Thanasis/Moment via Getty Images

Resideo Technologies, Inc. (NYSE:REZI) recently delivered better than expected EPS, and many analysts increased their quarterly EPS expectations. I agree with the general optimism given the acquisition of Sfty and BTX in 2023, recent restructuring and divestitures, the e-commerce growth, and the new opened Dallas Super Center. I also saw risks coming from covenant agreements with debt holders or goodwill impairments. However, I think that REZI is a buy at its current market price.

Resideo Technologies: Many Products, Many Professionals, And In Many Countries

Currently, Resideo covers the needs of more than 150 million homes globally, with its technological innovation products aimed mainly at security applications.

The company is a manufacturer and distributor of products and components for comfort and safety, in addition to being a wholesale distributor of low voltage and life safety products such as network products, cables, audiovisuals, and smart home solutions that are sold in both the residential and commercial markets.

In addition to its arrival in a large number of homes around the planet, according to the last annual report, Resideo maintains a close relationship with more than 100k industry professionals, having a fluid output of products to that market, mainly technicians and installers of security products.

The large markets in which it operates give the company the possibility of taking advantage of these markets and directing products towards trends in secular markets, with its own production facilities distributed geographically in Mexico, Hungary, the Czech Republic, the United States, Germany, the Netherlands, and the United Kingdom, primarily serving the European and North American markets.

The company performs its operations via two segments: products and solutions as well as ADI global distribution. The first of these segments is made up of its own manufactured products, aimed primarily at security elements for energy management, having good brand recognition mainly with regard to Honeywell Home Brand, although it also extends to Resideo, First Alert, Braukmann, and BRK among others. The products offer humidity and temperature control, indicators of carbon monoxide and compounds in the air, fire extinguishers, and security cameras.

The ADI global distribution segment, for its part, refers to the wholesale distribution activity carried out by the company through products that are not manufactured in-house, mainly known as low-voltage safety products. They include video cameras, communication devices, and access and fire controls with diverse end applications that go beyond just the home security market.

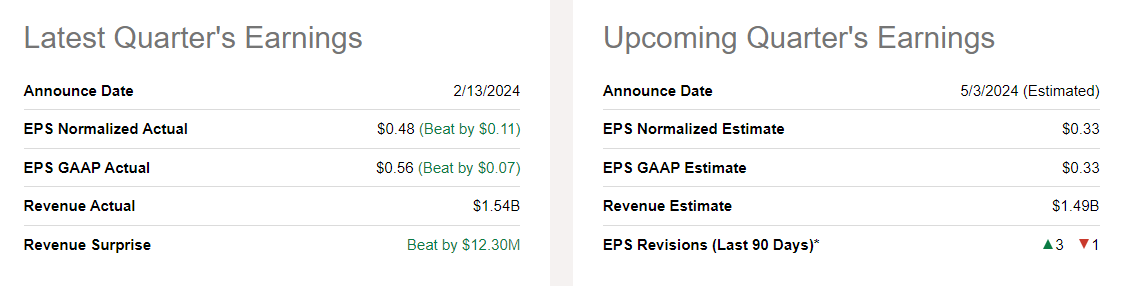

I believe that it is a great moment for reviewing the company’s financial figures mainly because of the recent quarterly earnings report. Resideo noted better than expected EPS GAAP of $0.56 with quarterly revenue of $12.3 million. It is also beneficial that the majority of analysts in the last 90 days reported an increase in the EPS expectations for the next quarter. Market participants seem to be optimistic about the future.

