PhonlamaiPhoto

Plexus Corp. (NASDAQ:PLXS) recently delivered better than expected results and decent guidance. In addition, the expectations from analysts are not pessimistic. PLXS appears to be receiving a lot of demand for products in the healthcare sector, and the price of components in this business segment is increasing. Additionally, if transformative efforts continue, and stock repurchases around current trading levels do not stop, the stock price could boost. Yes, there are risks from supply chain issues, challenges of inventory management, and competition, but PLXS does not look expensive.

Plexus

With a global team of nearly 25,000 professionals, the company delivers innovative solutions across the product lifecycle, specializing in the design, manufacturing, and servicing of complex products in demanding regulatory environments. Its optimized integrated supply chain supports solving challenges from development to the end of product life.

Source: Company’s Website

Plexus serves global leaders in sectors such as healthcare, life sciences, industrial, and aerospace/defense, supporting 28 facilities in the Americas, Asia-Pacific, and Europe/Middle East/Africa.

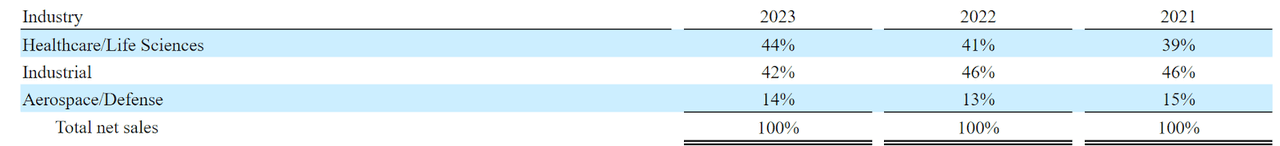

Plexus specializes in serving clients in the healthcare/life sciences, industrial, and aerospace/defense sectors. Each sector has a vice president and business development and customer management leaders, leading expert teams in development, supply chain, engineering, and manufacturing. These teams, with sector experience, execute strategies aligned with specific regulatory and quality requirements. The company serves approximately 150 diverse clients, with GE HealthCare Technologies Inc. (GEHC) highlighted as a key contributor. The separation of GE Healthcare as an independent entity reflects significant milestones in the business relationship of the company.

With that about the business model, it is worth mentioning that Plexus delivered more EPS GAAP than expected and better revenue than expected. EPS stood at $1.44, and quarterly revenue was close to $1.02 billion. Given the results, I did not really comprehend the recent reject in the share price, so I decided to run a complete valuation model of Plexus.

