Andriy Onufriyenko/Moment via Getty Images

By Michael J. Fleisher

Since early 2022, the Federal Reserve (FED) lifted the federal funds rate by 5.25% to curb inflation, triggering speculation from pundits over the economic impact and future path of rate increases. Recently, the Fed noted that inflation has been tempered by restrictive monetary policy and signaled the likelihood of easing monetary policy this year. Equity investors applauded this dovish pivot with a relief rally toward the end of 2023. However, beyond the market response to early signals of a potential decrease in the federal funds rate, we wanted to research the behavior of equities after the Fed actually lowers rates. Furthermore, we wanted to see if the decrease in rates can be used as a signal for future market behavior. In this research, we look at the trailing 12-month change in the federal funds rate going back to the mid-1970s to analyze market returns after the Fed has commenced easing.

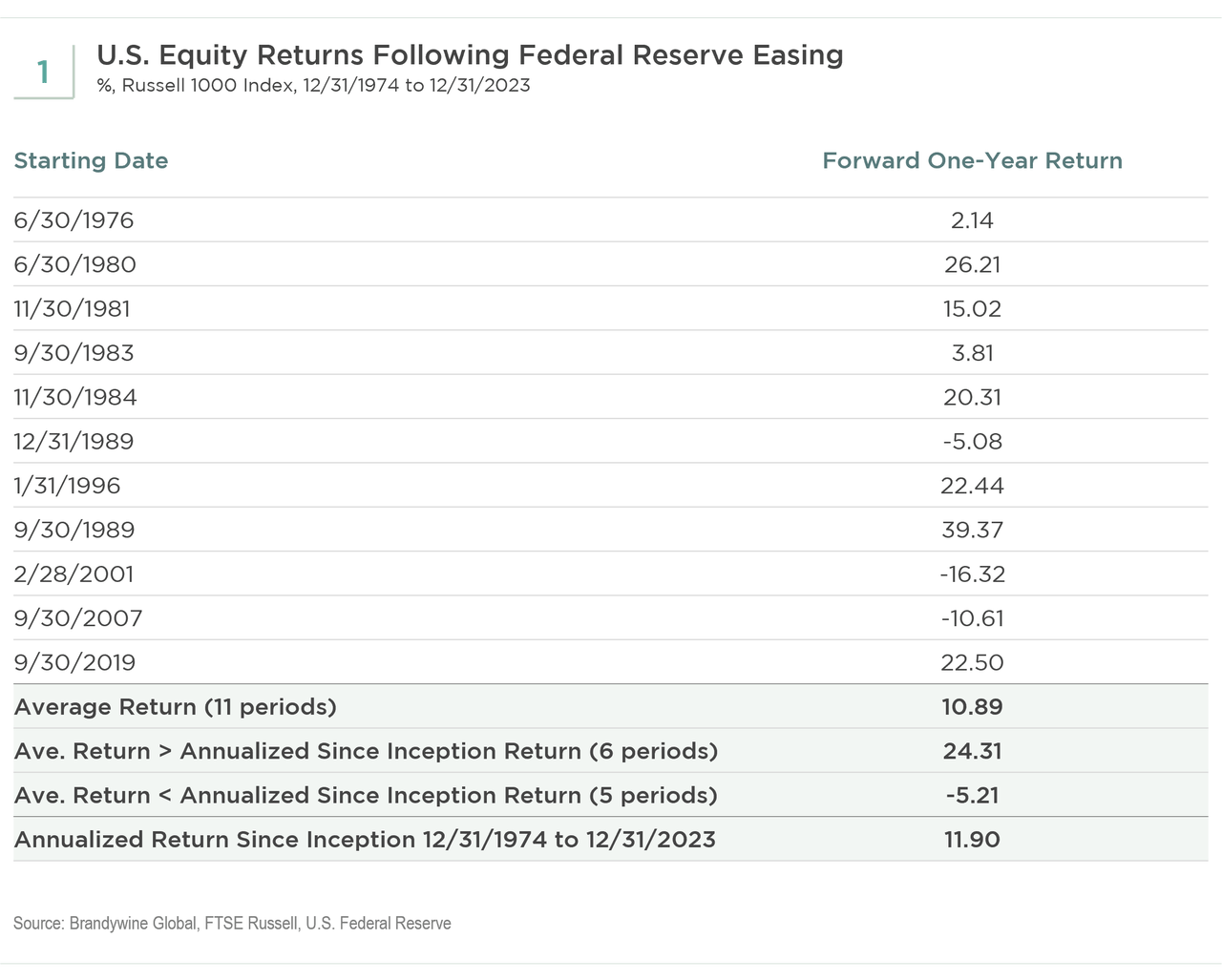

The chart below shows that the U.S. equity market, as measured by the Russell 1000 Index from December 31, 1974, to December 31, 2023, on average, records similar returns relative to its long-term history one year after the 12-month change in rates becomes negative (see Exhibit 1). However, when looking at each individual period of decreasing rates, the market outperformed its long-term average in 6 out of 11 occurrences with an average 