bfk92

By Andrew Prochnow

Significant global military confrontations typically have adverse effects on the world economy. In this context, the current conflict between Israel and Hamas is no exception, mirroring the economic repercussions seen in past conflicts.

It’s estimated that roughly 30% of the world’s container ships were traveling via the Suez route prior to October 2023. Importantly, however, the Panama Canal has also been operating at limited capacity of late due to dangerously low water levels, which means some of the traffic between the East Coast of the United States and Asia was also being redirected through the Suez route.

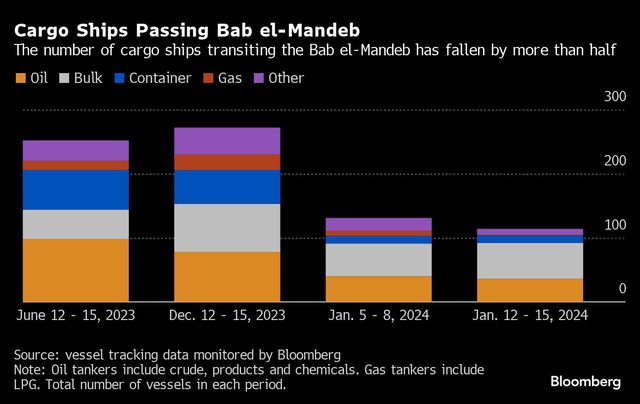

Of late, the biggest complication from the Israel-Hamas war—in terms of the global economy—has been the disruption of marine shipping traffic through the area surrounding the Suez Canal, particularly in the Red Sea. The difficulties started on Oct. 19 of last year, not long after the Israel-Hamas war intensified on Oct. 7.

Then on Oct. 19, Houthi rebels in Yemen started attacking commercial ships in the red sea using missiles, drones and other projectiles. In addition to trying to disable/destroy these ships with projectiles, the Houthis have also attempted to hijack some of the vessels, with varying degrees of success.

As a result of these terrorist operations, many global shippers are now avoiding the Suez Canal altogether, and have been detouring around the Cape of Good Hope at the southernmost tip of the African continent. The Suez Canal traditionally handles the bulk of the commercial shipping traffic between Europe and Asia, which means a large portion of the world’s seaborne goods have been affected by the aforementioned disruptions.

That means some of the ships bound between North America and Asia are now detouring around the Cape of Good Hope, as well. It’s estimated that a container ship needs an extra 20 days to go around the Cape of Good Hope, as compared to the direct route through the Suez Canal. And that extra time translates to extra costs, especially in terms of fuel. Experts estimate that the round trip between Europe and Asia via the Cape of Good Hope requires about $1 million in added fuel costs as compared to a trip through the Suez.

Not surprisingly, global shipping companies are compensating for elevated costs by raising their rates. That’s clearly evidenced by the recent spike in the

Containerized Freight Index (CFI), which has jumped by nearly 80% over the last month.

The CFI experienced a return to pre-pandemic levels in 2023, retracing from its peak in 2021 and 2022. Before the pandemic, the CFI consistently traded below $1,000 but surged to over $5,000 in early 2022.

In the previous year, a slowdown in global economic growth caused the CFI to drop below $1,000 once again. However, due to the Red Sea attacks, the CFI has rebounded and is currently trading above $2,000. While this is still considerably lower than the peak levels seen in 2021 and 2022, it is more than double the level observed just before the onset of the pandemic.

Not surprisingly, rising shipping rates have boosted valuations in the marine shipping sector. And that’s particularly true for shippers that were frequently transiting the affected routes, but as they say, “a rising tide floats all boats.” Accordingly, the industry as a whole appears to be benefiting from the rebound in rates.

The list below highlights some of the top performing marine shipping stocks over the last six months (sorted by return, highest to lowest):

-

Euroseas (ESEA), +81%

-

Scorpio Tankers (STNG), +60%

-

EuroDry (EDRY), +48%

-

Teekay Tankers (TNK), +47%

-

Overseas Shipholding (OSG), +46%

-

Frontline (FRO), +40%

-

Golden Ocean Group (GOGL), +39%

-

Teekay Corp (TK), +39%

-

International Seaways (INSW), +34%

-

Tsakos Navigation (TNP), +29%

-

Pyxis Tankers (PXS), +28%

-

SFL Corp (SFL), +28%

-

Matson Inc (MATX), +27%

-

Genco Shipping (GNK), +25%

-

Safe Bulkers (SB), +25%

-

Tidewater (TDW), +23%

-

Star Bulk Carriers (SBLK), +22%

Considering that the Red Sea attacks have been particularly disruptive to the Europe-Asia corridor, it’s no great surprise that Euro-linked shipping stocks—such as EDRY and ESEA—have seen the biggest impact on their valuations.

From an investment and trading perspective, the above list helps illustrate which companies might be most at risk if the Red Sea attacks were to suddenly stop, due to a cease-fire agreement or some other reason. Under that scenario, marine shipping activity in the Suez Canal would almost certainly rebound, which could weigh heavily on rates. That development could in turn trigger a selloff in shipping stocks—particularly those that have benefited from the spike in rates.

In addition to the aforementioned single stocks, investors and traders can also track and trade the marine shipping sector using sector ETFs such as the Breakwave Dry Bulk Shipping ETF (BDRY) and the SonicShares Global Shipping ETF (BOAT), which are up 127% and 15%, respectively, over the last six months.

Andrew Prochnow has more than 15 years of experience trading the global financial markets, including 10 years as a professional options trader. Andrew is a frequent contributor Luckbox magazine.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.