dushi82/iStock via Getty Images

Back in November, I warned investors about the troubling situation at Polestar Automotive Holding UK PLC (NASDAQ:PSNY). The electric vehicle company had just cut its guidance for 2023 yet again, and the overall financial situation there was continuing to worsen. After the bell on Thursday, we received Q4 delivery estimates that showed things are even worse than previously thought, meaning there could still be a bit of downside possible in this stock.

A couple of months ago, my bearish thesis was fairly simple. The company went public through a SPAC to great growth expectations in 2021, but has consistently failed to deliver. Vehicle production and delivery growth has fallen well short of the company’s projections, and large losses and cash burn have led to a balance sheet in terrible shape. I believed a major capital raise would be needed, which as the stock continued to hit new lows basically every quarter, could be massively dilutive for shareholders.

As it turns out, things here are much worse than even I thought. Polestar announced on Thursday that deliveries in Q4 were just 12,800 vehicles. In what’s supposed to be the seasonally strongest quarter of the year, the company actually reported a sequential decline of almost 1,200 deliveries, despite almost 900 deliveries of the new Polestar 4 in the fourth quarter. Management in the press release talked about a challenging market and how it is looking to protect its exclusive brand position.

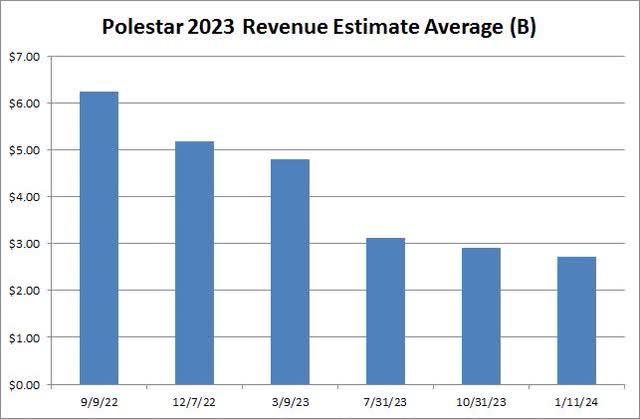

As a reminder, Polestar’s original guidance for 2023 was 124,000 vehicles, including some from the delayed Polestar 3 that is launching this year now. That forecast was cut multiple times, including to about 60,000 units in the Q3 report. In the end, deliveries for the year rose to approximately 54,600 cars, a growth of just 6% compared to 2022. As the chart below shows, analysts have continued to cut revenue estimates for the company, and the latest news could potentially send those projections even lower.

Polestar Revenue Estimates (Seeking Alpha)

With the company falling several thousand units short of its prior guidance, management also cut its gross margin forecast for 2023. The new forecast calls for approximately breakeven gross margins, compared to a prior hope for a positive 2%, which implies about a $50 million shortfall. Polestar lost $735 million on an operating basis in the first nine months of 2023, and it doesn’t look like we will see any major improvement in Q4.

On Thursday, there also was a sizable negative development in the EV space when Hertz Global Holdings, Inc. (HTZ) announced that it would be selling a large amount of Tesla, Inc. (TSLA) vehicles. Due to high repair costs and significant depreciation, the rental car giant is pulling back considerably on its EV push, part of which also involved Polestar selling up to 65,000 vehicles to the rental car giant. It’s not clear yet whether or not Hertz will also cut back on their purchases of Polestar vehicles until the market dynamics here improve. However, Polestar is much more reliant on fleet sales like this than Tesla is given the current sales volumes of these two EV names (55,000 a year for Polestar vs. over 1.8 million for Tesla).

As I have discussed in a previous article, the biggest problem I have with the company is its overall financial situation. Working capital continues to go further negative, finishing Q3 at a deficit of more than $2 billion. Polestar finished Q3 with about $950 million in total cash, but it has roughly $3 billion in debt. The company was previously targeting being cash flow breakeven in 2025, delayed by a year already, but the latest result may push that timeline back a little. The company needs to significantly improve its balance sheet, and equity raises will only be more painful with the stock down another 21% since my previous article, compared to a nearly 9% gain for the S&P 500.

At this point, I really can’t even say that there’s a positive argument to be made here on valuation. At Friday’s close, Polestar shares were going for 0.73 times expected 2024 revenues (which could come down further), which is more than double what established vehicle makers like Ford Motor Company (F) and General Motors Company (GM) trade for. A similarly underperforming EV name like Fisker Inc. (FSR) is only going for 0.17 times expected 2024 sales, implying Polestar could still have plenty of downsides ahead.

My personal rating on this stock remains a sell after this report. I just cannot move to a hold until we see delivery and revenue estimates start to bottom, and that doesn’t seem likely anytime soon. I also would consider moving to a hold if the company can get its balance sheet in order, as well as if the stock moved more towards a price-to-sales valuation that’s closer to Fisker since that is the name that 2025 delivery volumes will most likely compare to. The company has stated that it needs another $1.3 billion in capital in the next year or two, and that will mean either significant additional interest expense or a huge equity offering (market cap of $3.55 billion as of Friday’s close).

In the end, Polestar announced another awful quarterly delivery result on Thursday. The company actually reported a sequential decline in units sold, despite a new model launch, and fell well short of yearly guidance that was already more than halved. With revenue estimates heading lower and margin troubles building, the company’s already weak balance sheet is likely to be under even more pressure. The stock traded down to a new low Friday after more negative news in the EV space, but investors can see still major losses from here if this company doesn’t get its act together soon.