Eugene Mymrin/Moment via Getty Images

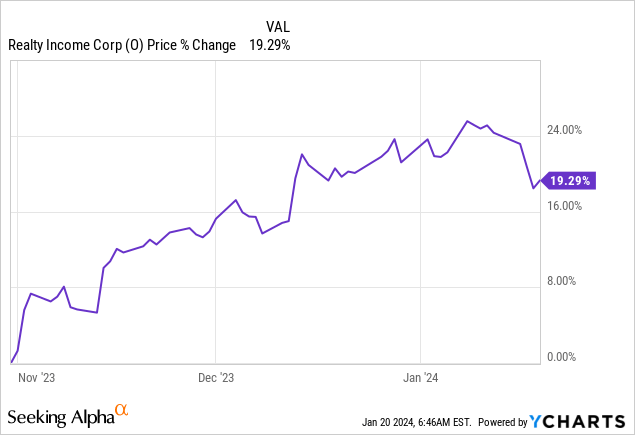

After a strong rally from the October lows for the market and REITs, we are giving Realty Income (O) a look at our latest options trade that expired on January 19, 2024. However, REITs have more recently again started to retreat lower based on what appears to be the market getting ahead of itself on interest rate cuts. That said, Realty Income still provides solid long-term prospects going forward as it remains attractively valued, in my opinion.

Realty Income Latest Options Trade

We ended up writing puts on shares of O back on October 30, 2023. The shares were dropping massively (just over 8% at the time) on the back of announcing an all-stock deal to acquire Spirit Realty Capital (SRC). This deal was just approved by SRC shareholders so that it will be going through.

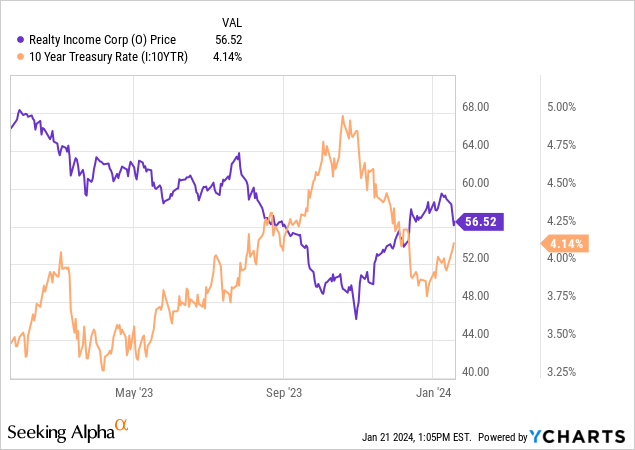

Since then, shares of O and most other interest-rate sensitive investments came roaring back as the risk-free Treasury Rates subsided on the back of the expectation that the Fed has pivoted. That is, we are expecting to get interest rate cuts heading through 2024 at some point and into 2025.

Ycharts

That meant this trade easily finished above our $40 strike that we had selected and pocketed us $0.85 in options premium. That’s good for 3.32x the monthly dividend or what works out to a potential annualized return of 9.56%.

However, in the above, we can see that shares of O are once again under pressure, and that isn’t just O. The culprit is once again Treasury Rates rising and pushing down interest-rate-sensitive investments such as REITs. Besides the Treasury Rate crashing so hard in such a short period of time, the market seemed to really get ahead of itself. This has sent REITs back into a bit of a retreat.

REITs Retreat

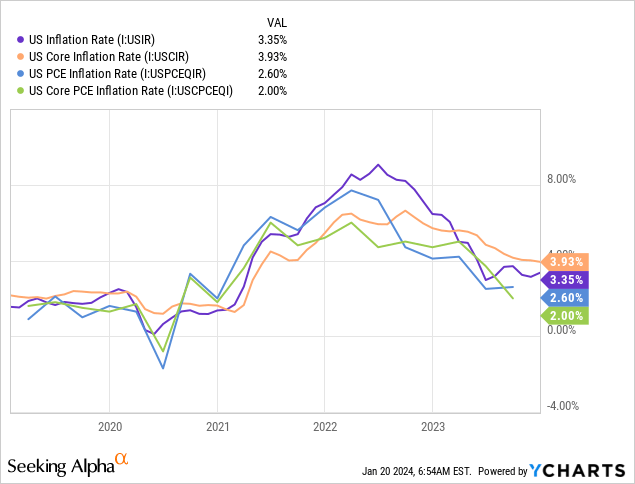

The market was starting to price in a cut as soon as March and was looking for six cuts in 2024. The Fed’s expectations were not for that much of a dramatic change. Instead, the Fed’s projections were for three cuts, and as CPI and PCE remained sticky, the market started to realize that we probably aren’t getting what would be an aggressive six cuts. All the inflation metrics are significantly lower than they were but are still running a bit hot.