Source: Seeking Alpha

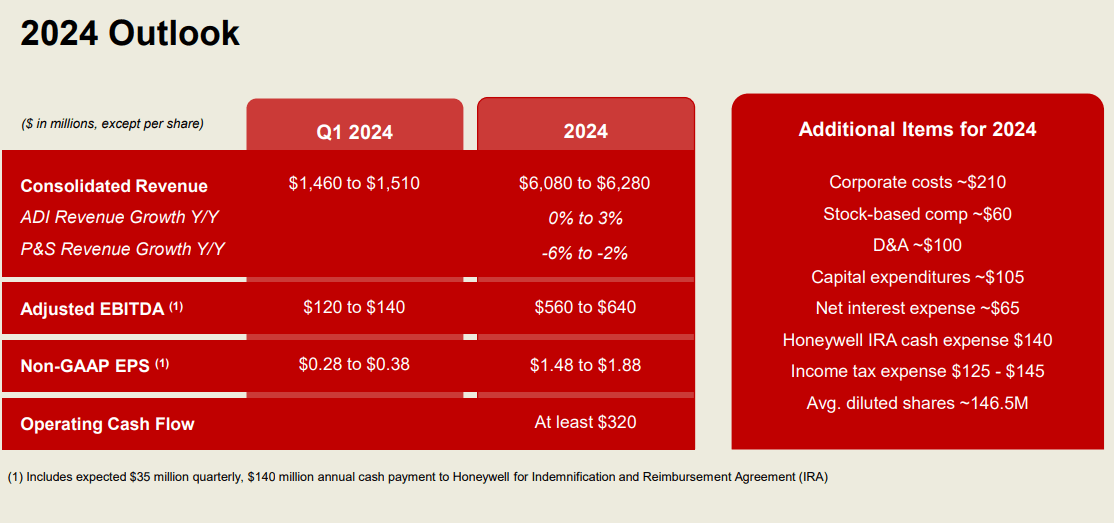

With regard to the guidance given for the year 2024, we have new figures. Consolidated revenue is expected to be close to $6.08-$6.2 billion, with Adjusted EBITDA of $560-$640 million and CFO of close to $320 million. Resideo Technologies also provided some information with respect to stock based compensation, capital expenditures, and corporate costs that I took a look at to design my DCF model.

Source: Presentation To Investors

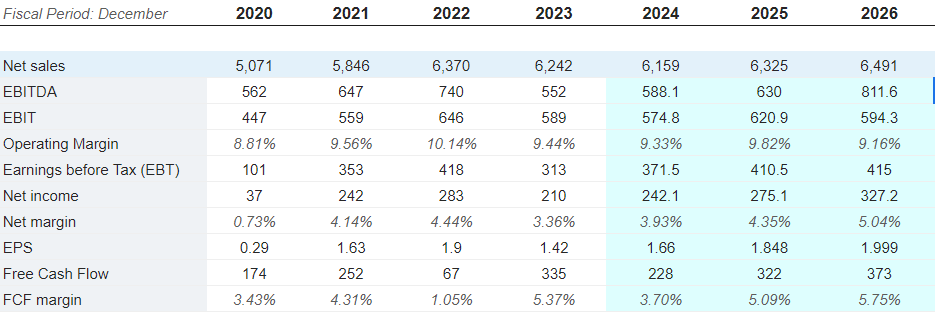

Market expectations are quite beneficial as they include net sales growth, EBITDA growth, and EPS growth. The expectations of other analysts include 2026 net sales of about $6.491 billion, 2026 EBITDA of about $811 million, 2026 EBIT of $594 million, and net income of $327 million. Besides, with free cash flow of about $373 million, 2026 FCF margin would be about 5.7%. Note that the FCF margin is expected to increase significantly from the figure expected for 2024.

