TimAbramowitz

Investors are increasing their collective bets that the Federal Reserve will soon start cutting interest rates – a bet that went into overdrive this week and ignited the strongest rally in bonds in 40 years.

“The Bloomberg US Aggregate bond index, a widely tracked measure of total returns on US fixed income, has risen 4.3 percent so far in November, putting it on course for its best monthly showing since 1985,” the Financial Times reports.

A key news event that helped fuel the rally: comments from Fed Governor Waller on Tuesday. “I am increasingly confident that policy is currently well positioned to slow the economy and get inflation back to [the Fed’s target of] 2 percent,” he said. “If we see disinflation continuing for several more months – I don’t know how long that might be, three months, four months, five months… you could then start lowering the policy rate just because inflation’s lower. There’s just no reason to say you would keep [rates] really high and inflation is back at target, for example.”

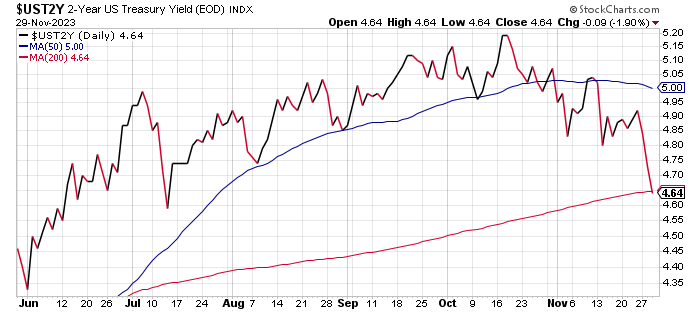

The policy-sensitive 2-year US Treasury yield has fallen sharply in recent trading sessions, dropping to 4.64% on Wednesday (Nov. 29), the lowest since July.

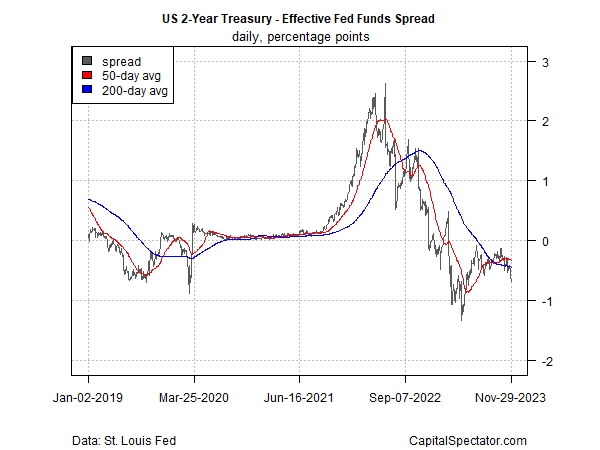

Notably, the 2-year rate is now falling rapidly relative to the current 5.25-5.50% target range for the Fed funds rates. That’s a signal that the market’s pricing in higher odds that 1) rates have peaked and 2) cuts are near.

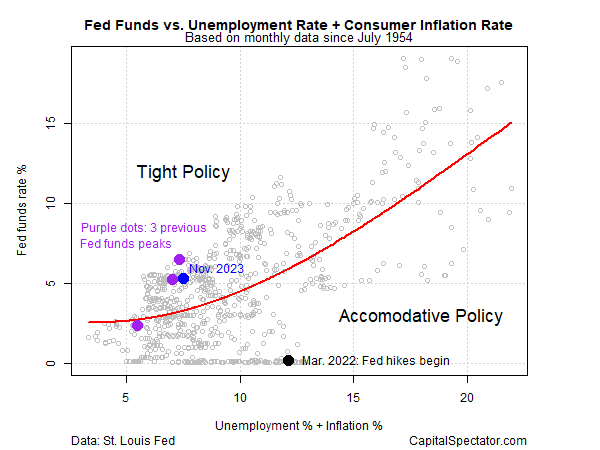

Comparing US monetary conditions against consumer inflation and unemployment suggests that policy is close to the tightest it’s been in recent hiking cycles.

