Sundry Photography

While Redfin (NASDAQ:RDFN) should benefit from lower mortgage rates and a potentially better housing market, there are better ways to play this scenario.

Company Profile

RDFN is a residential real estate brokerage firm. The company’s commission to sell a home is typically between 1.0-1.5% compared to the 2.5-3.0% traditional brokers charge.

Unlike traditional brokers, RDFN employs most of its agents instead of using independent contractors. Agents earn a base salary as well as bonuses for each home they close. Agents typically earn less per transaction than traditional brokers on the homes they close. The company also sends some leads to partner agents who are not employed by the firm.

In addition, RDFN owns Title Forward, a title and escrow company licensed in nine states and Washington, D.C. The company also underwrites mortgages through Bay Equity, which is licensed in 49 states and D.C. The company sells most of the mortgages it originates while maintaining a small portfolio of loans and mortgage servicing rights.

RDFN also owns a digital marketing platform for rental units that connects renters with available apartments and houses for rent. The unit generates revenue through advertising by property managers.

Opportunity & Risks

The biggest opportunity for RDFN would be a more robust housing market. As the Fed raised rates and mortgage rates soared, housing activity slowed down significantly in 2023. With the Fed expected to lower rates three times this year, lower mortgage rates could drive additional home sales compared to last year.

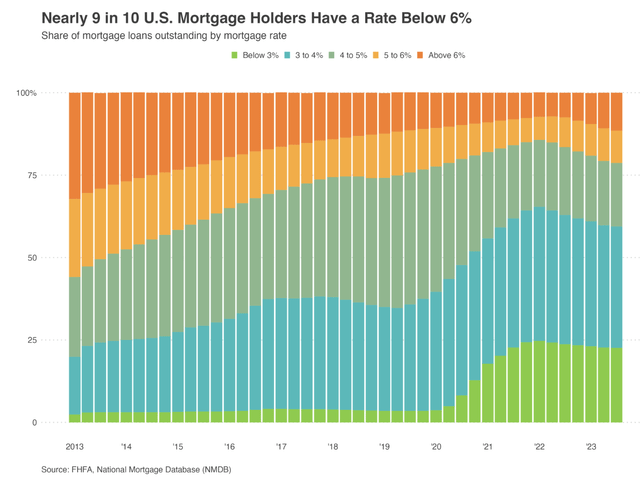

Of course, with many homeowners locked into low mortgages, this is likely to keep selling activity in check. According to RDFN analysis, 78.7% of homeowners have mortgage rates under 5%, while 59.4% have rates under 4% and 22.6% have rates under 4%. With mortgage rates hovering in the mid-6% range, the low rates from the latter two groups are more likely to keep those residences in place barring a needed move. However, if rates begin to approach 5% later this year after a few Fed rate cuts, it could open the market up a bit more.

Homeowner Mortgage Rates (Redfin)

Earlier this month, RDFN saw it was seeing some green shoots on this front, with 9% more new listings compared to a year ago. Total listings were still down -3% year over year, but it noted that was the smallest decline since June. Now the winter is a seasonally slow period for homebuying, so we’ll have to see how the market and listings shape up in the spring. And on its Q3 call in November, the company indicated that it thought the housing market would continue to see a downward trend in 2024.

RDFN also appears to be subtly looking to potentially shift away from its salaried agent model. On its Q3 call, the firm noted it was using its digital technology to route more demand to partners over employees. It noted that revenue from partners grew 30% in the quarter on a 24% increase in transactions and shift to higher price houses. The company has also started hiring some agents with all-variable pay in the Los Angeles and San Francisco markets. It also is introducing Redfin Max, where agents can retain as high as 75% of the commission of their own self-sourced listings. The company thinks this can help it get more of the high-end luxury California market.

It seems like RDFN wants to keep its employee-based model to help use a team approach, but it also wants to cut fixed costs. The company has laid off agents a few times since 2022. It also knows each market is different, so it is looking to offer top agents more in high-end markets while looking to direct sales to partners in other markets.

