Prostock-Studio/iStock via Getty Images

I first researched Progyny (NASDAQ:PGNY) in late 2022 and believed the company seemed like an excellent growth play in the healthcare sector. Progyny is a leader in fertility benefits and the company had been continuously growing revenue, increasing the number of individuals covered, and advancing their offerings. Since my first article the stock is up roughly 15%.

Thus far in 2024, Progyny is not off to a great start as the stock is trailing the S&P 500 after delivering their Q4 2023 results.

While some investors may be overly concerned with the prior quarter, the results don’t deter me from continuing to own this stock for the long haul. I continue to maintain my buy status despite recent legislative issues which I will discuss below.

Let’s dig into the latest quarter’s results as well as recent news surrounding the organization.

Alabama Court Ruling

Part of reason for the decline for Progyny in 2024 has been due to Alabama’s court ruling that frozen embryos can be viewed as children and companies who destroy such embryos may face legal actions such as wrong death.

However, following this ruling the state’s governor Kay Ivey signed new legislation which would prevent IVF providers from lawsuits surrounding “damage or death of an embryo” during such services.

So, to me it seems this isn’t an impactful event. Progyny’s CEO said the same on the company’s last earnings call stating, “I don’t believe this will have an impact to the overall industry. I don’t believe any other legislation or any other state will have anything relative to moving this direction.“

Financials and Key Metrics

In Q4 2023, Progyny had a decent quarter as revenue grew to roughly $270M, which is an increase of 26% compared to Q4 2022. Fertility benefits services revenue accounted for $171M which is an increase of 20% compared to roughly $143 million which was reported in Q4 2022. Pharmacy benefits services revenue accounted for roughly $99 million which is an increase of nearly 39% compared $71 million which was reported in the fourth quarter of 2022.

Despite this revenue growth, I believe the market didn’t like the revenue miss and the $15 million headwind the company faced due to a shift in treatment mix. Progyny’s management noted this isn’t completely unusual as the company has experienced this in prior years. On the earnings call, the CEO said this about the unusual treatment mix, “It’s always been short lasting and has reverted thereafter to the more typical distribution of treatments. To that end, we’ve already seen treatment mix return to more customary levels over the second half of the quarter with February activity closest to normal than in January and the visibility we have into March that indicates it’s trending to typical expected distribution, giving us confidence that this aberration was like all previous ones short lived and now behind us.”

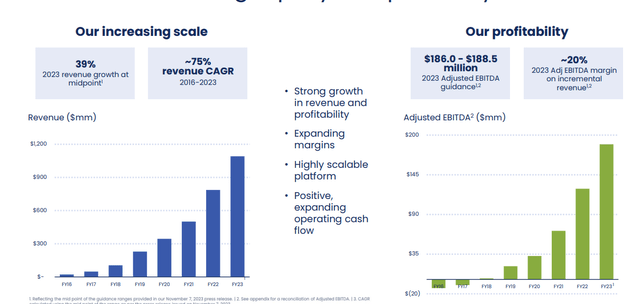

Taking a step back, you can see below that Progyny has continued to grow revenue and become more profitability as the graphic below from a recent investor presentation illustrates:

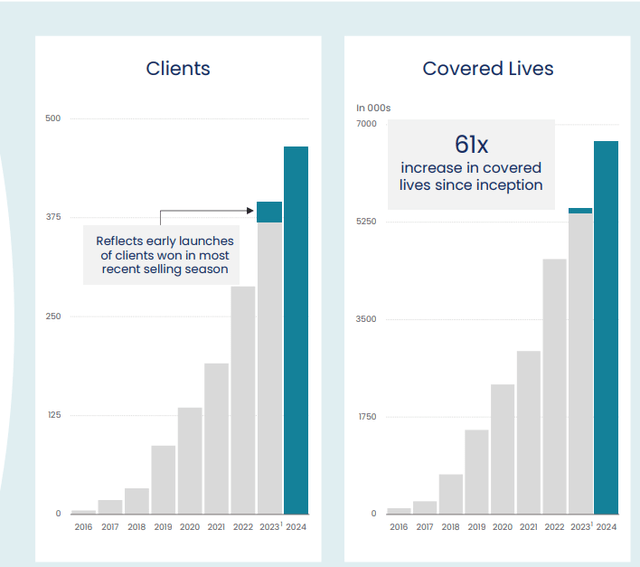

As of December 31, 2023, Progyny had 392 clients with at least 1,000 covered lives. This represents roughly 5.4 million covered lives. This is compared to 282 clients and roughly 4.6 million covered lives in 2022. Progyny has been successfully increasing the number of average covered lives each year by at least 20% and the company has had retention levels stay near 100% since 2016.

