General_4530/Moment via Getty Images

January’s global PMI data signalled improving global economic conditions at the start of 2024, in addition to a brightened outlook, with the sun shining especially brightly upon the financial services sector amid a loosening of financial conditions.

However, further improvements hinge largely on the outlook for global interest rates and inflation.

Although welcome news has been observed in the form of falling selling price inflation in January, signs of manufacturing costs rising amidst a renewal of supply constraints – especially in Europe due to the Red Sea crisis and in sectors such as construction materials and food – will need to be monitored carefully via the PMI data in the coming months.

Delivery delays return in Europe amid Red Sea attacks

S&P Global’s PMI Comment Tracker data revealed that attacks on ships in the Red Sea had a notable impact on supply chains in January, affecting delivery times across a variety of manufacturing sectors.

The impact was unsurprisingly the hardest hitting in Europe, as diversions to shipping lines around the circumference of Africa resulted in up to two weeks being added to average lead times for European producers.

Consequently, supplier delivery times in the UK and eurozone lengthened for the first time in a year.

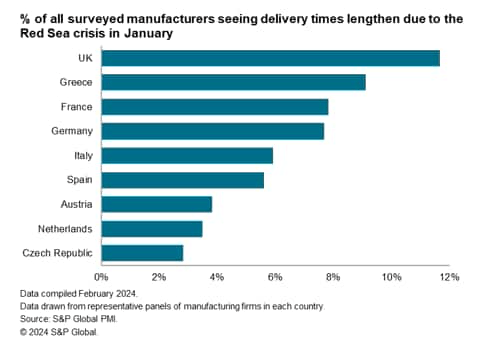

Of the European countries monitored, UK manufacturers were the worst affected, with 12% of the survey panel seeing lead times deteriorate in January. Greek producers also commonly saw delivery delays (9%), followed by France and Germany (8%).

While Europe faced the longest delays, there were reports of other economies also experiencing sea-related disruptions to their supply chains, including South Korea, Australia and USA.

Construction materials and food sectors face the longest delays

To examine where supply delays were most prominent by sector, we dive into our January Global Sector PMI data for further insights.

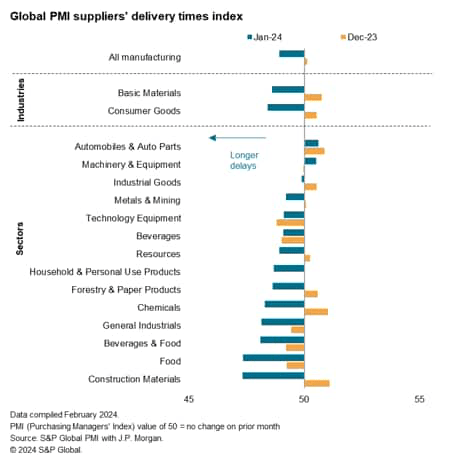

At the broad industry level, producers of both basic materials and consumer goods witnessed suppliers’ delivery times lengthening in January after having improved for 12 and 11 successive months respectively.

Detailed sector data further showed that half of the 14 sector and sector groups, for which suppliers’ delivery times data are available, experienced a renewed lengthening of lead times in January.

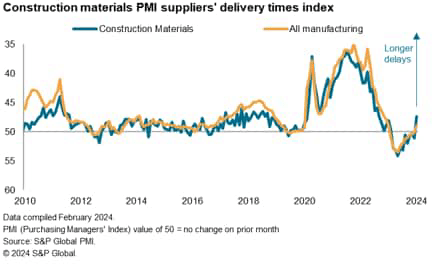

Of which, the construction materials sector saw the sharpest downturn in vendor performance. Anecdotal evidence revealed that disruptions in the Red Sea and supply shortages were the main drivers for the extension of delivery times at the start of 2024.

The beverage & food sector group followed with the second-highest incidence of global delays, with food manufacturers feeling an especially sharp worsening of supplier performance.

Although rising demand partly contributed to the pressure on supply chains, geopolitical disruptions and shortages were again listed as the key reasons for delays in shipments of beverage & food products.

