Pinterest (PINS -1.75%) stock trades at about $35 per share. But according to Wall Street, it should trade closer to $43 per share, representing a nearly 23% upside today.

TipRanks is tracking 30 analysts who follow Pinterest stock. Each of these analysts has their own opinion about where the stock is going, and not all of them think it’s a buy; some even forecast modest downside. But when averaging all the price targets out, the analyst community expects the roughly 23% aforementioned upside.

However, this consensus upside may be just the start of the upside for Pinterest stock. Let’s look at the investment thesis for Pinterest stock. Then see what’s happening right now to support an optimistic outlook.

The key to Pinterest’s upside

As a type of social media platform, Pinterest would ideally grow its user base. More eyeballs are always better. However, with nearly 500 million monthly active users as of the end of 2023, it’s not absolutely essential for the company to grow its user base. It can still be a winning investment if it better monetizes what it has.

Pinterest mostly monetizes its audience by displaying ads and it undoubtedly has room to improve. Consider that Meta Platforms‘ Facebook made $44.60 per active user in 2023. For comparison, Pinterest only made $6.44 per active user in 2023.

There is a massive disparity between these numbers for Facebook and Pinterest. I’m not suggesting that Pinterest will reach Facebook’s monetization levels anytime soon. However, the magnitude of the disparity suggests that Pinterest can do much better at monetizing what it already has.

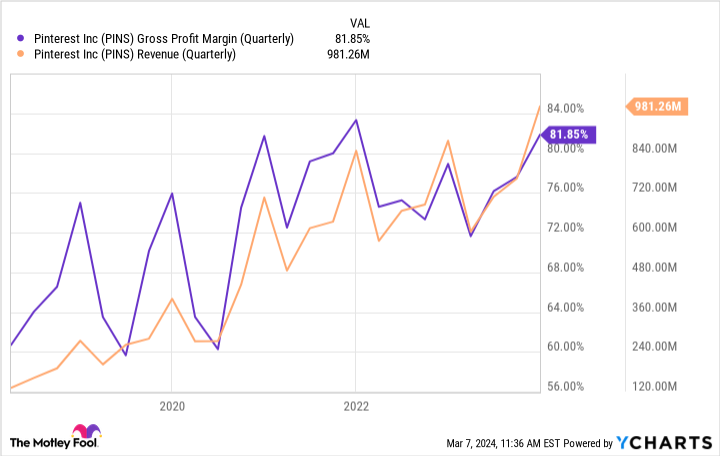

Of course for the stock to have upside, Pinterest can’t only grow its revenue; it must also grow its profits. If it can improve monetization rates, then its gross profit margin should logically improve — it doesn’t cost more money to earn more money for doing the same thing. And indeed that’s been the long-term trend for its gross margin, as seen below.

PINS Gross Profit Margin (Quarterly) data by YCharts

Moreover, Pinterest’s management needs to keep operating expenses in check to improve this stock’s chances of beating the market.

Here’s how Pinterest can improve monetization and keep operating expenses in check in 2024. And it’s why I think a 23% upside might be only the beginning.

What’s going right for Pinterest

Many investors gravitate toward companies with founders in the CEO position. And to be sure, many great investments have been helmed by founders. However, Pinterest transitioned away from its co-founder Ben Silberman when it hired CEO Bill Ready in June 2022. And I believe this has improved Pinterest’s prospects.

Ready has made some fundamental changes to Pinterest, including securing partnerships with big-time tech titans. Its two recent partnerships are with e-commerce giant Amazon and advertising behemoth Alphabet, the parent company of Google.

Amazon is pushing advertisements from its third-party merchants onto Pinterest’s platform in an effort to increase sales conversions. The benefit for Pinterest is two-fold. First, it increases ad supply on its platform, which can push revenue per ad slot higher. Second, it reduces its expenses because it’s increasing its supply of ads without spending heavily on sales and marketing.

When it comes to monetization, Pinterest’s results are meager outside of the U.S., Canada, and Europe. In the rest of the world, the company has 266 million monthly active users — more than half of its user base. But it only generated revenue of $0.50 per user on average in 2023.

One of the reasons Pinterest’s monetization is so low in the rest of the world is that it hasn’t even started displaying ads in some regions. That’s what its partnership with Alphabet’s Google intends to correct.

On the earnings call to discuss Pinterest’s financial results for the fourth quarter of 2023, Ready said, “This partnership will focus on monetizing several of our currently unmonetized international markets.” Therefore, investors can expect that its $0.50 per user will trend higher in 2024 and beyond. That’s a big deal considering it represents more than 50% of Pinterest’s users.

In conclusion, it’s important for Pinterest’s revenue to climb and for expenses to remain under control so that its profits can go up and support upside with the stock. To do this, the company needs to improve monetization. And as I’ve explained, partnerships with Amazon and Google can help in that regard.

Therefore, I agree with Wall Street that Pinterest stock could have 23% upside. And if these partnerships really start to pay off, 23% upside might be just the beginning of much bigger gains over the long term.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jon Quast has positions in Pinterest. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, and Pinterest. The Motley Fool has a disclosure policy.