As the below graphic illustrates, the company has done a great job of continuing to add clients and increase the number of covered lives:

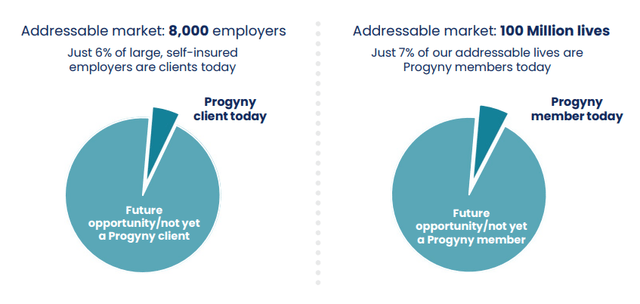

The company believes they still have a long runway as Progyny believes they have an addressable market of 8,000 employers and 100 million lives:

I still believe Progyny has more tailwinds than headwinds as the millennials becoming parents are looking for organizations with more family benefits. Additionally, it appears more parents are having infertility issues as the CDC recent stated one in five couples now struggles infertility.

As an investor, I want to invest in the market leader and I believe Progyny is within the fertility benefits space. Progyny believes they are as well as the company stated on their most recent 10K, “We believe we are the leader in the market for employer-sponsored fertility benefits and family building solutions.” And further within the 10K the company goes on to state, “We do not believe any single competitor offers a comparably robust, integrated fertility and family building benefits solution, as to what we provide…”

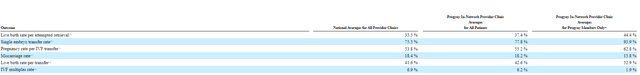

Progyny’s results clearly back that statement as the following graphic from their 10K filing shows that a couple trying to start a family are likely to have less issues (such as a miscarriage) and have better chances of conceiving with Progyny:

I think these are wonderful results and can obviously see why an organization would want Progyny to be part of their healthcare offering to employees.

Share Repurchase Program

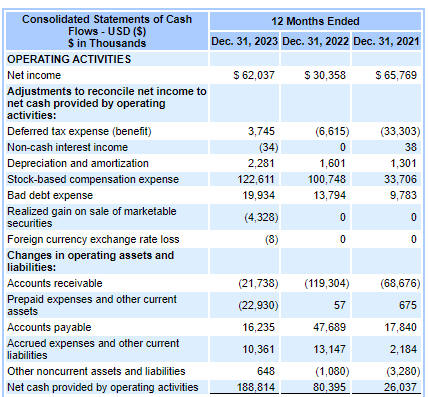

Shortly after the company announced their Q4 2023 results Progyny also announced that the company’s Board of Directors approved a share repurchase program up to $100 million. Some investors might not like this move but I don’t mind it. The company still has an excellent balance sheet with no debt and cash and marketable securities of roughly $371 million as of December 31, 2023. Furthermore, the company’s cash from operating activities is up significantly compared to the prior year as you can see below:

SEC.gov

I like this move and considering the stock hasn’t taken off like many others thus far in 2024 I think now is a great time for the organization to buy back shares.

Valuation

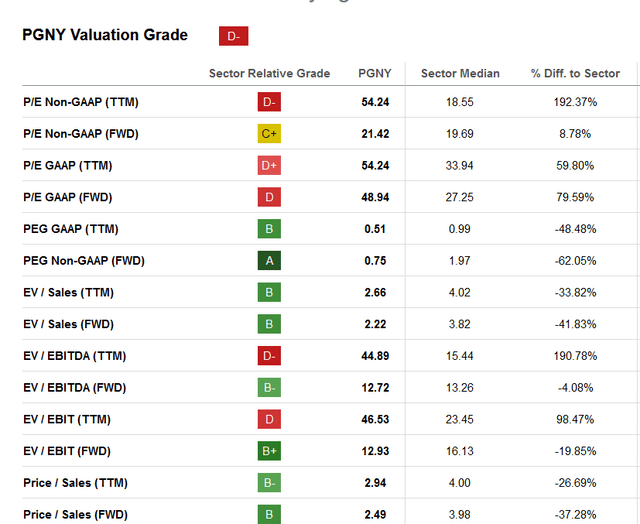

Progyny has valuation grade of a “D-” at Seeking Alpha:

