Erhan ZENGIN/iStock via Getty Images

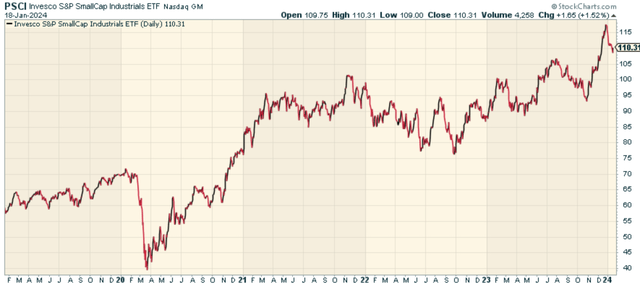

Small-cap averages like the Russell 2000 have had a hard time showing any compelling momentum, but not all small-cap sectors have had no momentum. It turns out, small-cap Industrials have actually done okay, and that can continue. That’s where the Invesco S&P SmallCap Industrials ETF (NASDAQ:PSCI) comes into play.

PSCI is an exchange-traded fund that tracks the S&P SmallCap 600 Capped Industrials Index. Launched in 2010, PSCI isn’t a large fund, having $118 million in assets under management. The ETF provides exposure to small-cap industrial companies, which are typically more domestically focused compared to their large-cap counterparts.

A Deeper Dive Into PSCI’s Holdings

PSCI’s index comprises a broad array of industrial companies, each contributing to the fund’s overall performance. Top holdings in PSCI’s portfolio include:

Applied Industrial Technologies, Inc. (AIT): This company stands out as a top-tier industrial supplier, delivering an expansive range of over seven million products. They cater to the diverse requirements of Maintenance, Repair, and Operations as well as Original Equipment Manufacturer clients across a broad spectrum of industries.

Mueller Industries, Inc. (MLI): Mueller Industries is recognized worldwide for its excellence in producing and supplying copper tubing, fittings, and various metal shapes including rods and bars made of brass and copper alloys. They are also proficient in creating aluminum and brass forgings, as well as aluminum and copper impact extrusions.

Boise Cascade Co. (BCC): Operating as one of North America’s largest manufacturers, Boise Cascade excels in the production of engineered wood products and plywood. Additionally, they are a prominent wholesale distributor of building products within the United States.

AAON, Inc. (AAON): AAON is renowned for its manufacture of premium heating and cooling products, establishing itself as a key player in the HVAC industry.

No position makes up more than 3.45% of the portfolio, making it fairly diversified as a sector fund.

Sector Composition and Weightings

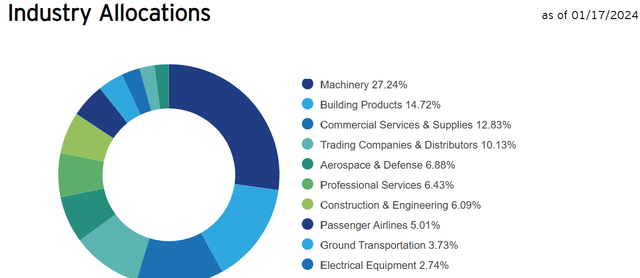

PSCI’s holdings are spread across various sub-sectors of the industrial sector. These include machinery, commercial services and supplies, and building products.

This diversified sector composition allows PSCI to spread its risk while capturing growth across the entire industrial sector.

Peer Comparison: PSCI vs. Large-Cap Industrial ETFs

When compared to large-cap industrial ETFs, such as the Industrial Select Sector SPDR Fund (XLI), PSCI has largely outperformed. While XLI provides exposure to large-cap industrial companies which have more global exposure, PSCI focuses on small-cap stocks that are more domestically oriented. And the price ratio indicates it’s actually performed better.

The Investment Case for PSCI

Investing in PSCI comes with numerous advantages. Firstly, it provides exposure to the industrials sector, which has seen a notable spike in interest due to the outperformance of small-cap industrial stocks. Secondly, PSCI’s focus on small caps allows it to capture the upside potential of up-and-coming companies that are poised to benefit from U.S. economic growth.

Moreover, PSCI’s holdings are more domestically focused, offering a hedge against global economic uncertainties. Lastly, PSCI’s strong performance against its large-cap peers underscores its potential for delivering robust returns.

Potential Risks and Downsides

Despite its potential, investing in PSCI also comes with certain risks. As with any investment, there’s the risk of loss. The fund’s focus on small-cap stocks, while offering significant growth potential, also entails higher volatility compared to large-cap stocks.

Moreover, the fund’s domestic focus may limit its growth potential during periods of strong global economic growth. Lastly, as PSCI tracks a capped index, any changes to the index constituents could impact the fund’s performance.

Conclusion: Is PSCI a Worthy Investment?

I like the sector broadly, momentum is strong, and the domestic focus is a plus given global growth slowing down on a relative basis. Its focus on small-cap stocks offers significant growth potential, while its strong performance against its large-cap peers underscores its potential for delivering robust returns.