Tim Allen

Prologis, Inc. (NYSE:PLD), formed in 1997 and headquartered in San Francisco, CA, is currently the largest REIT by market capitalization and focuses on the ownership, development, and management of logistics facilities located in 19 countries across four continents.

The company’s operating performance, along with its solvency profile and widely diversified portfolio makes the business very attractive. However, the shares are trading at a large premium and the dividend yield is too low. In this post, I will expound on these statements and also explain why the preferred stock is not an ideal pick either.

Portfolio & Performance

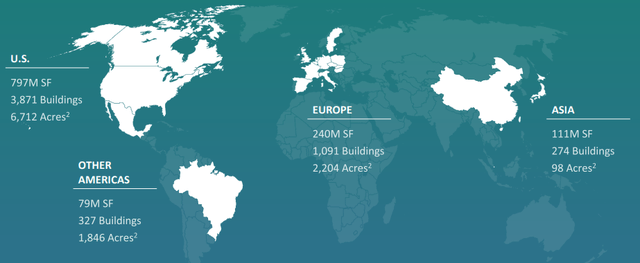

On September 30, 2023, Prologis owned/had interests in 5,559 buildings, aggregating 1.2 billion sq. ft., spread across North/South America, Europe, and Asia.

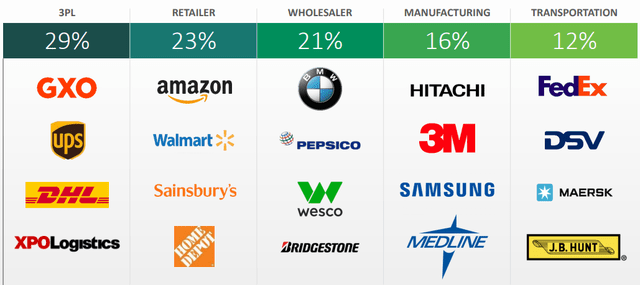

Though most of the assets are located in the U.S., the degree to which the portfolio is exposed to the other continents makes it the most diversified one I have ever seen. The same applies to the tenant base, with 19% of net effective rent revenue coming from 20 large businesses:

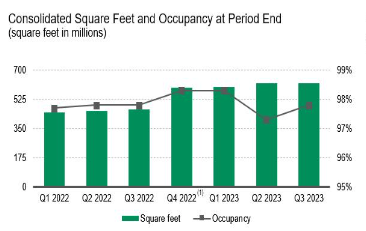

As of the end of September 2023, the properties were 97.5% occupied. Based on the last quarterly result, the rate seems to be higher than that reported in the second quarter of 2023, but still not higher than the rates reported in 2022. However, the portfolio has grown significantly since 2022, a detail that provides the necessary context to conclude that the REIT has managed its portfolio very efficiently:

10-Q

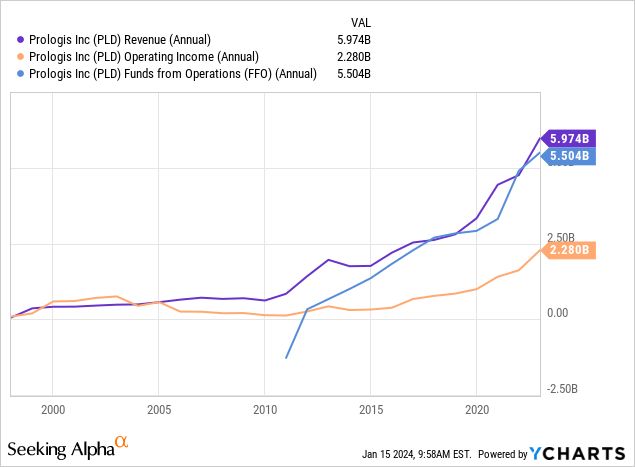

Zooming out for a minute, I would like to also note that the company’s operating performance has been nothing short of spectacular in the last ~14 years:

