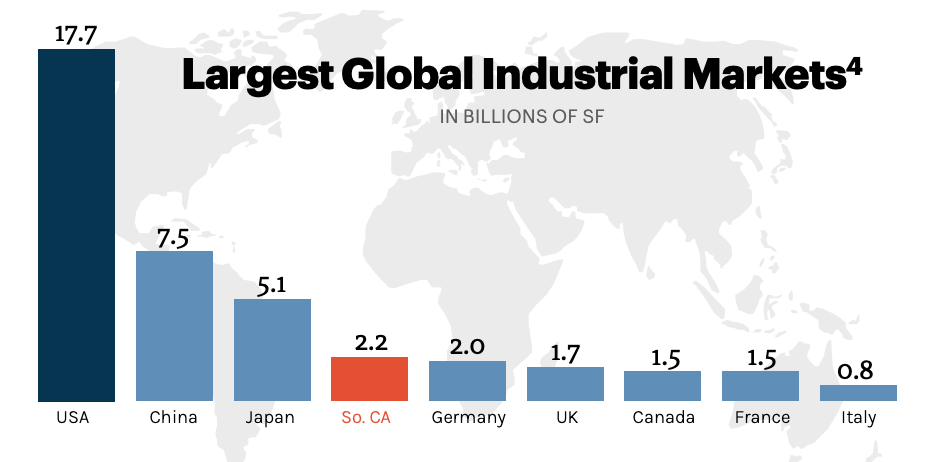

To put this into perspective, in their most recent shareholder presentation, Rexford noted that the SoCal industrial market is larger than each of the biggest European markets.

REXR October Investor Presentation

Rexford has focused its investments on this very high-demand market, which has enabled it to generate best-in-class rent growth (due to the unique supply/demand metrics found in southern California).

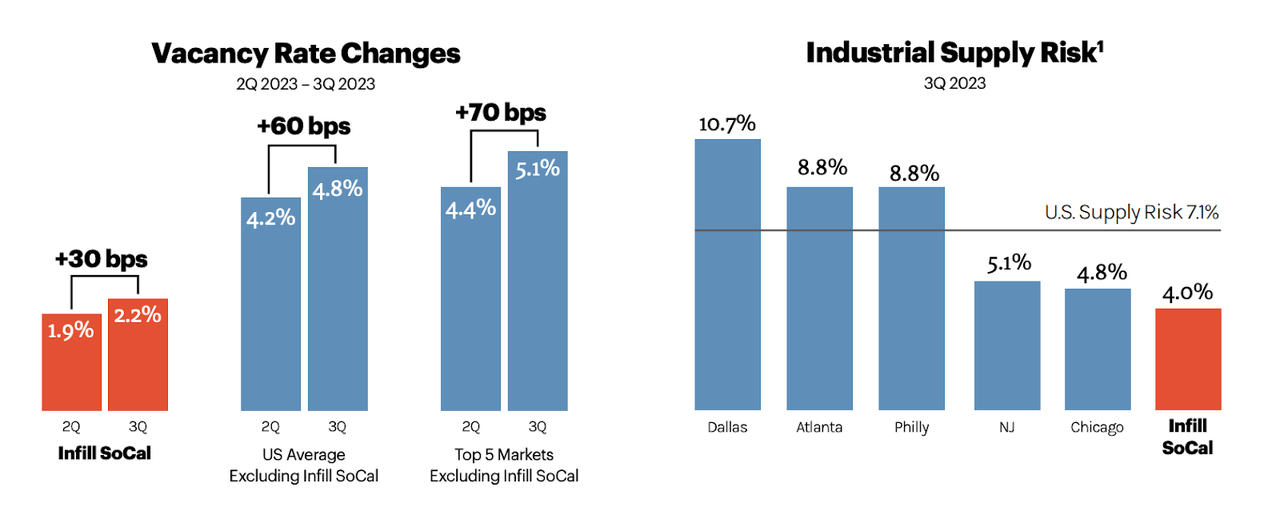

As you can see here, limited supply leads to extremely low vacancy rates.

