Evkaz/iStock via Getty Images

From August 1st to October 26th, the MSCI EAFE Index suffered a nearly 11% correction, led by interest rates worries, geopolitical risks and mediocre third-quarter corporate earnings. November was a different story. Improving inflation data for October and dovish comments from central banks spurred on a 9.30% rally in the MSCI EAFE Index. That month was the second strongest November in the Index’s history, and bond indices were equally ebullient. The rally continued into December, as investors anticipated a “soft landing” for the economy backed by 2024 rate cuts on cooling inflation. As a result, the MSCI EAFE Index returned 10.47%, while the Polaris International Equity Composite outperformed at 11.93% (net of fees) for the quarter.

Three sectors contributed most to gains, including consumer discretionary, industrials and financials. Other cyclicals, information technology (‘IT’) and materials, added measurably. Smaller absolute gains were noted in defensive sectors, including energy, consumer staples and health care. Holdings in France, the United Kingdom, Canada and Germany topped performance, with notable double-digit returns from off-benchmark countries including South Korea, Puerto Rico and China. Single stock holdings in the Netherlands and Italy detracted.

FOURTH QUARTER 2023 PERFORMANCE ANALYSIS

The rate-sensitive consumer discretionary sector had a strong showing in the fourth quarter, as consumers spent in the runup to the holidays. A half dozen portfolio holdings had double-digit gains. South Korean auto manufacturer, Kia Corp. (OTCPK:KIMTF), increased its market share in the U.S. and Korea, with EVs selling well in select locations. British clothing retailer, Next PLC (OTCPK:NXGPF), reported firmer pricing and revised guidance upward through the end of 2023. SONY Corp. offered bullish projections for 2024, highlighting the success of its PlayStation subscriber platform, recovering image sensor business and relaunch of its motion picture division after the Hollywood writers’ strike. By quarter end, the sector was buzzing as investors factored in pending rate cuts and resilient labor markets, both of which may spur big-ticket spending (cars, homes, appliances, TVs) in 2024.

Among industrials, China’s Weichai Power (OTCPK:WEICF) cited recovery in the heavy-duty truck (‘HDT’) market boosted by exports and returning domestic demand. The jump in Weichai’s liquefied natural gas HDT sales year-to-date in the domestic market is notable, as economics begin to favor gas over diesel due to pricing. Kion Group (OTCPK:KIGRY), partially owned by Weichai, reported increased profitability and free cash flow, driven by a momentum in the industrial trucks and services segment. Daimler Truck (OTCPK:DTRUY) was another top contributor as Morgan Stanley (MS) promoted the German commercial vehicle manufacturer as one of its favorite European auto stocks for 2024. Daimler also announced that Amazon would be among five companies to give its new Mercedes-Benz branded fuel cell truck a trial spin in Germany. A number of other industrials had strong results including SKF AB (OTCPK:SKFRY), Vinci SA (OTCPK:VCISF), Teleperformance (OTCPK:TLPFY) and Itochu Corp (OTCPK:ITOCF).

Financials were up across the board. Puerto Rican bank, Popular Inc. (BPOP), managed to beat street EPS estimates for the third quarter while German reinsurers, Munich Re and Hannover Re, both capitalized on hard market pricing and better returns on their investment portfolios. flatexDEGIRO AG (OTCPK:FNNTF), an independent online brokerage firm in Germany, released strong quarterly results, highlighting profitability. The company saw its customer base increase year-to-date through September; account growth doubled that of its nearest European competitors.

Material sector stalwart, Smurfit Kappa Group (OTCPK:SMFKY), was purchased as a “backdoor” investment into consumer staples, but at a much better valuation. The decision proved fruitful, as the food/beverage packaging company led materials sector gains this quarter. Smurfit reported stabilizing volumes, as a year-long destocking cycle is nearing an end. Containerboard price increases in the U.S. should boost Americas operations, and further validate Smurfit’s proposed purchase of U.S. based WestRock (WRK). Commodity suppliers also fared well in this market, as lower interest rates in 2024 may minimize costs of carrying inventories and boost commodity prices. Anticipation of this trend benefitted copper miners Lundin Mining (OTCPK:LUNMF) and Antofagasta (OTC:ANFGF), as well as methanol producer Methanex.