Source: SA

New Q1 2024 Guidance, And Beneficial Expectations From Other Market Participants

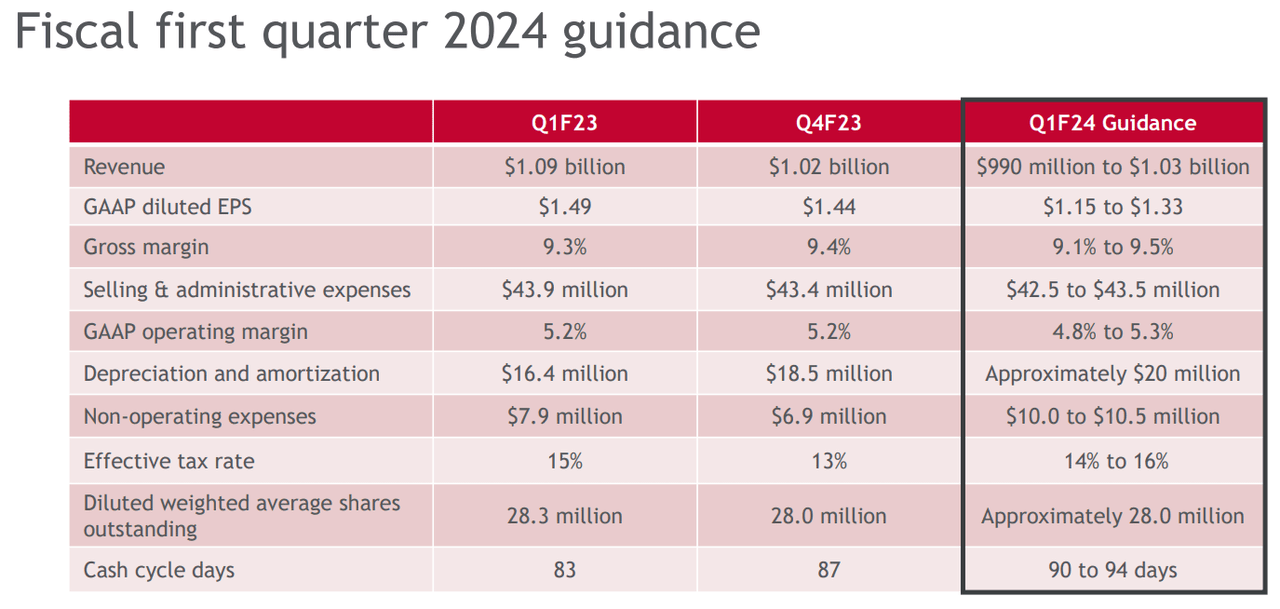

Q1 2024 revenue is expected to be close to $990-$1.03 billion, with a gross margin of about 9.1%-9.4%, GAAP operating margin of 4.8%-5.3%, and D&A of about $20 million. The numbers are not significantly better than that in Q4 2023, but I do not see them worse. I really do not see why investors would dump the shares at this point in time.

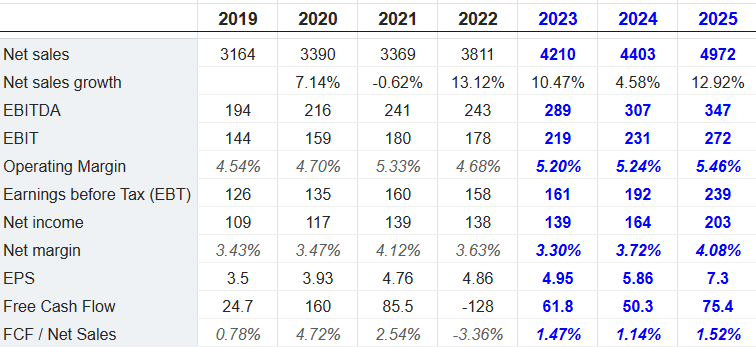

Investment analysts expect double-digit net sales growth in 2023, 2024, and 2025, operating margin growth, and FCF/net sales growth in 2025. I believe that analysts out there are optimistic. More in particular, 2025 net sales are expected to close to $4972 million, with net sales growth of 12%, 2025 EBITDA of $347 million, and net income close to $203 million. Finally, 2025 free cash flow would be close to $75.4 million, and FCF/net sales would be close to 1.51%.

Source: Market Screener

Stable Balance Sheet, And No Liquidity Issues

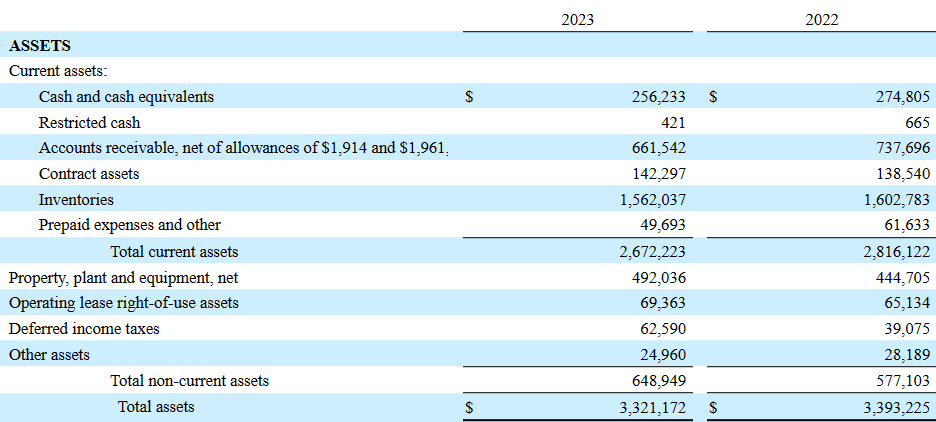

In the last quarterly report, the company noted cash and cash equivalents worth $256 million, accounts receivable of about $661 million, inventories of about $1562 million, and total current assets of close to $2.672 billion. The asset/liability ratio is larger than 1x, and the total amount of cash is not small. Hence, I believe that liquidity does not seem an issue here.

Among the list of non-current assets, the largest asset is property, plant, and equipment, which stands at about $492 million. Additionally, the company noted operating lease right-of-use assets close to $69 million and total assets of about $3.321 billion. The asset/liability ratio is larger than 1x, so I think that the balance sheet appears quite stable.

As compared to the same quarter in 2022, Plexus did not really see significant changes in the total amount of assets. Cash in hand, total current assets, and inventories declined. Since liabilities also declined, so I do not really think shareholders would worry.