REXR October Investor Presentation

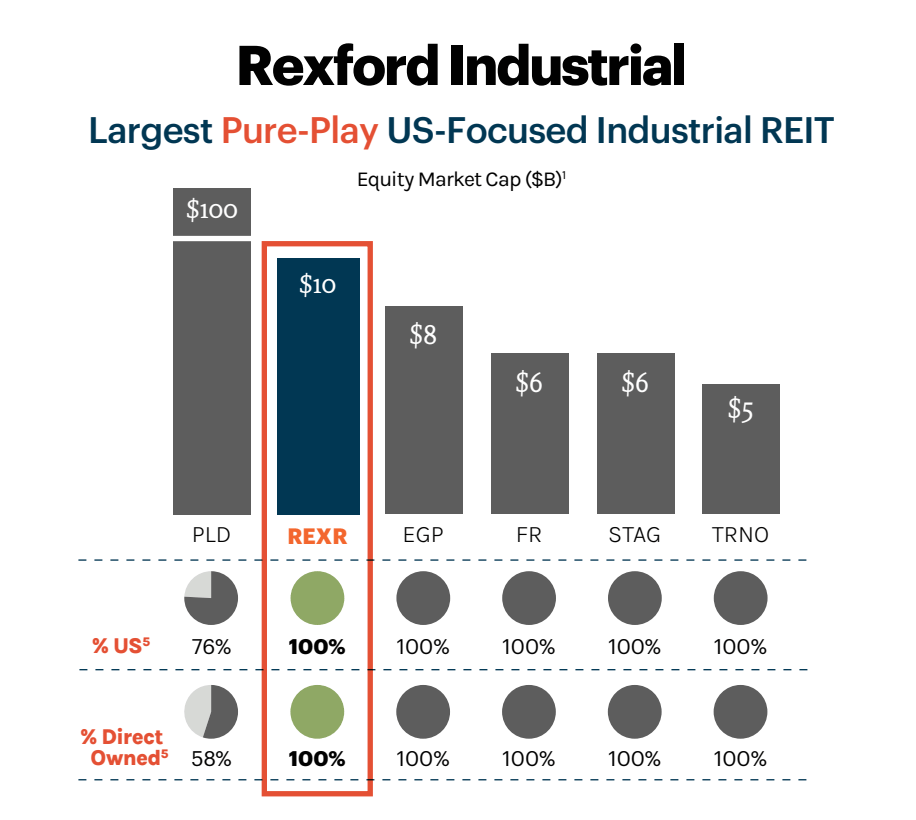

Ultimately, the size of the Orange County market alone has enabled REXR to become the largest pure-play US industrial REIT.

REXR October Investor Presentation

The supply/demand metrics of the southern California market have allowed REXR to generate outsized returns.

