marchmeena29

Redwood Trust, Inc. (RWT) is a real estate investment trust that specializes in the ownership of mortgages. The company carries residential property mortgages, multifamily loans, and business loans. Over a year ago, I discussed the 10% preferred share that was offered by the company (RWT.PA). Today, I am affirming my buy rating of Redwood Trust preferred shares and discussing a second income option, the company’s newest 9.125% baby bond (NYSE:RWTN).

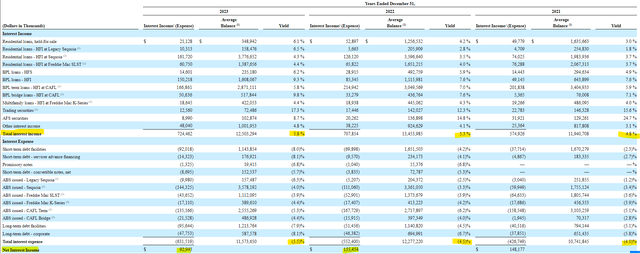

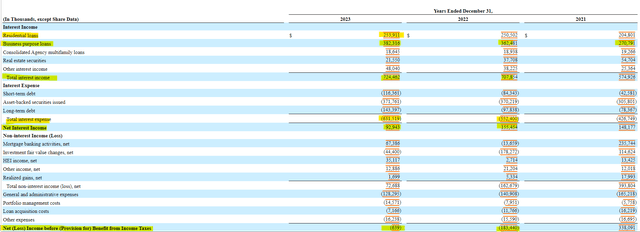

Redwood Trust’s operation depends on the use of leverage (borrowing) to earn income. As a result, the company has come under pressure with the rapid rise of interest rates. This challenge is best illustrated by reviewing Redwood Trust’s net interest statement, which shows asset yields rising from 4.8% in 2021 to 5.8% in 2023.

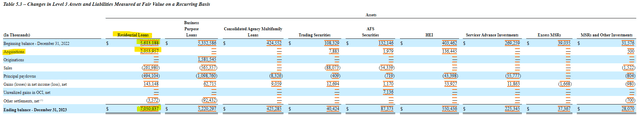

While interest income has increased by 100 basis points, interest expenses have risen by 150 basis points, from 4% to 5.5% in the same period. This has caused net interest income to fall from around $150 million to $93 million. One bright spot for the company is that the fair value of its investments stabilized a bit in 2023, after having to take a huge loss in 2022. These changes in valuation may be non-cash, but they affect Redwood Trust’s ability to borrow to expand lending.

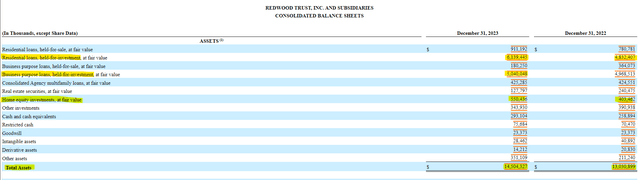

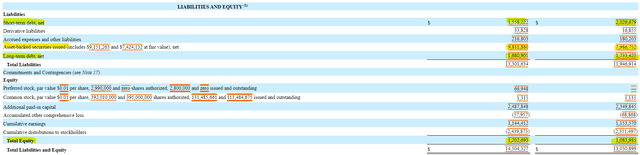

An examination of the balance sheet shows that Redwood Trust opted to take on risk and grow the balance sheet in 2023. The company holds several different investments, but residential loans and business purpose loans are the two biggest types of holdings. During 2023, the company’s investment in residential loans grew by $1.3 billion, accounting for almost all the growth in assets.

