marchmeena29

Thesis

The Invesco Fundamental High Yield Corporate Bond ETF (NYSEARCA:PHB) is a fixed income exchange traded fund. The vehicle is based on the RAFI Bonds US High Yield 1-10 Index and will invest at least 80% of its total assets in the securities that comprise the respective index. As per its literature:

The Index is comprised of US dollar-denominated high yield corporate bonds that are SEC-registered securities or Rule 144A securities with registration rights and whose issuers are public companies listed on a major US stock exchange. Only investible nonconvertible, non-exchangeable, non-zero, fixed coupon high-yield corporate bonds qualify for inclusion in the Index. Based on the Fundamental Index® methodology developed by Research Affiliates, LLC, the Index is compiled and calculated by ALM Research Solutions, LLC. The Fund does not purchase all of the securities in the Index; instead, the Fund utilizes a “sampling” methodology to seek to achieve its investment objective. The Fund and the Index are rebalanced monthly and reconstituted annually in March.

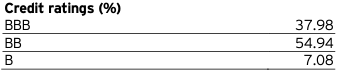

PHB is therefore another US high yield fund, even though its composition might sometimes contain investment grade credits due to rating upgrades. For this very reason it is currently sporting a large ‘BBB’ sleeve:

Ratings (Fund Fact Sheet)

The main culprit here is Ford (F) which recently got upgraded by S&P from BB+ to BBB-. The move follows a rating upgrade from Fitch, which occurred in September. As per the fund literature, the index is reconstituted annually in March, so expect investment grade credits to disappear in the April 2024 collateral tape. Until then the fund will end up clipping a lower yield from its Ford holdings, given the upgrade and improved pricing which is already reflected in what the bond gets on the secondary market. A quicker rebalance of the index would be preferable here, so that the ETF does not end up with large investment grade sleeves for long periods of time post upgrades.

The other take-away here is that the ETF is on the conservative side, with an overweight positioning in BB names, with single-B and CCC names almost non-existent here. However, its conservative build does not translate into much more attractive analytics:

| Name | St Dev | Sharpe |

| PHB | 7.6 | -0.13 |

| ANGL | 8.8 | -0.12 |

| HYDB | 8 | +0.02 |

In the ‘Performance’ section below we go into detail regarding the fund’s historical figures, but suffice to say it lags significantly. A retail investor should get much better risk analytics when a fund is conservative, versus ‘regular’ high yield funds, otherwise the risk/reward metrics are just not there.

The fund has a very low current 3build.0-day SEC yield of only 6.3%, mainly due to the collateral composition which is very high rated. We would have also liked to see more duration in the portfolio at this stage with peak rates behind us. Taking duration risk at this stage of the economic cycle is a smart play, and a good risk/reward proposition.

Analytics

- AUM: $0.64 billion.

- Sharpe Ratio: -0.13 (3Y).

- Std. Deviation: 7.6 (3Y).

- Yield: 6.30%. (30-day SEC yield)

- Premium/Discount to NAV: 0%.

- Z-Stat: n/a.

- Leverage Ratio: 0%.

- Effective Duration: 3.7 years

- Expense Ratio: 0.5%

- Composition: US HY

Fund composition

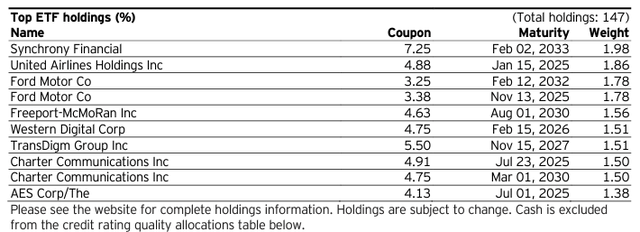

The fund contains a granular portfolio of high yield credits or names which have recently got upgraded:

Top Holdings (Fund Fact Sheet)

