Yuichiro Chino/Moment via Getty Images

Introduction

The Global X Nasdaq 100 Covered Call ETF (NASDAQ:NASDAQ:QYLD) is a relatively well-known and large-size ETF, which employs a covered call strategy to produce high streams of current income to investors, who also wish to carry some exposure to the Nasdaq-100 index.

It has ~$7.8 billion in AuM and an over 10-year history of delivering juicy distributions to investors.

In this article, I will elaborate on the key characteristics of QYLD that investors have to consider before committing any capital to this ETF as well as I will give my view on whether in this environment, QYLD is an attractive investment choice.

Thesis

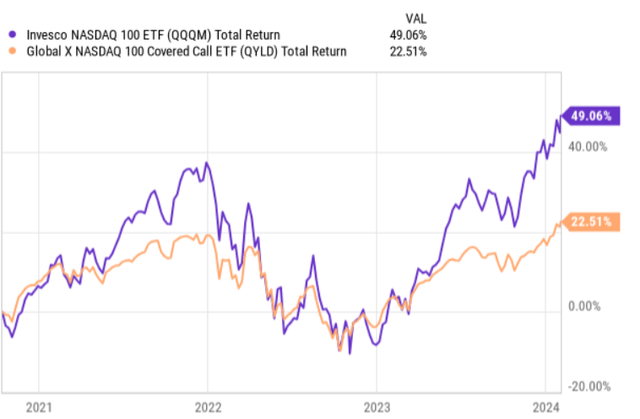

First, let’s take a look at how QYLD has performed relative to the Nasdaq-100 itself.

From the chart above, it is clear that even on a total return basis, QYLD has significantly lagged behind the index. In fact, it is worth underscoring the following two observations:

- There has not been any notable period under which QYLD had managed to register alpha compared to the index.

- Since the start of 2023, when the magnificent seven began to produce outsized returns, QYLD has failed to keep up with the index, thus marking an even steeper (negative) divergence from the benchmark.

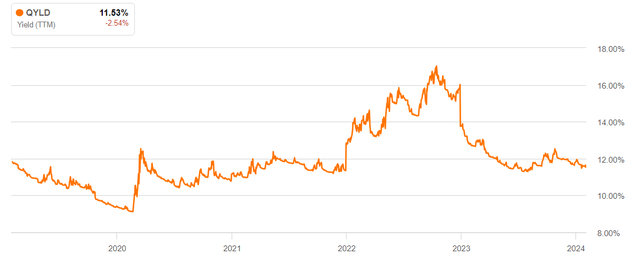

Now, to make matters specifically worse, we can take a look at the current dividend yield level, which has dropped from the recent levels that clearly provided a more attractive entry point (from the yield perspective) for the investors.

Having said that, I do not view these dynamics as something that would fully substantiate a thesis of avoiding this ETF. Instead, it all boils down to the investor’s preferences on risk and, in this context, type of returns.

Let me explain.

The fact that QYLD applies covered call strategy implies that the upside potential in terms of the price appreciation is inherently limited due to the sold calls, which put a cap on how far the ETF can register gains over a certain period of time (combination of strike and option maturity date).

In an upward trending market, this is obviously a disadvantage as we can see in the total return chart above, where since 2023 QYLD has consistently lagged behind the index, which in turn has gone nowhere but up mostly due to the “magnificent seven” factor.

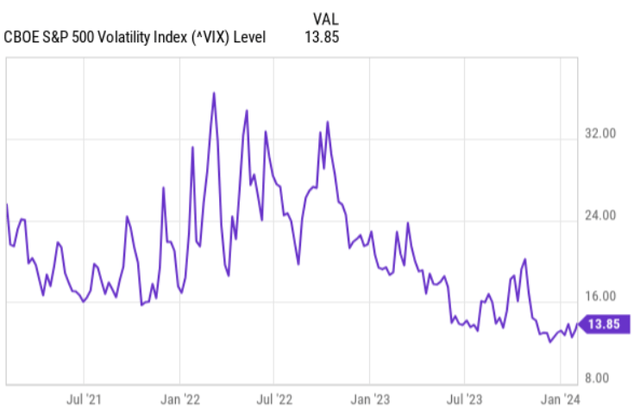

Moreover, such an option-based strategy becomes less attractive when the market is exhibiting lower depressed volatility levels, since this renders option premiums cheaper. In QYLD’s case, this means reduced ability to distribute enticing cash flows.

Now, when the VIX is down, obviously QYLD’s yield is not that attractive anymore (at least relative to the period when the VIX was revolving around 30x levels).

Yet, there are several aspects, which make this ETF an enticing investment to consider irrespective of the prevailing situation in the VIX or the embedded limit to fully participate in the booming markets.

First, for yield-seeking investors, QYLD is a great choice as the current dividend stands at ~11.5%. Plus, the fact that it has historically maintained similar yield levels even under low double-digit VIX levels makes this overall story quite sustainable as well.

Second, while under surging markets QYLD is not able to capture the full benefit, in the scenario of sideways trending or even declining markets, QYLD is definitely a more solid pick. The presence of sold call premiums allows the ETF to recognize extra income (offsetting the loss or adding to neutral returns) that otherwise for regular stocks or the Nasdaq-100 index would not be possible.

Third, and this is what we can also notice in the very first chart of this article, QYLD offers lower volatility levels than the index. Measured against the S&P 500 or Nasdaq-100, QYLD’s beta lands at 0.63x and 0.53x, respectively.

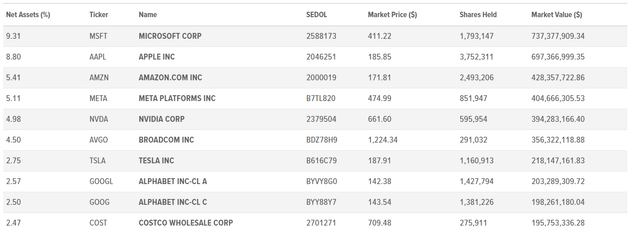

Global X Management Company LLC

Finally, given the current consensus on the future interest rate environment, where SOFR is set to go down this year and continue to do so in 2025 and 2026 as well, the underlying holdings of QYLD should benefit in a quite material fashion. Namely, the top portfolio constituencies of QYLD embody rather back-end loaded cash flows (i.e., they are growth focused), which implies a greater than average sensitivity to duration factor that tends to perform very well during periods of falling interest rates.

The bottom line

In a nutshell, QYLD is not the best choice for investors, who believe that the market will surge over the foreseeable future. This is because of the inherent cap on the upside potential that stems from the covered call strategy.

Instead, this ETF is an optimal vehicle through which yield-seeking investors, who seek lower beta in conjunction with additional downside protection, can assume a fairly attractive investment position.

Given the 11.5% yield with an embedded protection, but with limited upside potential, QYLD is a clear hold for me.