Source: Market Screener

Balance Sheet: Resideo Technologies Reports A Significant Amount Of Goodwill

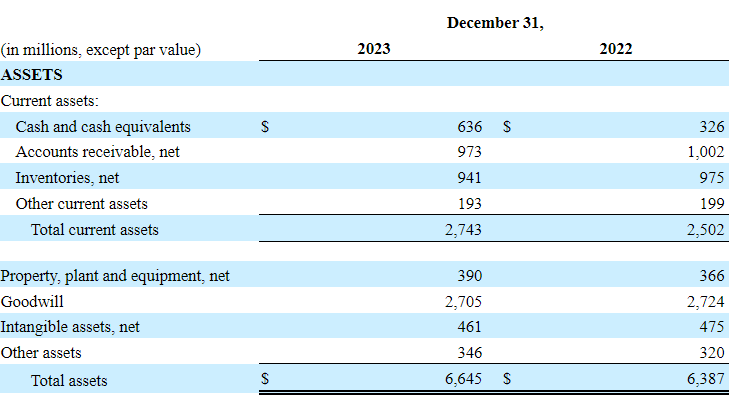

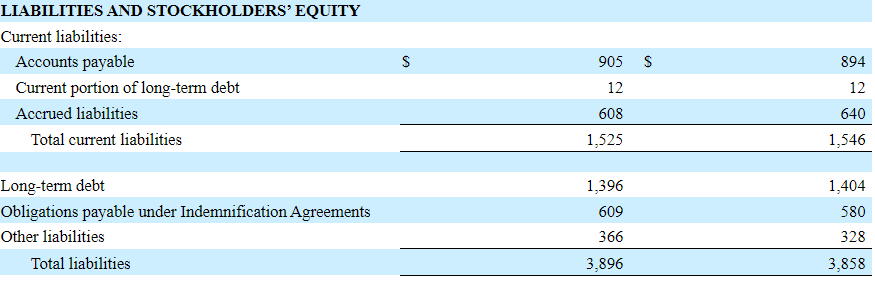

As of December 31, 2023, cash and cash equivalents stand at about $636 million, with accounts receivable of close to $973 million, inventories worth $941 million, and total current assets of about $2743 million. The current ratio is larger than 1x, so I believe that liquidity does not seem a problem here.

With property, plant, and equipment of close to $390 million, the largest asset is goodwill of close to $2705 million. It appears clear that the company reports a significant amount of expertise in the M&A markets. Finally, with intangible assets of about $461 million, total assets stand at $6.645 billion. The asset/liability ratio is larger than 2x, so I believe that the balance sheet appears quite clean.

Source: Annual Report

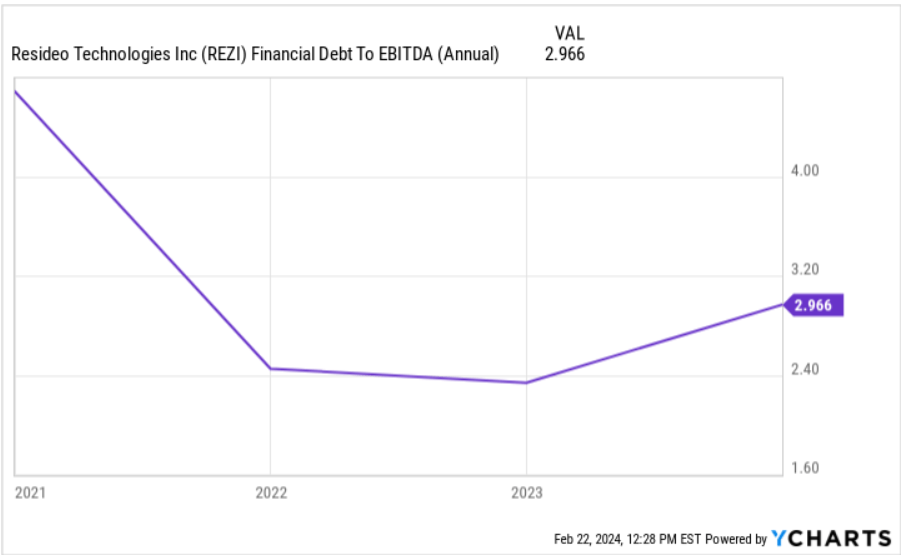

I am not concerned about the total amount of debt because the debt/EBITDA ratio decreased significantly in the last two years. It decreased to close to 2.9x. In the past, shareholders saw a ratio of more than 4x.

Source: YCharts

With accounts payable of close to $905 million and current portion of long-term debt of $12 million, long-term debt stands at close to $1396 million. Besides, with obligations payable under indemnification agreements of $609 million, total liabilities are equal to $3.896 billion.