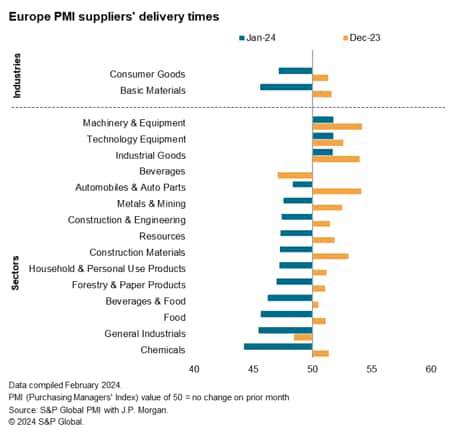

Looking specifically at Europe, where the disruptions from the Red Sea crisis had been most prominently reported by PMI respondents, both industries for which suppliers’ delivery times are tracked – basic materials and consumer goods – experienced a renewed deterioration in vendor performance.

This was likewise the case for two-thirds of the 15 detailed sectors tracked, with the respective suppliers’ delivery times indices falling below the 50.0 neutral mark to signal a lengthening of lead times in January.

However, in Europe it was not the construction materials but the chemicals sector that saw the most pronounced worsening of lead times in the beginning of 2024, corresponding to recent warnings from companies and observers of the sector.

Most sectors shrug off Red Sea impact with optimism building

One important question to ask amid the presence of delays driven by the disruptions in the Red Sea is the extent to which this has affected business activity.

Encouragingly, the overall picture presented is one of optimism among worldwide private sector firms so far being largely unaffected by the impact from the Red Sea, including convincing signs of goods producers showing no inclination to build safety stocks despite a renewed lengthening of worldwide manufacturing lead times.

To a large extent, the improvement in business optimism at the start of the year was buoyed by the loosening of financial conditions as private sector goods producers and service providers anticipate global central banks to lower rates in 2024, which is supportive of demand.

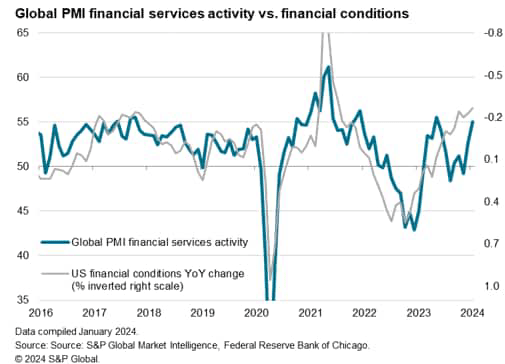

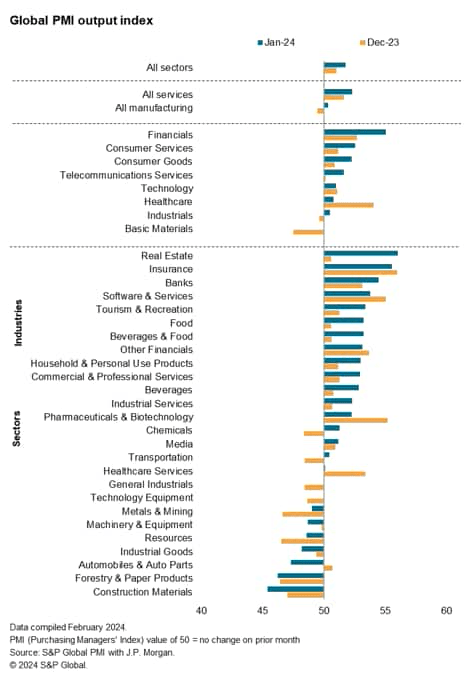

This is especially evident in financial services activity, with financials having risen to rank first among the eight industry groups in January on the back of loosening financial conditions, as shown by the Federal Reserve Bank of Chicago’s financial conditions index in the chart below.

A majority of the 26 detailed sector and sector groups also saw their respective business activity (output) index rise at the start of the new year, though unsurprisingly concentrated among services and services-related sectors.

