audioundwerbung

Note:

I have covered Plug Power Inc. (PLUG) previously, so investors should view this as an update to my earlier articles on the company.

Following the company’s annual business update call on Tuesday, beaten-down shares of struggling fuel cell systems, electrolyzer solutions, and green hydrogen provider Plug Power Inc. or “Plug Power” staged a 30% rally on massive volume as market participants cheered a number of perceived positive developments.

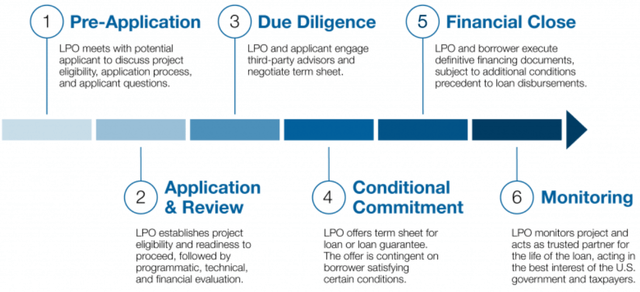

Progress on Department Of Energy (“DOE”) Title XVII Loan

On the call, CEO Andy Marsh announced that the company finalized term sheet negotiations with the DOE for a $1.6 billion loan facility with funding currently anticipated in the third quarter:

We were notified yesterday that the application has been submitted to the Credit Review Board for their final considerations and issuance of a conditional commitment.

This funding, when received, will support the development construction and ownership of up to six hydrogen production facilities, significantly advancing green hydrogen deployment in the United States.

However, the loan still needs to be approved by the DOE’s Credit Review Board and even if a conditional commitment will be provided, funding usually takes several months or even quarters.

But at this point, Plug Power doesn’t even have a conditional commitment at hand and given the company’s execution track record and dismal financial condition, I would expect the DOE, among other things, to require Plug Power to raise additional equity.

As an example, in late August, aspiring zinc-based energy storage solutions provider Eos Energy Enterprises, Inc. (EOSE) or “Eos Energy” was provided a conditional $398.6 million loan guarantee commitment by the DOE but the company still hasn’t satisfied all conditions for closing the loan.

With Plug Power’s loan application being 4x larger and covering up to six different green hydrogen plants, I would expect review and funding to take even longer. In fact, I wouldn’t be surprised to see closing being delayed beyond the U.S. presidential elections.

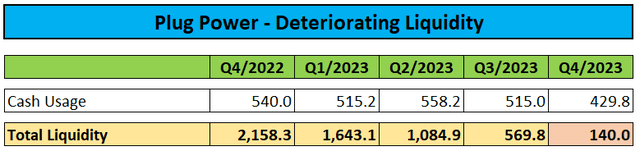

With just $140 million in unrestricted cash left in the bank at the end of Q4, the company will likely have to utilize its new $1 billion ATM facility aggressively in order to fund operations over the next few quarters.

Regulatory Filings / Business Update Call

First Liquid Green Hydrogen Plant Finally Coming Online

After missing several deadlines over the past 12 months, the company’s first liquid green hydrogen plant in Woodbine, Georgia finally commenced production of liquid green hydrogen. According to management, it will take “about three or four weeks” for production to reach the plant’s 15 tons per day nameplate capacity.

In addition, management claimed the company’s new liquid hydrogen plant in St. Gabriel, Louisiana is on track for a launch in Q3. Please note that this plant is part of a joint venture with Olin Corporation (OLN) or “Olin” and uses by-product hydrogen from Olin’s chlor-alkali production.

According to management, both plants will be producing liquid hydrogen at 1/3 of the cost of current third-party supply even without potential production tax credits thus positively impacting fueling margins over time.

Moreover, the company’s existing liquid hydrogen plant in Tennessee which reportedly was closed last summer “to clean up contamination” is expected to come back online in the near future. However, the plant was originally expected to restart operations last month already.

Company Targeting 70% Cash Burn Reduction in 2024

Based on 2023 cash usage of approximately $2 billion, management’s stated target would translate into a projected 2024 cash burn of $600 million.

In 2024, we’re targeting to reduce the cash burn by over 70% from ’23, with lower CapEx, no investment in working capital, and improved margins. We’re also targeting to leverage these improvements to achieve a positive cash flow run rate in the next 12 months. These initiatives will mean slower revenue growth in the near term compared to our prior history, but we think this paradigm shift is critical and necessary given the market conditions.

On the call, management outlined a number of initiatives to improve margins going forward:

- pursuing “significant” price increases across all offerings, including equipment, service, and fuel

- implementing a hiring freeze and using attrition to lower payroll cost

- reducing lease financing to customers

In fact, service and fueling margins are now expected to reach positive territory in the fourth quarter.

Quite frankly, I am struggling with these statements as fueling and maintenance/services are usually provided under multi-year fixed-price contracts which has resulted in the requirement to accrue substantial amounts for anticipated future losses under these contracts.

However, under U.S.-GAAP, the company is precluded from recording similar provisions for contracts that are part of its massive leasing (“PPA-“) segment.