Source: Annual Report

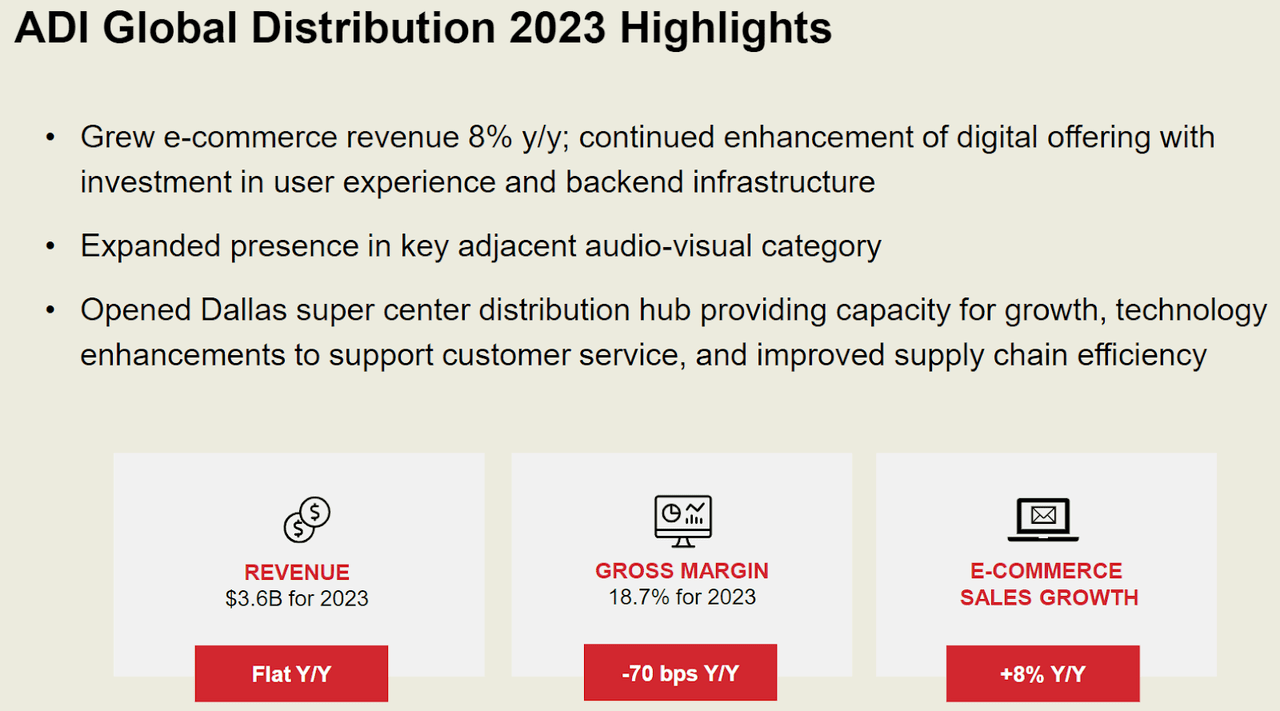

Ecommerce May Continue To Bring Organic Growth

Resideo Technologies reported e-commerce revenue of close to 8% y/y thanks to expansion of the digital offering as well as investments in user experience capabilities. In addition, I expect the new presence in the audio-visual category, and the new opened Dallas Super Center will represent net sales catalysts in the coming years. The slide below offers further information in this regard.

Source: Presentation To Investors

Resideo Technologies’ Recent Acquisitions Could Bring FCF Margin Growth

The hybrid business model, in which the distribution and marketing of products manufactured by the company itself as well as the wholesale distribution of the production of more than 1,000 global manufacturers are combined, is strongly supported by the acquisition strategy. These acquisitions have been directed mainly towards the universe of audiovisual technology for its application in security cameras and related devices. Under my base case scenario, I assumed that new deals may be announced in the coming years.

In 2023, the company acquired several targets including Sfty AS, a developer of cloud-based services, and BTX Technologies, a distributor of professional audio, video, data communications, and broadcast equipment. From these acquisitions, I would expect a few things. First, the year 2024 may be a bit different in terms of net sales growth as new inorganic growth from Sfty and BTX will be added. In addition, if management successfully conducts the integration of new teams, and new cost synergies are obtained, the FCF margin could expand.

On August 9, 2023, we acquired 100% of the outstanding equity of Sfty AS, a developer of cloud-based services providing alerts to multifamily homes and property managers with smoke, carbon monoxide and water leak detection products. We report Sfty AS’s results within the Products and Solutions segment. We completed the accounting for the acquisition during the fourth quarter of 2023, which did not result in any material adjustments. Source: Annual Report

We acquired 100% of the outstanding equity of BTX Technologies, Inc., a leading distributor of professional audio, video, data communications, and broadcast equipment. We report BTX’s results within the ADI Global Distribution segment. Source: Annual Report

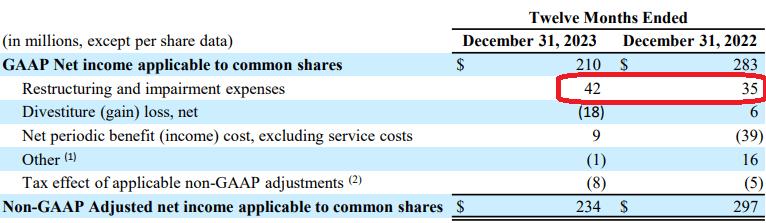

Restructuring And Divestitures Could Enhance The Balance Sheet

It is also worth noting that Resideo Technologies made significant restructuring efforts in 2023 and 2022. As a result, I believe that we could see some improvements in FCF margin growth from 2024.

