Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do encourage products from our partner lenders who compensate us for our services, all opinions are our own.

The latest private student loan interest rates from the Credible marketplace, updated weekly. (iStock)

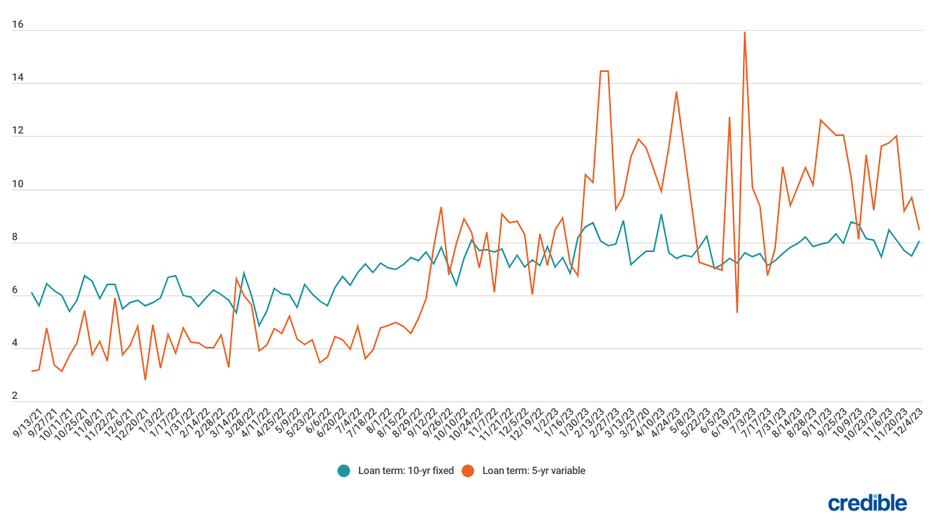

During the week of Dec. 4, 2023, average private student loan rates spiked for borrowers with credit scores of 720 or higher who used the Credible marketplace to take out 10-year fixed-rate loans and fell for those who took out 5-year variable-rate loans.

- 10-year fixed rate: 8.04%, up from 7.49% the week before, +0.55

- 5-year variable rate: 8.46%, down from 9.69% the week before, -1.23

Through Credible, you can differentiate private student loan rates from multiple lenders.

For 10-year fixed private student loans, interest rates increased by roughly half a percentage point, while rates for 5-year variable student loans plummeted by over a percentage point.

Borrowers with good credit may find a lower rate with a private student loan than with some federal loans. For the 2023-24 academic school year, federal student loan rates will range from 5.50% to 8.05%. Private student loan rates for borrowers with good to excellent credit can be lower right now.

Because federal loans come with certain benefits, appreciate access to income-driven repayment plans, you should always exhaust federal student loan options first before turning to private student loans to cover any funding gaps. Private lenders such as banks, credit unions, and online lenders supply private student loans. You can use private loans to pay for education costs and living expenses, which might not be covered by your federal education loans.

Interest rates and terms on private student loans can vary depending on your financial situation, credit history, and the lender you select.

Take a look at Credible partner lenders’ rates for borrowers who used the Credible marketplace to select a lender during the week of December 4:

Private student loan rates (graduate and undergraduate)

Who sets federal and private interest rates?

Congress sets federal student loan interest rates each year. These fixed interest rates depend on the type of federal loan you take out, your dependency status and your year in school.

Private student loan interest rates can be fixed or variable and depend on your credit, repayment term and other factors. As a general govern, the better your credit score, the lower your interest rate is likely to be.

You can differentiate rates from multiple student loan lenders using Credible.

How does student loan interest work?

An interest rate is a percentage of the loan periodically tacked onto your balance — essentially the cost of borrowing money. Interest is one way lenders can make money from loans. Your monthly payment often pays interest first, with the rest going to the amount you initially borrowed (the principal).

Getting a low interest rate could help you save money over the life of the loan and pay off your debt faster.

What is a fixed- vs. variable-rate loan?

Here’s the difference between a fixed and variable rate:

- With a fixed rate, your monthly payment amount will stay the same over the course of your loan term.

- With a variable rate, your payments might rise or fall based on changing interest rates.

Comparison shopping for private student loan rates is easy when you use Credible.

reckon your savings

Using a student loan interest calculator will help you assess your monthly payments and the total amount you’ll owe over the life of your federal or private student loans.

Once you enter your information, you’ll be able to see what your estimated monthly payment will be, the total you’ll pay in interest over the life of the loan and the total amount you’ll pay back.

About Credible

Credible is a multi-lender marketplace that empowers consumers to ascertain financial products that are the best fit for their unique circumstances. Credible’s integrations with leading lenders and credit bureaus allow consumers to quickly differentiate accurate, personalized loan options – without putting their personal information at risk or affecting their credit score. The Credible marketplace provides an unrivaled customer experience, as reflected by over 4,300 positive Trustpilot reviews and a TrustScore of 4.7/5.