- Insurance group Admiral logged more pothole damage claims than ever in 2023

- Not only is the number of cars damaged rising, but so is the average claim cost

The number of pothole insurance claims has risen 40 per cent in a year, according to the UK’s largest car insurance firm.

Admiral said it received a record 1,324 claims for car damage due to potholes in 2023, an increase from 946 in 2022.

Driving into a pothole can damage a vehicle’s tyres, alloy wheels, steering alignment and suspension.

The insurance firm’s previous record year for potholes was 2018, with 1,057 claims, largely due to the ‘Beast from the East’ storm damaging roads.

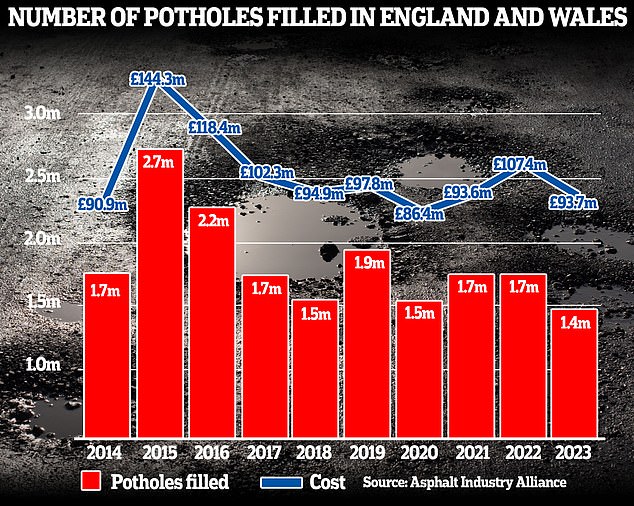

Low: In 2015, 2.7m potholes were filled – last year, that number slipped to 1.4m

The average pothole claim payout also rose by almost a third in 2023 when compared to 2022, from £2,378 to £3,070.

Admiral said the increase is due to modern vehicles being more complicated to repair, and therefore more expensive.

The insurance firm also said pothole payouts were rising due to vehicle repair costs rising generally.

Admiral said the UK’s roads were likely to see more potholes emerging after recent bad weather such as Storm Henk and the January cold snap.

Adam Gavin, head of claims at Admiral, said: ‘Potholes are more than just an inconvenience, they can also cause costly damage to your vehicle.

‘January, February and March are the worst time of year for pothole claims, with more than a third of claims we receive made over this period, as road surfaces become unsettled by freezing temperatures and thaws.’

The AA says 2023 is set to be one of its worst-ever years for pothole call-outs.

The breakdown assistance firm said it attended 48,994 callouts in August 2023 to vehicles stranded due to faults caused by potholes – a 13 per cent rise from the same month of 2022.