Phiromya Intawongpan

“Zero days until expiration” options, or ODTEs, have become a popular way to day trade markets. ODTEs are options that are issued and expire on the same trading day. The proliferation of derivatives trading as costs have come down, and as investors continue to shorten their holding periods, naturally led to a sprawling of 0DTEs over the last two years. There is now a way to get exposure to the Nasdaq 100 using 0DTE options, all in the ETF wrapper.

I’m cautious about the fund, though. It is an expensive vehicle and a possibly speculative strategy. Moreover, we do not know how the fund might perform during periods of heightened market stress or if another so-called “volmageddon” event (akin to what took place in early 2018) rattled stocks and the options market.

I have a hold rating on the Defiance Nasdaq 100 Enhanced Options Income ETF (NASDAQ:QQQY). Only investors who understand the nuances of the ETF should consider owning it, and risks must be grasped and continually monitored.

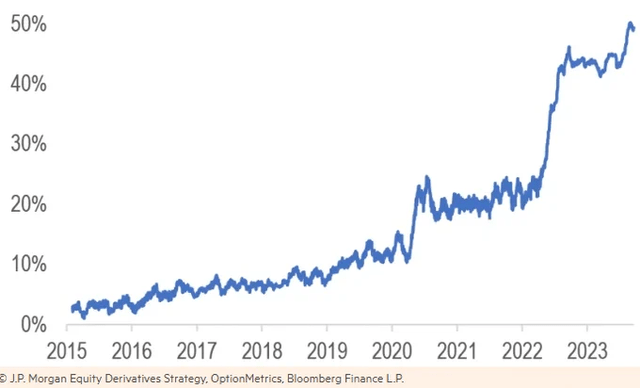

0DTE options now account for half of total S&P 500 options volume

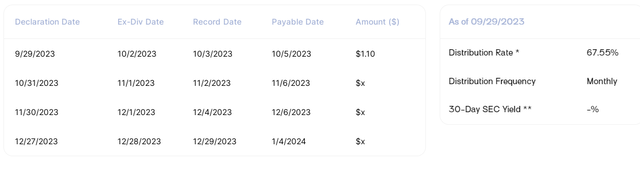

According to the issuer, QQQY aims to achieve consistent and outsized monthly yield distributions for investors coupled with equity market exposure to the Nasdaq 100 (NDX). QQQY is an actively managed ETF that seeks enhanced income, constructed of treasuries and Nasdaq 100 index options. The strategy’s objective is to generate outsized monthly distributions by selling option premium daily. The fund uses daily options to realize rapid time decay by selling in-the-money puts expiring the same day. Defiance ETFs notes that the ETF’s distribution rate is 67.6% as of September 29, 2023.

QQQY is the first fund to employ ODTE options as a strategy to generate income. With the primary objective of generating current income, the ETF also seeks exposure to the Nasdaq 100 with a cap on potential gains. So, while the fund looks to provide a large dividend return, there is ample risk exposure to the Nasdaq 100 through its short puts (which is generally a bullish options strategy on an underlying asset).

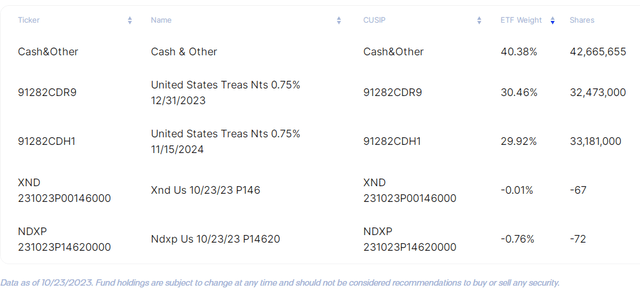

Let’s first go through QQQY’s holdings to grasp how the fund’s mechanics work. You’ll see that the ETF holds ample amounts of cash and US Treasury securities. Just a small portion of the allocation is in 0TDE options (naturally they will expire within a day), so the fund is essentially taking daily long positions in the Nasdaq 100 index and constantly selling new options.

QQQY Holdings (As of October 21, 2023)

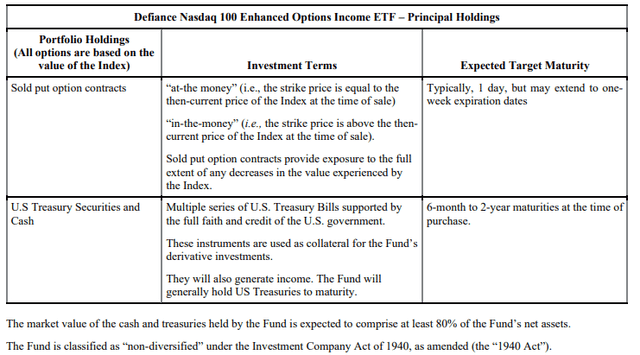

The ETF uses an at-the-money and in-the-money put-selling strategy to provide income and exposure to the value of the NDX. The in-the-money short puts effectively provide the upside exposure while the out-of-the-money short puts generate the income. Each day, QQQY sells puts that are priced either at-the-money or up to 5% in-the-money. The out-of-the-money puts being sold seek to benefit from fast time decay (or theta) that takes place as expiration approaches, enhancing the yield potential. Finally, the ETF’s strategy is designed to have approximately a daily, unleveraged, 100% downside notional exposure to the NDX.

QQQY Definitions & Strategy Context

In general, ODTE options are liquid and can be cost-effective compared to longer-dated options, but there is no guarantee that reality will hold into the future. Additionally, trading options often involves outsized return potential, which may bring about new risks during periods of market turmoil.

QQQY Distribution Schedule

QQQY is an expensive fund with total annual fund operating expenses of 0.99% and it remains small in terms of its assets under management at just $102 million as of October 20, 2023. Still, it has gathered a respectable amount of new money given its inception was just in mid-September of this year. Volume is not particularly high at 370,000 on an average daily basis.

I often like to review an ETF’s typical bid/ask spread for a gauge of liquidity, and the fund shows it at 0.15% (on the high side), so I suggest investors check how wide that spread is during the trading day – limit orders may be prudent when the bid/ask is wide. QQQY faces intense competition from other derivatives-focused equity funds, such as the JPMorgan Equity Premium Income ETF (JEPI) and the Global X NASDAQ 100 Covered Call ETF (QYLD).

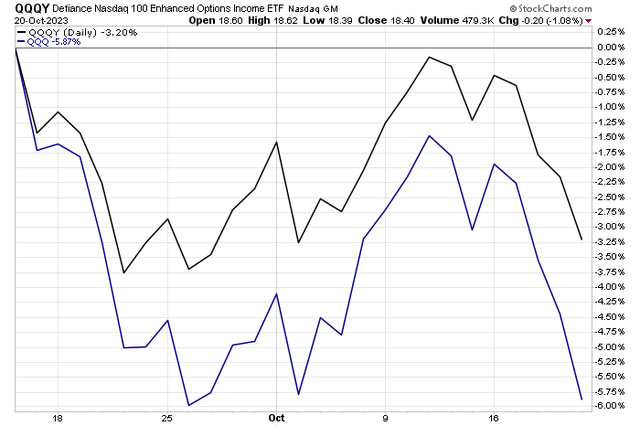

QQQY: Outperforming QQQ Since Its Sept 15 Inception As Volatility Has Increased

The Bottom Line

I have a hold rating on the ETF. I am bullish on the Nasdaq 100 looking into early next, as I have detailed in other articles, but this strategy adds a key risk. I acknowledge that the yield potential is strong, but I would like to see how ODTEs perform during market-stress events before allocating a significant amount to QQQY.