Newscast/Universal Images Group via Getty Images

Pet food and potential profitability improvements (from cost-saving initiatives and cost synergies from their pet food acquisition) could support Post Holdings’ (NYSE:POST) financial performance going forward. Valuation appears fair.

Overview

Post Holdings is a consumer packaged food company, operating across the center-of-the-store, refrigerated, foodservice, food ingredient categories with a product portfolio that includes ready-to-eat (RTE) cereals, peanut butter, potato and egg products, sausage, cheese and other dairy products, and pet food. The company also operates in the private label category through its ownership interest in 8th Avenue Food & Provisions which offers contract manufacturing services for pasta, dried fruits and nuts, granola, and nut butters.

The company operates four segments:

-

Post Consumer Brands: this segment offers branded and private label RTE cereals (including brands Weetabix North America, Honey Bunches of Oats, and Pebbles), peanut butter (under the Peter Pan brand), and branded and private label pet food (including brands Nutrish, Rachel Ray, and Nature’s Recipe). This is Post Holdings’ biggest segment accounting for over 50% of revenues and profits.

-

Weetabix: this segment covers the Weetabix business outside North America which produces and distributes branded and private label RTE cereal, breakfast drinks, muesli and other breakfast cereal products. The segment also includes protein shakes distributed under the UFIT brand, primarily in the United Kingdom. This is Post Holdings’ smallest segment accounting for under 10% of revenues and profits.

-

Foodservice: this segment sells egg and potato products sold through foodservice and food ingredient channels. This segment accounts for roughly 28% of revenues and profits.

-

Refrigerated Retail: this segment sells refrigerated retail products including side dishes, eggs and egg products, sausage, cheese and other dairy products, and egg substitutes (offered under a collection of brands including Bob Evans, Crystal Farms, and Egg Beaters). This segment accounts for under 15% of revenues and profits.

1Q 2024 performance

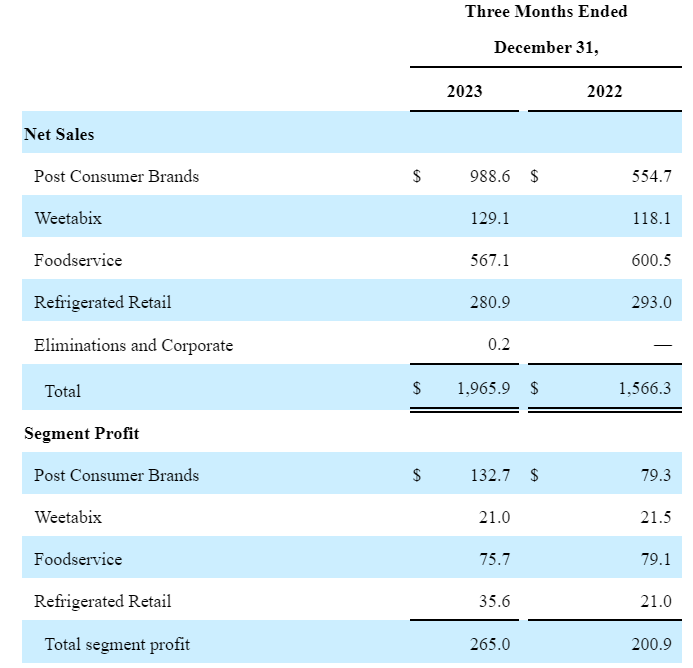

For the quarter ended December 2023, net sales rose 26% YoY to $1.965 billion, driven by the Post Consumer Brands segment which grew 78% YoY driven by the inclusion of three months of Pet Food sales and one month of Perfection Pet Foods (which was acquired in December 2023), as well as the impact of higher selling prices. Excluding Pet Food and Perfection Pet Foods, volumes declined 7% largely due to declines in branded and non-retail cereal and peanut butter.

