plufflyman/iStock via Getty Images

Moving On Up

Since our November ’23 study and Buy assessment of RADCOM Ltd. (NASDAQ:NASDAQ:RDCM), the stock price popped over 37% up from $7.71 to close January ’24 at $10.58. We believe the Israel-based 5G development and service provider has better future earnings potential with tailwinds from other factors that we are sticking to our previous Buy assessment for now. Our position is more conservative than Seeking Alpha’s Quant Rating and the upgrades from the few other analysts covering the stock.

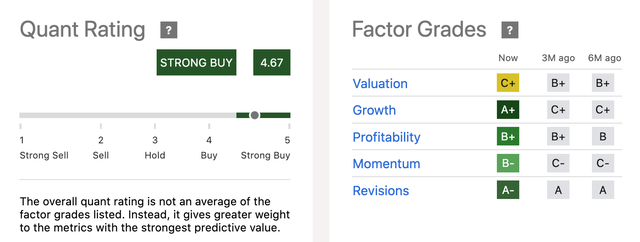

Quant Rating & Factor Grades (Seeking Alpha)

RADCOM’s Q4 ’23 financial results were just reported in sum on Seeking Alpha. GAAP net income for Q4 ’23 was reported to be $2.6M or $0.17 per diluted share, versus a GAAP net loss of $0.03M reported in Q4 ’22. Revenue in Q4 ’23 was $14M, 14% higher Y/Y. Moreover, the company continues to operate virtually debt-free. The company increased its cash and equivalents to over $82M, with about $1.4M of debt.

The full-year revenue guidance from management for FY ’24 is $56M to $60M, “a fourth consecutive year of growth with record revenue (FY ’23) of $51.6M, representing a 12% growth year-over-year.” It has taken 30 years, but by sticking to its business plan, strictly controlling SG&A costs, and researching and adopting new technology, RADCOM has upped its characterization from a small to mid-sized company.

Investing in AI

RADCOM sells 5G services across public, private, and hybrid clouds. 5G internet can be 100xs faster than 4G, and from request to result can be measured in milliseconds. With built-in AI-powered analytics to manage networks, RADCOM can proactively resolve degradations. RADCOM’s NetTalk segment has harnessed AI into its Generative AI applications to help business clients speed up operation services and improve cost controls. GenAI is improving clients’ customer service by speedily feeding back targeted issues on their network services.

In our experience, efficient customer service in the fixed-wireless access industry is the highlight of business success regardless of price, within reason. RADCOM is focused on helping telecom and communication service clients fix problems quickly, like avoiding outages and fixing glitches as clients upgrade their services. We expect RADCOM will build its customer base and stimulate organic growth as the company increases investments in AI.

In terms of market growth, we foresee that RADCOM has unlimited potential. In 2022, RADCOM corralled DISH (DISH) and upped its guidance on 5G rollouts. The stock price shot to ~$13.60 per share on RADCOM’s announcements, as Donovan Jones discussed back then. DISH committed to the FCC in 2023 that DISH’s 5G network spectrum will cover 75% of the U. S. population by the end of 2024; as DISH grows, so do RADCOM’s revenue and earnings.

Only 62% of all Americans have broadband coverage as of now. Israel’s expansion into full 5G coverage is so slow that the government is underwriting start-ups to expand it where RADCOM is based. And 72% of the population in 27 European countries have access to 5G, where RADCOM is marketing its services. GSMA Intelligence reports that 34 out of 50 European countries have deployed 5G and just 92 out of 173 launched 5G networks.

The performance of First Trust IndXX NextG (NXTG) indicates the incentive for considering an investment in an up-and-coming 5G firm like RADCOM. With investments in more than 100 companies, First Trust stock is nearly 65% over 5 years and +11% in the past year.

Valuation and Growth

In our opinion, there are solid reasons for retail value investors to consider holding RADCOM for the long term and perhaps buying on dips closer to the $8 range. At +$10 per share, the stock appears to some to be overvalued; our fair value estimate is around $7 taking the recent P/E of 28 times the EPS of $0.25. But then there are other positive considerations to include.