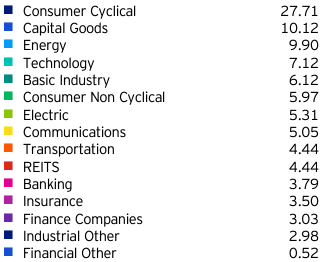

The largest concentration is to consumer cyclicals, which make up over 27% of the collateral pool:

Sectors (Fund Fact Sheet)

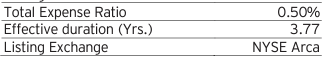

The vehicle currently sports a duration which is on the low side at 3.7 years:

Duration (Fund Fact Sheet)

In today’s environment where risk-free rates have peaked, and the market is starting to price even March 2024 rate cuts, a retail investor should want to be long duration, hence the higher the duration figure for a fund, the better in today’s market.

Historic performance – lagging severely

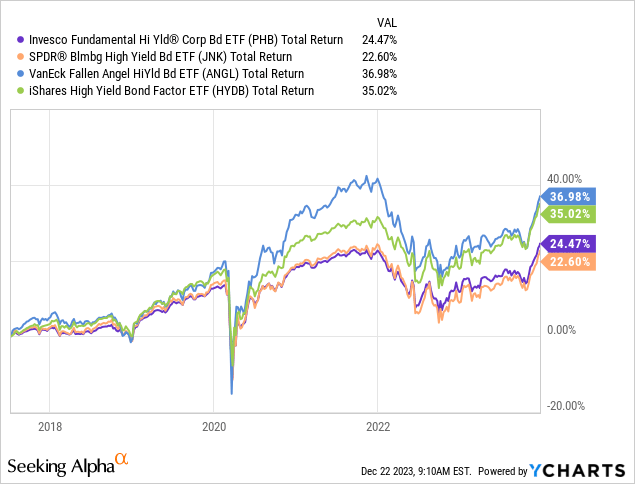

The fund has a poor historic performance when compared to other alternatives in the space:

We are benchmarking the ETF with the SPDR Bloomberg High Yield ETF (JNK), with the VanEck Fallen Angel High Yield Bond ETF (ANGL) and the iShares High Yield Bond Factor ETF (HYDB). We have covered ANGL and HYDB before on the Seeking Alpha platform, and they represent very robust expressions of views on US high yield with attractive risk/reward metrics.

A retail investor looking to allocate cash in the sector should either go with large AUM funds like JNK that provide ample liquidity with mammoth AUMs, or allocate to smaller outperformers like ANGL or HYDB. PHB does not fall in either category. We feel the fund could do better by tweaking the index or taking a more active approach to its collateral allocation.

Where should you invest in the high yield space right now

A retail investor is best served to look for funds that offer attractive risk/reward analytics when looking at current yields, standard deviations and historic performances. We are at peak rates, so providing a current yield that is equivalent to some short term funds like VRIG does not really cut it for PHB. Furthermore the fund does not take enough duration risk for the current environment, and with credit spreads at very tight historic levels there is very little upside in the next 6 months here from credit spread compression. We like ANGL and HYDB for retail investors, while institutional names looking to trade in large block trades are better served by very liquid instruments like JNK or HYG.

Conclusion

PHB is a fixed income high yield fund. The vehicle is built to follow the RAFI Bonds US High Yield 1-10 Index which is reconstituted annually. The index aims to take a fundamentals based approach to choosing credits, but is not quick enough to remove credits which have been upgraded, thus taking investment grade risk for long periods of time. The fund however has similar risk/reward analytics to ETFs taking on more credit risk like JNK, while golden standards in the HY ETF space outperform both names.

PHB currently fails to produce an attractive 30-day SEC yield and it takes too little duration risk for the current point in the monetary cycle when peak rates are behind us. With some short term funds like VRIG providing a similar 30-day SEC yield, we are hard pressed to see why PHB would be attractive. Furthermore we would like to see more duration risk here to take advantage of peak rates. There is nothing we find appealing regarding PHB currently, and we would swap out of this name for ANGL or HYDB as a retail investor.