So even if the company opts for a clean sweep in the service segment by increasing the provision for loss contracts even further thus benefiting reported gross margins going forward, leasing margins will continue to be impacted by heavily subsidized legacy fueling and service contracts.

Regardless of the accounting treatment, these losses are real and will continue to impact cash flows for years to come.

Please note that raising prices across the board is likely to impact the value proposition of the company’s offerings substantially, particularly for prospective new customers.

The same goes for the proposed reduction in lease financings which have been the key growth driver for the material handling business in recent years.

Consequently, management expects growth to slow down this year. Based on the preliminary Q4 revenues of “just over $200 million“, the company’s annual growth rate in 2023 was approximately 24%.

While each material handling site deployment provides additional recurring revenues, the price increases are likely to impact new sales across the board this year but management expects large electrolyzer contributions to make up for some of the headwinds, as outlined by CEO Andy Marsh during the questions-and-answers session:

I would expect that the electrolyzer business will be, call it, 30% to 40% of our business this year. It is certainly one of our healthier segments.

Assuming 10% growth in 2024, management’s guidance would translate into up to $400 million in electrolyzer sales this year, substantially above the company’s backlog at the end of Q3/2023.

Based on these numbers, the remaining business would suffer an approximately 25% decline in 2024.

Even assuming just $300 million in electrolyzer sales would still calculate a meaningful reduction in the legacy business.

On the call, management also outlined expectations for electrolyzer gross margins to jump to near 30% by Q4:

Our electrolyzer business is expected to reach positive gross margins in the latter half of 2024, contributing to cash flows throughout 2024. Initial high inventory costs and early underpriced deals will impact gross margin in the first half of the year, but pricing was adjusted in the second half of 2023, which will allow this business to achieve expected gross margins near 30% by the fourth quarter of 2023.

Given very weak electrolyzer market conditions with investment decisions pushed out across the globe, I just don’t see how the company would have managed to sell a substantial amount of electrolyzers at much higher prices in recent months.

As usual, it’s difficult to make sense of management’s projections, particularly in light of the current operating environment given the fact that Q4 revenues will be missing implied guidance by more than 60% and even the already vastly reduced analyst consensus by almost 50%.

Looking more specifically at Q4 2023, we had shared previously that we thought a lot of these factors would result in final sales coming in lower than expected. But the market dynamics were even more unfavorable in their impact than we expected in the fourth quarter of 2023.

As a result, it looks like the sales for fourth quarter will come in at just over $200 million. And we’re still closing the results and we have a lot of new customer arrangements and new products that are complex, but this is our current estimate.

Please note the references to “new customer arrangements” and “new products that are complex” as a warning that auditors might have a different view on revenue recognition, similar to last year when final Q4 revenues came in 15% below the preliminary number provided by management on the January 2023 business update call.

Assessment

DOE Loan

While there’s been important progress, initial funding will take at least a couple of quarters thus likely resulting in the requirement to raise additional equity sooner rather than later. Please note that the loan still requires approval and might come with some tough conditions including a potential equity raise.

Cash Usage

I would indeed expect the company’s cash burn to come down significantly this year mostly based on substantially lower capital expenditures and potential working capital reductions. However, reducing cash usage by a whopping $1.4 billion appears to be an overly aggressive target.

Margin Improvements

While fueling gross margins should benefit from Plug Power’s own liquid hydrogen production over time, I do not expect them to come even remotely close to break-even levels by year-end simply because of the company’s multi-year contracts with customers.

Same goes for the service and leasing segments. Even assuming a GAAP accounting benefit for the service segment, this is not going to change the fact that Plug Power has committed to long-term service contracts well below costs and consequently is likely to suffer outsized losses for years to come.

Electrolyzer sales of up to $400 million and segment margin guidance of “near 30%” by the end of this year appear to be the most aggressive projections made on the call. Given persistently weak market conditions, it’s hard to imagine the company coming even close to these numbers. Please note that management has missed its projections for the electrolyzer segment by a wide margin in each given year.

Bottom Line

Plug Power preannounced abysmal fourth quarter results and made some major changes to its business approach to improve margins and lower cash usage going forward.

On a more positive note, the company’s new green hydrogen plant in Georgia finally commenced operations and Plug Power made important progress on its loan application with the DOE.

However, with the potential loan not expected to close anytime soon and just $140 million of unrestricted cash left at the end of Q4, the company will likely have to utilize its new $1 billion ATM facility aggressively in order to bridge the funding gap.

As usual, I am struggling to make sense of management’s projections on the call, particularly with regard to electrolyzer sales and margin contributions.

In addition, I wouldn’t be surprised to see revenues decreasing year-over-year as compared to management’s expectations for continued growth.

While market participants cheered the perceived good news, I do not expect analysts to follow suit as vastly reduced growth expectations will result in the requirement to adjust models and lower price targets even further.

With markets near all-time highs, momentum might persist for another couple of sessions but I would expect the stock to give up most of the gains over the coming weeks as traders move on to assumed greener pastures ahead of an anticipated abysmal Q4 report next month and open market sales kicking into high gear.

Consequently, I am reiterating my “Sell” rating on the shares.