monsitj

By Jharonne Martis

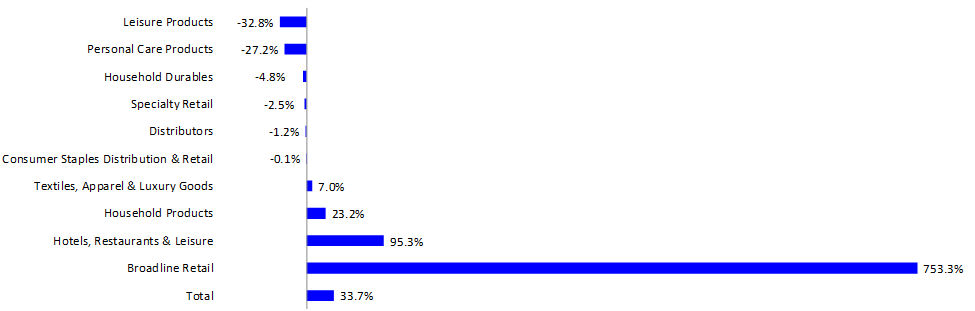

The LSEG U.S. Retail and Restaurant Q4 earnings index, which tracks changes in the growth rate of earnings within the sector, is expected to show a 33.7% growth over last year’s levels. However, much of this growth is coming from just two categories, and our metrics show that six of 10 consumer-related industries have turned negative (Exhibit 1).

Of the 204 retailers tracked by LSEG, the Broadline Retail sector is headed for the highest earnings growth rate in the fourth quarter, recording a 753.3% surge over last year’s level. The second-strongest sector is the Restaurants & Leisure group, with a 95.3% growth estimate. In fact, it has been consistently the strongest performing sector over the past two years as consumers’ preferences have pivoted from goods to services. It is still seeing double-digit growth on top of last year’s strong growth rates. Making up for lost time during the pandemic, people are traveling again, staying at hotels, and eating out.

At the other end of the spectrum, Leisure Products is facing difficult comparisons and has the weakest anticipated Q4 2023 estimate, with profits expected to decline by 32.8% (Exhibit 1).

Exhibit 1: The LSEG Retail Earnings Growth Rate – Q4 2023

Source: LSEG I/B/E/S

Within the Broadline Retail sector, Amazon (AMZN) already recorded the strongest earnings growth rate of 3,233.3%. Analysts polled by LSEG remain bullish on the online giant’s earnings estimates for the next four quarters. Amazon has the biggest weighting in the group and is boosting the sector’s growth rate. Still, of the seven companies in this group, only one is on track to post negative estimated earnings growth for Q4.

The second-strongest sector is the Hotels, Restaurant & Leisure sector. This sector has consistently posted strong gains over the past two years. Of the 49 companies in this group, 37 are on track to post positive estimated earnings growth for Q4. Las Vegas Sands (LVS) and Wynn Resorts (WYNN) already recorded the strongest earnings growth rates of 400.0%, and 255.3%, respectively. Analysts polled by LSEG remain bullish on these two companies’ earnings estimates for the current quarter.

In contrast, the Leisure Products group is hampered by difficult year-over-year earnings comparisons. Negative growth expectations are directly responsible for the forecast decline in the overall earnings growth rate within the group, as six of the eight companies struggle to match year-ago earnings growth levels. Hasbro (HAS) already reported a 71% decline in earnings growth in the fourth quarter of 2023, followed by Polaris (PII), which recorded an earnings decline of 42.8%.