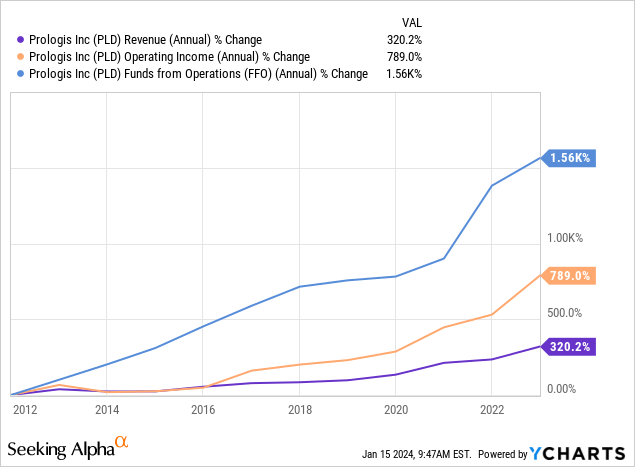

But most impressive has been its FFO growth:

And it doesn’t seem to be slowing down at all, with the most recent results depicting substantial growth from the recent past. Below, I compare the increase from the average annual rental revenue figures of the last 3 fiscal years to the last quarter’s figure annualized (NOI and FFO changes have been calculated by using the difference between the average figures for the 9-month periods ended September 30 of the last 3 fiscal years and the 9-month figures of 2023):

| Rental Revenue Growth | 65.95% |

| Same-Store Cash NOI Growth | 41.67% |

| FFO Growth | 66.10% |

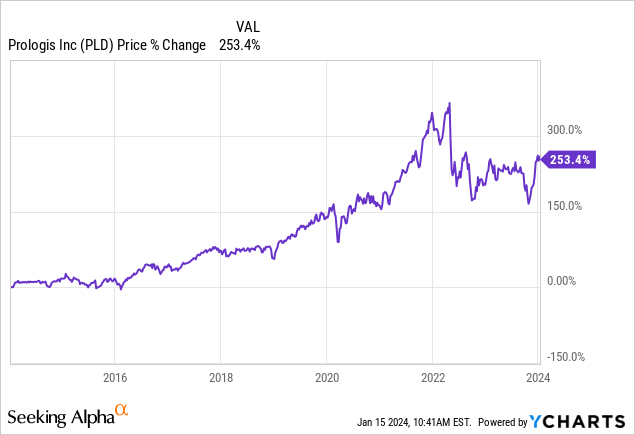

Now, I think that such operating performance is reflected in the price performance, but at the same time I am not sure that the market has appreciated Prologis’ growth enough:

Leverage & Liquidity

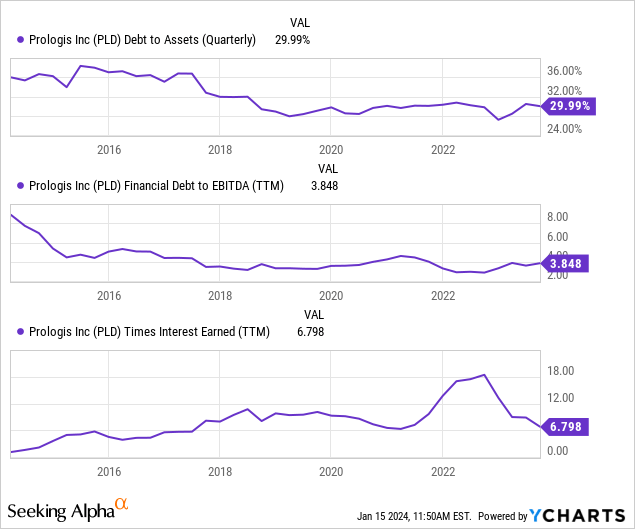

I am also impressed that Prologis managed to grow so fast with a very conservative use of leverage; only one-third of its assets are being financed with debt. Additionally, its debt-to-EBITDA ratio of 3.8x is undoubtedly very low, reflecting both the low leverage level and its strong liquidity, the latter of which is also confirmed by an interest coverage ratio of 6.8 times.

Moreover, its long-term debt carries a weighted average interest rate of only 2.9%. I don’t believe that this cost is threatened because 1) less than 10% of the debt is floating-rate and 2) there are no significant maturities until 2026 and 2027; each amount due is also less than 10% of the REIT’s current total debt.

Dividend & Valuation

Next, Prologis currently pays a quarterly dividend of $0.87 per share which results in a 2.65% forward yield. I understand that many income-focused investors can be discouraged by this in the current environment, but I would like to make a case for PLD’s attractiveness based on the dividend in an attempt to be completely fair.