Source: 10-k

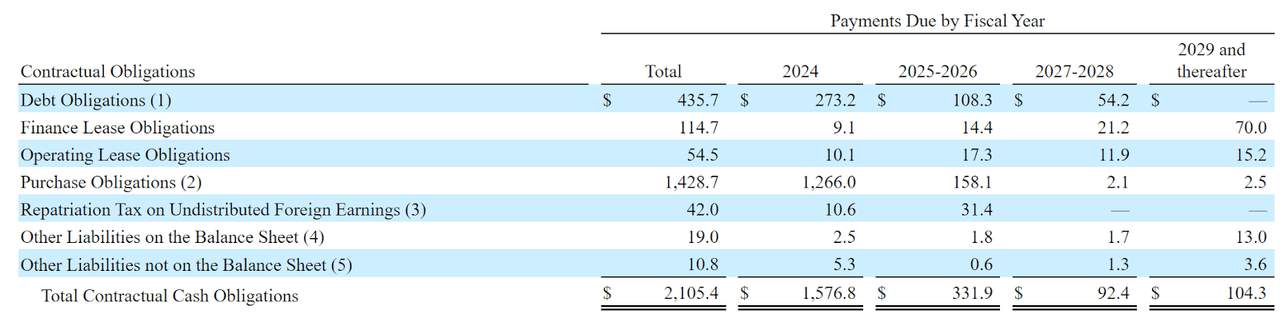

Given the total amount of cash, I am not really concerned about the net debt or the debt obligations. With that, I think that reviewing the debt obligations is necessary for running my DCF.

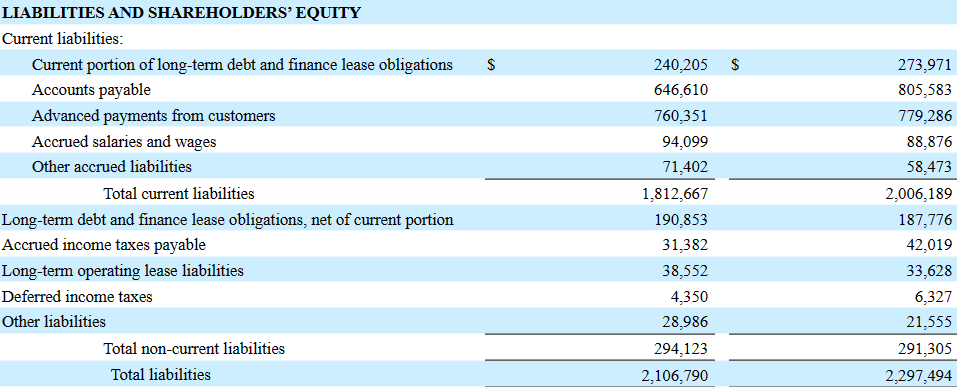

The current portion of long-term debt and finance lease obligations stands at about $240 million, with total current liabilities of $1812 million. Long-term debt and finance lease obligations stood at close to $190 million, and total liabilities are equal to $2.106 billion.

Source: 10-k

The type of financing issued by Plexus is also worth noting. On June 15, 2018, Plexus issued $150 million of senior unsecured notes in a private placement, divided into $100 million of 4.05% Series A Senior Notes due 2025 and $50 million of 4.22% Series B Senior Notes due 2028. These bonds are subject to customary operating and financial agreements, including financial ratios and covenants.

Additionally, in June 2022, the company refinanced its senior unsecured revolving credit facility, expanding the maximum commitment to $500 million and extending the maturity to June 9, 2027.

The following is a table from a recent annual report. I believe that the company may have to negotiate its debt obligations in 2024. If management obtains good terms for its debt obligations, I believe that Plexus could benefit from the lower cost of capital.

I Would Expect More Net Sales Growth As Exposition To The Healthcare Sector Increases

Plexus seemed to be obtaining more exposure to the healthcare sector as the net revenue coming from this business segment increased. Production ramps of new products for existing customers increased, and customer end-market demand also increased. There is also the fact that component prices increased, which led to higher net sales.

The boost was also driven by higher pricing associated with inflated component prices and a $10.8 million boost in production ramps for new customers. Source: 10-k

I believe that investing more in the healthcare sector is a good bet from Plexus. The global healthcare IT market is expected to grow at close to 18.3% from 2023 to 2032, so I think the overall net sales of Plexus will most likely benefit from the incoming market growth.

