Michael M. Santiago/Getty Images News

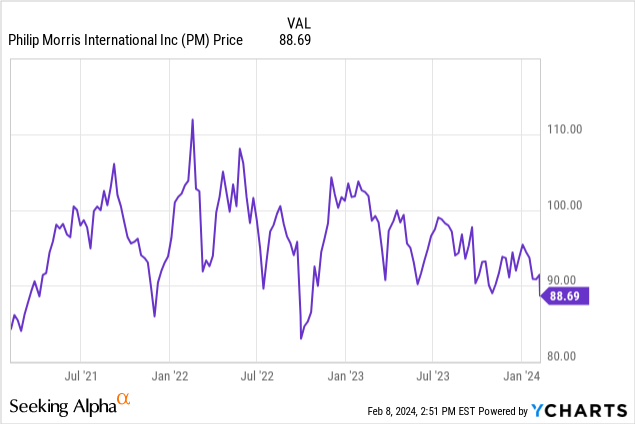

Philip Morris International Inc. (NYSE:PM) Q4 results can be described as mixed between a headline EPS miss, while revenue came in slightly above expectations. This report caps off a volatile year for the stock amid not only a tough macro environment, thinking about the impact of high-interest rates, but also the industry backdrop facing a secular decline in traditional cigarettes.

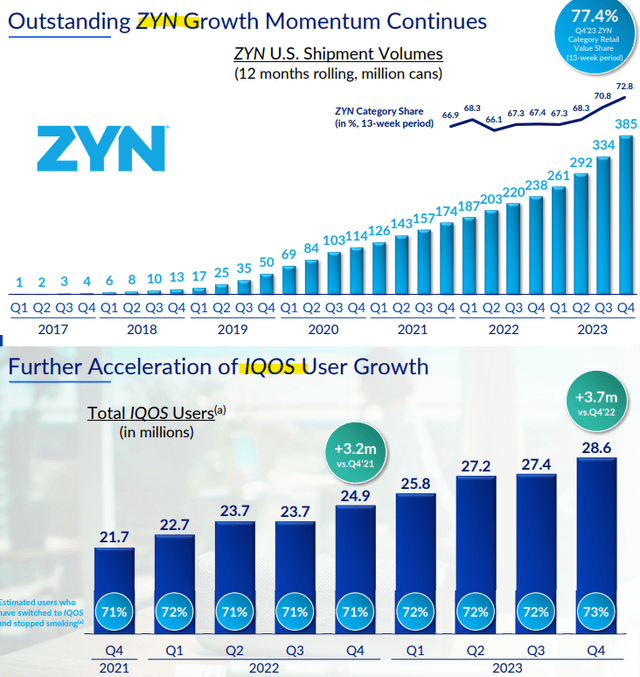

That being said, the company appears to be finding success with its ongoing transformation toward a smokeless portfolio. Impressively, the “IQOS” e-vapor brand has surpassed “Marlboro” in terms of its global net revenue contribution. Separately, the category of nicotine pouches has proven to be surprisingly popular with the “ZYN” brand capturing a climbing market share reaching 77% in the U.S.

Our take is that while PM isn’t perfect, the value in the stock is very compelling considering the 5.9% dividend yield. The company remains highly profitable and we see room for stronger growth going forward. Acknowledging the regulatory concerns and further weakness in cigarette sales, PM remains well-positioned to deliver positive returns going forward.

PM Earnings Recap

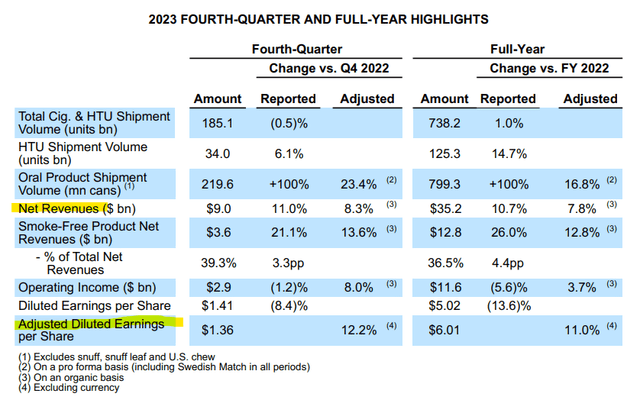

PM Q4 non-GAAP EPS of $1.36 was $0.09 below estimates but still climbed by 12.2% year-over-year. Revenue of $9.05 billion represented an 8.3% y/y increase, marginally above the consensus by $40 million.

If there was a disappointment this quarter, the cigarette side of the business was weaker than expected with volumes down by -1.9% y/y, with a sharper decline to end the year compared to trends in prior quarters. The company has attempted to manage this headwind through pricing increases while the global market share still managed to tick up by 10 basis points higher for the year to 23.7% compared to 23.6% in 2022.

On the other hand, the volume momentum from heated tobacco units (HTU) is more favorable, up 6.1% y/y, while oral nicotine is even stronger with a 23.4% increase in terms of millions of cans sold. Smoke-free products now represent 39.3% of the total business, up from 36% in Q4 2022.

That shift in the business is seen as a long-term earnings driver but did add to some margin volatility this quarter. The adjusted operating margin of 33.7%, down from 36.5% in the period last year considering a marketing push, higher research costs, and added manufacturing expenses.

