skynesher

Investment overview

My recommendation for PowerSchool Holdings (NYSE:PWSC) is a buy rating with a price target of $32.45. I believe PWSC is able to continue its current growth momentum, supported by strong underlying demand, international expansion, and its product innovation related to AI. All of these should maintain low-teen top-line growth, in line with management FY23 guidance. As PWSC grows into a larger and better business, I think it deserves to trade at a higher valuation than its historical average.

Business description

PWSC provides cloud-based software to the K-12 education market. Through its cloud-based technology platform, PWSC helps K-12 schools and districts supervise multiple functions such as state reporting and related compliance, special education, finance, analytics, etc. PWSC customers include state departments of education and schools (including public, charter, independent, virtual, etc.). As of the last 12 months of 3Q23, PWSC generated $676 million in revenue and $167 million in EBITDA. The company has been profitable over the past 5 years and has generated positive free cash flow [FCF] as well. PWSC balance sheet is in a net debt position of ~$540 million as of the latest 3Q23 filing.

Solid revenue growth in 3Q23

PWSC reported a solid 3Q23 with revenue growing 12.1% y/y, driven by license and other revenues, which grew 130.3% to $12.5 million. On the other hand, Subscription and maintain revenues came in at $149 million, representing growth of 8.7%. Service revenue growth was also slower at 4%, reaching $20.7 million. Nonetheless, the strong topline performance resulted in a strong incremental margin, expanding gross margin by 260bps to 71%. Strong gross profit performance and cost optimization initiatives led to adj EBITDA of $62 million, implying an EBITDA margin of 34%. As such, non-GAAP EPS came in at $0.24, beating the street’s calculate of $0.22.

In my opinion, 3Q23 was a strong signal that growth momentum can continue as it was another sequential improvement (1Q23 saw 6.6% growth, and 2Q23 saw 10.3% growth). I believe the two key drivers for revenue growth ahead are: (1) strong underlying demand; (2) international expansion; and (3) AI product innovation.

Strong underlying demand driving bookings growth

There are several key updates in the quarter that suggest PWSC is seeing strong underlying demand (based on the 3Q23 earnings call), which I see as a leading indicator of growth. For example, various product areas, including Talent Cloud, Student Success Cloud, and Student Information Cloud, experienced double-digit growth, according to management. Furthermore, they shared that, on a year-to-date basis, attendance interventions saw 68% booking growth, curriculum and instruction had a booking growth of >200%, and talent saw a booking growth of 21%. Not only that, but five of the top ten deals involved Unified Insights or Connected Intelligence products – two of the company’s most important growth areas. In addition, PWSC has announced that they are in the process of finalizing a statewide agreement in the Midwest for special education, and they have already inked a deal in Florida for multiple talent solutions. Although we do not know the exact quantitative impact on the financials, I think it is pretty indicative of underlying demand as PWSC continued to see healthy bookings across the board. Some might say that despite all of these qualitative data points, the net retention rate [NRR] declined sequentially, indicating that something is wrong. I disagree as the NRR performance was simply due to a difficult comparison quarter in 3Q22 due to the timing of deals. As PWSC laps these tough comparisons, NRR should inflect upwards, potentially driving positive sentiment around the stock.

We won a competitive takeout from — for the State of Florida, where frontline which is our probably most formidable competitor in that space, we displaced them for the whole State of Florida, super proud of the work that the team did there.

