Galeanu Mihai

By Scott Welch, CIMA

“I just dropped in to see what condition my condition was in.”(Kenny Rogers & The First Edition, 1967)

The first three quarters of 2023 were marked by a handful of factors and issues, among them: (1) the continued performance dominance of large-cap “mega-cap tech” stocks (and the corresponding continued underperformance of small-cap stocks); (2) a U.S. economy that continues to be more resilient than many expected; (3) a Fed that seems to be at or near the end of its rate hike cycle; (4) the ongoing Russia/Ukraine war; (5) simmering tensions between the U.S. and China; and now, of course, (6) the outbreak of war between Israel and the Iran-sponsored Palestinian Hamas.

As always, when reviewing the current state of the global economy and investment markets, we recommend focusing on market signals and weeding out market noise. We believe the five primary economic and market signals that provide perspective on where we go from here are GDP growth, earnings, interest rates, inflation and central bank policy.

This is not to dismiss geopolitical issues or political dysfunction in Washington, DC. But these are what we refer to as “known unknowns”—we are aware of them but have no way to forecast how they will turn out or what effects they will have (or not) on the economy or investment markets.

Spoiler alert: We now believe that any U.S. recession will be pushed out until later in 2024, maybe not even until 2025. The proverbial economic “soft landing” is no longer dismissed by analysts.

So, let’s dive in.

GDP, Inflation and Central Bank Policy

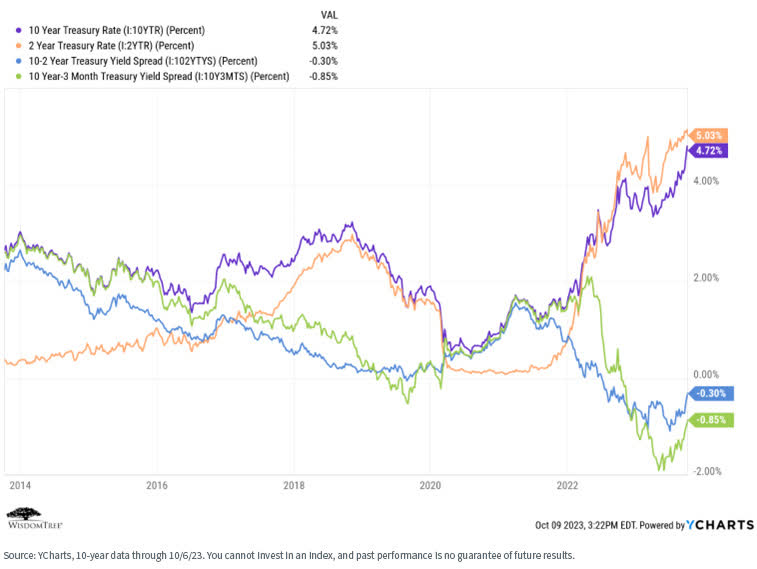

Let’s start with a look at the yield curve (i.e., interest rates), specifically two closely watched “spreads”: the 2-Year/10-Year (2s/10s) and the 3-Month/10-Year (3m/10s).

While the yield curve remains inverted (historically, a leading indicator of recession), the recent steepening of the yield curve (specifically, the dramatic rise in longer-term rates) suggests that the Treasury and bond markets are “normalizing.” “Higher for longer” remains our mantra.

Investors who have only been in the markets since the great financial crisis in 2008 might interpret the recent increase in rates as a “crisis” when, in reality, we are simply moving “back to the future” to where the Treasury curve is increasingly driven by investors (as it should be) versus Federal Reserve intervention.

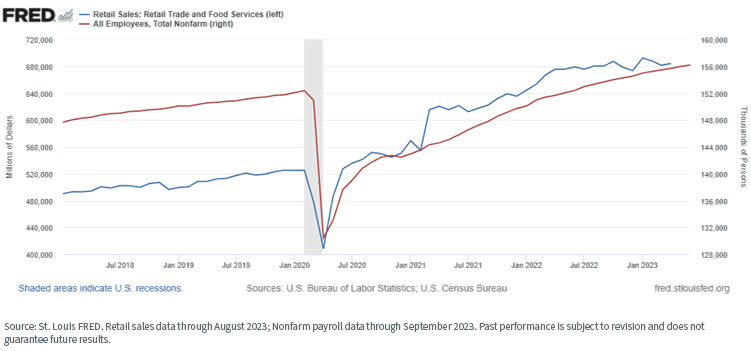

We see that the 2s/10s has been inverted since roughly July 2022, while the 3m/10s in October 2022. The recent trend toward “normalization,” however, suggests that the market is responding to the Fed reducing its market interventions and to ongoing economic resiliency, especially given the continued strength of labor and retail sales indicators.

