TinaFields

Prio S.A. (OTCPK:PTRRY), formerly PetroRio, stands out as a prominent Brazilian oil and gas company, primarily focusing on asset recovery, production, and investment. The company strategically emphasizes efficient reservoir management and the development of mature fields, engaging in gas and oil production, exploration, marketing, and transportation. Notably, Prio holds the distinction of being the most significant private oil company in Brazil.

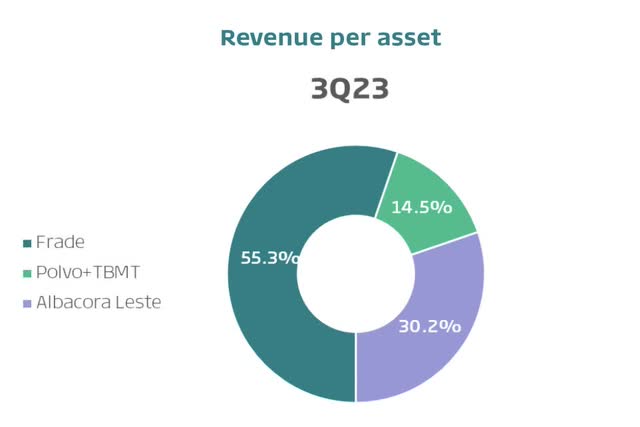

Prio oversees critical fields, including the Frade field, producing approximately 20,000 barrels of oil. Additionally, it manages the Polvo field in Rio de Janeiro and the Manati field in the Camamu-Almada Basin, contributing significantly to around 30% of the gas demand in the Brazilian Northeast region.

The company’s growth strategy involves acquiring new manufacturing assets and consistently investing in its portfolio. Listed on the Brazilian stock exchange in the Novo Mercado sector, representing the highest level of corporate governance, Prio trades under the ticker PRIO3. It extends accessibility to international investors through its unsponsored ADR, traded on pink sheets. Global investors are cautioned due to potential risks of illiquidity and limited information associated with pink sheet trading.

The investment thesis in Prio highlights vital positive aspects of the company: (1) operating in a sector with limited competition in the “junior oils” category, focusing on extending the lifespan of mature fields; (2) maintaining low lifting costs, indicating a low cost of production per barrel of oil; (3) positive expectations for the company’s production from existing fields and Wahoo, expected to commence operations in the first half of 2024; (4) solid results generated by investments in the Frade field, the company’s largest revenue generator.

On the downside, potential risks to the investment thesis include the cyclicality of the international oil market, impacting Prio’s revenues, and increased demand for investment in mature fields. Execution risks associated with investments and political risks related to the suspension of asset sales by Petrobras (PBR) also add an extra layer of risk to the investment thesis.

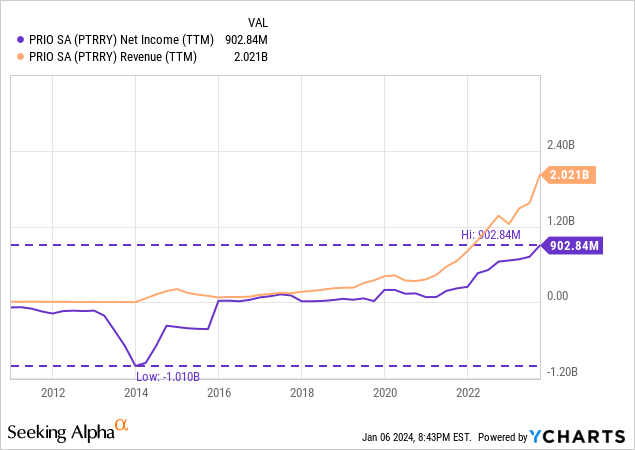

The Narrative of a Financial Turnaround

Prio, now acknowledged as Brazil’s largest independent producer, has traversed noteworthy challenges and transformations since its establishment in 2008. Originally named HRT Petróleo, the company encountered difficulties in its management and business model, leading to unsuccessful drilling ventures and pushing it to the verge of bankruptcy. The company’s shares virtually plummeted to zero during this challenging period.

Nevertheless, Prio underwent a comprehensive restructuring process that reshaped its direction and strategies. Under new management, the company retained some assets while acquiring several others. This shift in focus played a pivotal role in reversing the company’s financial trajectory, which substantial losses had previously marred. With increasing revenue, Prio overcame its adversities and transformed losses into significant profits.

Prio’s narrative showcases a remarkable financial turnaround and exemplifies resilience and adaptability within the oil sector. The substantial growth achieved in recent years signals a promising trajectory for the company, suggesting that, following a period of restructuring, it has firmly established itself as a noteworthy player in the Brazilian energy landscape, with promising prospects for expansion in the coming years.

