PM Images/DigitalVision via Getty Images

The quick answer is yes the market rallies anyway, though not straight up

First, the market goes higher before this notion becomes part of the overall narrative, and then we have a bit of a sell-off. My base case is that we do have some cuts by year-end November and December. It might come on the heels of higher unemployment, or perhaps on evidence of deflation, especially in services. So the title above is more about emerging narrative, and how that could affect stocks. No one is floating this notion yet, but it could gain some currency as the 10-Y touches 4.193%, and the price of WTI is now not too far away from $80 per barrel reaching 77.29 before settling at 76.60. The notion of the economy staying too hot for a cut is a real possibility. Let’s not forget that the Atlanta Fed is modeling +3% GDP for Q1, yes it is still early and the Atlanta Fed tends to run hot in its projections but still, the economy is humming. Employment is still at 3.7%

Make up your mind, No Cuts or Cuts in November?

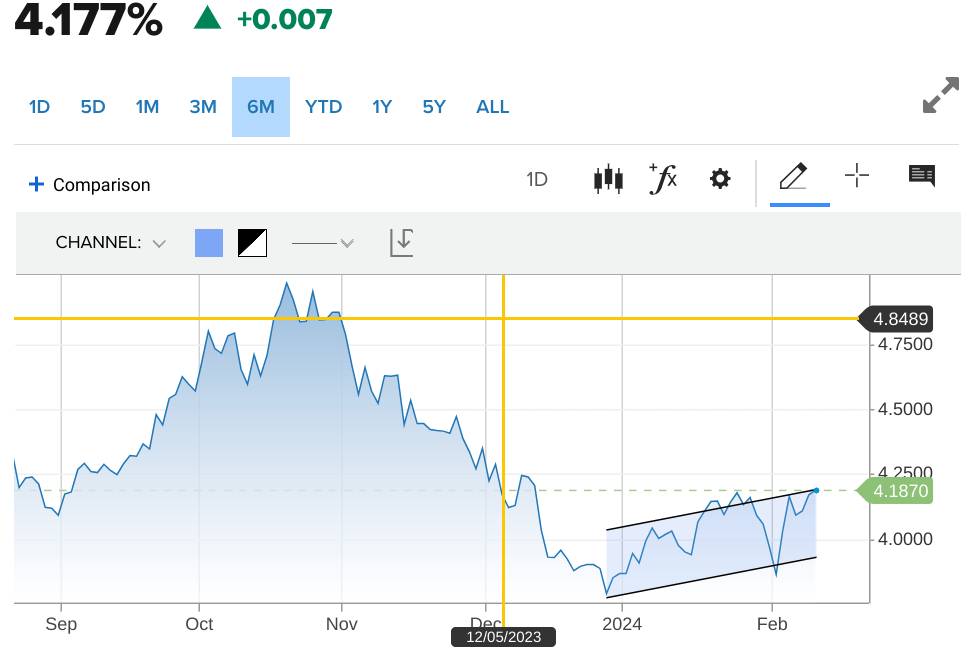

Right now, the notion of no cuts until November is still the minority view, and frankly, I think the first narrative to debut upon stock market participants’ consciousness will be the possibility of no cuts in 2024. The first inkling will be the runup of the 10-Y through 4.20% and threatening 4.30%. Once Powell backed away from a cut in March, the cut in May lost probability as well. According to the CME FedWatch tool May has a 52% probability of a cut. Bear in mind March had a virtual lock on the probability of a cut and now it is at 16%. To me, that is a tad high, though I have been saying for months there’d be no cut in March. Once March comes and goes, I believe May will fall just as precipitously. Meantime the 10-Y is rising, as my loyal readers know that I value charting, and right now the 10-Y is on an uptrend. I think it is there because the economy is growing, and the 10-Y has every reason to rise from that perspective. Some might make the connection that the rise is due to inflation expectations, but I don’t think so. As reported by the BLS on February 1st, productivity grew 3.2% in Q4, while the same quarter a year ago, nonfarm business sector labor productivity increased 2.7 percent. That is a significant jump, and I believe it is going to go higher as other enterprises mimic the “tech titans” in having a “year of efficiency” as proclaimed by Mark Zuckerberg last year. Still, with higher rates, we should see share prices react to a change in valuation. So far that hasn’t come to pass. What I am saying is with the rise in rates and moving apace, eventually (and likely soon) stock market commentators will be asking the question, can Powell justify lowering rates at all? Let me first set the table and show a chart of the 10-year Treasury Bond. I am using CNBC.com here

cnbc.com

You can see a definite pattern forming here right from the end of December. The 4.25% level is an easy jaunt from here. The question is do stock market participants take notice as rates near that 4.25% to 4.35% level? I think it becomes a thing, I think that the rise in Oil if that continues will plug into an inflation narrative as well, even as the cost of shipping is still impacted by the Houthis to boot.

