Igor Kutyaev/iStock via Getty Images

Prime Medicine (NASDAQ:PRME) is at the forefront of gene editing, advancing the boundaries of genetic therapies with its innovative Prime Editing platform. However, the potential of this technology is more than just a theoretical promise; it stems from strategic pipeline developments and preclinical successes.

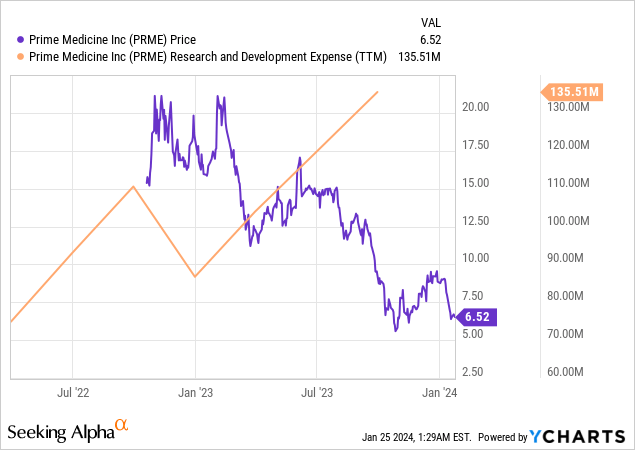

The bullish trend regarding Prime Medicine is supported by investments in R&D as the $41.0 million third-quarter 2023 expenditure increased from the previous year. This aggressive strategy of investment reflects the company’s desire to innovate and its faith in its technology.

However, innovation is not without risk, and this can be seen in the financials for Prime Medicine. The net loss of $50.7 Million for the same quarter is a glaring sign of how costly innovative R&D can be. On the other hand, a strong cash position of $178.8 million acts as a cushion and gives clear visibility through 2024 end per guidance by the company. This equilibrium of financial stability and investment creates the potential for growth in Prime Medicine.

A Closer Look at Prime Medicine’s Recent Performance

Prime Medicine’s financial reports show the company’s strategic focus on research and development, an essential factor for longevity in the biotechnology industry. Third-quarter financial results for the year 2023 reveal a company in an intense phase of investment. The firm is evidently powering its innovation following the explosion of R&D costs to $41.0 million from $25.0 million that it reported for the same period one year ago. This 64% YoY growth shows a strong willingness to improve its gene editing technologies.

ycharts.com

This R&D surge correlates with Prime Medicine’s development of its operational competencies and demonstrates its ambitious focus on technical breakthroughs. This has not come without a price. As the company’s net loss widened from $50.7 million to $29.4 million year-on-year, the road to commercialization of its therapies is highly expensive and points to high stakes in biotech innovation.

General and administrative costs have also increased substantially, going from $6.6 million to $10.5 million. This growth reflects a developing infrastructure that is vital for the increasing levels of R&D initiatives. These are strategic G&A investments, aimed at cultivating a team that can support the company’s ambitious research plans.

Despite these high costs, Prime Medicine has retained a healthy cash position. At least in the short to medium term, the company has sufficient cash and equivalents of $178.8 million to finance its activities. This financial cushion is important because it allows the firm to perform its R&D activities without capital pressure. The cash runway spanning till the end of 2024 shows a cautious approach to financial planning and a calculated rate of cash burn.