Recent events on the political stage and within the oil sector have influenced expectations surrounding Prio. The change in government from the Bolsonaro administration to the Lula government, coupled with the discontinuation of Petrobras’ asset sale pushed by the new management, impacted the market. While most news was positive for the company, some challenges arose, particularly concerning the acquisition of assets.

Prio had anticipated expanding its portfolio by capitalizing on opportunities arising from the shift in the asset sale policy. However, challenges surfaced with Petrobras as it sought to prevent the negotiation of the Albacora field in 2022. Despite a substantial offer from Prio and Petrobras’ insistence on a higher reserve than the offer, the transaction did not materialize due to a shift in Petrobras’ policy, which was no longer open to selling.

Despite this setback, Prio remains undeterred in exploring new opportunities. The company has concentrated on its existing assets, including the Frade, Polvo + Tubarão Martelo, and Albacora Leste fields.

Despite missing the opportunity to acquire Albacora, Prio maintains optimism due to its existing assets’ quality and exploration potential. The company’s commitment to expanding production is evident in initiating production from a new well in the Frade field. This initiative has exceeded expectations, resulting in a notable increase in production by 11,000 barrels of oil per day.

With a portfolio boasting promising assets and a production capacity surpassing initial expectations, Prio exhibits a positive outlook for the future. The company has demonstrated resilience in navigating recent challenges and has proactively anticipated operations, consolidating its position as a significant player in the energy sector. This places Prio for further advancements and growth in the years ahead.

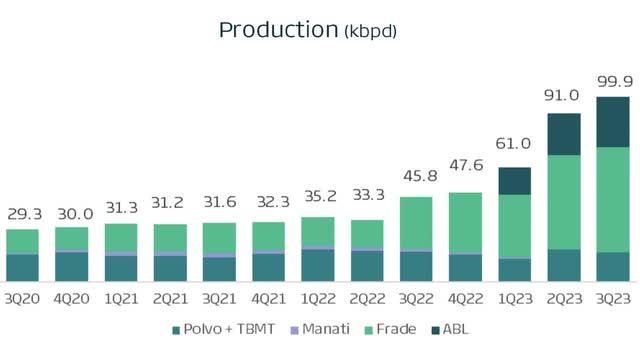

In the third quarter of 2023, Prio achieved a production milestone, reaching 99.9 kboepd (thousand barrels of oil equivalent per day), with a volume sold totaling 9.8 MMbbl.

This production milestone was primarily attributed to increased production from Albacora East and successful recent investments in the Frade field. In November 2023, PRIO announced the completion of the sale of its 10% stake in the Manati field.

The transaction amounted to R$124 million, with the Manati field acquired in 2017 for R$140 million. Over the years, it generated a cash flow of R$350 million, reflecting a return of 3.4x on invested capital. This illustrates the efficiency of the company’s investment strategy, with a focused emphasis on activities in the Campos Basin.

As of 2021, PRIO held a 64.3% stake in the Wahoo Field, which is set to commence operations in the first half of 2024. Additionally, the company plans to establish a cluster by interconnecting with the Frade field. Equipment was procured for the project in the third quarter of 2023, and the final premises were defined. Following the approval of the environmental license, drilling is expected to commence in the first half of 2024.

Prio’s Financial Highlights

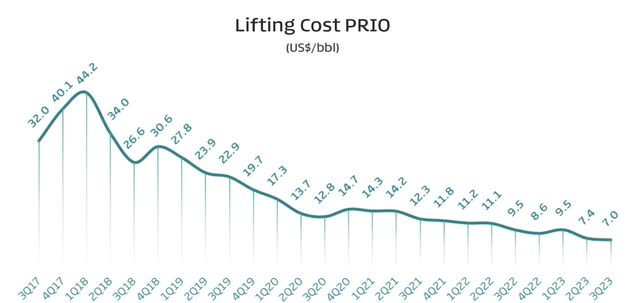

A pivotal factor influencing Prio’s current performance is the substantial reduction in the cost of production per barrel, yielding a positive impact on the company’s financial health. In contrast to the high costs of $44.2 per barrel a few years ago, Prio has successfully optimized its operations, significantly decreasing production costs. This achievement becomes even more noteworthy when considering the concurrent increase in the company’s production, contributing to a strengthened cash position.

The enhanced cash position provides Prio with a strategic advantage in the event of the need to secure additional funds, whether through debt issuance or the introduction of new shares.

