LumiNola

There’s Tech, and everything else. The dominance of the sector is undeniable. Personally I think the entire group is extended and due to a large pullback, but I’ve been wrong plenty of times in my timing there. If you think there’s still some gas in the tank in the Tech sector but want to venture out beyond AI, the Invesco NASDAQ Internet ETF (NASDAQ:PNQI) may be the fund for you.

PNQI is a fund that seeks to track the performance of the NASDAQ CTA Internet Index. The fund normally invests at least 90% of its total assets in securities that comprise the Index. The Index is designed to monitor the performance of companies involved in internet-related businesses listed on the New York Stock Exchange (NYSE), NYSE American, Cboe Exchange (Cboe), or The NASDAQ Stock Market (NASDAQ).

Primary businesses of these companies range from internet software, search engines, web hosting, website design, to internet retail commerce. The fund and the Index are rebalanced and reconstituted on a quarterly basis. It’s worth noting that the underlying index changed its name from the NASDAQ Internet Index to Nasdaq CTA Internet Index on August 12, 2020, and also underwent a change in methodology.

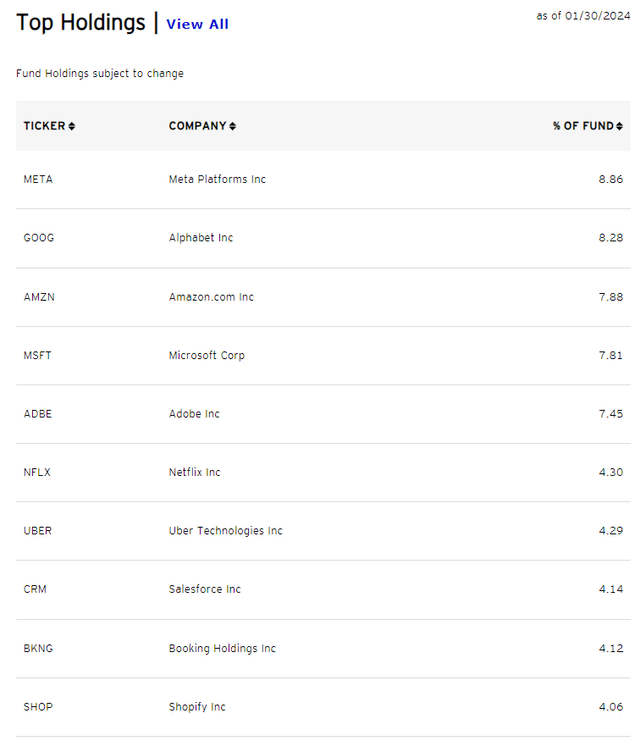

Exploring the ETF’s Holdings

A deeper look into the holdings of the Invesco NASDAQ Internet ETF reveals that it comprises 83 individual positions. Top positions are all the familiar ones. Note I earlier mentioned AI and yes – many of these companies are pushing hard there. But there are no semis which makes this less of a play on artificial intelligence than other tech funds.

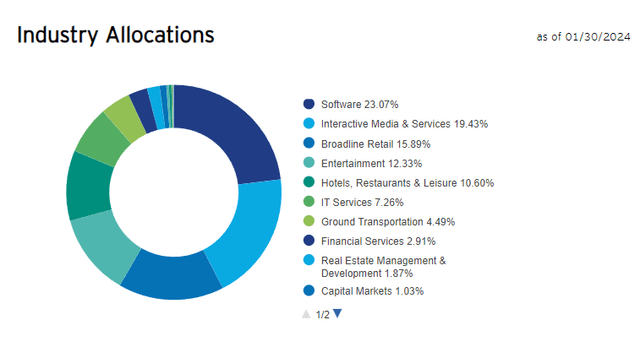

Sector Composition and Weightings

This is surprisingly well diversified. Even though I consider this a Tech fund given the holdings, we can see it’s got exposure to retail, entertainment, real estate, and even ground transportation. Personally I think this is a good thing to broaden out the risks while still playing the theme overall.

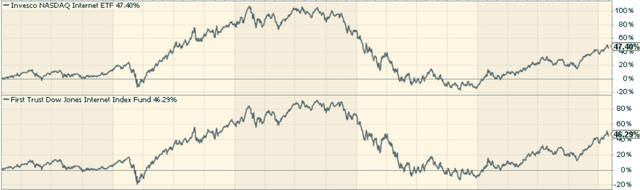

Peer Comparison

One comparable ETFs to compare against is the First Trust Dow Jones Internet Index Fund (FDN). The two have largely performed in line with each other, which means practically speaking the only reason to choose one over the other might be brand preference (which isn’t really a moat for ETF issuers to begin with).

The Pros and Cons of Investing in the Invesco NASDAQ Internet ETF

Like every investment, investing in PNQI comes with its own set of advantages and disadvantages.

Pros

-

Exposure to Internet-related companies: PNQI offers investors exposure to a wide range of companies involved in internet-related businesses. This could include companies involved in internet software, search engines, web hosting, website design, and internet retail commerce.

-

Diversification: The ETF is well-diversified across different sectors, reducing the risk associated with investing in a single sector.

-

Potential for High Returns: Given the rapid growth and innovation in the internet sector, there is a potential for high returns.

Cons

-

Sector Concentration Risk: While PNQI is diversified across different sectors, it is heavily concentrated in the internet sector. This could make the fund more susceptible to any downturns in this sector.

-

Volatility: The internet sector can be quite volatile and subject to rapid changes due to technological advancements and changing consumer preferences.

-

Regulatory Risk: Many internet companies face regulatory scrutiny, which could impact their performance.

Conclusion: To Invest or Not to Invest

Investing in PNQI could be an attractive option for investors seeking to tap into the potential of the internet sector. The fund offers exposure to a wide range of internet-related companies, providing opportunities for high returns. However, potential investors should be mindful of the risks associated with sector concentration, market volatility, and regulatory scrutiny. I prefer this over any AI specific fund now on a relative basis.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).