- RADCOM reported a strong Q4 ’23 and beat EPS estimates for the full year.

- The stock is moving up and with tailwinds, including the expected growth of 5G in North America, Europe, and Israel, the momentum of the stock price shares can claw back to its ~$13.60 share price 2 years ago. Some analysts go as high as $14 and have predicted higher in the recent past.

- The stock boasts healthy momentum and the company rarely has to revise its numbers. Compared to the IT sector median, RADCOM’s 3-month price performance is 29.33% to 20.14%, for 6 months it is 3.09% compared to the industry sector median of -3.15%.

- Despite the share price increase, short interest is holding at less than 1% with a day to cover since last December.

- We calculate the company’s price-to-earnings ratio at about 40x, versus the industry average of 46x.

- The P/E Non-GAAP (FWD) is 14.40 for RADCOM with the sector median at 24.91 giving the company an A- Factor Grade. The other valuation metrics are good but not as strong as those for growth, profitability, momentum, and revisions.

- Insiders own nearly 25% of the outstanding shares and have a vested interest in the company’s growth and success; they are forecasting higher FY ’24 revenue from $51.6M closer to $58M along with better earnings in the first half of the year. RADCOM Ltd. beat annual earnings expectations in 8 of the last 9 quarters.

- There is little chance the company will experience financial distress, with RADCOM holding some $82M in cash and equivalents and only reporting debt of ~$1.4M.

- Total receivables rose from $10.4M in FY ’21 to $11.5M at the end of FY ’22 and to $15M in 2023, while total liabilities dropped ~10% from $22.8M in 2022 to $20.1M in FY ’23.

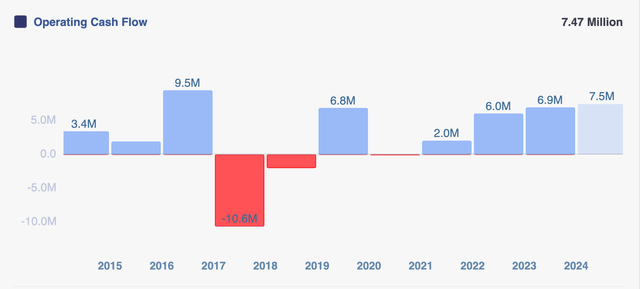

- Finally, RADCOM’s gross profit increased from about 30% in ’21 to 33% the next year, and 37.8% in 2023, while operating cash flow is ticking up.

Operating Cash Flow (Macroaxis)

Risks

The company details risks to future growth and profitability in notices to the SEC. First, we notice the market cap has an erratic history. Recently it was $0.16B at the end of 2022, $0.12B to close ’23, and up again to $0.15B at the opening of February, ’24. R&D investments are expensive.

Then there are unexpected delays in new contracts and resigning telecommunication companies. Delays can occur if their budget priorities change and from macroeconomic obstructions. For instance, the war in Ukraine prioritizes military spending over telecommunications infrastructure development in many European countries; and the massacre on Black Sabbath by Gazans in southern Israel pushed RADCOM into highlighting delays per the “size and timing of approval of grants from the Government of Israel” for upgrading to 5G. Telcos are subject to Capex spending cuts for profitability and economic forecasts.

Any of these situations can affect RADCOM at some point, particularly because its relatively small size amongst the competition makes it more vulnerable so far as we can determine. RADCOM is a relatively small player with fewer than 300 employees compared to others with 5xs or more as many in their companies and market caps over a billion dollars. They sport much greater market power than RADCOM. However, RADCOM has not reported glitches in contract renewals with its largest customers.

Takeaway

On the whole, we see little risk for retail value investors and a worthwhile potential opportunity. The share price can pop up again if, like in the past, the company beats quarterly expectations. The board appointed a new CEO upon the retirement of its long-time former CEO. Guy Shemesh comes from the industry with selling experience to firms in the global telecom market. This reinforces our sense of stability in the company and pursuit of its basic business plan, which is proving to be successful. Everything seems in place for ticking up revenue and earnings and the share price. In this case, good things come in small packages.