Ycharts

Thus, the probability of a March hike has diminished significantly, according to the FedWatch Tool. It went from an 80% chance for a cut in March to now the probability is showing a nearly 53% chance of holding the rate steady.

This is where the Fed has a tough balancing act of trying to hit that soft landing, but the pathway is narrow. Being overly aggressive and not easing up enough on their tight monetary policy means we could end up going the other way into deflation rather than just the disinflation trend we’ve been seeing.

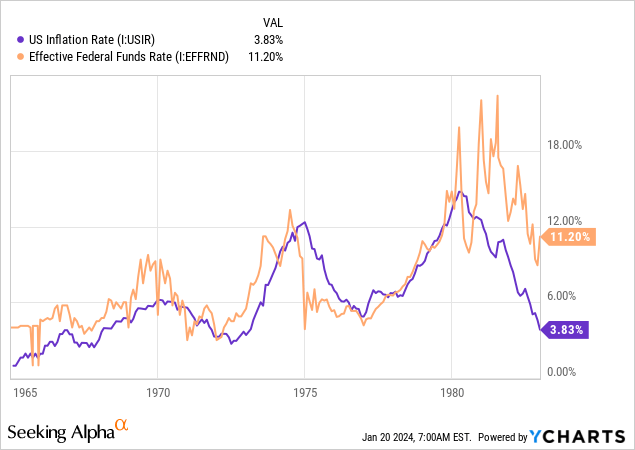

Moving to a monetary policy that is too loose too soon means that inflation could start moving higher once again. The infamous 1970s inflation is always what gets discussed, with Arthur Burns often being the one who takes the blame as the Fed Chairman of the time.

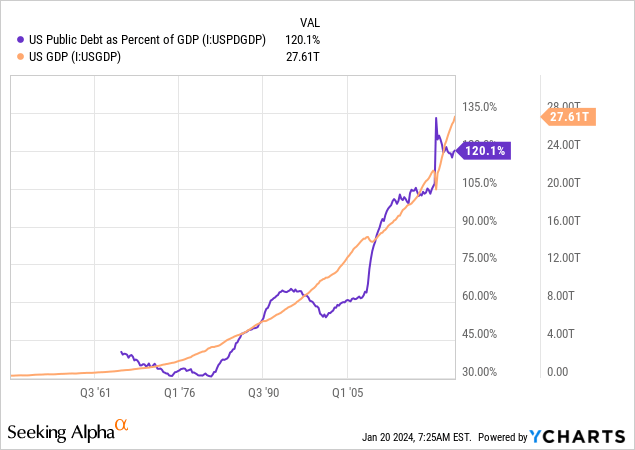

Ycharts

The caveat is that this was an incredibly different time in America and around the globe than what we have right now.

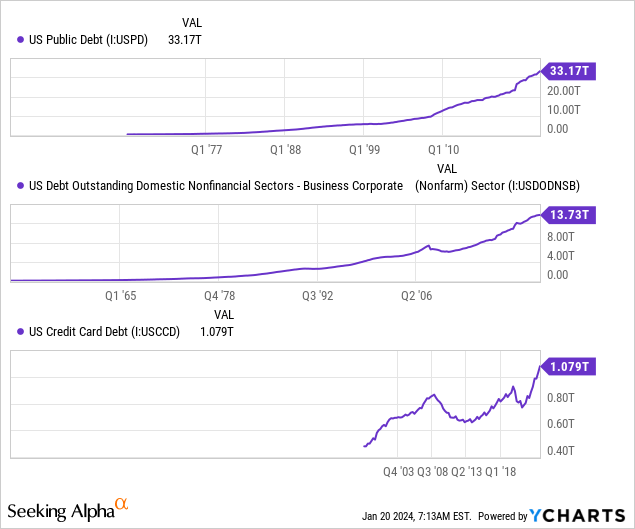

Massive deficits and surging debt levels of governments, corporations, and individuals built on the backs of a decade-plus of at or near zero-rate environment are certainly one thing to consider.

A higher absolute debt burden means that higher rates now mean more interest on an absolute basis than it did in the 70s. That said, the 70s is still a period many see similarities with today. Below is a look at the types of debt from the private and public sectors.

Ycharts

The argument could be made that the U.S. GDP is also significantly higher than it was in the 70s, and it certainly was. We are more productive, and there are just simply more dollars going around today than back then. However, even on a relative basis of debt to GDP, that has been increasing quite massively since the 70s as well.

Ycharts

Realty Income – Higher Price But Not Overvalued

With the above in mind, it certainly seems that interest rates really could go either way. So, I don’t have strong conviction in trying to predict that future outcome, but I do also believe that O looks attractive at this time despite the strong run-up from the October 2023 lows. The understanding here is that O could easily get cheaper if rates continue their upward march. Conversely, it could move higher over the coming years if rates are cut as projected by the Fed.