24% return. Intuitively, it makes sense that the market would outperform as the Fed lowers rates to stimulate the economy. When looking at the remaining 5 out of 11 periods during which the market underperformed its long-term average, we find that these subpar occurrences had an average return of -5.21%, and the performance for 3 of these 5 underperforming time spans resulted in negative returns. Also, these negative return periods occurred within 12 months of an inverted yield curve. As we briefly explained in our last analysis, the yield curve can un-invert as the Fed lowers short-term rates. The inverted yield curve has been a good predictor of recessions, and when followed by monetary easing, lower rates may be a more coincident indicator of worsening economic data and a struggling economy.

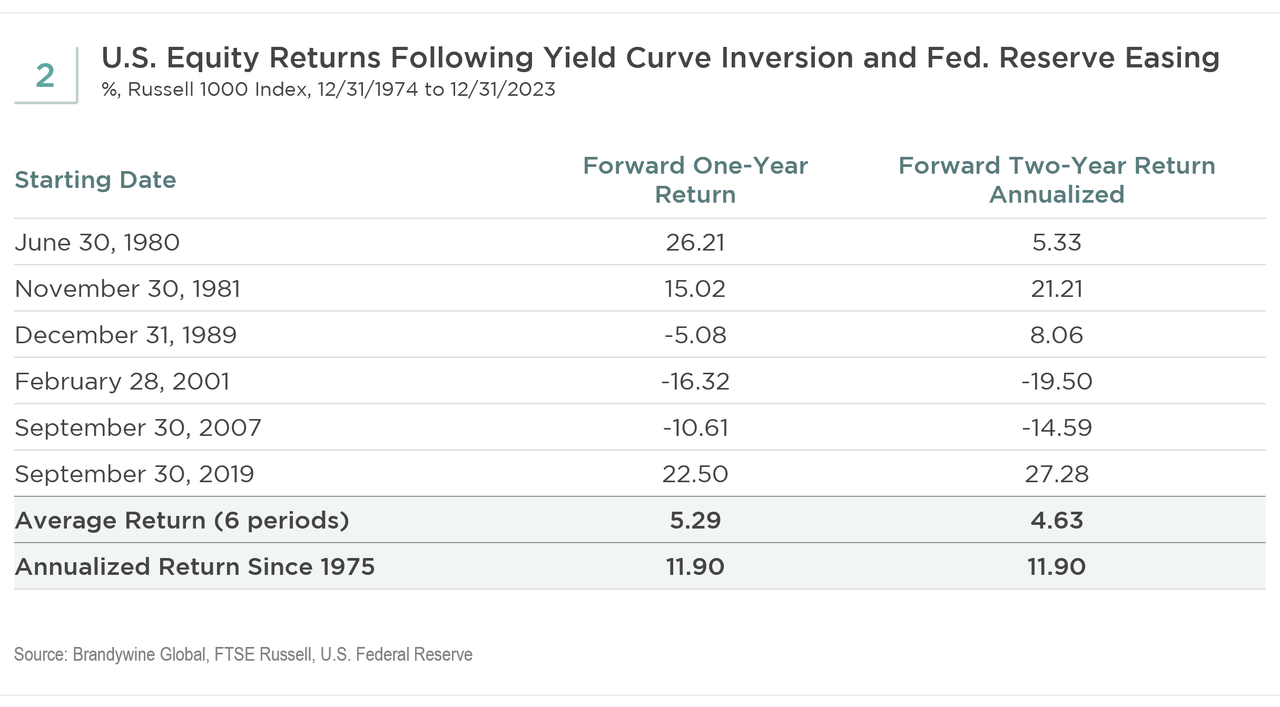

We looked at all periods from 1975 until 2023 in which both the 12-month change in the federal funds rate was first negative and the curve had been inverted within the prior 12 months. The below chart (see Exhibit 2) shows that the market, on average, underperformed with an average return of 5.29% versus the long-term average of 11.90%. Furthermore, the underperformance persisted on average when looking at 2-year annualized returns, with the average return dropping to 4.63%. The market underperformed for 24 months out in 4 of the 6 periods when the Fed lowered rates within 12 months of an inverted yield curve.

