Dilok Klaisataporn

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the fourth week of February.

Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the closed-end fund (“CEF”) markets for perspectives across the broader income space.

Market Action

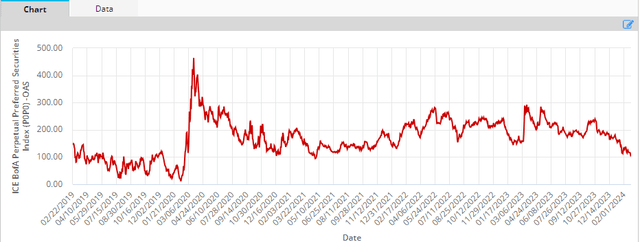

Preferreds had a strong week with a 1%+ return. A slight drop in longer-term Treasury yields and a further compression in credit spreads buoyed the sector.

Spreads have now reached the tightest level in the post-COVID period of just 1%. This is echoed across most other credit sectors and makes it a challenge to remain fully invested, particularly in lower-quality securities which are liable to experience larger drawdowns in an inevitable reversal.

ICE

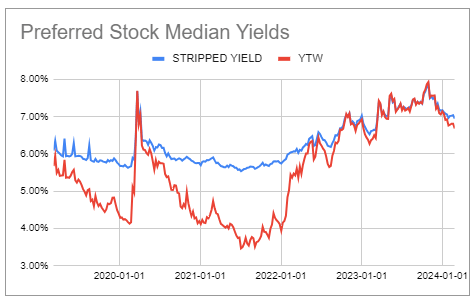

Spread compression has pushed the median yield-to-worst further below 7% – much less attractive for new capital than the recent peak of 8%.

Systematic Income Preferreds Tool

Market Themes

The persistent slide in preferreds credit spreads raises the obvious question of how should investors respond to the fact that the sector is trading at rich valuations?

There are roughly three ways investors could respond. One is by reducing lower-quality exposure – something we call countercyclical allocation. Second is to do nothing. And third is to shift to lower-quality / higher-yielding preferreds in order to maintain a consistent level of yield in the portfolio (something we call “reaching for yield” or a procyclical allocation).

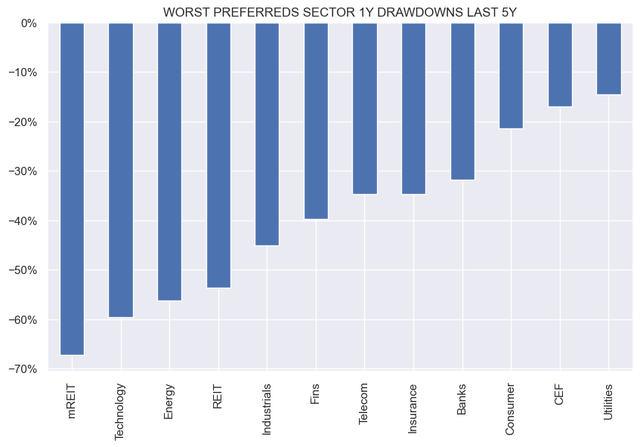

Our own allocation follows the countercyclical approach for four simple reasons. One, retracements and mean reversion are persistent features of credit markets. Two, lower-quality / higher-yielding assets tend to experience larger drawdowns and vice-versa.

Three, the opportunity cost of reducing lower-quality / high-yielding holdings is generally low in a period of rich valuations such as now. This is because the yield differential that lower-quality securities offer over and above their higher-quality counterparts is smaller in today’s environment than during periods of distress.

Four, securities that experience smaller drawdowns provide investors with a great opportunity to allocate to securities that experience larger drawdowns. In short, if some of your holdings are down 10% when something you wanted to buy is down 50% – a rotation to the more depressed security offers a great opportunity for potential capital gains. But if everything you own is down 50% then not so much.

The chart we keep an eye on is the following. It shows the worst 1-year drawdown of the various preferreds sectors in the last 5 years. Obviously not all securities within the same sector are the same (the Banks sector, for example, comes to mind) however it does capture a real pattern in markets.

Systematic Income

Given where spreads are, there is asymmetric risk to lower preferreds prices. And, more likely than not, the sector drawdown pattern in the chart above will repeat itself. This means that investors with some allocation to sectors like CEFs, Utilities and higher-quality financials can use them as a relatively resilient source of capital to scoop up stocks in larger-drawdown sectors the next time the market hits a bump.

Market Commentary

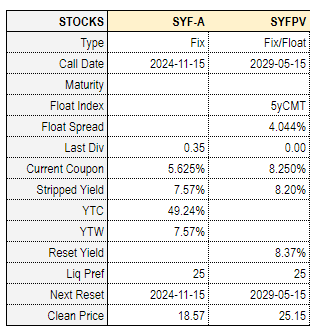

The online bank Synchrony Financial (SYF) (37th largest bank by assets, roughly between Zions and Regions) issued a new preferred (temporary ticker SYFPV, permanent ticker SYF.PR.B). The stock has a fixed 8.25% coupon with a May-2029 first call date at which point it will move to a 5-year Treasury yield + 4.044% coupon, unless redeemed. It is rated BB- / B+ by S&P and Fitch, respectively. The stock is currently trading close to 1% above par in stripped price terms, meaning its yield is closer to 8.2% with a slightly higher reset yield based on today’s forward rates.

SYF also has a fixed-rate Series A preferred (SYF.PR.A) with a yield of 7.57%. The yield differential between the two looks fairly high and will likely compress somewhat. At the same time we don’t expect it to disappear entirely since SYF.PR.B is much more likely to be redeemed which means its embedded call option is worth much more than that of SYF.PR.A.

Systematic Income Preferreds Tool

Stance and Takeaways

In line with the drawdown discussion above, CEF preferreds, particularly issued by funds other than CLO Equity CEFs, have been our go-to preferreds for resilient holdings. In our Defensive Income Portfolio we continue to hold CEF preferreds like NCZ.PR.A, OPP.PR.B and RIV.PR.A which are likely to offer a solid base for taking advantage of the next drawdown in the sector.