The global healthcare IT market was estimated at USD 200 billion in 2022 and is expected to hit around USD 1069.13 billion by 2032, poised to grow at a CAGR of 18.30% from 2023 to 2032. Source: Healthcare IT Market Size To Hit Around USD 1069.13 Bn By 2032.

Recent Increases In Restructuring Were Due To An Arbitration Decision In Norway, But The Efforts Could Bring Flexibility From 2024

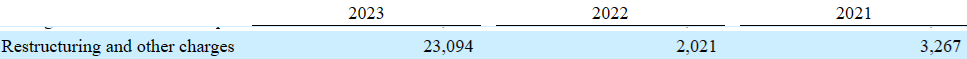

In the last annual report, the total amount of restructuring increased from close to $2 million to about $23 million, which appears quite significant. I do appreciate the efforts being made by management, but it is worth noting that a significant part of the charges was related to an arbitration decision in Norway regarding a contractual matter.

Source: 10-k

During fiscal 2023, the Company paid a one-time, non-recurring payment of $15.8 million related to an arbitration decision in Norway regarding a contractual matter concluded in May 2023. This payment resulted in a $14.2 million one-time, non-recurring charge, net of insurance recoveries and amounts previously accrued. The Company no longer provides services for this customer. Source: 10-k

I believe that the restructuring efforts currently being made could bring significant financial flexibility in the coming years. In 2021, 2022, and 2023, Plexus noted facility translation and changes in the APAC, AMER, and EMEA segments.

During fiscal 2023, the Company incurred restructuring and other charges of $8.9 million, which consisted of severance from the reduction of the Company’s workforce and a lease agreement termination. Source: 10-k

During fiscal 2022, the Company recorded $2.0 million of restructuring and impairment charges primarily due to employee severance costs associated with a facility transition in the Company’s APAC segment. Source: 10-k

During fiscal 2021, the Company recorded $3.3 million of restructuring and impairment charges which consisted of severance from the reduction of the Company’s workforce, primarily in the AMER and EMEA segments. Source: 10-k

The company knows well how to hire and train employees because the headcount only increased in the last two decades. With this in mind and considering the number of years in the industry and the know-how accumulated, I am expecting good management decisions and advance business growth.

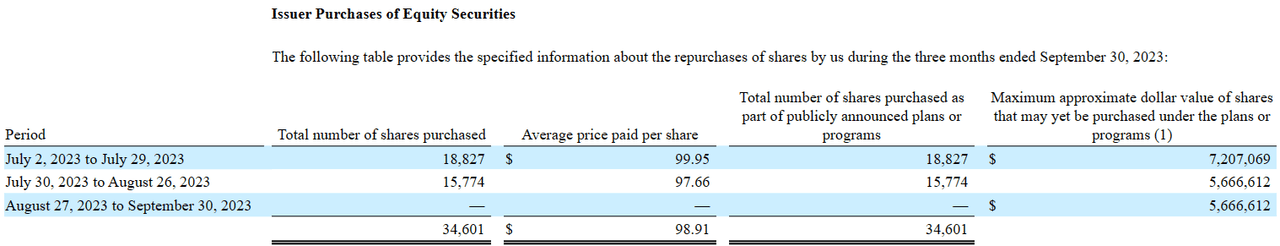

Stock Repurchases At Close To $98 Per Share Could guide To Stock Demand and Share Price Increases

In the most recent report, Plexus noted share repurchases at $99, $97, and $98 per share. The shares are currently not trading far from these levels. I believe that advance acquisition of shares will most likely guide to stock demand, and the share price, at some point, could boost. Additionally, with Plexus buying its own shares, institutional investors may also ascertain to buy, which may boost the cost of capital, and boost the fair valuation of Plexus.