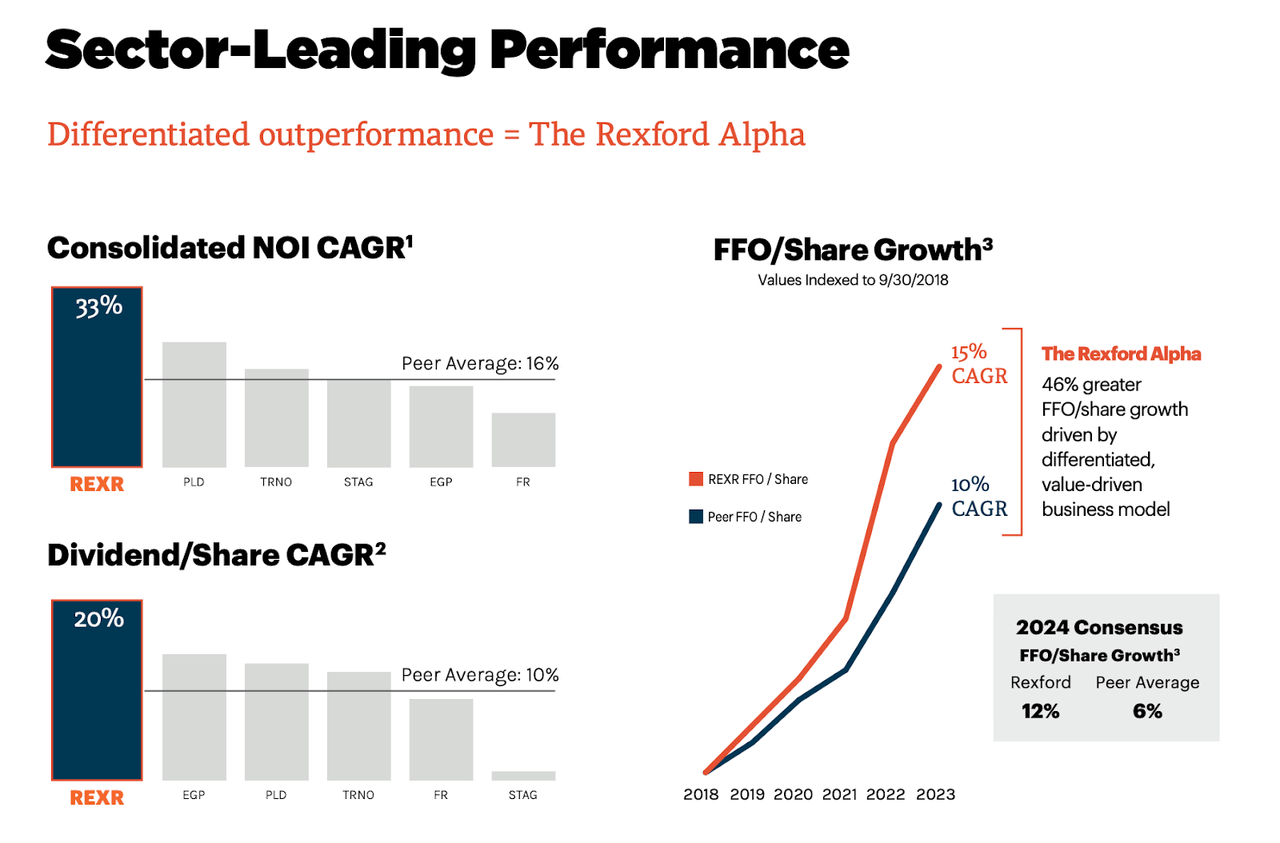

I know that a lot of people love to hate California. Both Essex Property Trust (ESS) and Rexford Industrial are sometimes criticized for their concentration in that state, largely due to the regulation and legislative policies that we’ve seen with regard to business, taxes, and landlords, in particular, that are deemed as unfriendly to business. However, as you can see below, Rexford’s bet on Southern California has played out nicely from a fundamental growth standpoint.

This company’s investments in Orange County infill have allowed it to generate best-in-class NOI, FFO/share, and Dividend growth.

Personally, I’m glad that I don’t have to pay California taxes, but I’m more than happy to own a company that does business there when it’s able to generate best-in-class fundamental growth.

