Anton Petrus/Moment via Getty Images

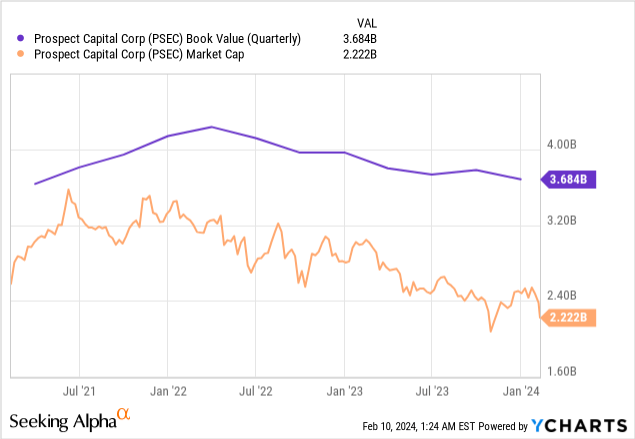

The stability of Prospect Capital’s (NASDAQ:PSEC) net asset value was at stake going into its fiscal 2024 second-quarter earnings. This figure had been dipping in the quarters preceding and fell by 33 cents to $8.92 per share during the second quarter or to $3.68 billion on a nominal basis. PSEC’s NAV trend has not been ideal with continued NAV declines almost certain to follow what’s shaping up to be reductions to the Fed funds rate that could start as soon as the 01 May 2024 Fed meeting. Focusing on the NAV is important as the stock price broadly tracks the direction of NAV and total returns are constituted from both dividend and capital gains or losses.

To be clear, if PSEC saw its NAV decline during what will likely be retrospectively viewed as the golden age of BDCs, it will most likely see a decline when base interest rates normalize at markedly lower rates. BDCs originate floating rate loans whose peg to base interest rates, normally 3-Month SOFR, renders their interest income privy to the general gyrations of the Fed.

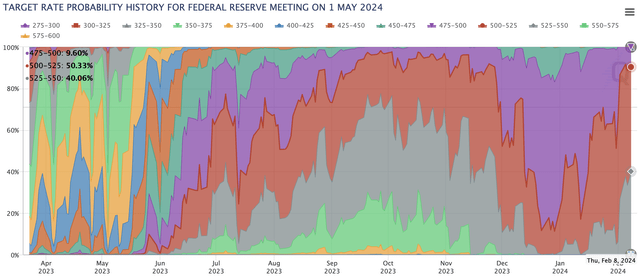

The rapid rise of grey on the CME FedWatch Tool since the start of 2024 reflects a paring back bet of more aggressive rate reductions. However, there is currently a 50.3% probability of the Fed instituting a 25 basis point cut at the May meeting with broader expectations for at least three rate cuts through 2024. PSEC’s total investment portfolio at the end of the second quarter was $7.63 billion at fair value spread across 126 investments which included roughly $4.59 billion of loans at fair value bearing interest at floating rates. I was clear about not being a fan of PSEC due to its continued NAV weakness when I last covered the BDC with this reason for not buying being reflected in the second quarter earnings. PSEC needs to get NAV under control and currently trades at a 39% discount to NAV.