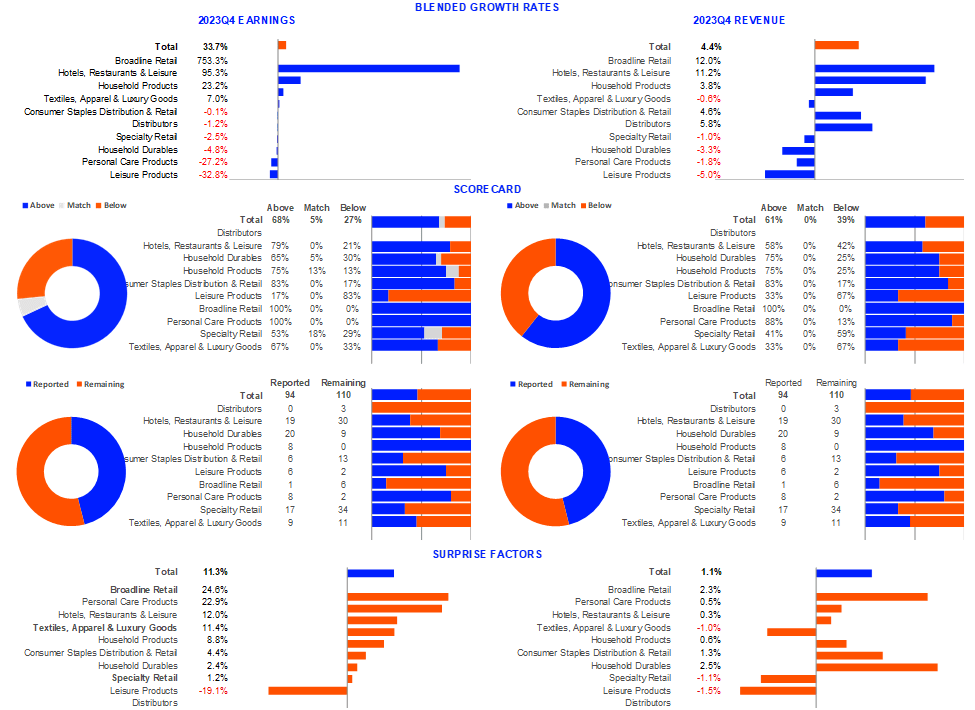

So far, 94 companies, or 46% of those in our Retail/Restaurant Index, have reported earnings for Q4 2023. Of this group, 68% announced earnings that exceeded analysts’ expectations, while 5% matched those forecasts and the remaining 27% reported earnings that fell below analysts’ predictions (Exhibit 2). The blended earnings growth estimate for Q4 2023 is 33.7%.

To date, 94 companies in the Retail/Restaurant index have reported revenue for Q4 2023. For this group, the Q4 2023 blended revenue growth estimate is 4.4%; 61% have reported revenue above analyst expectations, and 39% reported revenue below analyst expectations.

Exhibit 2: LSEG Proprietary Research Restaurant & Retail Dashboard – Q4 2023

Source: LSEG I/B/E/S

This week in retail sales and earnings

Walmart (WMT) posted its sixth consecutive quarter of positive earnings growth. For Q4 2023, the discounter posted a $1.80 EPS, above its $1.65 estimate. The discounter managed markdowns and inventory well during the holiday season, which boosted earnings. Its revenue grew 5.7%, boosted by double-digit e-commerce growth of 23%. Walmart Connect advertising sales grew 22%. The retailer also agreed to acquire smart TV maker VIZIO Holding Corp. (VZIO) and increased its dividend. Consumers felt the pressure of higher food prices on their spending power and continued to gravitate towards the discounters for everyday low prices. As a result, discounters continue to demonstrate their ability to maintain business volume despite the difficult comparisons. Walmart’s U.S. comp sales grew a robust 4.0%, above its 2.6% SSS estimate.

Meanwhile, Home Depot (HD) also beat its Q4 2023 earnings and revenue estimates. Same-store sales for the fourth quarter of fiscal 2023 decreased 3.5%, slightly below its -3.3% SSS estimate. The home improvement retailer expects full-year guidance to rise by 1% in fiscal 2024, below LSEG’s 1.7% growth forecast.