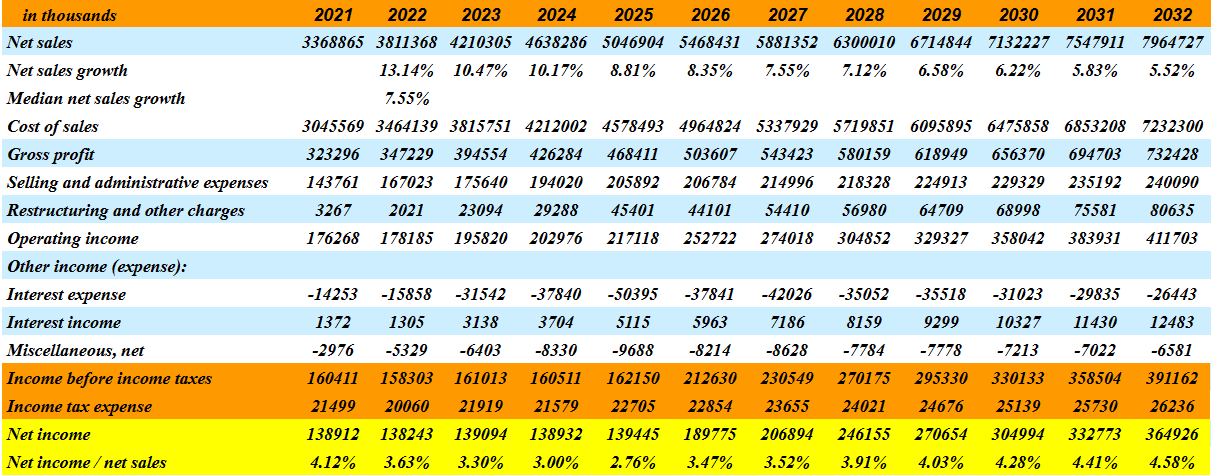

My Income Statement Expectations Based On Previous Assumptions

My expectations are in line with the expectations of other investment analysts, but I also included lower net sales growth from 2025 to 2032. Median net sales growth is expected to be close to 7%. From 2024 to 2032, I also included growing cost of sales, growing operating margin, and net income growth. The net income/sales would be close to 3%-4.58%, which is not far from the numbers reported in 2021 and 2022. In fact, I did not really think out of the box.

More in particular, I expect 2032 net sales close to $7.964 billion, 2032 cost of sales of about $7.232 billion, and operating income close to $411 million. Besides, with 2032 interest expense close to -$27 million, 2032 income before income taxes would stand at $391 million, with 2032 net income of about $364 million.

Source: My Expectations

My Cash Flow Expectations Based On My Own Assumptions And Previous Financial Figures

My cash flow projections include not only net income growth, but also D&A growth, share-based compensation declines, and changes in accounts receivable.

More precisely, I included 2032 net income of about $364 million, with 2032 depreciation and amortization of about $113 million, 2032 share-based compensation expense and related charges of close to $5 million, provision for allowance for doubtful accounts worth $9 million, and changes in accounts receivable of about $973 million.

Besides, with contract assets of close to $19 million and changes in accounts payable of -$1.570 billion, 2032 cash flows provided by operating activities would be close to $596 million. Finally, with 2032 payments for property, plant, and equipment close to -$116 million, 2032 FCF would be close to $481 million.

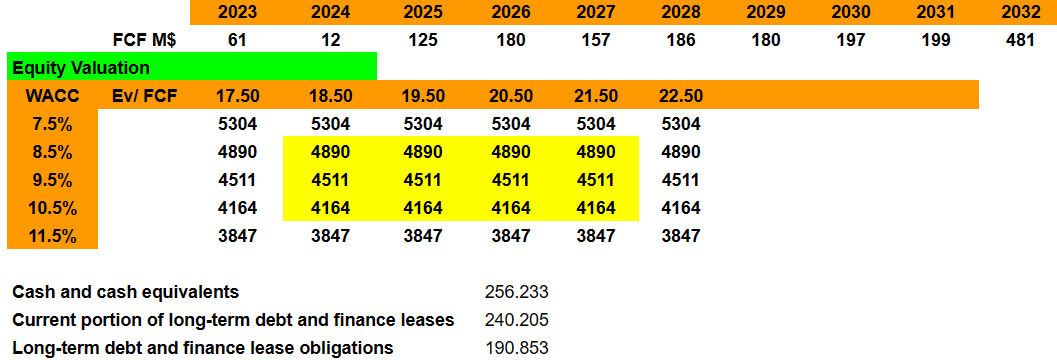

My DCF Valuation Using The Previous Cash Flow Statements

In order to design the DCF model, I took a look at the WACC reported and used by Plexus, which was noted in a recent annual report. The weighted average cost of capital included stands at close to 9.3%. Given these figures, I included a WACC between 7.5% and 11.5%.