On the flipside, the industrial goods sector group was notably the only sector group to experience a deepening of the downturn at the start of 2024, including for both construction materials and machinery & equipment sectors.

While delivery delays played a part, such as for construction materials (which faced the sharpest deterioration in vendor performance among the sectors tracked), broadly softening demand conditions within the industrial goods sector group remained the key underlying reason for the downturn in output according to anecdotal evidence.

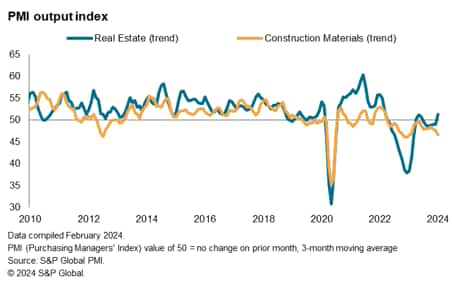

It must be added that the real estate sector, which has a strong correlation with the construction materials sector, has seen conditions improve at a more marked pace at the start of the year, thereby opening up a gap with the latter.

It will be of interest to study how and when a convergence may take place for the two.

Manufacturing cost increases

Another important aspect to investigate is the impact of the recent Red Sea episode on inflation. As it is, increased reports of higher shipping costs have surfaced among global manufacturers, though by no means to the extent seen during the pandemic.

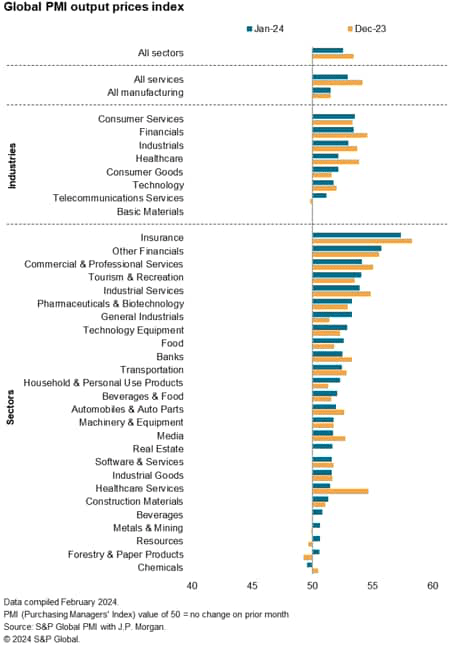

Service sectors remained at the head of the rankings in terms of cost increases, though various manufacturing sectors have also started to see a renewed increase in cost pressures.

The positive news is that the sector most affected by the Red Sea crisis – the construction materials sector – did not experience any cost spike as a result of increased shipping delays.

However, given the reliance on sea shipping for bulky and heavy construction materials, the sector may well remain at risk, especially if demand and output for the sector should converge higher with real estate activity as earlier highlighted.

A quicker rise in beverage & food costs will meanwhile be worth monitoring, given the impact this has for headline consumer inflation. Global food costs rose at the fastest pace in four months, sending output price inflation in the food-producing sector to the highest since September 2023.

Although the rate of selling price inflation for food products remain below the global average for all goods and services at present, with the prospect of increased supply constraints specifically in this sector could provide risks for higher inflation and induce greater caution among policymakers for the lowering of rates.

As it is, warnings of potentially higher food prices as a result of Red Sea disputes have been getting onto media headlines, including from major food suppliers.

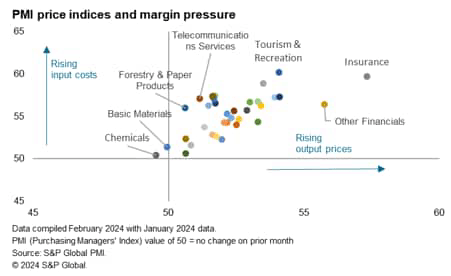

Finally, it is also the sectors that are seeing more elevated input price increases but that are unable to pass on the cost burdens to clients that should likewise be on the watchlist.

These sectors are typically the most vulnerable to weak demand should cost inflation worsen on the back of geopolitical and other disruptions.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.