JLco – Julia Amaral

When thinking about 2024, one of the major items everyone in the market is talking about is artificial intelligence (“AI”). Companies everywhere are using tons of AI buzzwords as they look to the future and ways to revolutionize their businesses. High profile ETF manager Cathie Wood, leader of Ark Invest, has been on the AI train for several years now, but this week make an interesting move geared at this coming technology revolution.

Everyone in the tech space knows Qualcomm (NASDAQ:QCOM). The chip giant is most notable for its chips that power smartphones, but the company is quickly pivoting to address other areas of the market. Management is hoping to deliver $9 billion in annual revenues in the automotive space by the end of the decade, and its Internet of Things (“IoT”) segment delivered nearly $6 billion in revenues in the recently finished September 2023 fiscal year.

Qualcomm is coming off a down year, primarily due to macroeconomic weakness hurting handset sales and manufacturers drawing down on their elevated inventory levels. The company reported a nearly 20% top line decline, but still generated over $35 billion in total revenue, $7.2 billion in GAAP net income, and almost $10 billion in free cash flow. As more connected devices come to market, and the company broadens its product portfolio, analysts expect the company to generate mid to high single digit revenue growth for this fiscal year and the next two.

Last week, Qualcomm announced a new AI-powered chip architecture, aimed at having more realistic experiences in both mixed and virtual reality. Qualcomm said that Samsung (OTCPK:SSNLF) and Google (GOOG) (GOOGL) would use the Snapdragon XR2+ Gen 2 in their respective upcoming mixed reality devices. This is an effort to help these devices compete with Apple’s (AAPL) Vision Pro headset, which will be available to consumers at the beginning of February.

With Qualcomm looking to bolster its artificial intelligence offerings, Cathie Wood and Ark Invest have decided to add the name to a couple of their ETFs. On Monday, the ETF firm started Qualcomm positions in both the ARK Autonomous Technology & Robotics ETF (ARKQ) and the ARK Next Generation Internet ETF (ARKW). The graphic below shows Monday’s moves from the firm’s daily trades e-mail.

Ark Invest January 8th Trades (Ark Invest)

There was another small round of Qualcomm buying in these two ETFs on Tuesday, bringing the respective purchases to around 50 and 25 basis points of fund weight, respectively, between ARKQ and ARKW. Those aren’t large purchases just yet, but it has only been two days so far. In the “Q” ETF, Qualcomm should already be larger than four other ETF components when we get the final Tuesday numbers in, although one of those positions may be exiting the ETF shortly. In the “W” ETF, the position is larger than two other names (when excluding cash as a “position” in both funds).

I personally like Qualcomm as a long term value play in this space. You’re not going to see revenues or earnings double in a year, but you’re also not paying for that kind of growth. The company trades for just 15 times this year’s expected adjusted earnings, whereas comparable chipmakers like Intel (INTC) and Texas Instruments (TXN) are trading for more than 25 times their forward adjusted earnings estimates. Qualcomm also pays a nice dividend that’s yielding around 2.30% annually right now, and its solid free cash flow supports a buyback that is slowly reducing the outstanding share count.

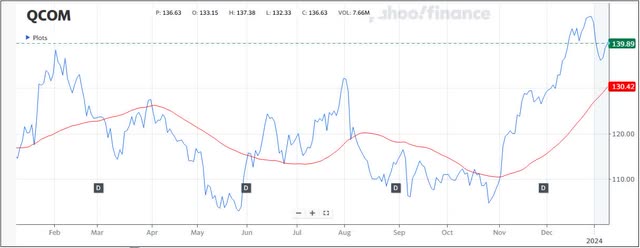

The stock is up about 35% since late October, rallying with the overall market, so I’d like to see a pullback before jumping in. As the chart below shows, the stock has a history of trading down below its 50-day moving average, which is the red line. In my opinion, that would be a better place for investors to look for an entry point, as you’ll also lock in a higher dividend yield with the lower price. Thus I would personally give shares a hold rating at present.

Qualcomm Last 12 Months (Yahoo! Finance)

In the end, Cathie Wood has added Qualcomm to two of her specialized ETFs this week, funds that primarily focus on autonomous technology. While most investors are familiar with the company’s handset business, the chip giant is looking to make strides in the artificial intelligence revolution, including powering the next generation of reality headsets. This may be more of a value play than one of Ark Invest’s traditional high growth names, as Qualcomm isn’t expected to see tremendous revenue and earnings growth, but it also is solidly profitable and free cash flow positive unlike some of Ark’s more speculative holdings. With Qualcomm, investors aren’t paying an exorbitant amount for shares here, and the company does have a solid capital return plan. I’ll be watching to see how large of a position in these ETFs Qualcomm grows to in the coming months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.