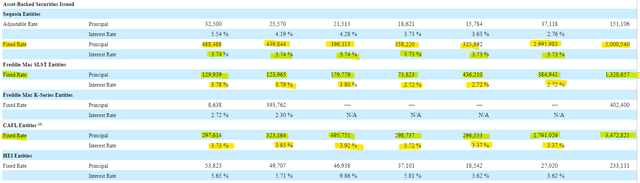

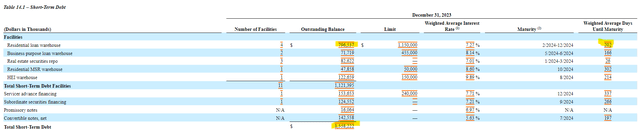

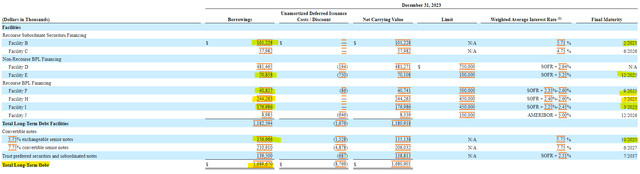

To grow its investments, Redwood Trust borrowed using asset-backed securities in 2023. Redwood Trust also utilizes short-term and long-term debt. During the year, the company paid down short-term debt by nearly $500 million, long-term debt by $50 million, and increased its balance of asset-backed securities by nearly $2 billion.

The shift away from traditional debt into asset-backed securities is a move that will likely keep Redwood Trust profitable through the current high-rate regime. In the shift to ABS financing, Redwood Trust now carries a super majority of its debt at an interest rate below 4%, compared to the near 8% rates for short-term and long-term debt.

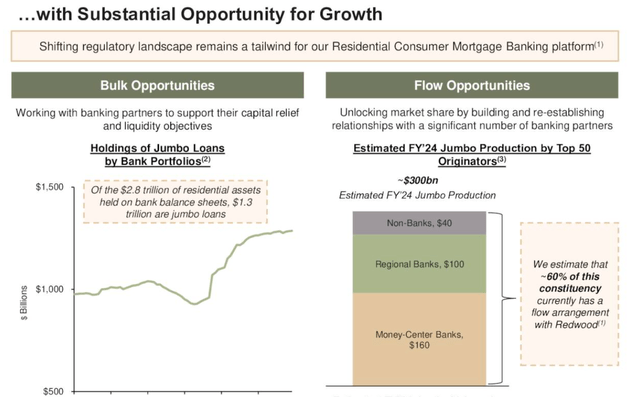

Looking forward, it’s clear that Redwood Trust wants to invest in residential loans. In fact, during the year 2023, the company did zero originations in residential loans and instead went out and acquired $2 billion worth of loans. The company went into further detail in its fourth quarter earnings presentation. Redwood Trust is pursuing the acquisition of jumbo loans, which are currently sitting on bank balance sheets. The company believes that they can provide liquidity relief to financial institutions by acquiring the loans they originate.

SEC 10-K Earnings Presentation

Redwood Trust’s business model is not without risk. I believe the firm faces risks associated with both the increase and decrease in interest rates. On the increase side, rate increases will raise the costs associated with short-term debt and further compress the company’s net interest margin and ability to grow into the jumbo residential loan market.

On the opposite end, if rates were to decrease rapidly, Redwood Trust would be stuck holding fixed rate asset-backed securities that could be near or above the rates of the mortgage market, creating an upside-down effect that would require the company to pivot back into the short-term debt markets to refinancing relief. While I don’t see a huge drop in interest rates as likely, I believe it is worth mentioning in case it happens.

As for the common shares, preferred shares, and baby bonds, I am opting to stay with the preferred shares for the time being. The common shares will bear the brunt of any volatility in the mortgage market along with company earnings. The baby bond is a great consideration for income investors seeking more safety, but it is currently trading above par. I may consider the baby bond if the price drops below par.

Redwood Trust is taking a bold move to grow its business in the face of high interest rates and strong headwinds in the mortgage market. The company has stabilized its profitability by locking into below-market fixed rate asset-backed securities and seems to have developed a strategy around an open market in jumbo residential mortgage loans. Investors who have invested in preferred shares up to this point have enjoyed the 10% dividend and should for the foreseeable future.

For more information on the Redwood Trust preferred share, click here.

For more information on the Redwood Trust baby bond, click here.