REXR October Investor Presentation

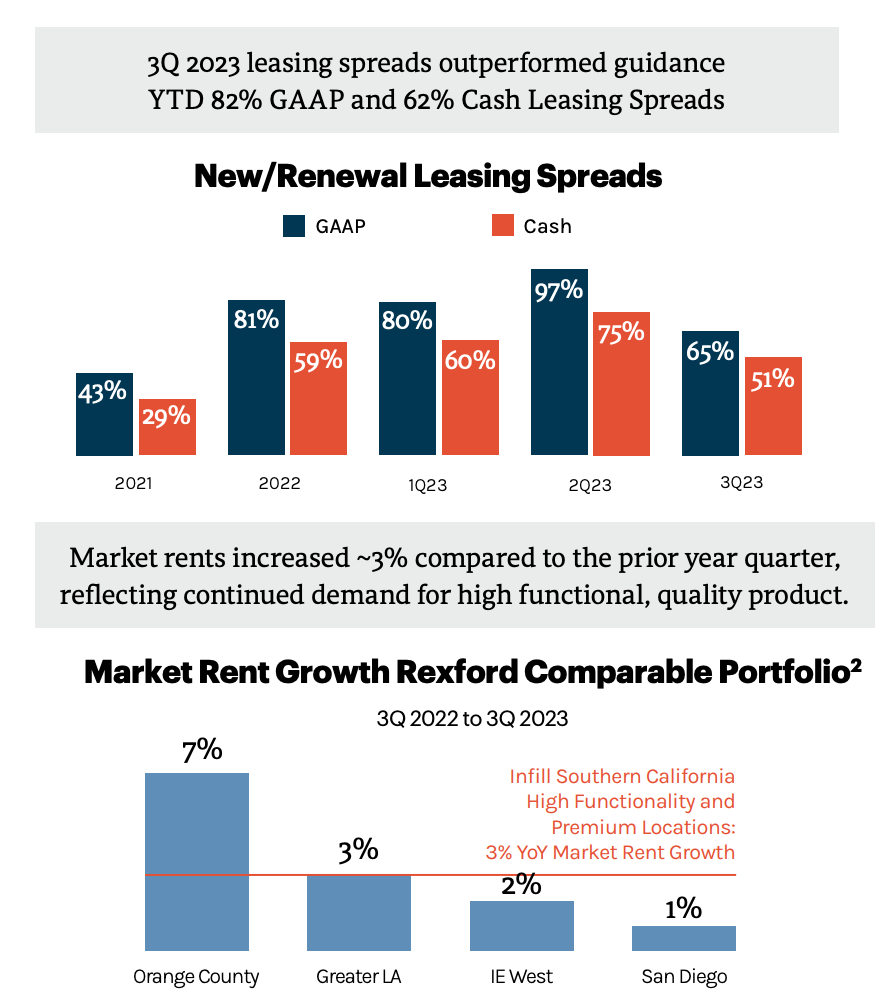

And looking at recent results, it appears that this outsized growth is likely to remain in place.

Rexford continues to post strong double-digit rent growth when renewing leases and overall, the company sees strong market rent growth across its Orange County/SoCal focus area.

REXR October Investor Presentation

Yes, it’s true that REXR’s SoCal concentration puts it at risk of significant disruption from something like a major Earthquake; however, I think it’s worth noting that the San Andreas fault line runs far west of LA. If REXR’s portfolio was concentrated in San Francisco, then I’d be more worried about disruption/destruction. However, Los Angeles appears to be a safer bet.

To me, the benefits of a company like REXR having all of its best minds and boots on the ground in one market like Orange County is that it allows the company to have a unique expertise of the infill landscape which can lead to deals that competitors don’t have easy access to.