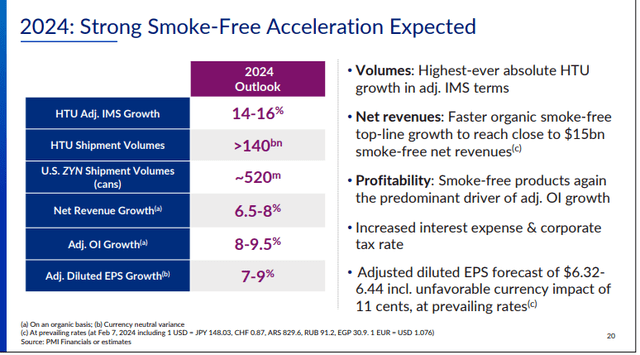

In terms of guidance, the expectation is for further acceleration of the smoke-free business. Management is targeting adjusted in-market volume sales HTU growth for HTU between 14-16%, exceeding the 2023 benchmark. A forecast for U.S. ZYN shipment volumes at 520 million cans, represents an increase of 35% over the rolling twelve-month volume from this last Q4.

Overall, an outlook for net revenue growth between 6.5% and 8% should be enough for adjusted EPS to climb in the 7-9% range, implying a 2024 midpoint target of $6.38.

What’s Next For PM?

There are a lot of moving parts when looking at Philip Morris but our takeaway is that the business has materially changed in recent years which means it’s likely misunderstood in the context of its current strategy direction for a large portion of the market.

It’s not a secret that cigarette smoking rates are falling in most of the world, and that headwind likely explains much of the underlying pessimism toward the stock and its deeply discounted valuation. Still, the bigger story here is the strength in the new products that will ultimately represent a more sustainable future for the company.

Nicotine pouches, for example, have evolved into a global phenomenon, with the ZYN brand the clear category leader in the United States with the latest trends suggesting a sequentially quarterly acceleration.

With the IQOS e-vapor product, while this is a highly competitive segment globally including cheaper alternatives, Philip Morris here benefits from its brand recognition as a reflection of quality control.

Keep in mind that IQOS is not currently for sale in the U.S. although the possibility of a future commercialization effort could represent a significant new growth driver.

Simply put, the opportunity here is that as people quit cigarettes, the smoke-less products represent a less harmful alternative to smoking which is a claim that is backed by several independent “harm reduction studies“.

The point here is to say that there are plenty of reasons to maintain confidence that the tobacco industry has a long future with plenty of room for PM to consolidate its market position.

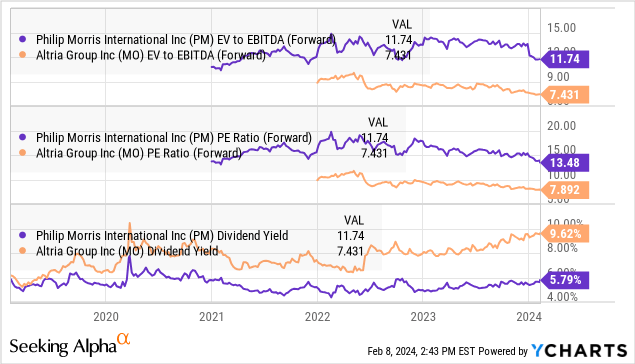

We’d say that Philip Morris’s market lead particularly in the nicotine pouch category through ZYN highlights its major advantage and strength over perennial competitor Altria Group, Inc. (MO). In this case, even as PM trades at a premium MO across various valuation multiples, we believe that spread is justified based on its stronger positioning and growth outlook.

It’s also worth noting that PM trading at a 13.5x forward P/E multiple appears undervalued relative to the historical average for that metric closer to 17x over the past decade.

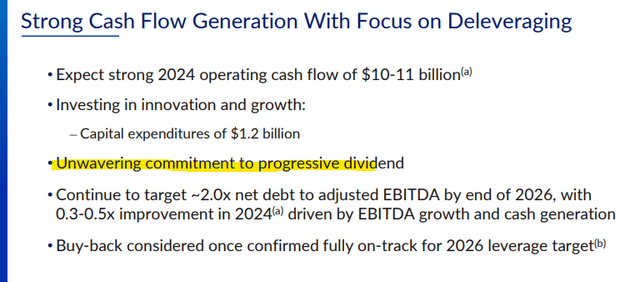

At the end of the day, the conviction here is that PM’s dividend of $1.30 per share quarterly dividend with a forward yield of 5.9% is well supported by a strong balance sheet and underlying cash flows.

Comments by management confirm their intention to a future dividend increase, with a roadmap to initiate share buybacks targeting a narrowing net leverage ratio of around 2x by the end of 2026.

Final Thoughts

We rate PM as a buy focusing more on the attraction and value of its yield as a solid dividend stock. To the upside, a price target is around $97.50, reclaiming a high from Q3 2023 is on the table assuming we get a string of positive results over the next few quarters.

We want to see continued momentum from the smoke-less portfolio and any news of a potential U.S. IQOS launch likely working as a catalyst for more positive sentiment. An outlook for stabilizing or lower interest rates through 2024 should also be positive for the stock.

In terms of risks, we won’t downplay the industry uncertainties considering regulatory actions in various countries including changes in the tax environment from different regions. A scenario where global macro conditions deteriorate would also undermine the earnings growth outlook.