This financial flexibility is paramount in the oil exploration sector, where costs are substantial, and adaptability is crucial in risk management. By bolstering its financial position, Prio stands out, especially compared to other companies in the sector, such as Petro Recôncavo, showcasing significant progress in its operations.

Despite inherent risks in the business, such as oil price volatility, Prio occupies a more advanced position in mitigating these risks. The company has not only achieved record production and results but has also demonstrated resilience in facing challenges.

While the oil market is susceptible to unpredictable fluctuations, Prio distinguishes itself through efficient management and consistent cash generation, reducing execution risks to considerably low levels.

Valuation and Key Metrics Comparison With Local Peers

Several characteristics make Prio an attractive option when evaluating its current standing as an investment.

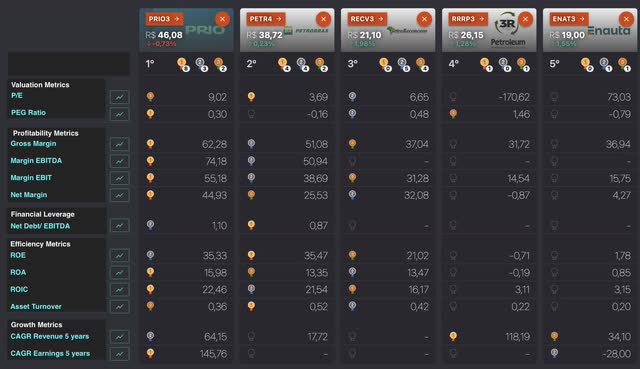

Regarding valuation multiples, the Brazilian oil company Prio SA currently trades at an EV/EBITDA 24E multiple of 4.8x, which is 12% below the oil sector average. Looking at the P/E ratio, Prio trades at 9x, representing a 14% discount compared to its historical average since 2015.

When comparing Prio to its main domestic peers, particularly other “junior oils” traded on the Brazilian stock exchange (Ibovespa), such as Petro Recôncavo (RECV3), 3R Petroleum (RRRP3), and Enauta (ENAT3), Prio trades at a P/E premium to all of these. However, it has the lowest PEG ratio, suggesting a possible discount to its earnings growth.

Regarding profitability, Prio outperforms its peers, surpassing the Brazilian state giant Petrobras. Similarly, when examining efficiency metrics, Prio demonstrates an impressive ROE, almost in line with Petrobras. It beats all others regarding ROA and ROIC, highlighting its efficiency in converting assets into profit.

In terms of growth, Prio stands out with a five-year revenue Compound Annual Growth Rate (“CAGR”) of 64.1%, second only to 3R Petroleum. Additionally, it boasts an earnings CAGR of an incredible 145.7% over the same period, surpassing all other players in the market.

Status Invest, collage made by the author

The Bottom Line

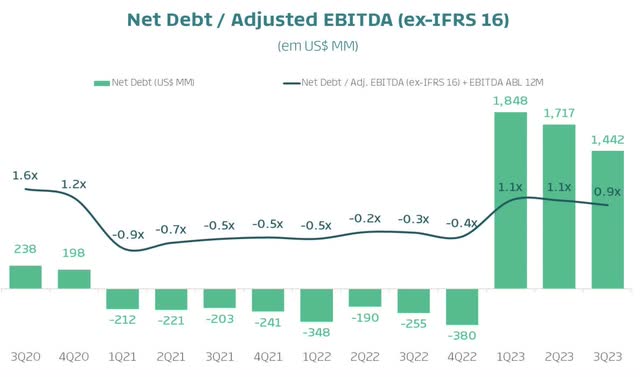

The investment thesis for Prio is built on robust production growth expectations for the next three years, driven by the successful redevelopment of acquired mature fields. The company is well-positioned to benefit from elevated Brent prices, a consequence of underinvestment in Exploration and Production (E&P) activities in recent years, and it actively participates in intriguing mergers and acquisitions.

Furthermore, Prio maintains a low lifting cost, contributing to its financial strength. The company’s indebtedness is declining, particularly after the expenditure related to the acquisition of Albacora Leste. Notably, Prio exhibits a commendable ability to adapt to macroeconomic changes, allowing it to adjust the volume sold quickly. This agility provides a competitive edge over peers, as evidenced by its trajectory in recent years.

Considering Prio’s strong cash generation capability and its ongoing recovery, the potential for substantial dividends in the future could attract investors seeking not only capital appreciation but also consistent returns.

Despite carrying a premium valuation compared to domestic peers, Prio stands out among “junior oils” and offers an attractive option for exposure to the Brazilian oil sector with minimal exposure to political risks. Consequently, I adopt a bullish stance on Prio, anticipating it as a potential top performer in 2024.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.