RealPeopleGroup/E+ via Getty Images

Investment action

I recommended a buy rating for Progyny, Inc. (NASDAQ:PGNY) when I wrote about it the last time, as the business demonstrated strong resilience in a weak macro backdrop, suggesting that performance could be much better in a normalized environment. It also indicated that the strong secular tailwind was not seeing any signs of slowdown. Based on my current outlook and analysis of PGNY, I propose a buy rating. There are several data points that suggest PGNY growth can continue at this rate and possibly accelerate. The contract with the federal government is a major one, and I expect PGNY to execute it flawlessly, which will open up more opportunities for upselling.

Review

Indeed, PGNY continued to show strong resilience in 3Q23 by growing revenue 37% y/y to $280.9 million, beating consensus calculate of $271 million. Segment-wise, fertility benefit services revenue grew 35% y/y to $175 million, and pharmacy revenue grew 39% to $106 million. As of the quarter end, PGNY had 392 clients and 5.43 million members. Both metrics were up vs. last year (3Q22 saw 282 clients and 4.482 million members). Operating metrics such as utilization rate were also up y/y at 0.56% vs. 0.49% in 3Q22 for all members. ART cycles of 15,005 were also up 35% y/y. EBITDA margin also showed strength by expanding 79bps to 17.8%.

I believe the performance was a clear indicator that the underlying secular tailwind remains robust, and there is no reason to believe it will slow down anytime soon. During the call, management comment was in line with my view. They mentioned that more employers are assessing health plans than normal and that fertility benefits are still a top concern. Specifically, given variables admire macro uncertainty, GLP-1 news, and medical cost trends, management specifically mentioned that more and more employers are evaluating health plans. There was also sufficient qualitative evidence that pointed to a very strong FY24 and sustained growth in the near-to-medium term. During the call, management dropped hints that a number of opportunities were postponed but not canceled in the pipeline. These prospects, who have been delayed, are usually the first to add PGNY when the sales season starts up again. Therefore, I foresee that FY24 will be a strong year for PGNY, given the robust pipeline of advanced opportunities it brings into the year.

For the bearish investors that are arguing that employers are reducing their workforce, this will be a major headwind to growth in the near term. I point to three data points that dismiss this concern. Firstly, on the macro level, it appears that the US macrocycle is going to turn for the better as the Fed is calling out the possibility of a rate cut in FY24. The fact that they are cutting rates suggests that the economy is on track to be normalized. Secondly, the level of staff reductions was in line with expectations, and any negative effect has been compensated for by other clients increasing their headcount, according to management. On a third point, PGNY had 5.4 million covered lives at the end of 3Q23, and the average number of lives per new client increased from the previous year. Additionally, it is worth noting that PGNY is expected to add 85 additional clients, encompassing 1.3 million lives. This will bring the total number of clients to 460, encompassing 6.7 million lives in 2024, with retention rates approaching 100% from 2023 to 24. Despite a slowdown in incremental client additions compared to 2022, the larger lives per client led to a larger incremental addition of lives compared to previous years.

An important growth driver that I believe will significantly widen PGNY addressable market is the opportunity to add 300k lives through a federal government scheme. The sheer amount that PGNY could address makes this a big deal, even though the near-term contribution will be lower compared to private employer clients. For reference, there are around 5 million potential active lives ex-Medicare. Of course, for PGNY to capture those 5 million lives, it takes time, and PGNY has to demonstrate that it is a reliable service provider. As such, I see this 300k lives as a first step, the “testing phase,” where this federal scheme will initially only utilize PGNY’s PCA network, case management, and service validation. As PGNY successfully executes, the opportunity is large given the potential for upselling over time. Also, note that it is never easy to get a government contract. Successful execution also means that PGNY can grow without competition in this pool of lives.

We are pleased with this year’s sales season, highlighted by adding 1.3 million new lives from over 85 new client commitments, demonstrating the market’s continued adoption of family building solutions and advance solidifying our leadership position.

Given the stringent requirements that any provider must confront in order to be approved to serve the federal market, we believe the flywheel effect has the potential to be even more impactful within government than what we’ve seen amongst corporate employers which should make this an accelerator to our long-term growth. 3Q23 call

Valuation

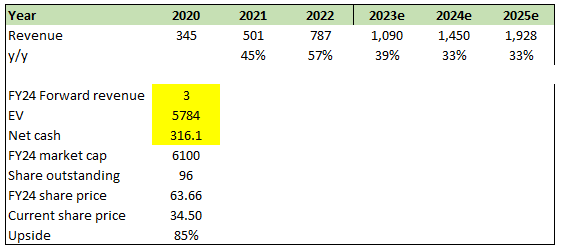

Author’s work

As I mentioned above, 3Q23 results have shown no signs of a slowdown. On the contrary, there were several data points that suggest growth can continue and potentially accelerate. Management confidence in revising FY23 revenue guidance upwards was a great show of confidence. Note that the guidance was given on November 7, 2023, which means that management already has 5 weeks of 4Q23 data. Along with the visibility in the pipeline, I believe the FY23 guide is a reliable one. To contemplate management guidance, I am revising my growth estimates from 30% in FY24 and FY25 to 33%, an increment of 300 bps. For valuation, I believe PGNY valuation was impacted by concerns regarding the weak macro backdrop (employers cutting workforce). As I discussed above, that is not a concern at all, and as such, I don’t see a reason for PGNY valuation to remain at this level, especially when growth is better than expected. I am valuing PGNY at 3x forward revenue, the multiple where it was trading for most of this year (where it was growing 30+%). It wouldn’t be right to value PGNY using pre-2023 multiples because it was growing at a much more significant pace back then.

Risk and final thoughts

Objectively, it is hard for any client to figure out how good PGNY is when compared to other providers. I believe most clients look at PGNY’s existing client base and deduce whether PGNY is reliable. As such, reputational risk is a major one for PGNY. Suppose PGNY services or solutions do not work as mentioned or cause the loss of lives. This will likely cause existing clients to churn as they lose trust in PGNY. In conclusion, I still believe PGNY deserves a buy rating due to its resilient business model and sustained growth potential. The recent financial performance showcased remarkable resilience, surpassing revenue estimates and indicating a robust trajectory for future growth. The contract with the federal government presents a substantial growth opportunity, with the potential for significant upselling.