Strategic Pipeline

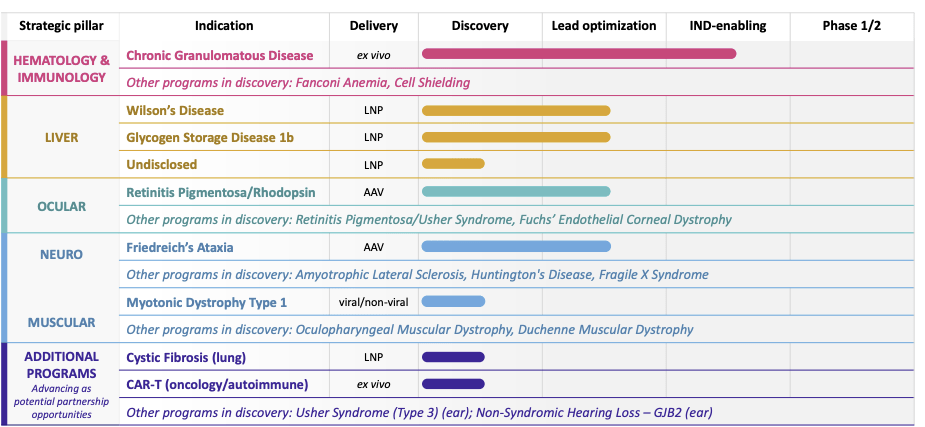

The strategic pipeline of Prime Medicine highlights eighteen programs that not only represent a wide variety but are focused on unmet medical needs.

primemedicine.com

The company’s focus on diseases like Chronic Granulomatous Disease (CGD) and Glycogen Storage Disease 1b (GSD1b) demonstrates a targeted strategy, picking battles where it can be first-to-market or offer a significant improvement over existing therapies. The Rare Pediatric Drug designation (RPDD) for PM359, targeting CGD, underscores the company’s ability to navigate the regulatory landscape and the potential speed to market.

primemedicine.com

GSD1b’s progress is equally hopeful. In vivo data with up to 50% whole liver precise editing in non-human primates and no safety concerns in doing so, Prime Medicine is setting the standard for liver-targeted gene therapies. Combined with the absence of any detectable off-target effects, this level of precision indicates a possible best-in-class safety profile that can serve as a powerful differentiator against competition.

Another outstanding point of Prime Medicine’s pipeline is an ocular program directed at retinitis pigmentosa/rhodopsin, which showed a 70% precise correction in photoreceptors.

Implications of Prime Medicine’s Technology

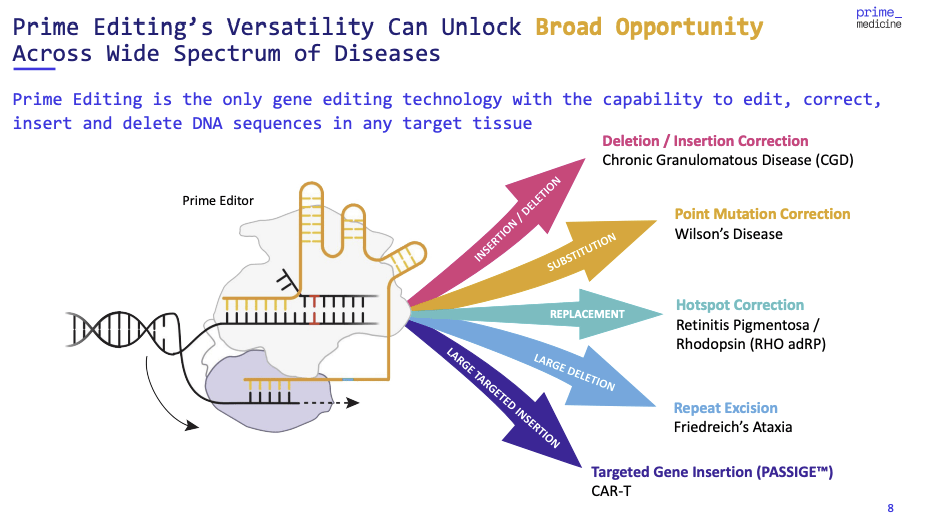

The technological advancement of Prime Medicine in the gene editing process with its proprietary Prime Editing platform is a significant evolution. The importance of this platform goes beyond simple improvements—it offers a new way of thinking about how efficient and precise gene editing can be.

The technology’s promise is underscored by the preclinical success in addressing mutations underlying conditions like GSD1b. Achieving up to 83% of target liver hepatocytes editing without significant off-target effects is significantly promising. This high level of precision editing is critical, as it addresses one of the most significant concerns in gene therapy: the reduction of off-target effects, which may result in undesirable outcomes such as tumor formation.

Prime Medicine’s dual adeno-associated virus (AAV) delivery platform for ocular conditions and the LNP delivery systems for liver diseases also show how well Prime Medicine appreciates the role of delivery in gene therapy. The ability to selectively target different tissues and deliver gene editors at desired sites is no less important than the editing. The company’s platform shows a possibility of the best-in-class efficacy to become a new standard in the field.