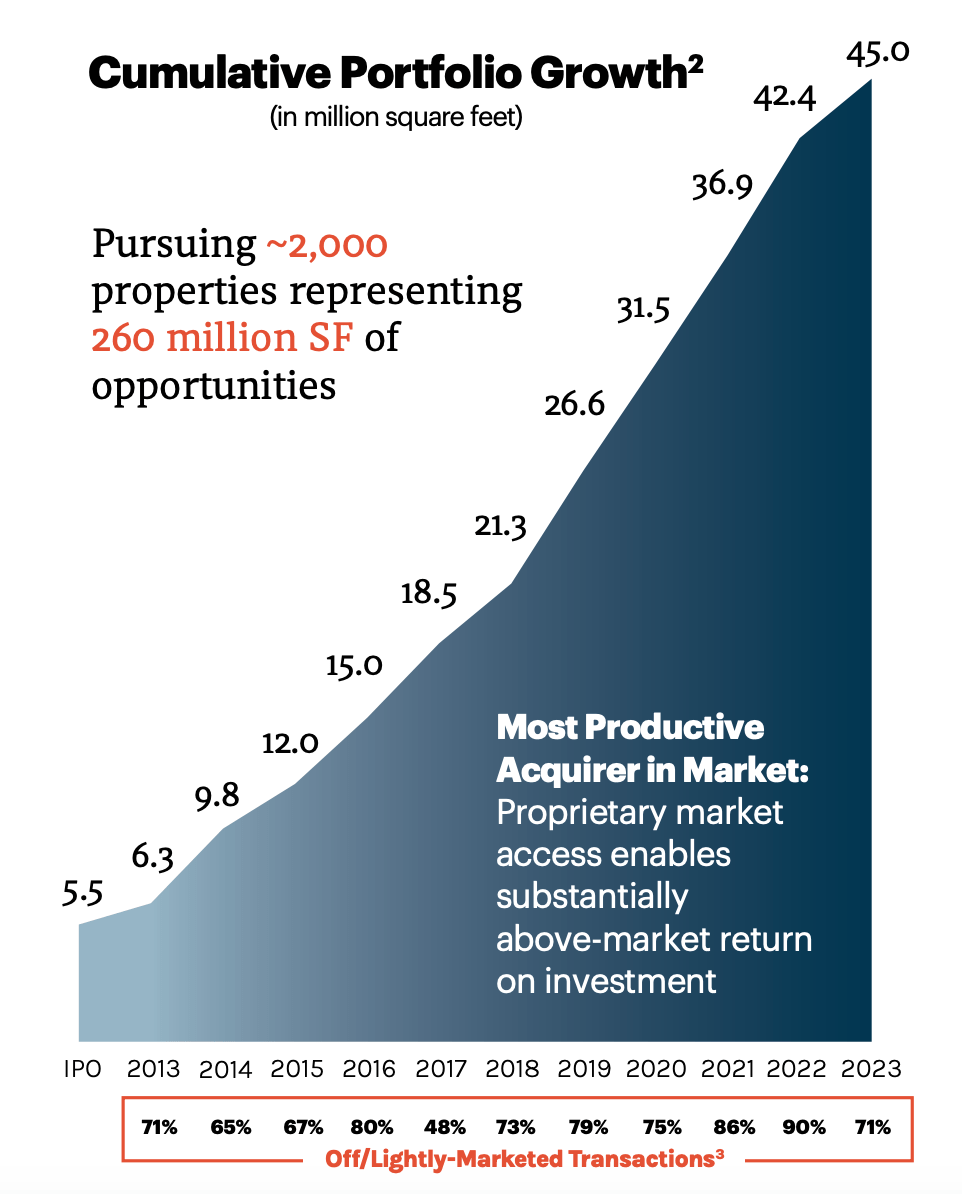

Here’s a chart showing REXR’s portfolio growth over the years.

REXR October Investor Presentation

The steep trajectory of its portfolio size goes to show the immense size of the SoCal market (it’s amazing that REXR is able to continually source more and more infill properties to invest in and develop).

However, the most important numbers on the list (to me, anyway) are at the bottom.

As a former Realtor, I know the power of off-market opportunities. Deals like this often put the bargaining power in the hands of the buyer rather than the seller by removing competition and unwanted bidding wars. As a well-capitalized buyer, REXR is able to get deals done here quickly and easily for sellers, serving as the foundation for the company’s long-term gains. And if its resources were spread thinly across the globe then they’d probably miss out on many of these opportunities which require local relationships and ears constantly to the ground.

Valuation

I’ve established that REXR is a top performer in the dividend growth space, due to its concentrated real estate portfolio that generates best-in-class fundamental growth. Now, the question remains, what’s a fair price to pay for these shares?

REXR shares are down by ~9% during the last year, in large part due to rising interest rates and the negative sentiment that they’ve created for REITs (the VNQ is down by ~5% during the ttm).

As a longer-term investor here, this underperformance has been tough to stomach. It’s hard to own stocks that post negative performance when the broader market is up by ~18.5% during the same ttm period. But, looking at REXR’s fundamentals, I believe that the stock’s recent weakness is irrational. Assuming that Rexford continues to post growth that is anywhere near consensus estimates, I believe that these shares offer strong upside potential.