Source: Annual Report

With regard to divestitures, Resideo Technologies recently sold the Genesis Cable business in a cash transaction. The new cash does appear in the last balance sheet. With that, I think that the company may be willing to sell other divisions in the coming quarters, which may enhance the liquidity standing in the balance sheet. As a result, we may see improvements in the net debt/EBITDA ratio, which may lead to increase in the EV/FCF ratio.

We sold the Genesis Cable business in a cash transaction for $86 million, subject to working capital and other closing adjustments. We recognized a pre-tax gain of $18 million in other expenses, net in our Consolidated Statements of Operations, which includes $5 million of divestiture related costs. Source: Annual Report

The Stock Repurchase Program Could Bring Demand For The Stock And Enhance Stock Price Dynamics

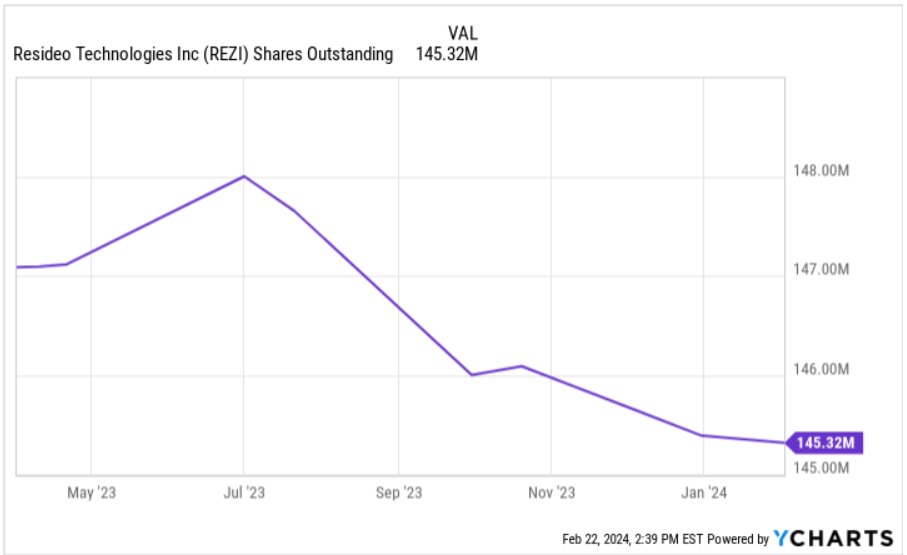

With $109 million of authorized repurchases remaining under the share repurchase program, I believe that we could expect significant stock demand coming only from Resideo’s stock purchases.

As of December 31, 2023, the Company had approximately $109 million of authorized repurchases remaining under the Share Repurchase Program. Common stock repurchases are recorded at cost and presented as a deduction from stockholders’ equity. Source: Annual Report

With regard to the share count, I believe that the recent decrease from 148 million to about 145 million is appealing. If the total amount of shares outstanding continues to decline, I would be expecting more stock demand from investors.

Source: YCharts

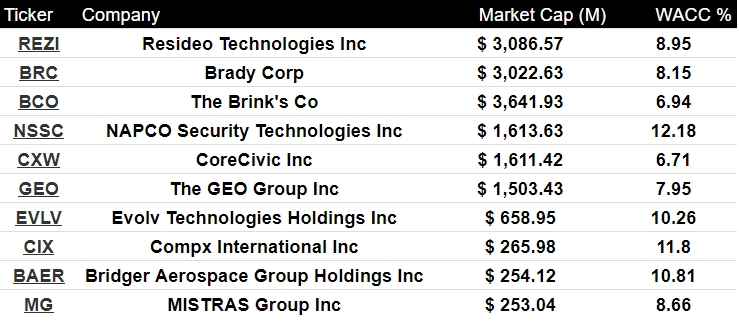

Cost Of Capital, And Review Of Competitors

According to other online analysts, Resideo’s peers report cost of capital between 6% and 12%. With these figures in mind, I used a cost of capital of 8.9% in my base case scenario and 10% under my bearish case scenario. I believe that these assumptions are realistic and conservative.