The ramifications of the technology used by Prime Medicine are deep. Not only is the company developing therapies, but it is offering hope for cures to conditions that have always been difficult to treat, such as CGD, GSD1b, and retinitis pigmentosa. This is an essential consideration for investors, since effective such therapies can result in substantial market exclusivity, pricing power, and long-term potential returns.

In addition, the company’s progress in non-viral delivery systems and their favorable off-target profiles for Prime Editing programs are positive indicators of regulatory approval processes and patient safety.

Valuation Snapshot

The EV/Sales (TTM) of Prime Medicine which is 88.55 is far above the sector median of 3.83, meaning that there is significant future growth and market potential in the company. This high multiple can be a sign of a market that is pricing in a large premium for Prime Medicine’s cutting-edge gene editing platform and its future cash inflows. Although a multiple as high as nine may raise some eyebrows in “normal” industries, such figures are not unusual in the biotech world because the success of just one therapy can take a company from research to benefiting the bottom line.

The FWD metric of 57.67, although high, indicates that the market is optimizing growing sales. This expectation is probably based on the fact that the company has a strong pipeline, especially as it approaches the clinical stage with therapies such as PM359 for CGD and its liver-targeted Prime Editors for GSD1b.

Furthermore, the Price/Sales (TTM) ratio of 3.35 compared to the sector median of 3.97, implies that the company may be slightly underpriced based solely on sales figures. This is compared to the forward Price/Sales (FWD) ratio of 76.20, which indicates a significant premium and implies strong sales growth as the pipeline matures.

The Price/Book (TTM) is at 3.14, above the sector median, which means investors are willing to pay more for each dollar of Prime Medicine’s net assets, demonstrating trust in the value and future profitability of the company’s assets. The forward Price/Book (FWD) ratio at 4.37 indicates even more enthusiasm among the investors on behalf of this company. Although certain ratios imply a significant premium, they are representative of the risky yet rewarding nature of the biotech industry in general and more specifically for companies such as Prime Medicine that serve to pioneer new therapeutic platforms.

Future Prospects and Milestones

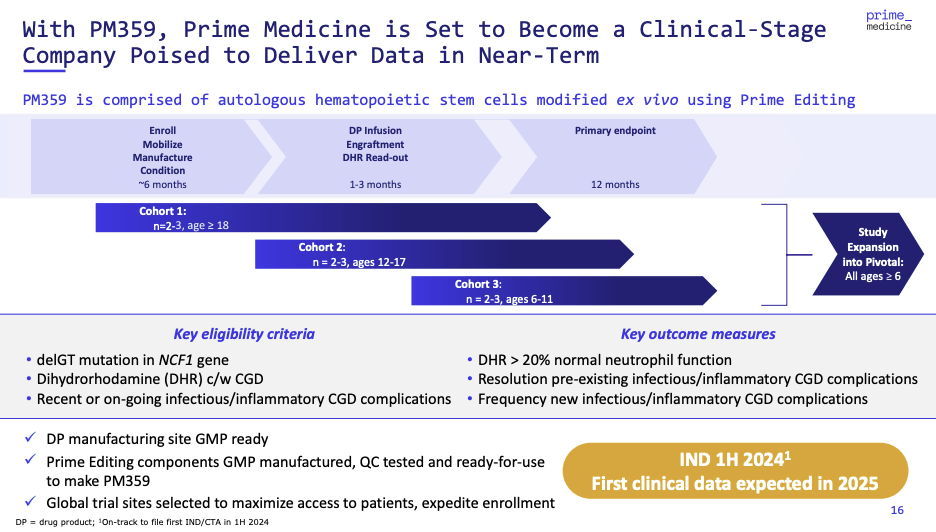

In the near term, the initiation of IND (Investigational New Drug) application-enabling studies for PM359 in CGD represents a significant step towards clinical trials, a fundamental gateway to eventual market entry. The company’s strategic foresight to focus on conditions like CGD, with orphan drug status and unmet medical needs, could streamline the regulatory path and hasten market access.

