Lemon_tm/iStock via Getty Images

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as the top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the third week of February.

Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the closed-end fund (“CEF”) markets for perspectives across the broader income space.

Market Action

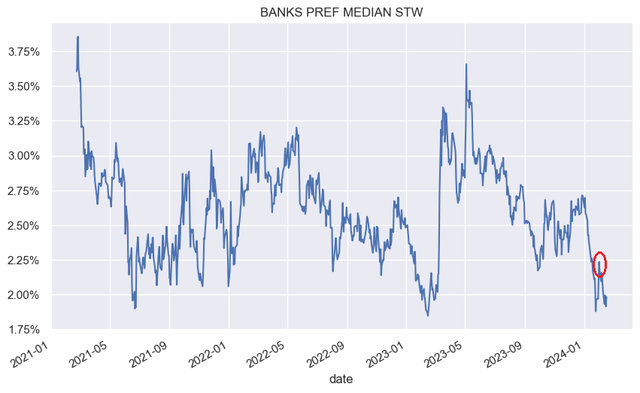

Preferreds fell this week as the rise in Treasury yields proved a headwind for the sector. Bank preferreds recovered from their CRE-induced jump and are trading at very tight credit spreads – interestingly, at the same level as just prior to last year’s mini crisis.

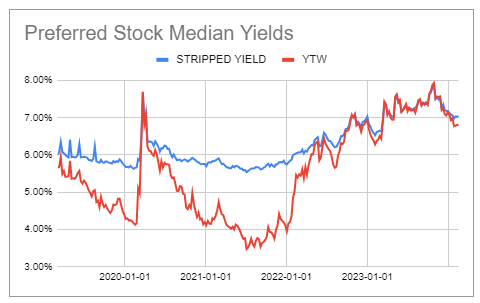

Yields paused their lower trend this week as higher than expected inflation pushed Treasury yields higher. We are also beginning to see a divergence between yields-to-worst and stripped yields, similar to the situation prior to 2022. This is caused by many stocks rallying to trade over “par”, which creates a drag due to the potential redemption and lowers the yield-to-worst faster than the stripped yield (yield-to-worst is the minimum of yield-to-call and stripped yield for perpetual preferreds). This means the stripped yield is becoming less relevant for evaluating preferreds.

Systematic Income Preferreds Tool

Market Themes

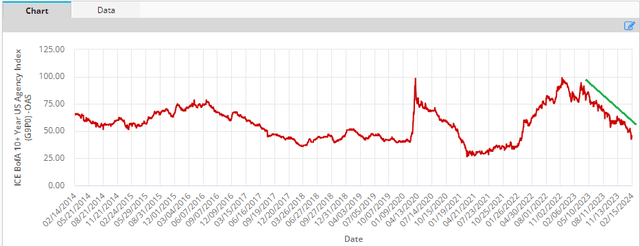

Most Agency mortgage REITs have already posted their Q4 numbers and they were very good, at least from the figures most relevant to preferreds shareholders. This is something that was straightforward to anticipate given the recent downtrend in Agency spreads as shown below, a partial reversal of the rise since 2022 which has hammered book values.

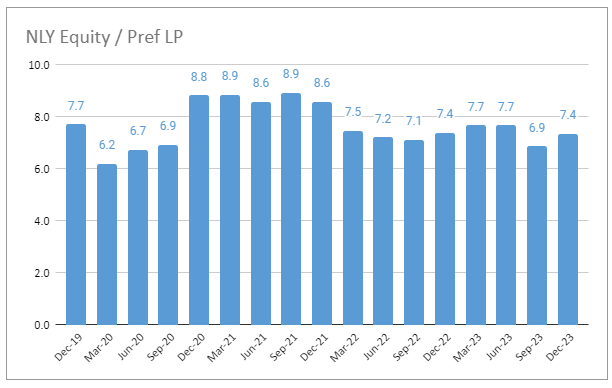

AGNC book value rose by 8% while leverage fell to 7x. As a result equity / preferreds coverage rose to a healthy 4.9x. NLY book value rose by 6.5% and equity / preferred coverage rose to a pretty strong 7.4x. Coverage is only a bit below its Dec-2019 level of 7.9x despite book value falling by half since then. The key factors for this resilience has been equity issuance and preferreds redemptions.