We review our internal calculation of WACC annually. Our WACC was 9.0% for fiscal 2023 and 9.3% for fiscal 2022. By exercising discipline to produce ROIC in excess of our WACC, our goal is to create value for our shareholders. Fiscal 2023 ROIC of 13.4% reflects an economic return of 4.4%, based on our weighted average cost of capital of 9.0%, and a fiscal 2022 ROIC of 13.0% reflects an economic return of 3.7%, based on our weighted average cost of capital of 9.3%. Source: 10-K

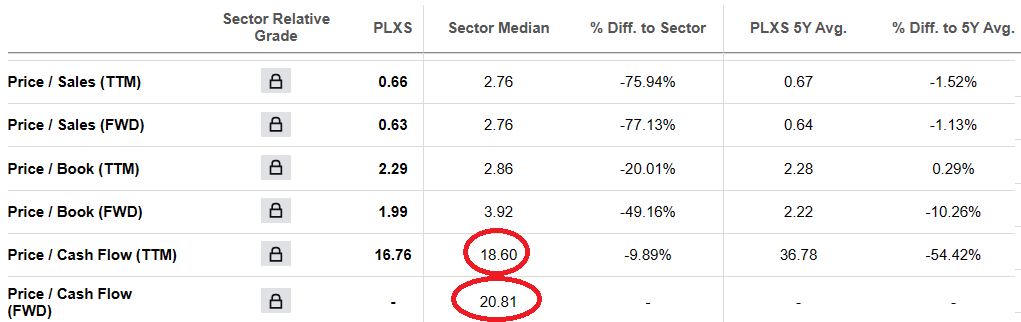

For the exit multiples included in the model, I took a look at the valuation in the sector because I believe that the past EV/FCF reported by Plexus was quite volatile. According to Seeking Alpha, the sector median Price/Cash Flow stands at close to 18x-21x. Hence, I assumed that the exit multiples used by most financial professionals would not be far from these figures.

Source: SA

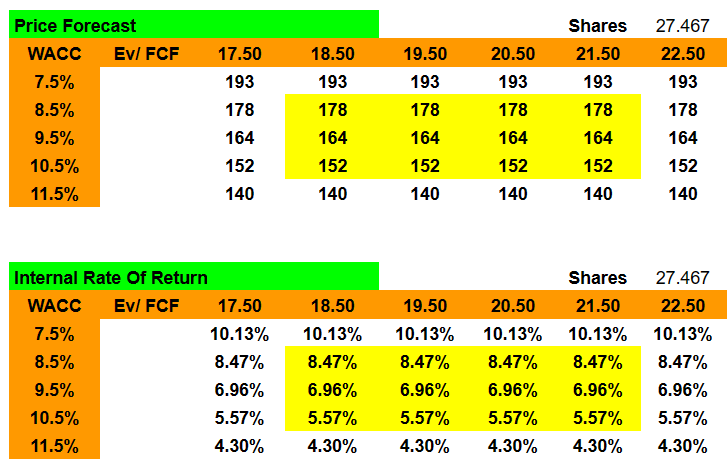

With a WACC of about 7.55%-11.55% and exit multiples close to 17.55x and 22.55x, which I believe are conservative multiples, I obtained an implied valuation close to $3.855 billion and $5.3055 billion. Note that I included cash close to $255 million, and subtracted current debt and finance leases of about $240 million as well as long-term debt of $190 million.

Source: My DCF Model

If we divide by the share count, my price forecast would be a maximum of $192.5 per share, a minimum of $140, and a median of around $165 per share. The internal rate of return would be as large as 10.55%.

Source: My DCF Model

Risks, And Competitors

In my opinion, Plexus faces significant challenges related to inventory and supply chain management as it finances the initial purchase of materials and components for turnkey projects. Changes in forecasts or cancellations can produce excess inventory and additional expenses. Offering inventory management programs can boost financial exposure.

In my opinion, the company faces competition from companies with similar services, more established in specific sectors, or with greater financial resources. Smaller competitors work in specific sectors and limited regions. Plexus also competes with its customers’ internal capabilities. Its advantage lies in offering a complete range of services throughout the product life cycle at the global level. However, factors such as manufacturing volumes, flexibility, and complex regulatory requirements produce additional investments and costs as compared to competitors.

My Opinion

Plexus did not only deliver better than expected quarterly results, but also a recent boost in sales from the healthcare sector as a result of higher demand and price component increases. Given the expected growth of the IT healthcare market, I believe that Plexus is well-positioned for growth in the next decade. Management is currently making a significant amount of transformation efforts with facility changes in the APAC, AMER, and EMEA segments, which may bring future financial flexibility. Finally, future stock repurchases will most likely boost the fair valuation of Plexus. Despite facing challenges of inventory management and competition in a global market, I believe that the company does not appear expensive.