With the advent of artificial intelligence (‘AI’), the IT industry was dominated by the mega-cap high flyers like Nvidia (NVDA) and (META). Instead of considering pricey AI players, we invested in value “derivatives” that serve the AI market behind the scenes. For example: Memory chip maker SK Hynix was up more than 25% for the quarter, noting improvement in DRAM pricing and AI demand for its very advanced high bandwidth memory chips — for which SK Hynix has almost 100% market share. Samsung Electronics capitalized on the same.

Marketing and advertising companies have been generally weak as tech companies curtail ad spending. However, communication services companies like Ipsos SA (OTCPK:IPSOF) and Publicis Groupe (OTCQX:PUBGY) were industry standouts, focusing on generating organic growth, increasing market share and controlling costs. A diversified customer base, less reliant on tech customers, also helped.

Nearly 90% of the international portfolio’s holdings were in absolute positive territory for the quarter; only a small handful of stocks detracted, among them were Yara International (OTCPK:YARIY), JAZZ Pharmaceuticals and Ahold Delhaize (OTCQX:AHODF). Norwegian fertilizer manufacturer Yara International posted lackluster results, as profitability dropped on reduced margins. Increased delivery volumes and lower raw material costs failed to offset falling fertilizer prices. Irish drug maker, Jazz Pharmaceuticals, had mixed news as its key product, Xywav, faced generics competition; however, Jazz’s drug is being extended to treat idiopathic hyposomnia. After a stretch of excellent results, grocer Ahold Delhaize noted moderating growth and margins as consumers tighten their belts due to a longer-than-expected spate of inflation.

During the quarter, we exited Honda Motor Co. (HMC), Amcor PLC (AMCR), and Taylor Wimpey PLC (TW). Honda was initially purchased when its auto division was under pressure; auto margins recovered in late 2023 on low inventories, minimal incentives, and better volumes as the chip shortage has eased. We determined this was opportune timing to sell at a profit. The portfolio sought to reduce overexposure in the packaging industry, selling richly-valued Amcor while retaining its peer, Smurfit Kappa.

The culmination of falling inflation, Bank of England rate cuts and pent-up demand should boost U.K. homebuilders in 2024. Yet, Taylor Wimpey showed few signs of capitalizing on this trend, with volumes, prices and margins middling. The company also struggled with the housing approval process, with unit sales expected to be down 25% from pre-pandemic levels. We sold Taylor but maintained a position in the industry with Bellway PLC (OTCPK:BLWYF).

Portfolio holding, Novartis AG (NVS), spun off its generic pharmaceuticals/biosimilars manufacturer, Sandoz (OTC:SDZNY). As a result, the international portfolio now has ownership of Sandoz shares. A new position was initiated in ENI SpA (E), the Italian oil and gas company with a diverse geographic footprint. Oil prices dropped to more normalized levels this quarter; we took advantage of this downturn to boost our energy weighting.

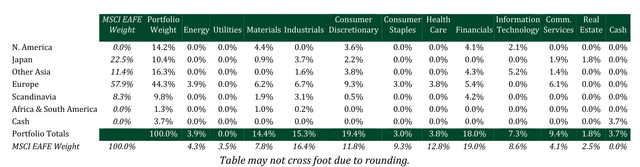

The following table reflects the sector and regional allocation for the Polaris International Equity Composite as of December 31, 2023.

2023 YEAR IN REVIEW

2023 will be remembered as a year of several plot lines. The year started with economists calling for a recession; by summer, the consensus shifted to the “higher for longer” (higher inflation and interest rates for longer period) catch phrase; but by November, the temperature changed to cooling inflation, rate cuts and a “soft landing” scenario. Returns were particularly strong across both stocks and bonds in the fourth quarter as a result. The anticipated recession has not materialized; in fact, just the opposite occurred with the S&P 500 Index up 26.29% for the year, leveraging gains from a concentrated group of tech stocks.