The company is also looking to become more digital and better monetize its digital assets. The company has been developing new digital revenue streams, which has been helping improve its margins as well. Q3 gross margins improved to nearly 37% from 30% as a result of these efforts. Among some of its digital efforts have been adding display ads to its website; developing a mortgage marketplace to connect its website visitors to lenders; and publishing new-construction listings from Zillow (ZG).

Another opportunity for RDFN is to improve its attach rate for originating mortgage and title services. The company has done a nice job of this in the title business, with an attach rate of 57% in Q3. This is up from 39% a year ago and only 12% at the end of 2021. Bay Equity, its mortgage unit, meanwhile, had a Q3 attach rate of 18%, which was actually down from 19% a year ago. RDFN thinks over time Bay Equity can get a 25-30% attach rate. It noted that all-cash buyers have been hindered getting to a higher attach rate in the current environment.

When it comes to risks, a continued weak housing market is the biggest one. The longer it lasts, the tougher it will be on RDFN. However, the company has reacted by taking out costs. It has done this through layoffs as well as earlier eliminating the buyer refund it previously gave to buyers and shutting down its home flipping service RedfinNow. The company turned EBITDA positive in Q3 and has generated positive cash flow throughout the first nine months of 2023.

RDFN also carries debt, most of which is in the form of nearly $800 million in convertible notes. In October, though, it entered into a $250 million term loan with Apollo and it has been in the process of buying back these convertible notes. The Apollo notes come at a pretty hefty variable rate, currently at SOFR +575, which is about 11%. If things get worse for the company, its debt could become an issue.

A $1.8 billion verdict against the National Association of Realtors (“NAR”) over commissions could also hasten changes to the industry. If the end result is lower commissions, the biggest impact on RDFN could be more competition to its low commission structure. RDFN has among the lowest commissions in the industry, so any reduction should not impact it much directly. However, commissions have come down over the years and if the gap closes even further it could lose its advantage of attracting sellers.

Valuation

RDFN currently trades at an EV/EBITDA multiple of 134x the 2024 consensus of $13.8 million. Based on 2025 EBITDA projections of $59.1 million, it trades at a 31.3x multiple.

The company is currently not projected to EPS positive until 2029.

Revenue is projected to fall nearly -3% in 2024 and grow 13% in 2025. Revenue is set to be cut in half in 2023.

By comparison, Anywhere Real Estate (HOUS) trades at 7.5x 2025 EBITDA projections of $489.2 million, and RE/MAX (RMAX) trades at 5.9x the consensus of $101.3 million (adjusts negative minority interest to $0).

RMAX trades around 2.4x gross profits in 2025, while HOUS trades at 1.6x gross profits. RDFN trades at 4.4x 2025 gross profits.

At a 3x gross profit valuation would put RDFN at $3.50, while 25x EBITDA would put the stock at $5.50.

Conclusion

One of the problems with the RDFN in the current market environment is its employee agent model. In a downturn, the company has additional costs as it is paying them a salary with benefits. This also led the firm to have to lay off many agents to the right size of its business. This in turn could leave the company scrambling to hire more agents if and when the housing market takes a turn for the better.

It appears the company is trying to adjust its model somewhat to have employee agents pay them a complete variable salary, but it may not go far enough. Its digital efforts are going well, but this is still a small piece of the pie. Its title and mortgage businesses will also do better in an improved environment.

RDFN currently trades at a much higher valuation than traditional real estate brokers and while it may not feel direct pressure from low commissions, I’m not sure the large premium is warranted. At the same time, given its high debt-load to equity value, small moves in multiple expansions or compression can mean big moves for the stock. As such, I would fade the recent rally in the stock and think there are better ways to play potentially lower mortgage rates, such as through mortgage REITs or even traditional brokers. I rate RDFN a “Sell” with a $5.50 target.