Source: Gurufocus

Under My Base Case Scenario, The Company Could Be Worth Close To $25-$26

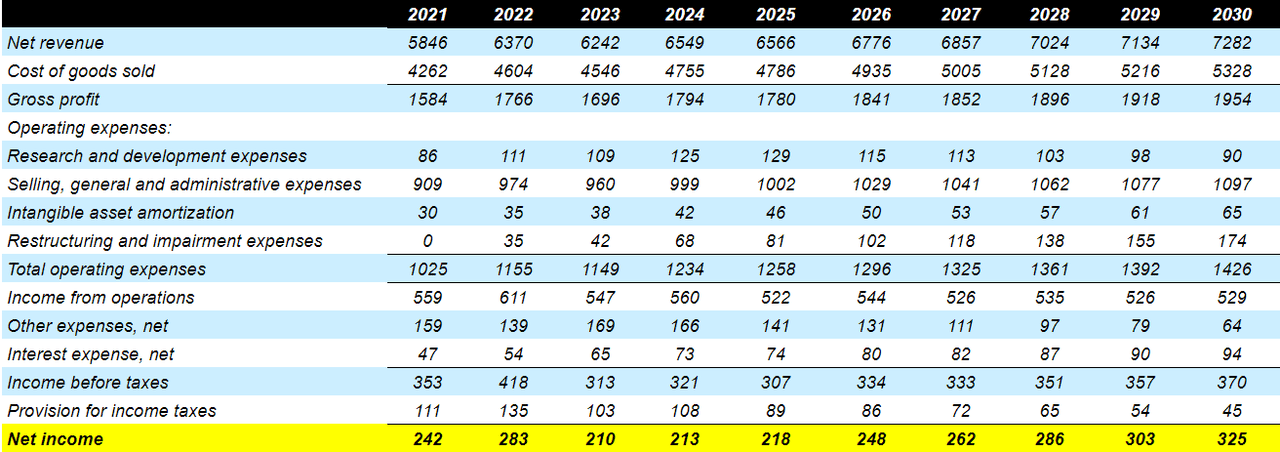

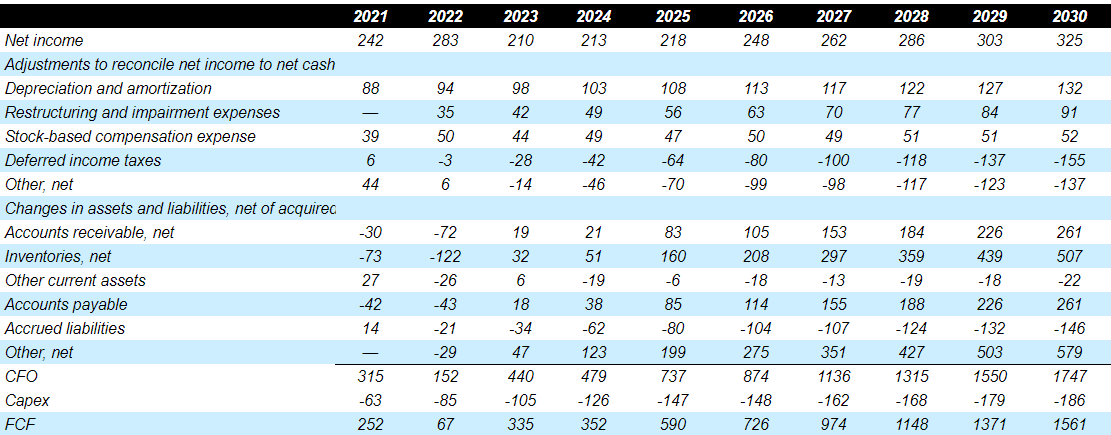

Under my base case scenario, I included what I assumed could be the most likely financial figures in the next six years. First, I assumed 2030 net revenue of $72.282 billion, with the cost of goods sold worth $5327 million and gross profit of $1954 million.

Besides, with research and development expenses worth $90 million, selling, general, and administrative expenses of about $1096 million, and intangible asset amortization close to $64 million, income from operations would stand at about $528 million. In addition, with interest expense of about $94 million, I also assumed 2030 net income of about $325 million.

My cash flow statements include 2030 net income of about $324 million, 2030 depreciation and amortization of about $131 million, 2030 stock-based compensation expense of $52 million, and changes in accounts receivable worth $261 million.

In addition, with changes in inventories of close to $507 million, changes in accounts payable of about $260 million, and changes in accrued liabilities of -$147 million, 2030 CFO would be $1.747 billion, and 2030 FCF would stand at close to $1561 million.