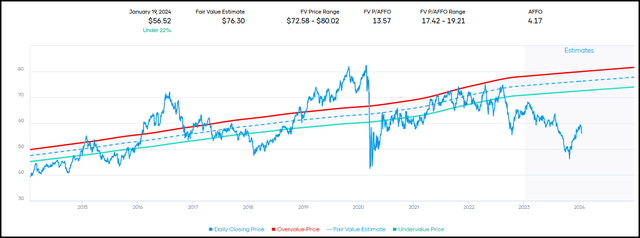

O looks cheap on a few different metrics. For one, the historical P/FFO pushes it well below its average historical trading range. That said, the historical period was clearly one where interest rates were near zero. So, also trying to consider that, we would expect it to be trading below its range. The P/FFO of 13.57x seems to factor that in and more, in my opinion.

O Fair Value P/AFFO Range (Portfolio Insight)

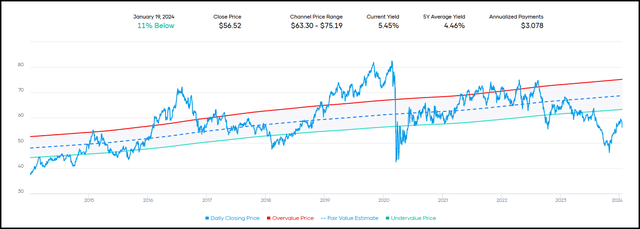

Another metric to check is the dividend yield historical channel. Similar to the above, we are going to see it trading below its historical range because of the higher interest rate environment now. With higher risk-free rates, that needs to be taken into consideration if an investor is going to be comfortable with a REIT.

O Fair Value Yield Range (Portfolio Insight)

The logic is pretty simple. If you can earn a ~4% rate on a 10 Year Treasury, then O needs to have a higher dividend yield to make it worthwhile. However, for longer-term investors who are also looking for dividend growth – O seems set to continue to deliver that as well. Realty Income is projected to grow FFO by around 3% in the coming three years.

Certainly, that isn’t massive, but it is an uptrend that can continue to support a higher dividend – even if the dividend increases are a bit slow. This is now a giant REIT and is set to get even larger after the SRC merger. So, it becomes incredibly difficult to move the needle for O.

With that said, that’s why we see the dividend yield channel rising over time to reflect these raises. At some point, even if rates stay around where they are now, the expectation would be that O could support a higher share price based on a higher payout. That is, of course, assuming that earnings continue to trend higher as expected to support said payout, too.

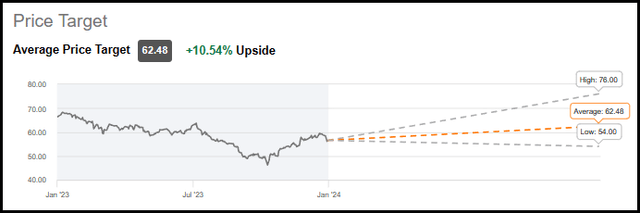

Finally, the average price target of analysts does see some upside from here as well. The average price target of ~$62.5 would suggest around 10.5% upside potential.

O Price Target (Seeking Alpha)

What’s Next For O?

To sum up, I still believe that O looks like a decent value here, and I wouldn’t mind buying shares in the market at these prices.

However, with a fairly sizeable position already, I also don’t mind being a bit greedier in wanting a lower possible share price either. That’s where I’d return to writing puts at lower strike prices to either collect premium or possibly enter into a position lower. With that in mind, here are a couple of trades that look rather appealing depending on where the market opens up as we start the new week of trading.

- February 16, 2024 expiration at the $55 strike price. That doesn’t leave a lot of downside, but the breakeven gets widdled down due to the premium being deceived. Based on the last trade completed, we could collect a premium of $0.65 for a potential annualized return of nearly 16%.

- Sticking with the same February 16, 2024 expiration but allowing for some further downside, one could go with the $52.50 strike. That doesn’t collect a lot of premiums on an absolute basis at $0.20, but annualized, it still comes to a fairly respectable 5.15%. In fact, that’s only a touch lower than the dividend yield itself. Further, investors writing cash-secured puts should still be earning some decent rates on their idle cash as well.

- For investors who like higher premiums upfront rather than focusing on annualized potential, going further out in terms of expiration can achieve that. Going out to May 17, 2024’s expiration of $55 could net an investor $1.95. On an annualized basis, that takes you down relative to the shorter time frame of February’s expiration to an annualized result of nearly 11% – that said, you get a larger premium upfront and don’t have to worry about it for another quarter.

This latest options trade and potential ideas complement well with my currently outstanding written puts on Agree Realty (ADC), which similarly finds itself in the same situation of being quite attractive.

O is going to be at the mercy of interest rates going forward, as we can see it was over the last year.

That said, I believe O looks attractively valued, with solid long-term prospects of not only delivering an attractive yield but also providing dividend growth.