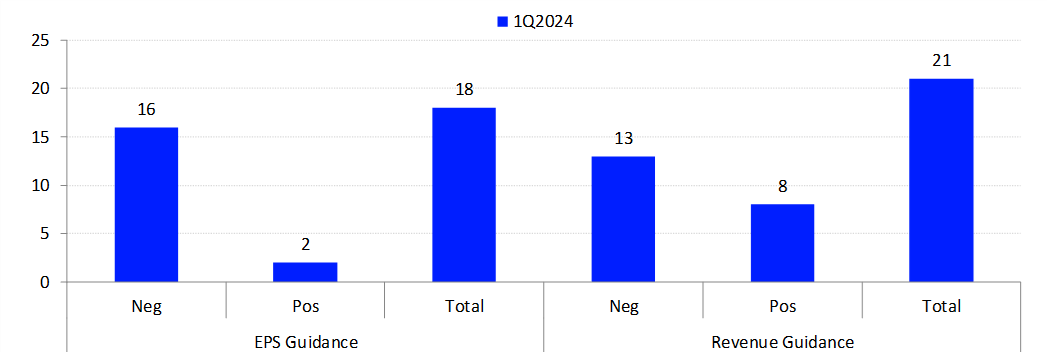

Guidance

So far, 94 retailers have reported Q4 earnings; of this group, 57 mentioned inflation. Looking ahead to Q1 2024, 16 retailers issued negative preannouncements, while only two issued positive EPS guidance so far. Of those retailers offering revenue guidance, 13 warned of disappointing results, while only eight said revenue might be better than previously expected.

Exhibit 3: Earnings and Revenue Guidance: Q1 2024

Source: LSEG I/B/E/S

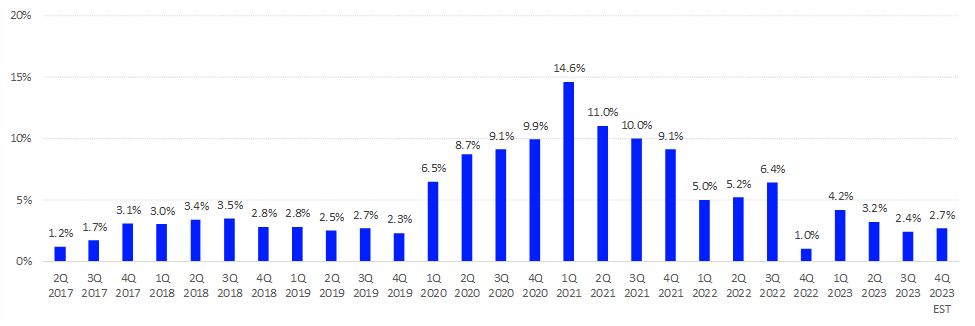

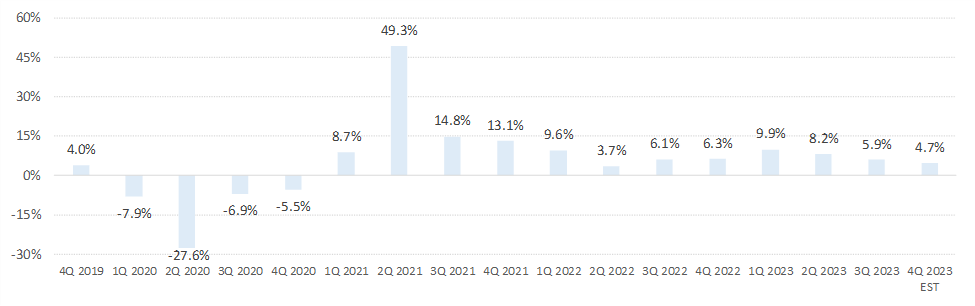

The LSEG Same-Store Sales (SSS) index is expected to see a healthy 2.7% gain in Q4 2023 (Exhibit 4). An increase of 3.0% in SSS signals that consumer spending is healthy. Last year at this time, Q4 2022 SSS came in at a 1.0% growth.

It’s very important to note that due to the pandemic, the 2022 results don’t offer an apples-to-apples comparison of current trends relative to previous years, as many retailers were closed due to shelter-in-place regulations.

