Darren415

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as the top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the first week of February.

Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the closed-end fund (“CEF”) markets for perspectives across the broader income space.

Market Action

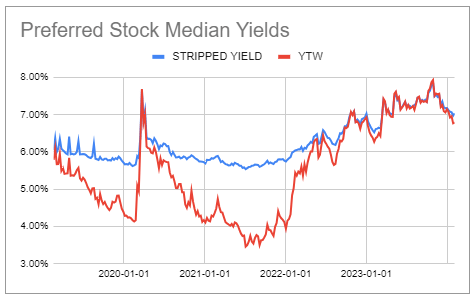

Preferreds rallied on the week as longer-term Treasury yields fell. Year-to-date, preferreds are one of the stronger-performing income sectors, with a total return of around +3%.

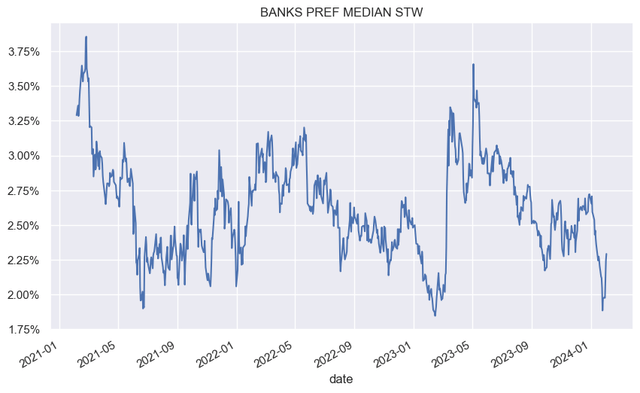

The recent wobble in New York Community Bancorp (NYCB) means that Bank preferred credit spreads have bounced off their tights and look somewhat more appealing.

Overall, preferreds yields continued to move lower, pushing below 7%, making the sector less attractive than it has been for most of last year.

Systematic Income Preferreds Tool

Market Themes

The NY Community Bancorp share price fell by 42% in the wake of its earnings results, bringing back memories of last year’s brutal price action in the bank sector. Recall that NYCB was in the news last year when it took over much of the failed Signature Bank portfolio, after gobbling up Flagstar in 2022.

What spooked investors was the $552m loan loss provision, which blew up by an order of magnitude from the previous quarter. The 70% dividend cut didn’t help things either. The company’s loans 30-90 days past due jumped by nearly 50% with much of the net charge-offs ($185m in total) related primarily to 2 loans (one of which has not defaulted but was rather transferred to a held-for-sale portfolio). The bank’s relatively low capital ratio of 9.1% will need to be shored up, requiring a sale of some of its assets.

The key question is whether it’s an idiosyncratic case of management failing to anticipate potential credit issues and the amount of liquidity and capital the now larger bank would require (the Signature acquisition pushed the bank into a stricter regulatory regime) or whether the souring loan portfolio is reflecting the realities of the broader market which would have repercussions for other banks.

So far the market thinks the former is more likely than the latter. NYCB management has tended to run the bank with relatively low capital, cash and liquidity. Now that it is no longer really a “community bank”, that has repercussions, particularly given the additional risks involved in the Signature takeover.

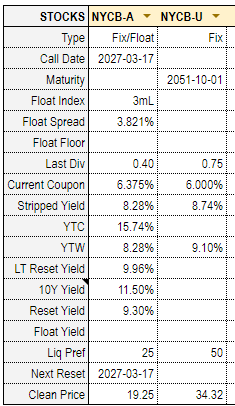

As expected, the company’s two preferreds (NYCB.PR.A) and (NYCB.PR.U) tumbled by 13-15% on the week. The two stocks are somewhat unusual because they are as different as can be. While A dividends can be skipped and are non-cumulative, U dividends can only be deferred for a time (i.e. they are cumulative). While A dividends are QDI, U dividends are not. While A is perpetual, U has a maturity. While A is callable, U is not.

Ultimately, a lot of these differences derive from the fact that A is a preferred while U is a subordinated bond wrapped into a preferred structure. It also means that U is higher up in the capital structure than A. We view U as the more attractive of the pair, particularly given its higher headline yield. Neither is likely to have much value left in a worst-case scenario however, and the QDI difference is relevant for investors in taxable accounts.

Systematic Income Preferreds Tool

Stance And Takeaways

Many investors remain worried about the preferreds sector, given its overweight in banks and the issues around bank lending to CRE or commercial real estate.

Although we expect losses in CRE pockets, we are less concerned about a systemic knock-on impact on the banks. First, the writedowns are not going to be equal across the sector – some parts of the sector like second-tier office buildings and malls are very troubled, while prime locations are doing just fine.

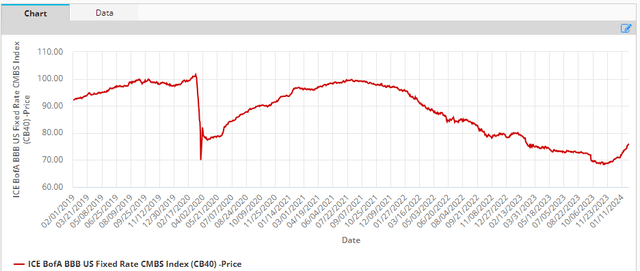

Two, how much is priced in? Quite a lot already so arguably risks are symmetric at this point, at least as far as public securities are concerned. The CMBS sector has rallied quite a bit already off last year’s lows as the following chart shows. Banks have enjoyed a top-up in liquidity via the BTFP facility, so they are less likely to be forced sellers of CRE loans.

Three, CRE defaults will come to the fore over time, as the loans come due for refinancing. These slow-motion defaults can allow banks to rebuild capital over time. This isn’t like the subprime crisis, where most of the securities had to be marked to market.

Four, just because the value of the collateral falls doesn’t mean the bank has to take a loss. Banks obviously don’t lend $100 for $100 worth of property. A 60% LTV, which looks to be the average across the sector, has a decent margin of safety.

In any case, CRE will struggle, there will be losses on some loans, and we could certainly see some bank wobbles. it’s perfectly fine for investors to underweight bank exposure, particularly as bank preferreds are not all that cheap. This is trivial to do for investors who allocate to individual preferreds. For investors who tend to hold funds, the two worth a look are the VanEck Preferred Securities ex Financials ETC (PFXF) and the Virtus InfraCap US Preferred Stock ETF (PFFA). The latter allocates to higher-yielding preferreds and is leveraged which offers a higher octane option.

Within individual bank preferreds we continue to tilt to the more established banks with stronger balance sheets. Among these, we like the floating-rate USB.PR.A, Fix/Float SNV.PR.E and floating-rate MS.PR.A among others, trading at yields of 8.1%, 6.2% (due to step-up to around 8.6% later this year) and 7.1%.