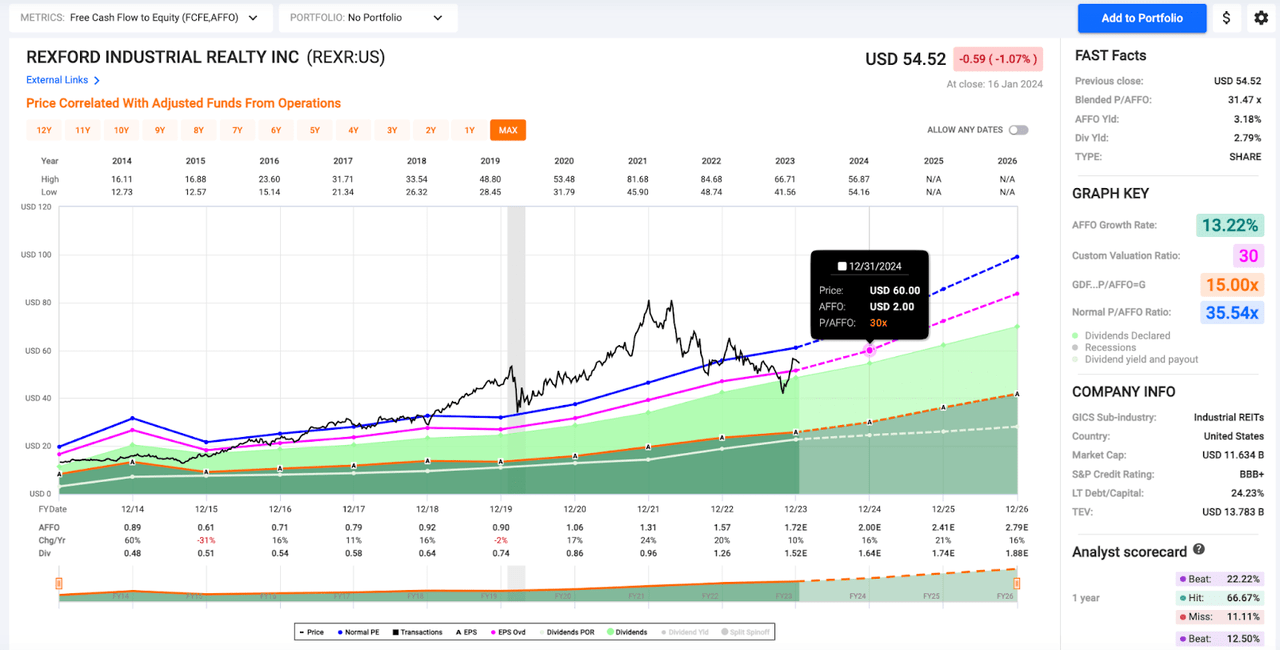

Because of its strong AFFO growth results over the years, REXR has historically traded with a high P/AFFO multiple.