Tech stocks also boosted the MSCI EAFE Index, which gained 18.85% on the year. The Polaris International Equity Composite outperformed, up 21.41% (net of fees), largely due to outstanding returns in the overweight consumer discretionary sector. The portfolio also beat the benchmark in IT, communication services, consumer staples, energy and real estate sectors. Health care was the only absolute detractor. Country-level analysis indicated that the international portfolio benefited from its holdings in the United Kingdom, Japan, France and Germany, while exacting 20%+ gains from off-benchmark countries including South Korea, China, Puerto Rico and Greece.

INVESTMENT ENVIRONMENT AND STRATEGY

The single biggest influence on equity markets this past year was the rise in interest rates. The markets whipsawed in the fourth quarter, as the Fed signaled rate cuts in the second half of 2024.; we expect an environment of modest rate cuts (Fed Funds target range at 4%-4.25%) by the end of 2024, both in the U.S. and overseas. However, the cuts are not without risk. Substantial wage inflation will pressure service sector inflation, which dominates the global economy. Further, based on our dialogue with management teams worldwide, it appears moderating prices have been helped by destocking. As inventory reductions turn to rebuilding, it is possible supply chains will tighten up and prices may start to trend up again.

Regardless of the near-term rate challenges, we suspect that the Fed and other central banks will keep rates at more stabilized levels especially in real, after-inflation terms, departing from the ill-advised period of artificially low rates. More appropriately priced cost of capital has far-reaching implications, and is particularly beneficial for value stocks. The gale force headwind of growth over value stocks for the past decade is shifting and, in the case of international markets, has already changed direction. The U.S., driven by continued euphoria over a handful of mega cap tech stocks, aka the “Magnificent Seven”, is the lone holdout. We expect this will change as well, since the actual growth of cash flows at some of these companies has stagnated around 5%. Such modest growth does not deserve high valuations.

Under the surface there is much more going on, specifically the recent outperformance of large cap companies versus small and midcaps. A combination of factors has driven this dispersion, including risk appetite and the disproportionate impact higher rates had on smaller companies. But herein lies the opportunity for the coming year.

While focused on economic factors in our outlook, we are equally vigilant of current geopolitical risks (U.S. presidential race, ongoing warring factions, trade tensions). Last year at this time, we discussed navigating the polycrisis (the simultaneous occurrence of crises). As 2023 turns to 2024, the world continues to be marred by continuous rolling conflicts. We keep macroeconomic events in sight as we update our international portfolio, seeking to enhance the risk/return profile with cash-flow generative companies purchased as excellent values. We expect that such positioning will lead to continued outperformance as we enter 2024.

|

IMPORTANT INFORMATION: The Polaris International Equity Composite was established on April 1, 1995 with a performance inception date of June 30, 1984. Performance from the inception date through March 31, 1995 represents the portfolio track record established by Portfolio Manager Bernard Horn while affiliated with a prior firm. The information presented is supplemental. It should not be considered as a recommendation to purchase or sell a particular security mentioned, may change at any time and may not represent current or future investments. References to individual securities throughout this document are intended to illustrate contributors to recent performance or market trends and to provide examples of thematic or security-specific catalysts identified by the investment team as part of its investment process. References to specific securities should not be viewed as representative of an entire portfolio, nor should the performance of any particular security be viewed as representative of the performance experienced by any other security or portfolio. Please refer to the annual disclosure presentation. Past performance is not indicative of future results. The MSCI EAFE Index, gross dividends reinvested, is designed to represent the performance of large and mid-cap securities across 21 developed markets, including countries in Europe, Australasia and the Far East, excluding the U.S. and Canada. The S&P 500 Total Return Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.