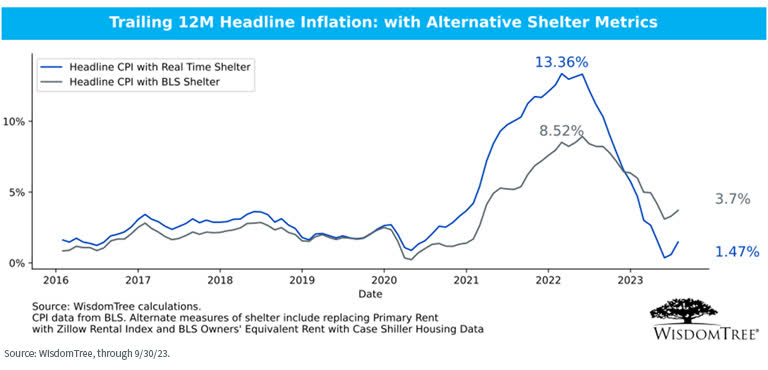

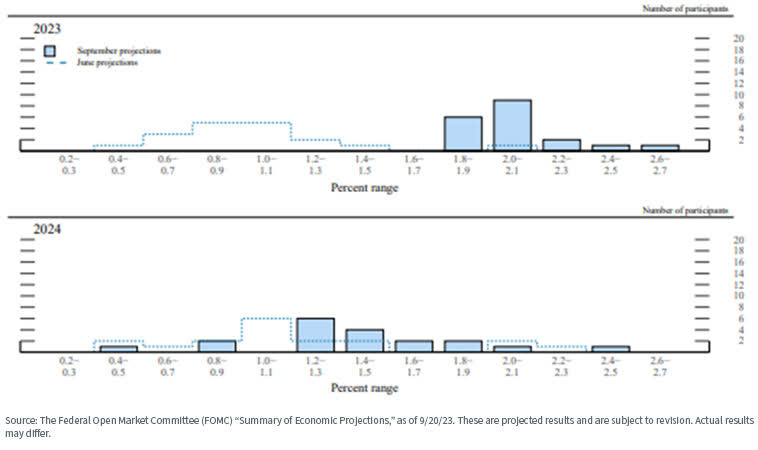

While some argue that inflation remains a concern in 2023, it certainly is trending in the right direction. We believe the Fed is at or near the end of its rate hike cycle, and it continues to reduce its balance sheet. The market itself is not pricing in any rate cuts until June of next year—quite a reversal from the beginning of the year when cuts were anticipated as early as this past June.

We note that the headline CPI number is significantly impacted by housing and shelter data, which are subject to around a six-month reporting lag. CPI would look much lower if current or contemporaneous shelter data were used.

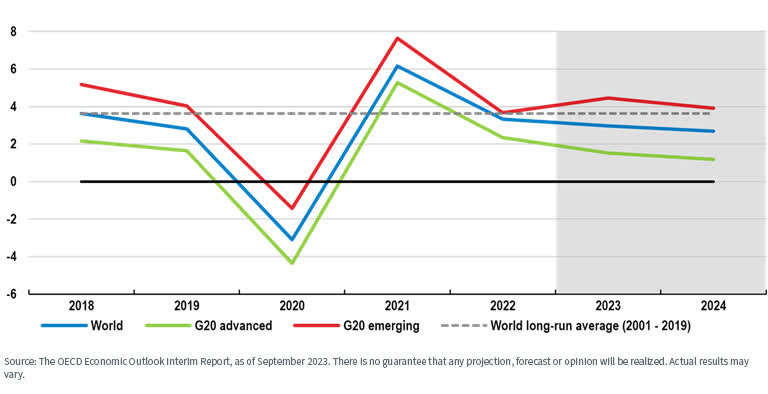

Estimates for annual GDP growth in 2023 and 2024 are muted but positive.

Estimates for economic growth outside the U.S. are also muted but positive.

Translation: While economic growth may be slowing, it is proving to be more resilient than expected. Here in the U.S., there remains positive economic news, especially in consumption and labor, but some indicators—especially manufacturing—are in “contractionary” mode.

While the Fed will be highly “data dependent” as we move through 2023, we believe we are at or close to the end of the rate hike cycle, with perhaps one more hike in 2023. The market currently is not pricing in any rate cuts until well into next year.