Post Holdings 10-Q, Q1 2024

Profitability improved significantly with 1Q 2024 gross profit increasing to 29% from 26.5% the same quarter a year earlier and operating profit rising to 10.6%, up from 9.6% the same quarter the prior year. Margin improvements largely stemmed from the Refrigerated Retail segment which saw segment margins increase to 13% during the quarter from around 7% the prior year quarter helped by lower manufacturing costs, favorable ingredient costs and lower freight costs.

|

Q1 2023 |

||

|

Post Consumer Brands |

13% |

14% |

|

Weetabix |

16% |

18% |

|

Foodservice |

13% |

13% |

|

Refrigerated Retail |

13% |

7% |

Pet foods may support growth

Looking ahead, the company’s prospects are positive. Post Holdings’ growth strategy has for years focused on acquisitions (the company made an acquisition in all but one year over the past decade), helping deliver top line growth of 11% CAGR over the past decade and 4% CAGR over the past half decade, despite operating in extremely saturated markets. However with debt on the relatively high side, the pace of acquisitions may slow going forward.

|

Debt to equity (MRQ) |

|

|

Post Holdings |

|

|

General Mills |

|

|

Nestle |

Nevertheless, their newly acquired pet food business (which generates over $1.5 billion in sales or over a fifth of sales) could support growth; research projections forecast the U.S. pet food market to expand in the high single digits over the coming years, a higher growth rate than the company’s core cereals, dairy and egg products market which is projected to grow in the mid to low single digits. Nutrish and Nature’s Recipe pet food brands are underperforming according to management, and in response the company is ramping up marketing investments to rehabilitate the brands and drive growth.

Potential profitability improvements from pet food acquisition synergies, cost saving initiatives

Margin recovery has room to run near term as inflationary pressures continue to moderate. Medium term, their pet food acquisition is already delivering better than expected margins and there is room for further expansion on the back of supply chain initiatives, as well as cost synergies (which management expects to realize by FY2025). Efforts to cut costs and simplify Weetabix’s business (their highest-margin business) which has been affected by market share erosion to private label brands due to macro challenges in the U.K., could be margin accretive as well.

Risks

All of Post Holdings’ markets are saturated and highly competitive. Their newly acquired pet food business, expected to be a key earnings growth driver, is also highly competitive with CPG giants like General Mills (GIS), Nestle (OTCPK:NSRGY) among many others vying for market share. Competitive pressures may hinder management’s brand revitalization efforts and financial performance may fall short of expectations.