Systematic Income

Dynex Capital (DX) book value rose by 9% though this remains below $17.99 at the end of 2021. However, equity / preferred coverage has risen over the same period due to additional common share issuance.

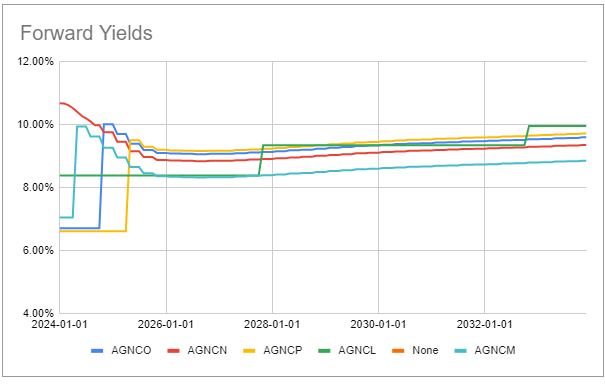

In the AGNC 5 preferreds suite the ones that look decent are the floating-rate AGNCN with a yield north of 10%. One advantage of AGNCN is that its high spread over SOFR (5.372%) and its relatively high price means that each drop in short-term rates has less impact on its yield. The second one is the familiar AGNCL which has a fixed yield of 8.4% until it switches to a 5Y Treasury linked coupon with an expected yield of near 10%.

Systematic Income Preferreds Tool

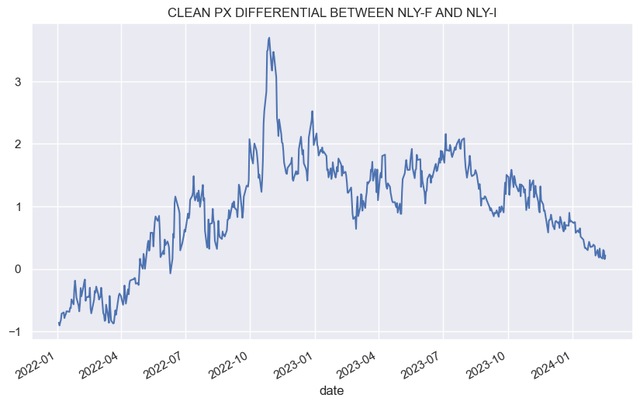

As suggested earlier, the prices of NLY preferreds NLY.PR.I and NLY.PR.F have now nearly converged. These two preferreds have been a good relative value pair. As NLY.PR.I converts to a floating-rate preferred in the middle of the year, they should start tracking each other very closely. At this point there is no strong case either way. F gets you bigger coupons leading up to the June I conversion but I gives you slightly higher coupons after its own conversion. These two preferreds remain very attractive. F trades around a 10.6% stripped yield which is then likely to move lower towards 8.8% over the next few years. based on expectations of the Fed policy rate.

Dynex Capital Series C (DX.PR.C) remains a higher-quality preferred with a high level of equity / preferred coverage at 7.8x. That’s one of the highest in the sector and it’s also not far off its peak in the last few years. The stock trades at a 7.14% stripped yield however it’s very likely to step up significantly in 2025. The only way the coupon would fall is if short-term rates are below 1.5% – fairly unlikely. It is a Libor reset stock and while it hasn’t said what’s doing with the SOFR transition it will almost surely move to SOFR because of the Calculation Agent language in its prospectus. Its high spread over Libor also means that a drop in Libor is relatively less impactful for the stock as more of its coupon is made up of a fixed spread.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!