Additionally, we have been given vendor of choice for a state level Special Education solution for another state in the Midwest, which we hope to get to signature and approvals in Q4 or early Q1. Company 3Q23 earnings

International expansion on track

PWSC strategy to grow the business internationally appears to be working well. PWSC strategy, unlike the US, is to work with partners that have strong local knowledge. I find this strategy particularly effective in countries where PWSC has low penetration. Rather than investing organically, partnering will significantly reduce the execution risk. With the addition of six more channel partners in 3Q23, PWSC’s network of exclusive global partners reached 13. Furthermore, PWSC mentioned that it has acquired Neverskip, an Indian provider of administrative SaaS and K-12 ERP software. I believe this advance anchors PWSC in-routes into India as it provides them access to 900 schools and 1.2 million learners. Importantly, the acquisition gives PWSC more insights into product relevance in India, helping them to enlarge their product suite to face local needs. I would also note that India is a very big market as it has the largest population on earth; therefore, this acquisition enhances PWSC’s ability to capture share in this market. In my opinion, PWSC should keep speeding up its international push by executing tuck-in M&A across important international markets. recollect that only 2% of PWSC’s revenue comes from outside the U.S. and Canada, so there is significant room for PWSC to grow internationally. Based on management estimates, they expect to see this 2% grow to 10% in the next 3 to 5 years.

AI product innovation

Last but not least, I expect that PWSC product innovation will uphold the present growth momentum. As PWSC uses its industry-leading K-12 software platform to propel personalized learning through AI advancements, I see it as a clear AI beneficiary. I think the benefits of generative AI in learning are something that everyone can agree on. The way of learning something has changed dramatically over the past few years. Physical courses and lessons were the original way of learning, then it evolved to self-research via files available online (YouTube is one of my favorites). Now that we have generative AI, it sort of combines the two together, as one can engage with the AI to learn almost everything (you can literally ask a question and it answers). This makes learning something a lot easier today. Management announced during the quarter that they will release their first Gen AI solution as an add-on to the Performance Matters Assessment product following a successful beta trial. Also, PWSC’s Personalized Homework Assistant beta is set to be released later this month. With these products rolled out, I expect the PWSC product offering to be much more competitive, which should drive demand.

Valuation

May Investing Ideas

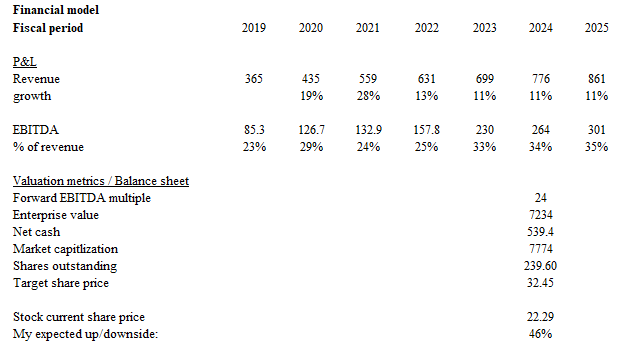

I believe PWSC will be able to uphold its current growth momentum of low teens in the coming years as it continues to see strong bookings across its products, deliver success in expanding internationally through its partnerships strategy, and deliver on its AI product innovation initiatives. Management is guiding FY23 revenue growth of 11%, which I believe is a reliable guide as management has generally met its guidance over the past 9 quarters (only missing 2x within a 1% margin). My growth assumptions are 11% for FY23/24/25.

PWSC is a business that has a high incremental margin; as such, I expect the EBITDA margin to enlarge as the business grows. My EBITDA margin assumptions are 33% in FY23 (as management guided), followed by 100bps expansion a year through FY25.

My overall take is that PWSC is going to become stronger and more competitive as it grows; hence, I believe it deserves to trade at a higher valuation than in the past. PWSC historically trades at an average of 23x forward EBTIDA, and I am valuing it at a 1x premium.

Based on my relative valuation model, I have a price target of $32.45.

Risk

Expanding internationally is not an easy task, and while the current partnership strategy reduces risk, it does not completely eliminate it. Although the M&A strategy reduces the reliance on partnerships, it also introduces risks regarding integrating the business. Value-disruptive M&A would disrupt the growth momentum of the business.

Conclusion

My recommendation for PWSC is a buy rating with a target price of $32.45. I expect growth momentum to continue, underpinned by robust demand, international expansion strategies, and AI-driven product innovation. I expect PWSC to trade at a higher valuation than its historical average if it grows as I expected.