To Summarize

I still believe Powell cuts this year albeit way later than anyone thinks. However, the market is not cutting as fine a line, and market commentators and market participants might begin to chew on the notion that there may not be any cuts this year. This logic could extend to there being hypervigilance regarding any data points that point to inflation. So this is where this gets interesting, so far the preponderance of evidence points to disinflation. Meaning the rate of inflation keeps falling. We know that as in life in general nothing happens in a straight line which leads us to my next point

This whole preamble brings me to this week’s CPI and PPI

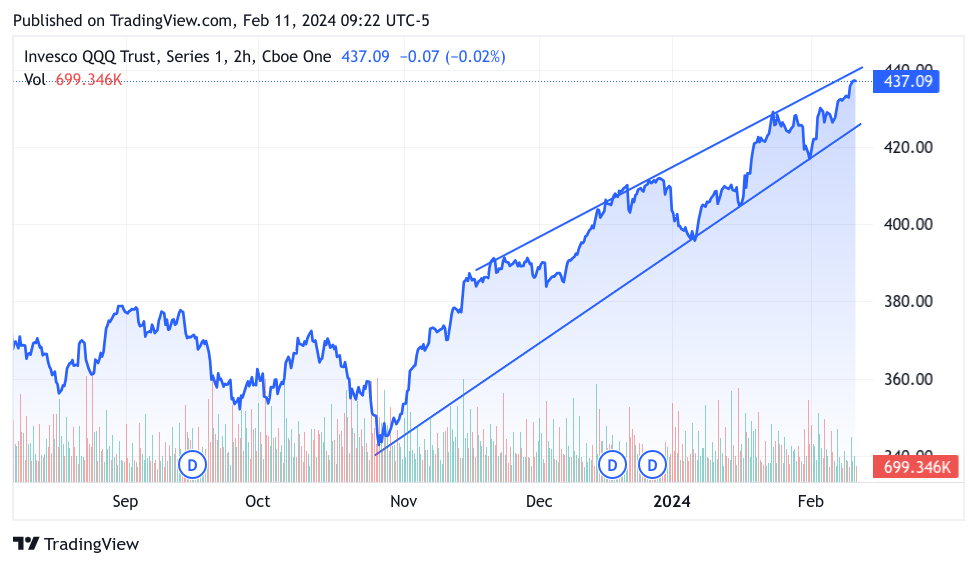

I know we are all sick of inflation indicators having an outsized influence on stock prices. Friends, it is what it is. Right now, no one is paying this data reveal any mind. I haven’t heard of one market commentator even bringing up the CPI as a market-moving issue. So maybe this old boomer is having 70’s flashbacks, to when inflation would not stay dead. Like the old scary movies, where the villain was thought to be dispatched but somehow finds enough strength to take that last stab at the victim. What if we get an uptick in the CPI? On this Tuesday, February 13th, a propitious date we have the CPI then Friday the PPI follows. I have no foreknowledge nor even an inkling of where the CPI comes out, also the PPI which was hardly ever given notice has been well lower than the CPI lately. The lower PPI was considered a harbinger of continued lower prices but also better profits for business. As I said, no one is expecting this and the CPI will likely give its expected lower inflation gauge as it has been for a year. I am merely pointing out the possibility. We do have many further instances where the macro-economic picture impinges on stocks and it pays to pay attention, especially as the stock market marches ever higher. Just to put it in perspective here is a 6 month chart of the Nasdaq-100 ETF (QQQ).

TradingView

We see very few retreats touching the lower band as the trend moves ever higher. We are currently at the desired 45-degree angle at least by my eye. The latest move looks like it will break above the upper band. I will watch that like a hawk, as it will signal to me that we are entering a euphoric stage which could be very vulnerable to anything less than perfection. Right now according to TradingView the RSI for the S&P 500 is at 73, and the 70.83 for the Nasdaq-100 neither of them is technically oversold as yet. I would advise monitoring the rally closely. I have been writing for months that it looks like we could have some kind of sell-off from mid-February to mid-March. The most vital ingredient is over-exuberance by market participants. The CPI reveal this Tuesday is a bit too soon for a substantial correction but it could be the dress rehearsal for something bigger soon. Or more likely, the CPI will reveal more of the same, a slowing of the rate of inflation. We will soon see, I believe just pointing out the negative possibilities, where no one seems to care to elevate besides me, that I have done a service.

My trades and plans for next week.

I was long Snap (SNAP) calls, I don’t like being long Calls going into earnings but this was a small position, so I reduced it by ⅓. I was severely chastised by the market and closed out the rest of my calls at a 70% loss. This led me to close out other names before earnings like Pinterest (PINS) I was up 40% on those calls that I closed out on Wednesday, and did the same with Affirm (AFRM). I earned about 50% on the AFRM long calls, but had I held to Thursday I probably would have made 80% to 90%. Did I self-remonstrate on “losing” that extra 40%? Not a chance, I perform this simple mental exercise to assess risk. I simply ask myself, would I be upset if I were to lose this 50% return tomorrow? The answer is of course yes, and based on that I closed out the position. Why is this my guide? Self-knowledge is key to success in a lot of high-demand occupations and sports. Had I stayed in AFRM on Thursday and the stock faltered for whatever reason then I would have been very tempted to remain in the stock going into earnings and we saw what happened with AFRM. I have checked and re-checked the earnings report and I don’t see the reason why the stock was so badly punished. So naturally, I got back in. I am long AFRM once again, though at the 45 strike and out to June. If AFRM falters from the current level of just under 44, I will roll down to 42.5 strike and wait for it to move back to 47 to 49 for the trade. I also bought shares in the post-market right after earnings at 40.07 for my long-term investment account. Max Levchin the CEO of AFRM is a very able Fintech CEO and I am happy to invest at a discount. Ultimately AFRM breaks into the 50s very soon in my opinion. I also got long Palantir (PLTR) after earnings, I think they continue to move higher after an excellent earnings report with 70% growth in commercial contracts.

It probably won’t surprise anyone reading today’s article to learn that I started hedging. In this case, my first focus is on the long bond. As interest rates rise the price of the bond drops. I am long the inverse long bond ETF (TLT), and I am also short of Tesla (TSLA) via Puts at the 185 strike, as well as Coinbase (COIN) Put at the 120 strike. I intend to lean toward more general hedges like Puts on the TQQQ and also getting Long Calls on the VIX at the 13 strike. The waiting is over, and either the market gives me the swoon I was looking for in the next few weeks or I might be totally wrong. We will soon see.

Good luck everyone!