Moving forward, the completion of the first IND filing is expected as early as 2024. These filings are integral to switching Prime Medicine from a preclinical organization to an entity with clinical validation that is typically followed by a re-rating of the market valuation for such a company.

On the platform level, the growth of Prime Editing technology via proprietary recombinase technologies should lead to a strengthening of the platform’s multi-functionality and effectiveness. However, this development is not just a technical success; it’s also a business move aimed at extending the reach of Prime Editing to a greater number of genetic targets and increasing the company’s market share.

primemedicine.com

Another strong feature of Prime Medicine’s future is targeted business development. Through partnerships and collaborations, the company plans to harness value from Prime Editing and expand its reach beyond areas of focus. These types of strategic alliances would add further resources, knowledge, and opportunities for increased income to the firm.

Prime Medicine in the Broader Biotech Sphere

The gene editing industry is characterized by speedy developments and fierce rivalry. In this field, there are a handful of contenders for leadership using unique technological approaches. Prime Medicine’s proprietary Prime Editing platform differentiates itself in terms of its high fidelity and broad utility, which could provide great benefits over CRISPR/Cas9 and other gene editing technologies.

Nevertheless, this technological advantage needs to be framed in terms of the dynamic nature of the industry. Competitors do not stay idle, and breakthroughs elsewhere can affect Prime Medicine’s comparative advantage. This will be especially important as the company moves from preclinical to clinical stages, where technological advantages must remain.

In addition, the resolution of disputes between Prime Medicine and Myeloid Therapeutics, Inc. is a positive development as it eliminates inconvenience while freeing up resources to invest in product development. This resolution also demonstrates a mature view on addressing the inevitable intellectual property problems that are always time and money-consuming.

Investors should also look at the bigger market factors, such as regulatory environments, market access strategies, and reimbursement concerns, which all play a part in how successful a biotech company is. Prime Medicine’s focus on diseases with orphan drug designations and fast-track potential could help it overcome these confusing terrains.

Risks and Considerations

The future success of Prime Medicine greatly depends on the clinical efficacy of its pipeline candidate and their subsequent approval by regulatory authorities. The phase from preclinical to clinical efficacy, safety demonstration, and later market approval is full of uncertainties. Any delays, unforeseen negative outcomes, or failure to achieve clinical endpoints can undermine the company’s future.

The rate of technological developments in gene editing is also rapid and unceasing. Although the Prime Editing platform of Prime Medicine is currently one of the leaders in precision and efficiency, newer technologies can make it obsolete and less competitive. This risk can only be gradually minimized through constant innovation and adaptation.

Despite these risks, Prime Medicine’s cash buffer will provide some cushioning and the strategy of targeting diseases with significant unmet medical needs and fast-track regulatory pathways may offer a smoother ride to market.

Final Thoughts

Prime Medicine is the perfect example of a high-risk, high-reward profile that defines the biotechnology industry. Its emphasis on innovative gene editing technologies places the company at the forefront of a potential healthcare transformation. The strength of the strategic pipeline, strong cash position, and recent R&D breakthroughs create an attractive story for investors wanting to invest in innovative genetic treatments.

The company’s financial discipline, reflected in its cash runway to the end of 2024, speaks to a strategic approach towards resource management and an appreciation for the capital-intensive nature of biotech R&D. The strategic pipeline of eighteen programs that are oriented on rapid clinical translation reflects a deep commitment to the solution of unmet medical needs and clear perspectives in future growth.

The technological potential of the Prime Editing platform by Prime Medicine is impressive, with preclinical data supporting its possible superiority over other existing therapies in terms of precision, effectiveness, and safety. The strategic focus on diseases with shorter paths to clinical success would help generate revenues earlier and validate the platform.

But the path of this company is not without complications. Commercialization is a path littered with clinical, regulatory, and competitive risks. But for the educated investor, these risks are among the considerations of biotech investing. The case of Prime Medicine with its clear strategic direction, transparency in milestones, and commitment to innovation is one that should be considered. The bullish case for Prime Medicine, therefore, is one of long-term optimism that is based on a critical analysis of its prospects and the challenges it faces, as well as the revolutionary nature of its technology.