Source: My Expectations

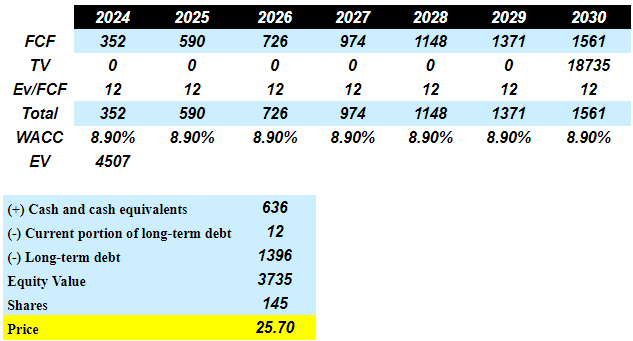

With an exit multiple of about 12x and a WACC of 8.9%, I obtained an implied enterprise value close to $4.507 billion. Also, adding cash of $636 million and subtracting short term debt and long term debt, the implied stock price would be $25.7 per share.

Source: My Expectations

Competition

In the markets in which the company participates, competition is given by companies with international, national, and regional reach that offer an extensive suite of products with great applications in an integrated security network as well as niche companies that offer a single line of products and are specialized in audiovisual security and the technologies included in the development of the products.

I believe that the largest risks from other actors come from pricing strategies, which may lower market prices, and reduce FCF margins. Resideo Technologies may also fail to offer suitable products for clients, who may buy products from competitors. As a result, I would expect decreases in free cash flows. In this regard, Resideo offered the following explanation.

In addition, aggressive pricing actions by competitors may affect our ability to manage the price/cost relationship to achieve desired revenue growth and profitability levels. To the extent that we do not meet changing customer preferences or demands or other market changes, or if one or more of our competitors introduces new products or services, becomes more successful with private label products, online offerings or establishes exclusive supply relationships, our ability to attract and retain customers could be adversely affected, which could adversely affect our business, financial condition, results of operations and cash flows. Source: Annual Report

Risks

The competitive risk for this company is not minor as one of the value differentials in its products has to do with technological innovation and the application of tools such as artificial intelligence in their development. In my view, new innovations may appear that change the current parameters of manufacturing and distribution as well as pricing strategies.

Given the total amount of debt, I believe that Resideo Technologies could suffer from restrictions derived from covenant agreements. If debt holders block new acquisitions, or they lower the sales and marketing potential expenditure, net sales growth may lower. As a result, I believe that we may see decreases in the EV/FCF ratio. Resideo Technologies did mention some covenants in the last annual report.

The terms of our varied indebtedness include a number of restrictive covenants that impose significant operating and financial restrictions on us and limit our ability to engage in actions that may be in our long-term best interests, including actions such as incurring additional indebtedness, paying dividends, making investments or acquisitions, selling or transferring certain assets and other corporate actions. If market changes, economic downturns, or other negative events occur, our ability to comply with these covenants may be impaired and waivers from our lenders may not be provided. Source: Annual Report

With regard to the total amount of goodwill, I believe that shareholders could suffer goodwill impairment risks. If future earnings are not reached, or accountants increase their cost of capital required in the financial models, I think that we could see impairments. The management talked about these risks in the last 10-k.

The estimates and assumptions about future results of operations and cash flows made in connection with the impairment testing could differ from future actual results of operations and cash flows. If the assumptions used in our analysis are not realized or if there was an adverse change in facts and circumstances, it is possible that an impairment expense may need to be recorded in the future. If the fair value of our reporting units falls below their carrying amounts because of reduced operating performance, market declines, changes in the discount rate, or other conditions, expenses for impairment may be necessary. Source: Annual Report