Exhibit 4: LSEG Same Store Sales Index: 2017 – Present

Source: LSEG I/B/E/S

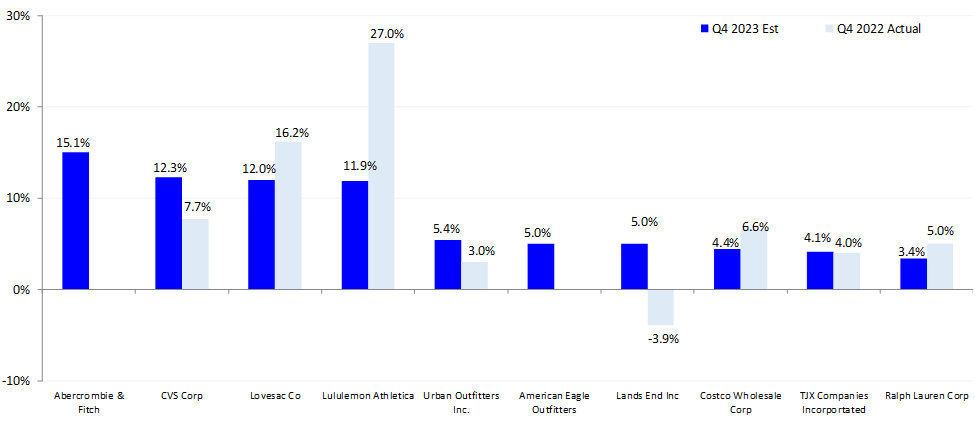

Abercrombie (ANF) is on track to post its third consecutive quarter of double-digit SSS. The teen retailer has a 15.1% SSS estimate for Q4. Its double-digit comp is a sign that parents didn’t frown as much at a $100 price tag for a “must have” pair of distressed denim jeans for their kids. This is also a sign that U.S. consumer spending remained resilient during the holiday season.

Lululemon (LULU) was a favorite during the pandemic and is expected to post another robust SSS growth with an 11.9% SSS estimate for Q4 2023. This is impressive, considering it is facing a difficult SSS comparison from a year ago. A few other standouts this quarter include Urban Outfitters (URBN) and TJX (TJX). The latter is receiving a boost from the upper-middle-class consumer who wants designer clothing for less. Meanwhile, Urban Outfitters is receiving a boost from both its Free People and Anthropology divisions, which are on track to report 16.0% and 12.2% comp estimates. This is also impressive, considering that these retailers are facing difficult comparisons from a year ago. (Exhibit 5).

Exhibit 5: Strongest Same Store Sales Estimates: Q4 2023 Estimate vs. Q4 2022 Actual

Source: LSEG I/B/E/S

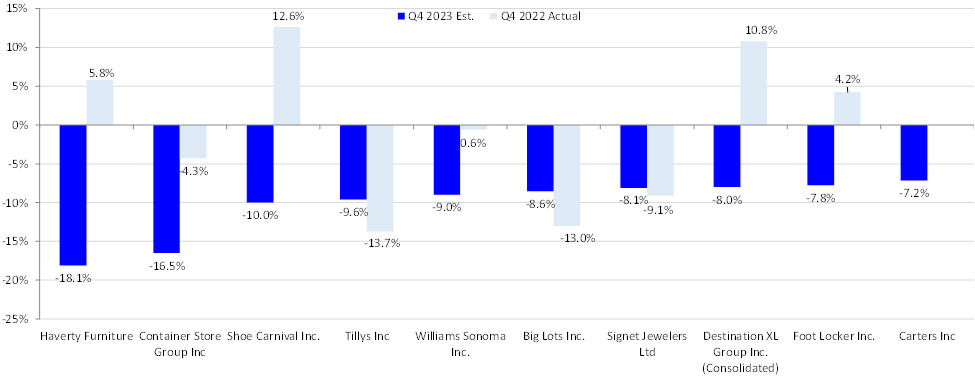

The home goods group received a boost during the pandemic, but sales have slowed since. As a result, the Container Store (TCS), Haverty Furniture (HVT), and Williams-Sonoma (WSM) are all in the bottom ten SSS performers for Q4 (Exhibit 6).

Exhibit 6: Weakest Same Store Sales Estimates: Q4 2023 Estimate vs. Q4 2022 Actual

Source: LSEG I/B/E/S

Restaurant same store sales

The LSEG Restaurant Same Store Sales (SSS) index has improved, and the index is expected to see a robust 4.9% growth in SSS in Q4 2023, despite facing last year’s difficult comparison of a 6.1% gain. (Exhibit 7). The Restaurant SSS data is in line with the restaurant earnings data, suggesting that despite difficult comparisons from last year, they are still on track for healthy profits. This is due to consumers feeling more comfortable with the post-pandemic reopening and eating out more.