Earnings and Valuations

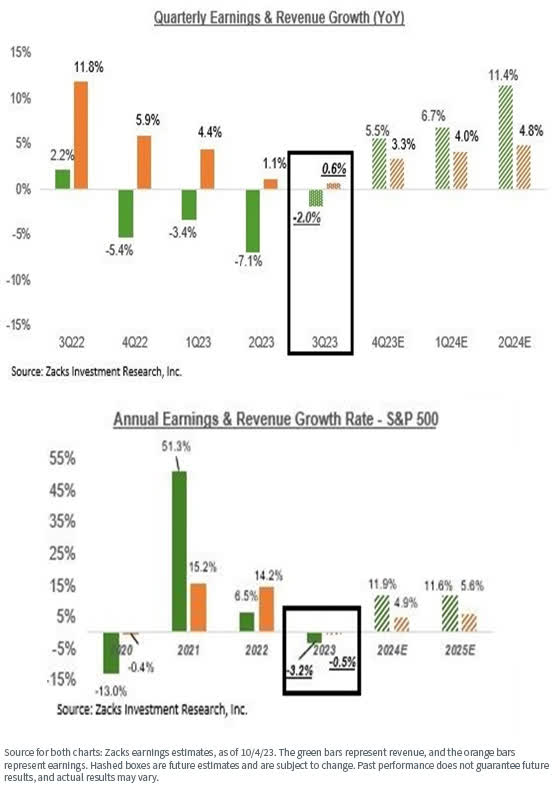

The Q3 earnings season is just getting started. The consensus is that 2023 will witness a small decline in corporate earnings but then improve again as we move into Q4 and 2024. Wage increases and declining productivity are putting downward pressure on margins, but this is somewhat mitigated by the continued strength of the labor markets and the labor participation rate.

One question is whether the “AI-themed” stocks that have driven so much of market performance YTD will be able to continue to generate sufficient earnings to maintain their current elevated valuations. In a recent blog post titled “Growth Stocks Are Less Expensive than Traditional Measures Imply,” however, we suggest that valuations may not be as high as suggested if “intangible adjusted” valuation metrics are used.

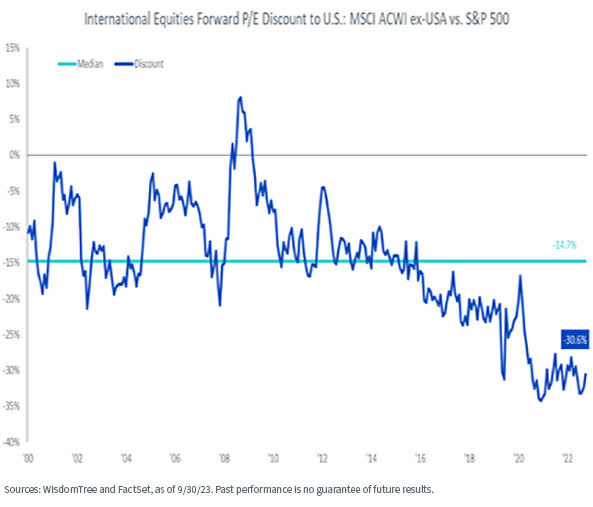

Outside the U.S., fundamental and dividend-driven investors may find relative valuations to be attractive. That said, we are less optimistic about economic growth outside the U.S., especially in Europe and China, and the dollar has been on a strong rally for several months.

For these reasons, we recently reduced our exposures to EAFE and EM in favor of going over-weight in the U.S. relative to the MSCI ACWI Index.

Translation: Global equity markets remain relatively “complacent,” though they do react to changes in interest rates (and have fallen with the recent rise in rates). Ex-the mega-cap tech “AI” stocks, market valuations are in line with historical averages, with perhaps relative value available outside the U.S. For U.S. investors, non-U.S. markets remain sensitive to slower economic growth rates and an upward-trending dollar.

We saw a strong factor rotation toward large-cap growth and mega-tech stocks through the first three quarters of 2023. Those factors “rolled over” slightly in Q3 as interest rates rose but remain the dominant ones in overall market performance.

Small-cap and value stocks continue to represent a relative value opportunity going forward, though small caps are also more sensitive to interest rates and to the financial and energy sectors, which have performed relatively poorly so far this year. Q3 showed signs, however, of a potential “re-rotation” back toward value stocks in both large and small caps.

We believe “quality” (i.e., companies with strong balance sheets, earnings and cash flows) will become increasingly important as margins and earnings get squeezed. Firms that can maintain their pricing power and dividends should more consistently perform.

Interest Rates and Spreads

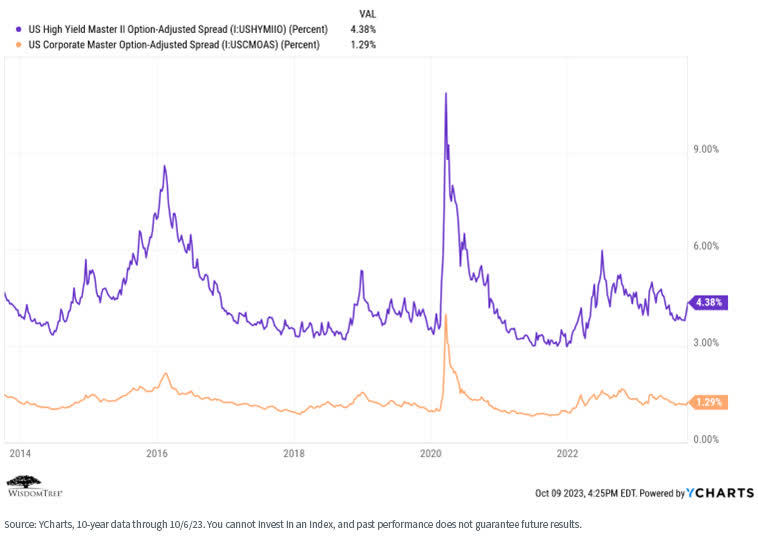

The yield curve remains an item of intense focus these days. We discussed the level and shape of the curve above, but what about credit spreads?