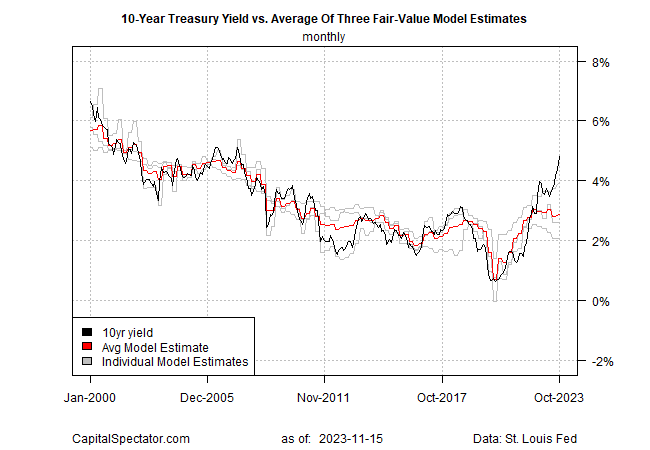

Additional preserve for expecting that interest rates have peaked: Recent estimates of the “fair value” for the benchmark 10-year Treasury yield have been well below the current yield set by the market. Earlier this month on CapitalSpectator.com, the 10-year rate’s fair value calculate for October was nearly 2 percentage points below the market rate – the biggest gap in nearly two decades, and a clue for thinking that the bond market selloff had gone too far.

It’s still early for confidently deciding that a new bull market in bonds has started, but the odds are certainly tipping advance in that direction. Incoming inflation data will likely be decisive for determining what comes next.

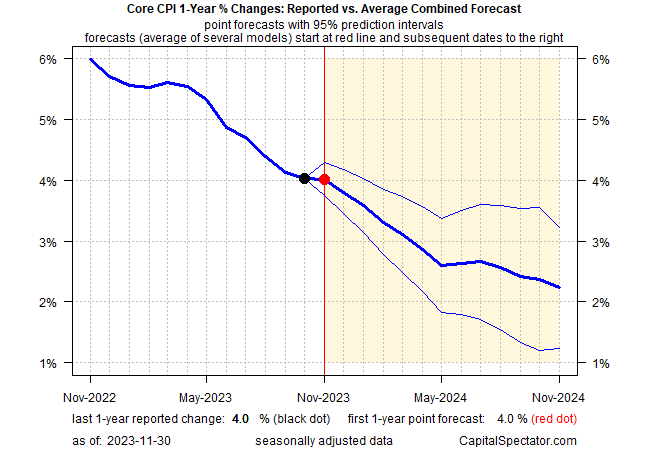

The outlook for core consumer inflation suggests that disinflation will continue, albeit at a modest pace and sometimes sticky pace that may create headwinds for the bond market at times. An ensemble model developed by CapitalSpectator.com projects that the one-year change for core CPI will hold steady at a 4.0% year-over-year rate in the upcoming November report and then resume a downward bias in subsequent months.

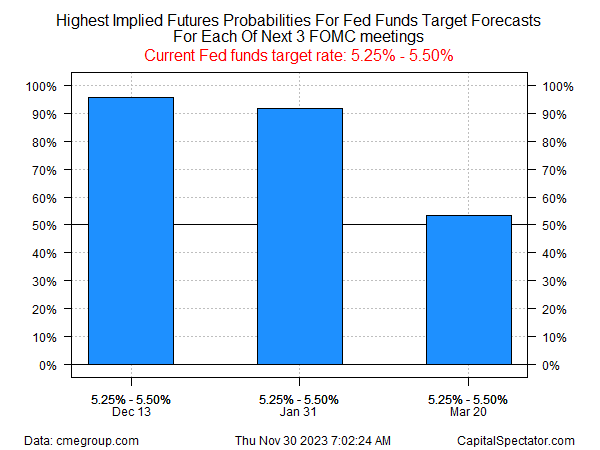

Fed funds futures are on board with pricing the end of rate hikes, but the jury’s still out on when cuts will start. The market estimates a near certainty that the central bank will leave its target rate unchanged at the next two policy meetings, while March meeting is effectively a toss-up between leaving rates unchanged and cutting.

Which way will the odds break in the days and weeks ahead? Incoming macro data will likely be the determining factor. Two key questions are front and center. First, is the economy slowing after the blow-out gain in GDP in Q3? Second, is inflation still easing at a pace that gives the central bank comfort in forgoing more rate hikes and then cutting early next year?

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.