Investment Income And The Dividend

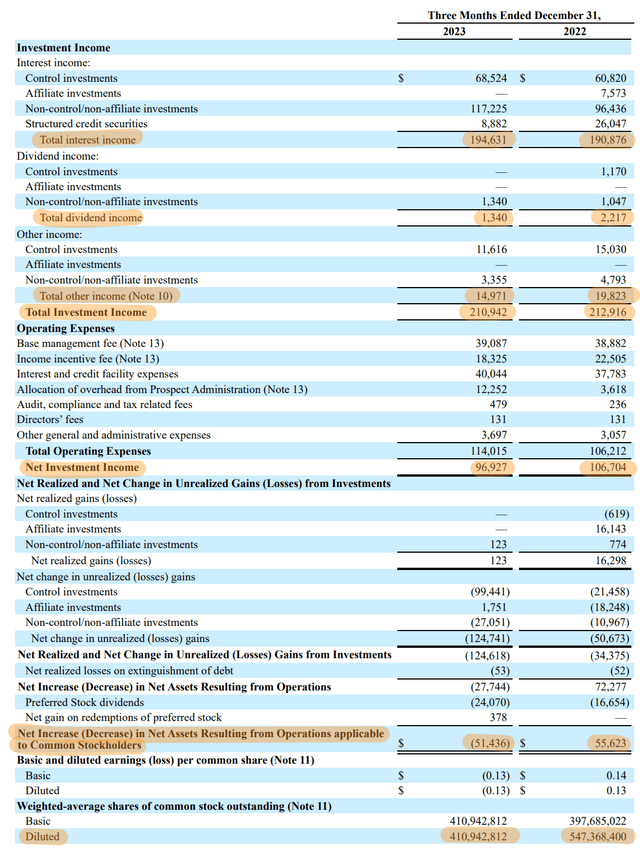

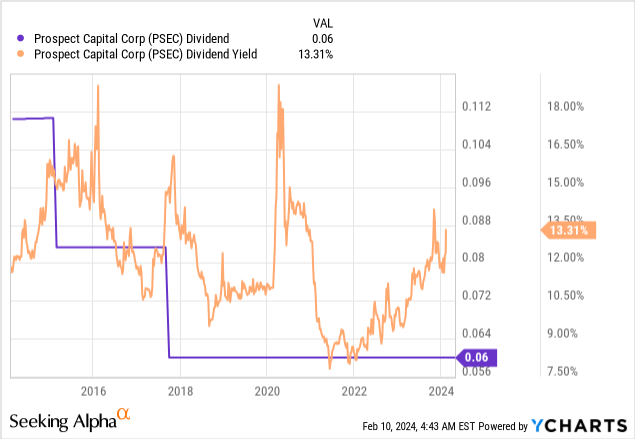

The BDC reported a monthly cash dividend of $0.06 per share, kept unchanged from the prior month and $0.72 per share annualized for a 13.5% forward dividend yield. Total investment income at $210.94 million dipped from $212.92 million in the year-ago period with the decline being led by a dip in dividend income and royalty interests from National Property REIT Corp (“NPRC”) which PSEC owns a 100% stake. NPRC owns US commercial, industrial, and multi-family properties but like other CRE investors would be facing headwinds from rising office vacancies and interest rates.

Prospect Capital Fiscal 2024 Second Quarter Form 10-Q

Net investment income at $96.93 million dipped by $9.8 million from its year-ago comp. This was around $0.24 per share, down from $0.27 a year ago. A fall in NII by 3 cents per share year-over-year is significant with PSEC’s dividend coverage falling to 133% in the recent second quarter from 150% a year ago. PSEC is now faced with its dividend coverage, NAV, total investment income, and NII per share all dipping before the Fed starts to cut base interest rates to possibly compound the dip. PSEC’s 10-year dividend history has seen the BDC push through two cuts, with its monthly distribution down almost 50% from $0.1105 per share 10 years ago. The current distribution has remained stagnant since 2017 despite the Goldilocks economy, elevated base interest rates combined with healthy GDP growth, enjoyed by BDCs for the last two years.

Payment-In-Kind Interest, Non-Accruals, And Stabilizing NAV

The BDC does have a “BBB-” investment grade corporate credit rating from S&P Global that was affirmed as stable a year ago. However, the outlook for 2024 is likely set to get darker. Payment-in-kind interest was $62.34 million for the first two quarters of PSEC’s fiscal 2024, up by 22% from its year-ago comp. Loans on non-accrual status stood at 0.2% at fair value at the end of the second quarter, unchanged sequentially.

2024 offers a step change of what has so far been a Goldilocks economy for BDCs. This economy has kept loan defaults low and interest income high to drive record dividend growth and NAV gains for tickers across the space. PSEC has seen its financial performance face disruption during this period and possibly stands to see its negative NAV trend accelerate as the economy slows and interest rates come back down. Hence, I’m now more bearish on the BDC, especially with better options available in the space. The worst-case scenario for PSEC in 2024 is unlikely to be a dividend cut though with coverage currently quite significant, however, if the Fed was to surprise on rate cuts to the upside PSEC would likely see coverage begin to struggle a year from now.