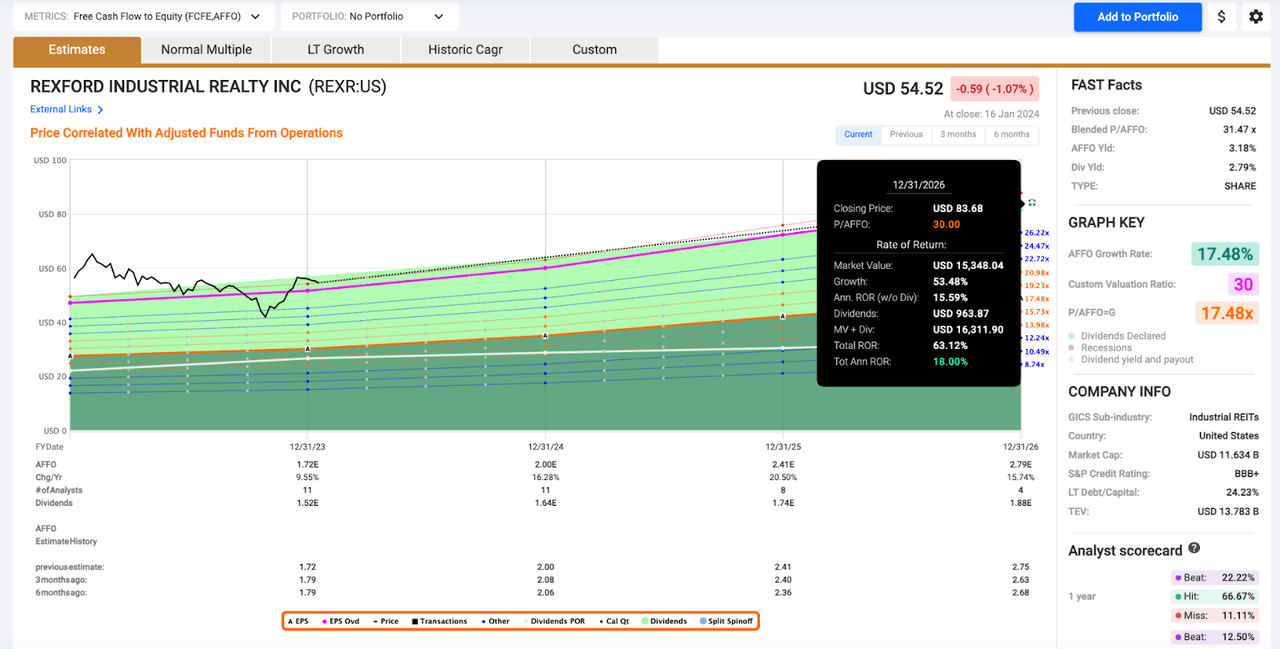

FAST Graphs

Since its IPO, REXR’s average P/AFFO multiple is ~35.5x.

That’s extremely high for any REIT. But, on the other hand, there aren’t many REITs compounding their AFFO at such a rapid rate.

Looking ahead, I don’t think 35x makes sense here. But, I do think a 30x multiple (which has served as support for shares in the past (see sell-off during 2015, 2016, 2018, and 2022) is a valuation level that seems fair for a company expected to compound its bottom line at a 17.6% average rate over the next 3 years.

As you can see on the chart above, a 30x multiple on REXR’s consensus AFFO estimate for 2024 would equate to a $60.00/share price.

That’s a nice round number and it’s where my fair value estimate lies. Therefore, today shares are trading with an attractive margin of safety attached.

Relative to today’s $53.25 share price, we’re looking at an upside potential of approximately 12.7%. And that’s before the dividend is factored into total returns.

Looking out to fiscal 2026, if REXR is able to meet analyst expectations with regard to that high-teens AFFO growth rate, and continues to pay a growing dividend, then someone buying shares today would be setting themselves up for a potential total return CAGR of 18%.

FAST Graphs

Therefore, even if REXR doesn’t see mean reversion back to its long-term average P/AFFO multiple, shares still offer considerable upside potential. And, in the meantime, long investors like me get to sit back and collect a growing 2.85% dividend while they wait for growing fundamentals to drive share prices higher.

Conclusion

Simply put, I’m not aware of any other REIT that offers the fundamental and dividend growth potential that REXR shares possess.

I’ve come to trust this management’s intense focus on the SoCal market and I don’t mind holding shares of this highly concentrated REIT.

REXR pays a 2.85% dividend yield. I believe they’re likely to post ~15% annual dividend growth during the next several years. And therefore, Rexford is one of my highest conviction dividend growth picks in the entire market (from a yield + growth standpoint).

What’s more, shares appear to trade at a double-digit discount to fair value.

All in all, I believe that the negative sentiment surrounding REITs has created an intriguing opportunity here.

That’s why I was buying REXR throughout 2023 and plan to continue to add to my position into weakness during the new year as well.