- The 804p per share offer represents a 34% premium to Thursday close

Pollen Street Capital is set to be buy AIM-listed wealth manager Mattioli Woods in an all-cash deal worth £432million.

The 804p per share offer, which Mattioli Woods’ board is recommending investors back, represents a 34 per cent premium to the group’s closing share price on Thursday.

Pollen Street said it was hoping to capitalise on a ‘significant opportunity in the UK wealth market’ via Mattioli’s ‘distinctive and diversified range of solutions’, which are ‘underpinned by a highly trusted brand, client-centric culture and technology-enabled processes’.

Another listed firm set to go private: Pollen Street to buy Mattioli Woods for £432m

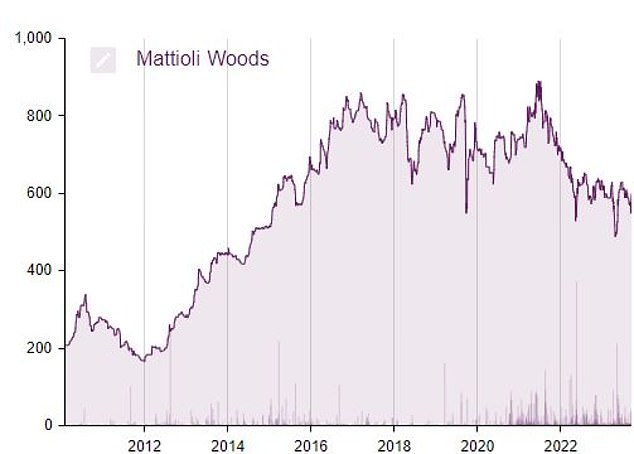

Mattioli Woods shares were up by 31.7 per cent to 790p approaching midday on Friday, roughly 11.2 per cent below their December 2021 peak.

The deal, should it go ahead, will represent another in a rapidly consolidating wealth and asset management industry as a result of the growing importance of scale in the sector.

Leicester-headquartered Mattioli Woods has grown substantially since listing on AIM in 2005, amassing more than £15billion of assets under management via organic growth and acquisitions.

Its core proposition integrates asset management and financial planning to serve a market predominantly consisting of the mass affluent, controlling directors and owner-managers, professionals, executives, individuals, families and retirees.

Pollen Street Mattioli Woods would benefit from a move to private ownership, which would give its management team ‘the flexibility to take longer-term decisions to maximise the growth potential of the business’.

The private equity firm, which is FTSE All-Share listed, said it was attracted by Mattioli’s ‘vertically integrated, holistic model with its high-quality brand and client base and clear organic and inorganic growth opportunities across its wealth and asset management and employee benefits business’.

It follows a similar deal in 2019 when Pollen Capital bought wealth manager Kingswood Holdings.

Lindsey McMurray, managing partner of Pollen Street Capital, added: ‘Pollen Street Capital has strong heritage in supporting companies in the financial and business services sectors and we are excited by the opportunity to work with Mattioli Woods in achieving our ambitious goals for the business.’

Backing the takeover, the Mattioli Woods board said: ‘The delivery of the group’s growth strategy would be both slower and more uncertain without considerable further capital funding, which will be difficult to raise in the public markets at the current share price without materially diluting existing shareholders’.

Boss Ian Mattioli added: Since our admission to AIM in 2005, we have seen significant expansion in both the size and nature of our business, integrating asset management, financial planning and employee benefit services to serve personal and corporate clients throughout the UK.

‘We have a strong track record of combining like-minded businesses that share the same culture and ethos of putting clients first. The team at Pollen Street Capital share our passion for delivering exceptional client outcomes and have demonstrated their ability to partner with entrepreneurial financial services business.

‘I believe that with Pollen Street Capital’s support and access to capital we can accelerate the delivery of our strategy and provide our clients with the proactive advice and bespoke investment solutions they require.’

Mattioli Woods shares have struggled to regain ground since late 2021