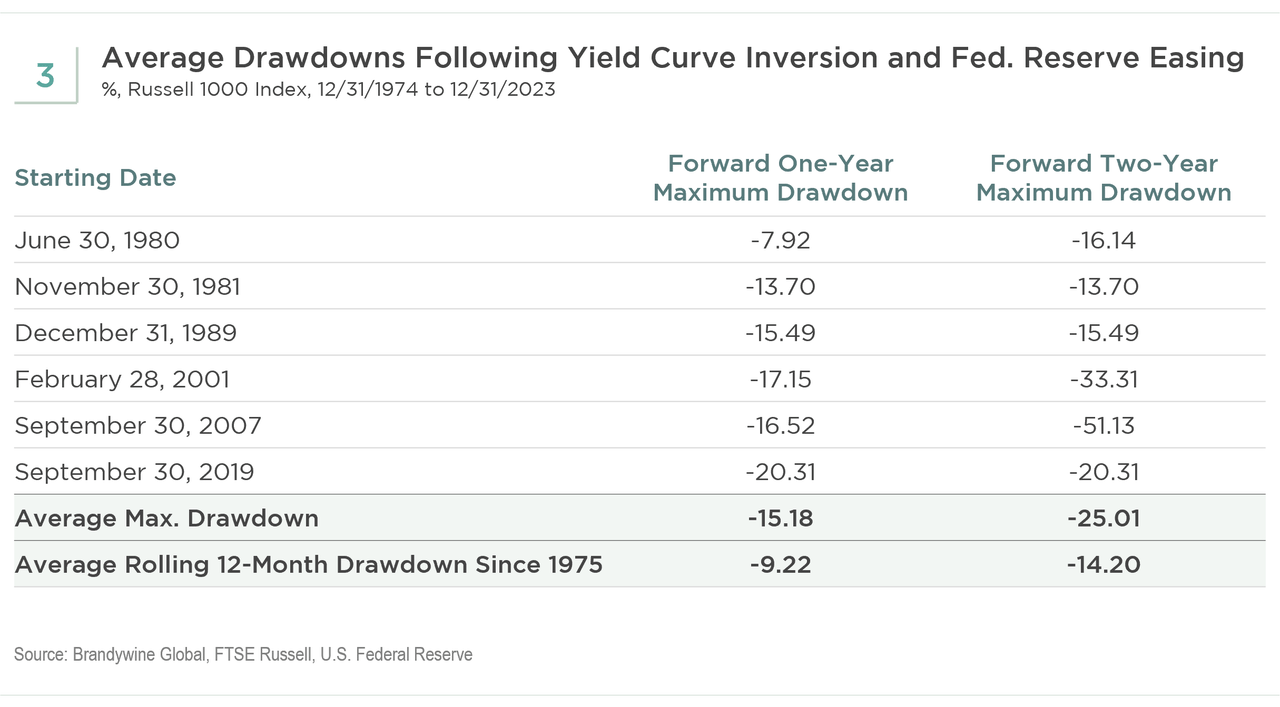

We also looked at the maximum drawdown during each decreasing rate period after an inverted curve. As seen in Exhibit 3, the average one-year maximum drawdown during these time periods underperforms the average maximum one-year drawdown for the full research history. When looking at maximum two-year drawdowns, the average return is much lower and underperforms the maximum two-year drawdown in five of the six periods. Regardless of the full-year returns, the maximum drawdowns help to quantify the volatility that can occur when the Fed lowers rates close to inverted yield curves and/or recessions. For example, after September 30, 2019, the one-year return of the market was 22.5% (Exhibit 2). However, the maximum drawdown that occurred was -20.31% in just two months as a result of the COVID-19 pandemic (see Exhibit 3).

There has been much discussion around whether the U.S. is headed for a recession. Increasingly, some investors believe the Fed has been nimble enough to orchestrate a soft landing for the economy. However, the yield curve remains inverted, although well off-peak inversion levels, despite the Fed signaling its likelihood to lower rates this year. While there are only 11 data points of trending declines in interest rates, we get an understanding that the results in the equity markets have been mixed when rates have decreased. When looking at the charts, we see that when rates are decreasing and there has been an inverted yield curve, a bear market – most likely from a recession – may occur. However, the decrease in rates may be a lagging indicator of a poor economy. Meanwhile, investors already may have reacted proactively to poor expectations, whether it was a weak economy or higher inflation-delaying rate decreases. While we do not know exactly when the Fed will lower rates, historically, after the curve has been inverted, monetary easing coincides with elevated market volatility.

The Russell 1000® Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.