ImagePixel

Introduction

I’ve been writing about earnings “bust” bear market and recession risk for about two years now on Seeking Alpha. Over that time, the earnings bust occurred for most businesses that had experienced a “boom” from the pandemic, stimulus money, and supply chain issues that followed, but the economy hasn’t gone into recession, yet. Two of the three big remaining catalysts for a recession have been diminished recently, while one will persist into next year. The one recession catalyst that will remain with us for some time is the repayment of student loans, which only started two months ago. We have seen credit card debt and delinquencies rise since then, so there will be continued economic restrictions from student loan repayment as time goes on, but the other two recession catalysts have been diminished. The first of those is gasoline and fuel prices, which have dropped significantly, and are immediately felt by consumers. The second occurred this past month with interest rates falling significantly.

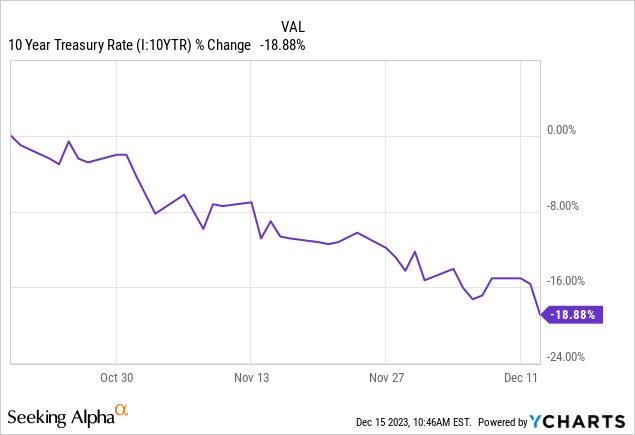

The 10-year US treasury yield has fallen nearly -20% in two months and currently stands near 4%. Even though the Federal Reserve did not proceed short-term rates, any time long-term rates fall this much it gives borrowers a chance to refinance or to be able to make a purchase they previously could not afford to make for big-ticket items. Additionally, it gives a little relief to those borrowers who may be right on the edge of delinquency and default. In short, even if rates eventually come back up, this sort of proceed gives the Fed more time to adjust, and it reduces the immediate risk of deep recession.

This is important for a somewhat economically sensitive stock appreciate Interpublic Group (NYSE:IPG) which also carries some debt. While I don’t think IPG is out of the woods, and while I don’t think a recession is completely off the table, the odds of a near-term deep recession have decreased. This means the biggest risks associated with an advertising and marketing business appreciate IPG have been mitigated, and we can scrutinize the valuation of the stock in light of this reduced cyclical risk.

Examining IPG’s Historical Cyclicality

The first thing I always check when analyzing a stock is what the historical earnings pattern has been. Earnings cyclicality is the main thing I check for, but I also look for other patterns appreciate stagnation, unusual rises or declines, or erratic fluctuations that can’t be easily explained. If I ascertain the historical earnings are cyclical, then I usually don’t use earnings to value the stock because they can be too unpredictable and can often send the wrong signals regarding valuation. Also, if earnings are very erratic I sometimes immediately put the stock in the “too hard pile” if I don’t think historical earnings are a reasonably good guide for the future.

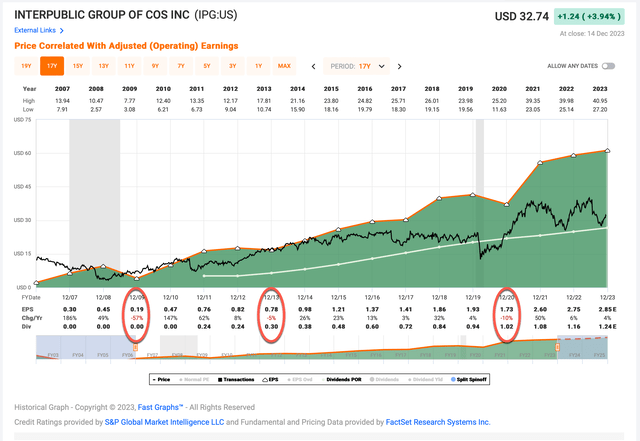

IPG suffered a -57% EPS reject in 2009, a -5% reject in the weak economic year of 2012, and a -10% reject in 2020. So, they have a history of their earnings being economically sensitive if the economy is struggling or in recession, and the -57% reject in 2009 was quite significant. However, their earnings more than fully recovered immediately after the years in which the declines occurred, and if an investor had held through those downturns they would have done fine as long as they didn’t pay too much for the stock. So, I think as long as investors comprehend that these earnings declines will happen and are prepared for them, the worst outcomes can be avoided. And as long as we take these declines into account when estimating earnings growth I don’t think IPG is too cyclical to use my typical “full cycle” valuation approach, which focuses on earnings and earnings growth.

