Pgiam/iStock via Getty Images

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as the top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the second week of February.

Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the closed-end fund (“CEF”) markets for perspectives across the broader income space.

Market Action

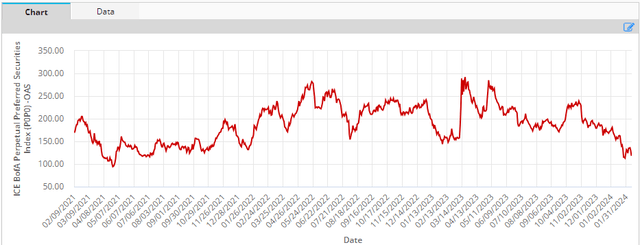

Preferreds were flat on the week as higher Treasury yields were offset by tighter credit spreads. Much of the initial dip in bank preferreds on the back of poor NYCB earnings report was reversed, and the market is treating it as a fairly idiosyncratic issue. Overall, preferred spreads reversed lower after the initial jump and remain close to their tights over the last few years.

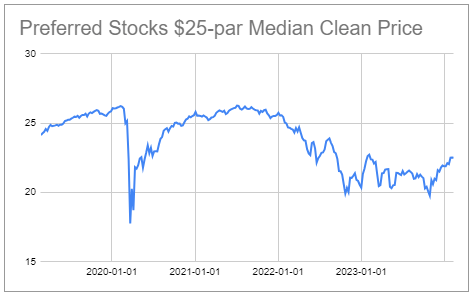

The median exchange-traded preferred price continues to inch higher from its recent $20 trough level, which, interestingly, has been the bottom several times since the Fed started to hike rates in 2022.

Systematic Income Preferreds Tool

Market Themes

With the Fed apparently setting the ground for rate cuts later this year, we have been getting a lot of questions and comments having to do with the yield-to-call or YTC of various preferreds. The yield-to-call is the total return of the stock if it is redeemed on the first call date.

Various reasons are proposed to show why a high YTC is a great opportunity. One, is that a high YTC is an opportunity in and of itself. Two, a high YTC presents a nice opportunity because when the Fed starts to cut rates it’s likely to push the price higher and cause the stock to be redeemed / called. And the third reason offered why a high YTC is a great opportunity for Fix/Float stocks in particular is that in most cases a stock will reset to a higher coupon (because today’s short-term rates are above the level of short-term rates when the stock was issued) and this increase in the coupon will push the issuer to redeem the stock.

As far as the first idea that a high YTC presents a decent-probability opportunity, what’s important to highlight is that a YTC “opportunity” is not a thesis – it’s a tautology. A high YTC results from the combination of a below-par stock and a near-term first call date. The lower the first and the nearer the second, the higher the YTC.

And, generally speaking, the higher the YTC the less likely it is going to be realized. A high YTC is a mechanical outcome of the current coupon (and the reset coupon the closer we get to the first call date) being below the stock’s yield. This means it is uneconomical for the issuer to redeem the security because refinancing it would require it to pay out a higher coupon – not something it is going to be willing to do.

There are three scenarios where a high YTC can be realized – the issuer redeems the security and doesn’t refinance it, because, maybe it has some spare cash and doesn’t mind returning equity back to investors or longer-term Treasury yields collapse or the company’s credit spreads collapse. These are not impossible, but they are not typically the base case scenario and for this reason, they require a thesis of how it will play out. Simply saying high YTC = opportunity is not sufficient because it’s not a narrative, it’s a description of the same thing in other words.

On the second type of high YTC argument, there is a syllogism at play here. 1) The Fed will cut interest rates, 2) preferred shares are driven by interest rates – i.e. lower rates push prices higher. Therefore, preferreds are very likely to get redeemed once the Fed cuts rates. This obviously confuses short-term rates which are anchored to the Fed policy rate and longer-term rates, which are obviously not. After all, why did 10Y Treasury yields fall 1% with the Fed not having done anything in the last couple of months?

Longer-term rates are likely to fall if the Fed delivers more rate cuts than is currently expected. The most likely scenario for that to happen is a recession, in which case, ironically, preferreds yields are likely to actually rise rather than fall because credit spreads could rise more than Treasury yields would fall. Another key point is that the reset coupon matters as well. A fixed-rate stock that is going to be refinanced to a floating-rate coupon is progressively less impacted by what happens to longer-term rates. Near the first call date its duration is zero and so it doesn’t matter what longer-term rates do.

Finally, it’s important to remember that even if a Fix/Float stock’s coupon steps up on the first reset date (i.e. when it transitions to a floating-rate stock) that step-up, in itself, is not a sufficient reason to redeem and many preferreds have not. This could be because refinancing to another fixed-rate preferred is not a slam dunk, given it both incurs fees and locks in the preferred to a relatively high rate for longer. Short-term rates are also expected to fall to a level below today’s longer-term rates, so it can be perfectly reasonable to pay a higher coupon today in order to be able to pay a lower coupon in a few years. And an outright redemption may not make sense, as it requires the company to find and return cash to investors.

Ultimately, there needs to be more to the story of a high YTC opportunity than just the high YTC or “the Fed”.

Market Commentary

This week, we added a few new securities to the Preferred and Baby Bond Tools. Two from mortgage REIT Redwood Trust, a preferred (RWT.PR.A) with a 10.4% yield and a 2029 bond (RWTN) with a 9.1% yield. The company is involved in housing credit, specifically single-family residential and multifamily sectors. There is also a 9.45% yield 2029 bond (ATLCZ) from Atlanticus which does consumer credit.

Overall, given how tight credit spreads, we are happy to tilt to the more established banks and higher-quality preferreds for the time being until new opportunities open up.