Credit spreads remain in line with historical levels (despite a recent uptick in high-yield spreads). This, combined with positive real rates across the maturity spectrum, translates into “there is income back in fixed income.”

Corporate balance sheets and debt structures are in decent shape, so coupons should be safe. We increased the duration of our strategic fixed income model several months ago but remain short duration relative to the Bloomberg Aggregate Index, as well as over-weight in quality credit.

We believe that, given their current yields, high-yield bonds offer an adequate “buffer” to adverse movements in either rates or spreads, and given the shape of the yield curve, we still like floating rate Treasuries.

Despite our favorable view of high yield, we did recently make the decision within our Model Portfolios to reduce our high-yield over-weight positions and reallocate into mortgage-backed securities.

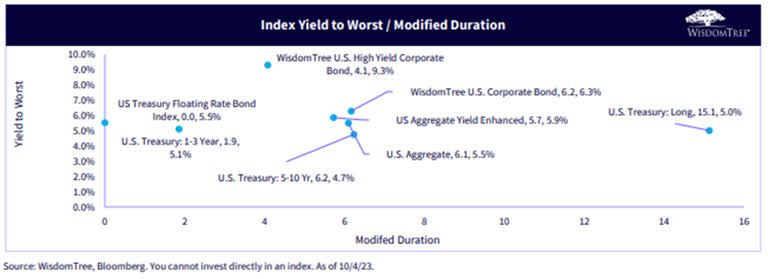

Investors continue not to be rewarded for taking on duration risk. This chart illustrates why we still favor floating rate Treasuries and U.S. corporate high-yield.

Summary

When focusing on what we believe are the primary economic and market signals, the “condition our condition is in” is positive, with some uncertainties—specifically, a still publicly hawkish Fed and heightened geopolitical tensions.

Economic growth is proving to be resilient, and recessionary fears have been pushed back until well into 2024. Earnings are expected to decline in Q3 but then improve going forward.

To summarize our primary investment themes and views for the remainder of 2023 and into 2024:

- There is income back in fixed income. We believe there continues to be relative value in high yield, and we continue to like U.S. floating rate Treasuries.

- Despite market performances YTD, we maintain our conviction in value, small-cap and dividend stocks.

- Quality continues to be the most consistently performing risk factor (rarely the best or the worst) and remains the “anchor” factor tilt in our Model Portfolios.

- U.S. small-cap stocks continue to present attractive valuation plays.

- Non-U.S. markets present interesting valuation and dividend opportunities, but we are concerned about economic growth and the direction of the dollar.

- Active management and intelligent risk factor tilts should be rewarded versus passive management (i.e., cap-weighted “beta”).

- Real assets (e.g., commodities and MLPs) and alternative strategies (e.g., managed futures and option-based) continue to present interesting diversifying opportunities.

As generally strategic investors, we continue to recommend focusing on a longer-term time horizon and the construction of “all-weather” portfolios, diversified at both the asset class and risk factor levels.

Scott Welch, CIMA, Chief Investment Officer, Model Portfolios

Scott Welch is the Chief Investment Officer of Model Portfolios at WisdomTree, a provider of factor-based ETFs, differentiated model portfolios, and digital asset solutions. In his role as CIO, he oversees the construction and ongoing management of the WisdomTree model portfolio solution set. He chairs the WisdomTree Model Portfolio Investment Committee and is an active member of the WisdomTree Asset Allocation team. Prior to joining WisdomTree, Scott was the Chief Investment Officer of Dynasty Financial Partners, a provider of outsourced investment research, portfolio management, technology, and practice management solutions to RIAs and advisory teams making the move to independence. Prior to Dynasty, Scott was a Co-Founder and the Chief Investment Officer of Fortigent, LLC, a provider of outsourced investment research, technology, and practice management solutions to RIAs and banks that targeted high net worth investors. Scott holds the Certified Investment Management Analyst (CIMA®) designation, and he sits on the Board of Directors of the Investments & Wealth Institute (IWI, formerly known as IMCA) and is an outside member of several RIA Investment Committees. Scott earned a Bachelor of Science in Mathematics from the University of California at Irvine and an MBA with a concentration in Finance from the University of Massachusetts at Amherst.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.