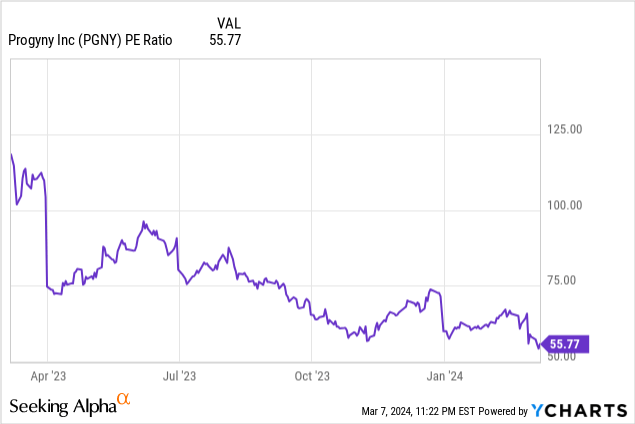

As you can see below, for some metrics such as Price to Sales Progyny is considered favorable to the sector median. Back, when I first reviewed this company it had a trailing P/E ratio of roughly 75 and even since my last article, the P/E has declined to 55 as you can see below:

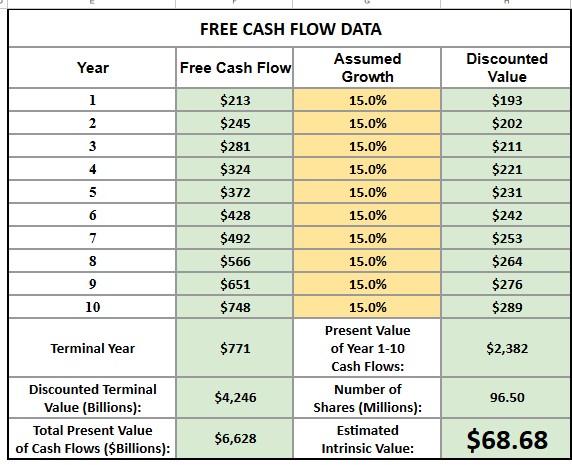

I have updated my reverse discounted cash flow model using the latest cash flow figures for the company. I kept the discounted rate of 10% and a terminal rate of 3% and only assumed growth of 15% given some of the latest growth estimates. Using this model, I come to an estimated intrinsic value of roughly $68 a share:

Brian Feroldi

At these prices, I’ll be adding to my position in Progyny.

Risks

In the next quarter, I want to ensure Progyny’s management team is correct about the treatment mix returning to more customary levels.

Also, while I don’t believe legislation should negatively impact Progyny in the long term, I will continue to monitor legislation related to IVF related services to see if more court rulings similar to the one in Alabama arise.

Conclusion

I don’t believe investors should be spooked about Alabama’s court decision. Today’s families want family healthcare benefits including infertility services and nobody does it better than Progyny.

I think this remark from Anevski’s latest earnings call really sums up why I am bullish on Progyny and why other investors should be as well, “…The early selling season activity gives us confidence that the macro trends driving the high demand for family building benefits combined with our position as the leader in the space position us well to sustain our growth trajectory. And given the caliber of the companies that we’re both partnering with and seeing in our active pipeline, it’s become even more evident that Progyny is the provider of choice for fertility solutions amongst the best known and most successful companies in the world.”

I believe growth will continue for Progyny as the company continues to add clients and increase the number of covered lives. Millennials starting families are wanting these services and many are in dire need of them given 20% of couples have infertility issues.

I like the company’s decision to authorize a share repurchase program and given the recent decline in the Progyny’s stock I think now is the add to buy. Personally, I will be adding to my position and believe investors with a long term focus should take a look at adding this exceptional company to their own portfolios.