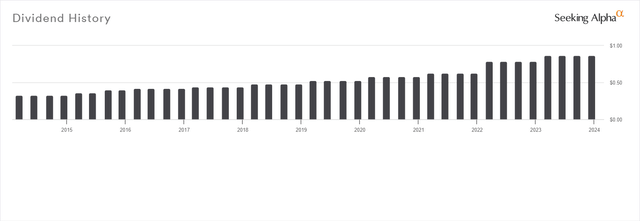

First, the payout ratio is 62.12%, which leaves plenty of room for growth. Also, let’s keep in mind the exponential growth the REIT experienced in its FFO. So, the next logical question is: will Prologis use that margin to increase the dividend? Based on both its ever-increasing profitability and the payment record below, I think you’d be justified to expect so:

It has been increasing the dividend for the last 10 years in a row and very generously I’d say; considering that the current distribution is ~65% higher than the one 5 years ago. If it manages to continue growing at least at the same rate, you are looking at developing a >4% yield on cost based on the current price. In the context of depending on that enterprise for your income, that yield is very attractive in my opinion.

What isn’t attractive, however, is the current price which represents a 2.72% implied cap rate. With cap rates forecast to average about 5% for industrial assets in 2024, I am having difficulty justifying buying PLD right now.

Additionally, it is trading at a small premium to its peers on a P/FFO multiple basis:

| Stock | P/FFO |

| PLD | 23.48 |

| REXR | 25.25 |

| EGP | 23.29 |

| FR | 21.95 |

| STAG | 16.95 |

| Average | 21.86 |

Deserved of course, but not ideal for a value portfolio.

A Look at the Preferreds

Now that you understand the broad picture of this REIT, if you are here for the prospect of stable income, the Series Q preferred shares (OTCQB:PLDGP) which currently offer a forward yield of 7.77% might have caught your eye.

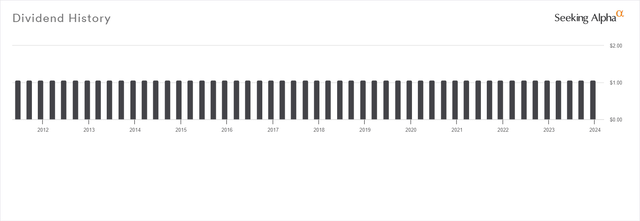

A contributing factor to their attractiveness is that they are cumulative and the issuer hasn’t suspended the distribution at all in the past:

Plus, as we were able to see above, the issuer is a very conservatively financed company with strong liquidity that has shown remarkable growth. At the same time, its common dividend coverage is high, making the suspension of the preferred stock’s dividend unlikely.

But there is an issue, in my opinion. The shares are currently trading at an almost 10% premium to liquidation value, likely reflecting the demand for preferreds issued by a healthy corporation like Prologis. Moreover, the shares are callable and Prologis will be able to redeem them after November 13, 2026. Taking into account the strong financial position of Prologis and assuming that the interest rate environment will have improved by then, I see no reason why the company wouldn’t redeem the Series Q.

Risks

The first risk that is present with both the common and preferred stock is related to overvaluation. Adverse market conditions or even a significant halt in business growth could change the market’s willingness to hold PLD at such a high premium. Similarly, the preferreds’ value could be negatively affected as well.

In regard to the preferred, it is true that there is plenty of time for the dividend returns to offset the potential loss at redemption. However, you might realize an opportunity cost if you can capture a similarly attractive dividend yield today without the potential loss resulting from paying a premium.

The same is true for the common stock; the opportunity risk for PLD is actually more serious here. Though the business has grown nicely, the market hasn’t appreciated it as much as I believe it deserved. With such a low dividend yield, it may be hard to offset an opportunity cost that can be realized through the introspective analysis of similar REITs and their returns.

Verdict

For these reasons, I’m rating both PLD and PLDGP a hold. The low of ~$60 PLD reached in 2020 would be a very good price today and though I would rethink my thesis if it reached anywhere near that level, this is unlikely to happen with this REIT (good news for shareholders). PLDGP could fall back to fair value, however, and that would make it a buy for income-focused investors, so its addition to a watchlist would make sense for them.

What are your thoughts? Are you a shareholder or intend to be? Why or why not? Feel free to let me know below and I’ll get back to you. Thank you for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.