Interpublic Group’s Current Valuation

The most basic way I perform a valuation for a moderately cyclical stock appreciate IPG is to compute how much in earnings I would likely collect over a 10-year period if I owned the business and kept all the earnings for myself. I convert that amount of collected earnings into a CAGR percentage and use that percentage to deduce whether or not the valuation is attractive. I do this by using a combination of earnings yield and earnings growth expectations. I typically base my earnings growth expectations on what the growth rate has been over the previous economic cycle. In this case, I’m going to begin with the historical earnings growth since 2015, so we include the down year in 2020.

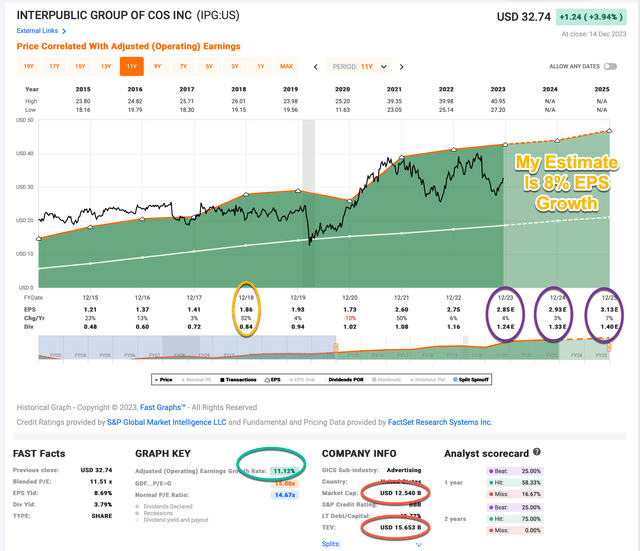

In the FAST Graph above, the earnings growth rate from 2015 through 2025’s estimated earnings (circled in green) is expected to be about +11.12%. Because this earnings growth rate includes the one-time corporate tax cuts of 2018 and because we did have a big boom in earnings in 2021, fueled by stimulus money. Along with the fact that analysts are only expecting about 4% to 5% EPS growth in the next few years, I chose to assess their future earnings growth over the next decade at 8%. This is lower than the rate since 2015 but a little higher than analysts currently expect. Additionally, in my valuation process, I will also control a little bit of debt since we are no longer in a zero-interest rate environment. My quick way of doing this is to see how much higher the total enterprise value is compared to the market cap, and then raise the stock price by that percentage to compute a more conservative earnings yield assess. This number does change a little bit as the stock price moves, but I made about a 19% adjustment to their valuation to account for their debt. When I do this, I get an earnings yield for IPG of about +7.19% at its current price.

Next, I’ll apply the 8% growth rate to current earnings, looking forward 10 years in order to get a final 10-year CAGR assess. The way I think about this is, that if I bought IPG’s whole business for $100, it would pay me back $7.19 plus +8% growth the first year, and that amount would grow at +8% per year for 10 years after that. I want to know how much money I would have in total at the end of 10 years on my $100 investment, which I compute to be about $212.62 (including the original $100). When I plug that growth into a CAGR calculator, that translates to a +7.84% 10-year CAGR assess for the expected business earnings returns after adjusting for debt and other obligations.

10-Year, Full-Cycle CAGR assess

Using my old valuation method, which included a mean reversion factor and did not take debt into account, I used a “Hold Range” for the 10-Year CAGR between 4% and 12%, and if it was below 4% the stock would usually be a “Sell”, and above 12% a “Buy”. Now that I have removed the P/E mean reversion part of the assess I’ve tightened the “Hold” range from 5% to 8% because there is typically a lot less fluctuation when it comes to average business earnings than there is with the stock price.

The current +7.84% 10-year estimated business CAGR is slightly under my 8% threshold for a “Buy” because the stock price has risen a little bit since we bought IPG in my investing group, The Cyclical Investor’s Club, a few days ago. But since it’s still pretty close I am rating IPG a “Buy” for this article. (The official buy price is $32.25.)

Conclusion

While I’ve purchased about 18 stocks in my investing group in 2023, IPG will be only my 3rd public “Buy” rating this year. It’s not a super exciting stock that has huge return potential, but it’s a steady earner, pays a reasonable +3.79% dividend that is in line with its earnings growth, and if it simply recovers its highs from earlier in the year will produce a +25% gain. Also, at its current valuation, I don’t see a lot of risk of the bottom completely falling out of the stock without warning. Absent some sort of market crash, IPG will probably muddle through any moderate economic weakness the economy does encounter, so I recently added a 1% weighted position to my portfolio. I expect it will produce above-market average returns over the medium term.