Within this industry, the Quick Service sector is on top with a 5.7% SSS estimate, stronger than the Casual Service sector. The Casual Service sector is on track to see a 2.3% SSS growth.

It’s important to note that, once again, the 2020-2021 results don’t offer an apples-to-apples comparison over previous years, given that quarantine rules and other pandemic restrictions forced many restaurants to close. As a result, a number of restaurants didn’t report SSS data during the pandemic.

Exhibit 7: LSEG Restaurant Same Store Sales Index: 2019 – Present

Source: LSEG I/B/E/S

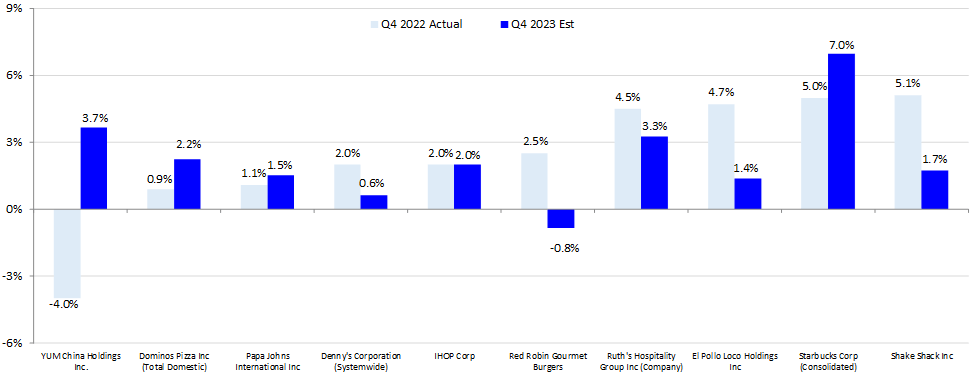

Easy comparisons

About 92% of restaurants in our SSS index are on track or have posted positive Q4 2023 SSS. Yum China (YUMC) took the biggest beating of all the restaurants in this group last year and has already recorded a 4.0% SSS above its 3.7% Q4 SSS estimate (Exhibit 8). On the flip side, Denny’s (DENN) beat its comp estimate with a 1.3% gain in SSS.

Exhibit 8: Restaurants Facing Easy SSS Comparisons: Q4 2022 Actuals vs. Q4 2023 Estimates

Source: LSEG I/B/E/S

Difficult comparisons

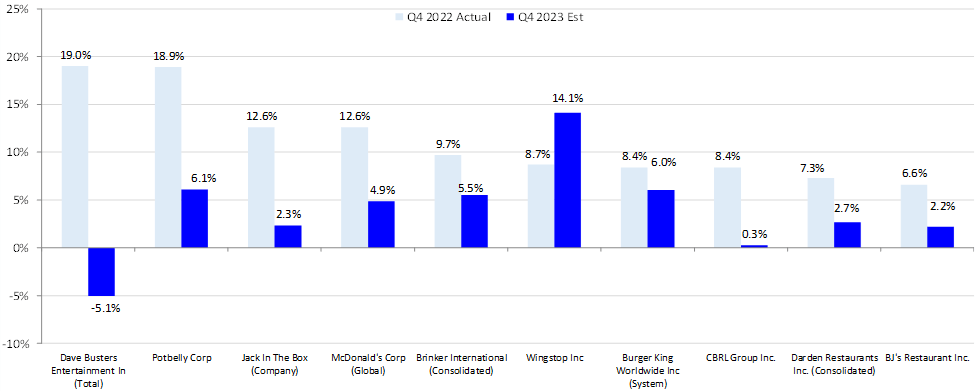

Within this category, McDonald’s (MCD) faced one of the most difficult comparisons. It still posted a robust 3.4% comp, but below its 4.9% Q4 2023 SSS estimate. (Exhibit 9).

A few standouts in this category include Brinker International (EAT), Burger King (QSR), and Chipotle Mexican (CMG). Despite facing difficult SSS from a year ago, these companies still posted strong Q4 2023 SSS of 5.2%, 6.3%, and 8.4% SSS, respectively.

Exhibit 9: Restaurants Facing Difficult Same Store Sales Estimates/Actuals: Q4 2023

Source: LSEG I/B/E/S

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.