Bearish Case Scenario

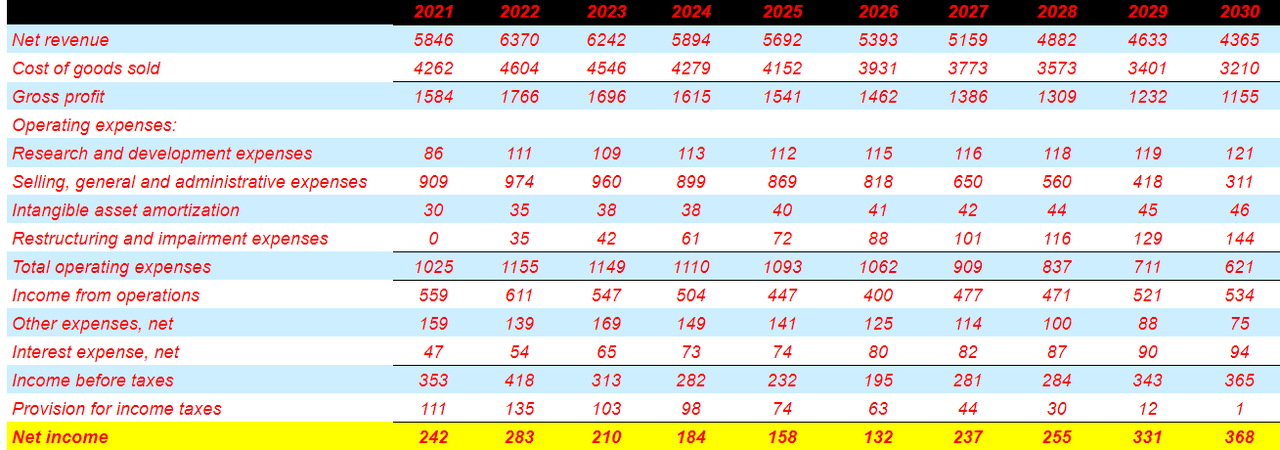

Under my bearish case scenario, I assumed 2030 net revenue of about $4.365 billion, cost of goods sold close to $3209 million, and gross profit close to $1155 million.

I also assumed 2030 research and development expenses worth $120 million, 2030 selling, general, and administrative expenses close to $310 million, and 2030 intangible asset amortization of $46 million. Finally, with restructuring and impairment expenses of about $144 million, 2030 net income would be close to $368 million.

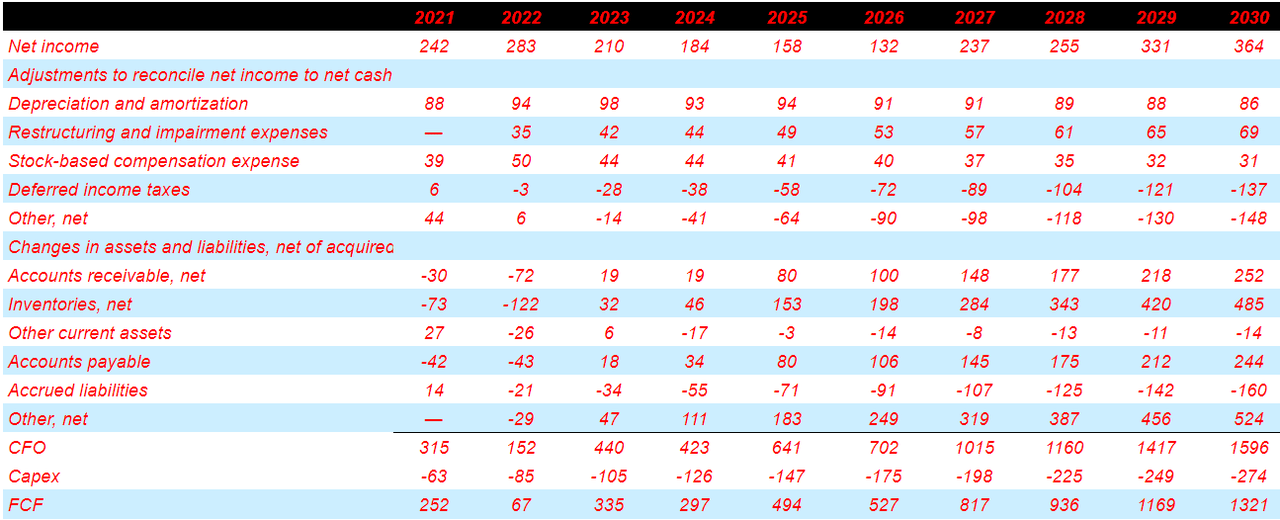

Also with depreciation and amortization of $86 million, restructuring and impairment expenses close to $69 million, and stock-based compensation expense of $31 million, 2030 FCF would be close to $1321 million.

Finally, taking into account a WACC of 10%, and Ev/FCF multiple of 10x, the implied valuation would be $19 per share.

Source: My Expectations

Conclusion

Resideo Technologies will most likely experience net sales growth coming from e-commerce activities and the new opened Dallas Super Center. In addition, I believe that we may see FCF margin growth coming from increases in restructuring and divestitures as well as the acquisitions of Sfty and BTX. Besides, considering the stock repurchase program in place and the potential demand for the stock, I believe that Resideo Technologies is a buy. I did see risks coming from debt agreements, covenants, goodwill impairments, or the actions of competitors. With that, Resideo Technologies is a buy at its current market price.