Conclusion

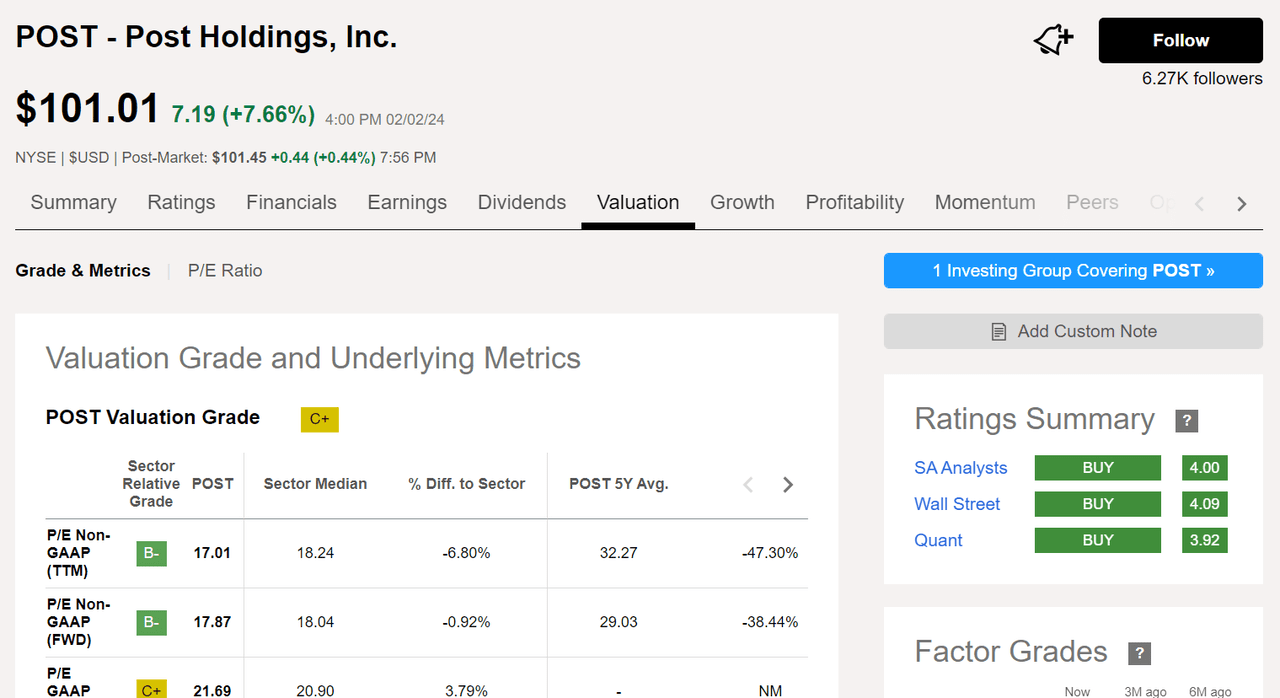

Post Holdings has a buy analyst consensus rating. Post Holdings’ valuation appears fair. Their forward P/E of 17.8 is just slightly lower than the sector median of 18.

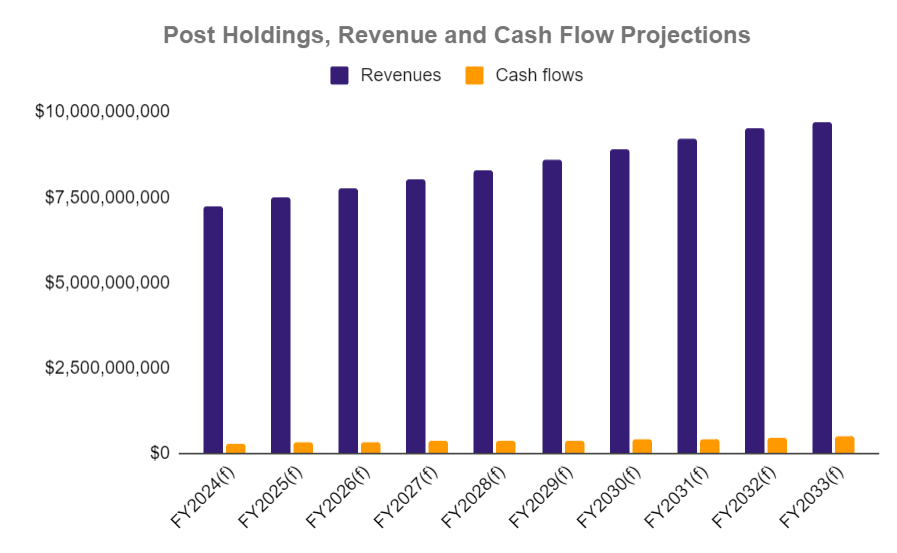

Over the past decade, Post Holdings has more than quadrupled its annual free cash flows, largely driven by strategic acquisitions. With debt relatively high in a climate of elevated interest rates, it remains to be seen if they can continue this pace of M&A. Conservatively assuming no major acquisitions going forward along with the following assumptions below suggests Post Holdings is worth around $ 6 billion, on par with their current market value of $6.1 billion. The stock could be viewed as a hold.

|

Revenue growth rate % |

3.5% annually (based on 8% growth for their pet food division and 2% growth for the rest of their food businesses) |

|

Terminal growth rate % |

2% |

|

Net margin % |

Gradually improving to 5% (based on productivity improvements, cost synergies from pet food acquisition) |

|

Depreciation % |

5.8% of revenues |

|

CAPEX |

6% of revenues |

|

Discount rate % |

8% |

Author